Iranian missiles weren’t the only things booming in Tel Aviv in 2025.

Despite war and domestic turmoil, the year that ended Wednesday saw the value of tech merger and acquisition tech deals reach record heights as foreign investors scooped up Israeli innovation and talent, and the Tel Aviv stock exchange soar again and again to new all-time highs, outperforming global peers.

With the security situation seemingly calmed, investors and entrepreneurs in the tech space are much more optimistic for the year ahead than they were 12 months ago, according to a survey presented at a recent tech conference organized by venture capital firm Fusion and the Pearl Cohen Zedek Latzer Baratz law firm.

The poll of 200 VCs, angel investors, and entrepreneurs conducted by Fusion found that only 6 percent of respondents thought political and security uncertainty posed the biggest challenge for investors in Israel, down from 43% in last year’s survey. Asked about Israel’s future, 74.5% of respondents said they were optimistic, compared to 57% the previous year.

Among conference participants, though, the mood was decidedly less sanguine, with the apparent exodus of startup talent and business — stemming from those supposedly dissipating political and security concerns — fueling worries for the future of the tech sector, Israel’s main economic driver.

Sign up for the Tech Israel Daily

and never miss Israel’s top tech stories

By signing up, you agree to the terms

The dissonance reflected what appears to be an increasing lack of synchronicity between Israel at large and its tech ecosystem, which has seen unprecedented gains even as the nation’s economy has been stunted by wartime call-ups, airport-shuttering missile attacks and geopolitical isolation.

Israeli security and rescue forces at the scene where a ballistic missile fired from Iran hit and caused damage in Ramat Gan, June 19, 2025. (Chaim Goldberg/Flash90)

Speaking to some 300 venture capitalists, startup founders and entrepreneurs gathered on the 53rd floor of the Azrieli Sarona Tower in Tel Aviv, investor Adam Fisher warned that the tech sector’s wins were increasingly escaping abroad, cautioning against what he described as a “virus of Israeli founders registering companies as American.”

“More than 80% of Israeli-founded companies are choosing to register in the US [compared with about 20% in 2022],” said Fisher, a partner at US-based investment firm Bessemer Venture Partners.

“This is a real disaster, and this is the main issue for the industry that worries me right now,” he added.

The move by Israeli entrepreneurs to incorporate abroad picked up pace at the beginning of 2023, spurred both by economic advantages in the US and by growing uncertainty over the Israeli government’s efforts to curtail the judiciary, according to data by the Israel Innovation Authority. The outbreak of war with Hamas triggered by the terror group’s onslaught on southern communities in Israel on October 7, 2023, accelerated the trend as the increased geopolitical risk fueled uncertainty among investors.

Outside the country, the war ignited widespread criticism and anger at Israel, with calls for sanctions and downgrading of trade ties as well as arms embargoes.

IDF reserve soldiers take part in a surprise military drill in northern Israel along the border with Lebanon and Syria, November 24, 2025. (Michael Giladi/Flash90)

“Let’s not be naïve, there are LPs [limited partners or investors in funds] who won’t touch investments in Israel,” said Blackstone senior managing director Yifat Oron, who is heading the US alternative asset manager’s Tel Aviv office. “It is a silent disappearance of investments by some US pension funds who are now preferring to focus on less complicated investments.”

But others described the phenomenon as the product of entrepreneurs overestimating the level of risk that investors associate with having an Israeli entity in their portfolio.

Serial entrepreneur Gigi Levy-Weiss, general partner at venture capital firm NFX, said he hasn’t encountered a situation in which foreign investors decided against funding because the entity was registered in Israel.

“This is fiction and we need to fight it,” Levy-Weiss urged.

Fisher, who established Bessemer’s Tel Aviv office in 2007 and is a long-time investor in Israeli startups, noted that he had “not heard about any US venture capital fund which is not prepared to invest because the company is registered in Israel.”

Right to left: Adam Fisher, partner at US-based investment firm Bessemer Venture Partners; Blackstone senior managing director Yifat Oron; and Gigi Levy-Weiss, general partner at NFX, participate in a conference panel in Tel Aviv on Dec. 25, 2025. (Courtesy)

“It is almost like a reflex,” he said. “Israeli founders are acting out of a gut feeling that US or other foreign investors will not invest in an Israeli entity.”

The decision by Israeli entrepreneurs and founders on the place of incorporation of their business has implications for future activity of the startup, including the location of its main assets, intellectual property, center of research & development, and sales and management operations, and ultimately where it pays taxes.

Fisher emphasized that Israel was losing out on an essential funding source.

“We are stealing taxes from the next generation, that is, from our children and grandchildren, without noticing,” he exclaimed.

More than in any other area, tech’s flight abroad could have far-reaching economic repercussions for the state.

Illustrative: People walk by a poster displaying a spiral tower being built in Tel Aviv on November 17, 2025. (Miriam Alster/FLASH90)

The sector remains the main engine of growth for the country’s economy, responsible for almost 20% of GDP and accounting for about 30% of payroll taxes collected by the government. It employs about 11% of the country’s workforce.

Both Fisher and Levy-Weiss called on the government to create incentives to encourage incorporation in Israel and to keep companies and tech talent in the country.

“No one worries about this in Jerusalem,” lamented Fisher. “If we won’t find the incentives for companies to register in Israel we will find ourselves in a serious problem.”

Similarly, Levy-Weiss said, investors “need to encourage entrepreneurs to register in Israel.”

A view of the Nvidia offices at the Yokneam High-Tech Park, September 8, 2024. (Michael Giladi/Flash90)

The gutting of the tech sector extends beyond Israeli startups to multinational companies that have established bases here, including some of the world’s largest tech powerhouses.

According to a report released this week by the Israel Advanced Technology Industries (IATI), an umbrella organization of tech and life sciences firms operating in Israel, 53% of multinational companies in Israel experienced an increase in relocation requests from Israeli employees, a development that may, “over time, harm the local innovation engine and Israel’s technological leadership.”

In its report, IATI said some multinational companies in Israel are examining the transfer of investments and activities to other countries because they faced supply chain disruptions and found alternatives outside the country during the war, and “there is a risk that activity will not fully return.”

Multinational companies, including Apple, Meta (Facebook), Microsoft, Google, Amazon, and Nvidia serve as a central anchor for the local ecosystem, and were responsible for about 80% of the volume of M&As in Israel over the past five years.

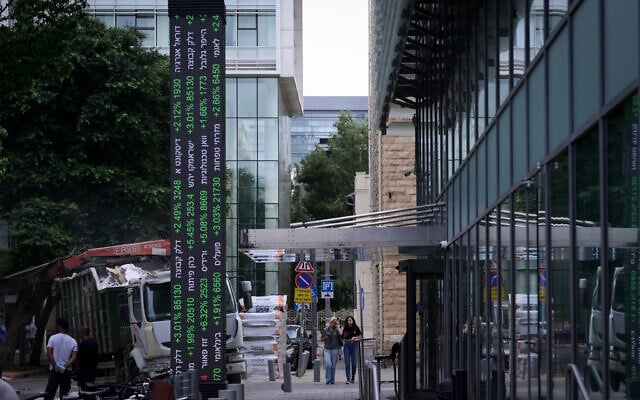

View of the Tel Aviv Stock Exchange. October 8, 2025. (Avshalom Sassoni/FLASH90)

“Without active steps by the state to create regulatory and geopolitical stability, there is concern about gradual erosion in the stability of the local ecosystem,” IATI warned.

To fix the regulatory environment, Israel earlier this year introduced a tax reform intended to reverse the tech brain drain and encourage local and foreign fund investments in the sector.

“We have an opportunity to try and bring Jewish immigrants and talent to Israel from abroad with capabilities to close the talent gap that we have here, especially in the area of AI,” said Fisher.

The reform by the government sets out to provide tax certainty for multinational companies, remove investment barriers for foreign investors, and incentivize a rapid return of Israeli entrepreneurs and high-skilled tech workers from abroad.

“This is a challenge for the Israeli government and for the Finance Ministry to make sure that Israel, not as a brand, not from a geopolitical point of view, but from a bureaucratic stance, is an easy place to incorporate your company and do business here,” Fusion co-founder Guy Katsovich told The Times of Israel on the sidelines of the confab.

Guy Katsovich, co-founder of Israeli venture capital fund and tech accelerator Fusion, speaks at a conference in Tel Aviv on Dec. 25, 2025. (Court

Data presented at the Tel Aviv conference by Asaf Horesh, managing partner at Vintage Investment Partners, showed that despite the war challenges, Israel is on track for a record year in the value of Israeli tech exits or M&As, while US and European markets continue to show only modest recovery in dealmaking.

“The war has a counterintuitive side effect of making people double down on the ecosystem just to show resiliency,” said Katsovich. “This is something that is very unique to Israel.”

Even excluding Google’s $32 billion acquisition of cybersecurity unicorn Wiz, the largest-ever deal involving an Israeli-founded company, 2025 still set new records for such deals. There were another two acquisitions above $1 billion this year — local fintech firm Next Insurance and Melio, bought for $2.6 billion and $2.5 billion, respectively.

But those astronomic numbers can be misleading, with recent reports showing that fewer companies were involved in high-value deals last year.

“The majority of capital invested in startups is increasingly concentrated in a smaller number of VC funds and directed toward fewer companies across cyber, artificial intelligence, and quantum technologies, and the rest are having a much harder time of getting funded,” said Horesh.

In the Fusion survey, the number one challenge pointed to by respondents was increasing competition for investments, especially for cybersecurity and AI firms.

Israel’s Innovation Authority says it ranks as the fifth-largest hub in the world for startup fundraising after San Francisco, New York, London, and Boston. However, capital of late has concentrated on cybersecurity and AI, signaling a lack of dispersion across new technology areas and a decline in innovation diversity.

Investors, founders, and entrepreneurs at an annual VC trends conference in Tel Aviv on December 25, 2025. (Courtesy)

Looking ahead to 2026, investors were asked in the Fusion survey which three sectors are expected to lead the industry in the coming year. Nearly all respondents believe cybersecurity will continue to lead investments, while AI was cited in second place. Quantum technologies ranked third, replacing fintech, which fell to fourth place.

Foreign investors maintained their dominant role in the Israeli tech ecosystem in 2025, accounting for 60% of total investors, led by US funds including Insight Partners, Bessemer Venture Partners, Andreessen Horowitz (a16z), and Blackstone, according to data compiled by Startup Nation Central.

Looking ahead to 2026, Guy Lachmann, a senior partner in the high-tech department at Pearl Cohen, said that he expects “a renewed entry of non-US foreign investors whose investments are not driven by Zionist considerations.”

“Assuming there is no geopolitical deterioration that halts this trend, the sense is that the market is about to loosen up,” Lachmann said. “There is currently an abundance of attractive acquisition targets that, after about two challenging years, have transitioned to lean and efficient operating models.”

Lachmann noted that many startups are under pressure to sell, in part because current investors have pulled back or lack the resources to continue investing.

“After the holidays, a shift in sentiment is expected, with an increase in reports of fundraising activity,” said Lachmann. “Sectors that were significantly affected by the geopolitical situation, including digital health, fintech, agri-tech, foodtech, and construction-tech, experienced prolonged stagnation and drawn-out investments, but it now appears that these barriers are beginning to ease.”

Reuters contributed to this report.