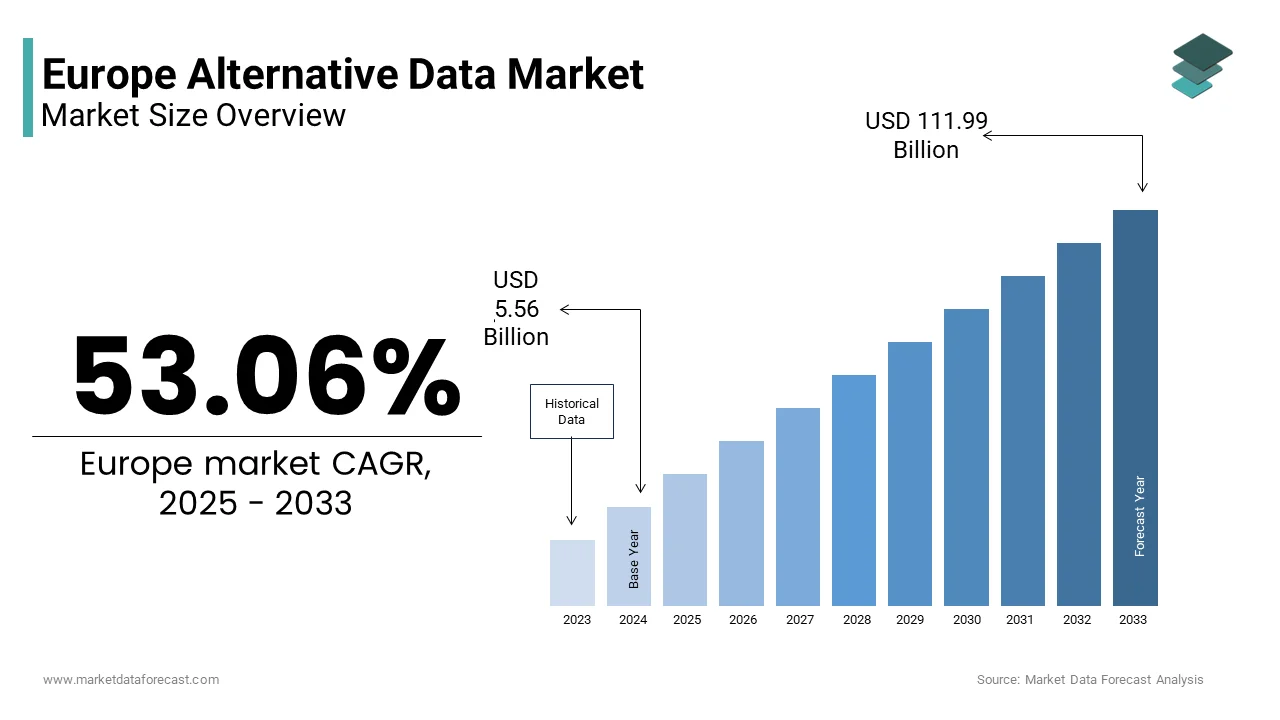

Europe Alternative Data Market Size

The Europe alternative data market size was valued at USD 3.63 billion in 2024 and is anticipated to reach USD 5.56 billion in 2025 and USD 111.99 billion by 2033, growing at a CAGR of 53.06% during the forecast period from 2025 to 2033.

Current Introduction of the Europe Alternative Data Market

The alternative data is the collection, processing,g and commercialization of non-traditional datasets that supplement or replace conventional financial and operational metrics to inform investment risk assessment and strategic decision making. These datasets include satellite imageryweb-scrapedped transaction log,,s mobile geolocation footfall analytics,s IoT sensor feed,s and public registry linkages that offreal-timeime orhigh-frequencyy insights into economic activityy consumer behavior, and supply chain dynamics. Unlike traditional data derived from audited financial statements or official statistics, alternative data thrives on velocity,volume,e and variety often generated outside formal institutional channels. In Europe, this ecosystem operates within a stringent regulatory perimeter defined by the General Data Protection Regulation and the Digital Services Act, which collectively impose strict consent provenance and anonymization requirements. As per Eurostat, over 310 million individuals in the European Union actively used the internet daily in,,2024 generating an estimated 2.5 exabytes of behavioral data each day. These data generation vectors combined with Europe’s advanced fintech infrastructure and institutional demand for alpha generation establish the foundation for alternative data adoption across asset management, insurance, and corporate strategy functions.

MARKET DRIVERS Rising Demand for Alpha Generation inLow-Yieldd Investment Environments

Institutional investors are increasingly turning to alternative data to uncover predictive signals and generate excess returns in an era of historically compressed yield spreads and efficiency. The rising demand for alpha generation in low-yield investment environments is majorly propelling the growth of Europe alternative data market. As per the European Central Bank, the average yield on investment-grade corporate bonds in the euro area stood at just 2.8% in 2024, while equity market volatility remained elevated due to geopolitical uncertainty and monetary policy recalibration. This environment has intensified pressure on asset managers to differentiate through data-driven insights rather than traditional fundamental analysis alone. According to the European Fund and Asset Management Association, assets under management by European firms in 2024 were allocated to strategies that now incorporate at least one form of alternative data, such as credit card transaction aggregates or shipping AIS telemetry. Hedge funds in London and Geneva, for instance, routinely license satellite data to monitor retail parking lot occupancy or refinery throughput as leading indicators of company earnings. The European Securities and Markets Authority has observed a threefold increase since 2021 in disclosures referencing alternative data in UCITS and AIFMD fund documentation,n reflecting institutional normalization. This quest for uncorrelated return drivers in a low signal financial landscape continues to fuel sustained procurement and integration of non-traditional datasets across Europe’s investment community.

Integration of ESG and Climate Risk Analytics into Investment Mandates

The regulatory and fiduciary imperative to quantify environment, al soc,,ial and governance risks has propelled demand for alternative data that offers gr,,anular me,,asurable and auditable ESG signals beyond self-reported corporate disclosures. The integration of ESG and climate risk analytics into investment mandates is eventually fostering the Europe’s of Europe’s alternative data market. As per the European Commission, over 83% of EU-based asset managers were required to comply with the Sustainable Finance Disclosure Regulation by January 2024, mandating detailed reporting on principal adverse impact,,s including carbon footprint,t labor practices, es and biodiversity effects. Traditional ESG ratings often suffer from lag, inconsistency,ency and methodological opacity,pacity prompting firms treal-timeal time proxies such as thermal satellite emissions tracking,g vessel oil spill detection, or social media sentiment on labor disputes. According to the Network for Greening the Financial System, European financial institutions collectively sourced more than 120 distinct alternative data feeds in 20,24 specifically for climate scenario analysis and physical risk modeling. The European Environment Agency also reported that over 400 public and private sector entities now use Copernicus Sentinel data to assess fl,,ood dr, ought and wildfire exposure at asset level resolution. This emergence of regulatory enforcement, cement investor accountss,ability,, and data availability has transformed alternative data from a tactical alpha tool into a core infrastructure component of Europe’s sustainable finance architecture.

MARKET RESTRAINTS Stringent Data Privacy Regulations Limit Data Sourcing and Processing Flexibility

One of the world’s most rigorous data governance regimes, which significantly constrains the types of personal and behavioral data that can be legally collected, processed, or commercializedh is limiting the growth of Europe’s alternative data market. As per the European Data Protection Board, enforcement actions related to unlawful data scraping and insufficient anonymization in 2024 compared to the previous year,with fines exceeding 1.2 billion euros, collectively issued under the General Data Protection Regulation. The regulation’s principles of purpose limitation, data minimization, and explicit consent effectively prohibit the use of many web-scraped or location-derived datasets that are commonplace in North American markets. For instance, geolocation data from mobile apps must undergo rigorous pseudonymization and aggregation before commercial use, and even then may be deemed unlawful if derived without granular opt-in consent, as clarified by the Court of Justice of the European Union in its 2023 rulings. According to a 2024 survey by the European Data Innovation Board, alternative data providers reported delaying or canceling European product launches due to compliance uncertainty. These legal barriers not only increase operational costs but also reduce dataset richness and recency, thereby diminishing analytical edge for European end users.

Lack of Standardization in Data Quality and Provenance Verification

The universally accepted standards for assessing data lineage accuracy, freshness,s and bias, which undermines trust and scalability among institutional buyers is declining the growth of Europe’s alternative data market. As per the European Securities and Markets Authority, only a few ofthe lternative data vendors operating in the EU providedmachine-readablee data quality certificates in 202,4 and fewer than participated in independent audit frameworks, such as those endorsed by the International Organization of Securities Commissions. This opacity complicates due diligence as asset managers struggle to verify whether a satellite image feed truly capturereal-timeme activity or whether a web traffic dataset reflects genuine consumer intent versus bot traffic. The absence of a centralized certification body akin to credit rating agencies further fragments validation efforts. Consequently, many institutions resort to costly internal vetting pipelines or limit usage to low-stakes applications.

MARKET OPPORTUNITIES Expansion of Public Sector Open Data Initiatives Enhances Analytical Depth

The commitment to open government data is creating unprecedented opportunities for alternative data firms to enrich proprietary datasets with high-quality, authoritative public sources, thereby improving model accuracy and compliance. This factor is certainlyset to set up new opportunities for the growth of Europe’s alternative data market. The Copernicus Earth observation program alone released more than 20 petabytes of free multispectral radar and atmospheric imagery by enabling commercial analysts to track industrial emissions, port activity,y and agricultural yields without privacy constraints. Additionally, the European Health Data Space launched its first cross-border data exchange pilots in late 2024,offering anonymized epidemiological and pharmaceutical utilization metrics that can inform healthcare investment theses. These public assets not only reduce reliance on sensitive private data but also serve as ground truth validators for commercial datasets.

Growth of Embedded Finance anReal-Timeme Credit Assessment in SME Lending

The proliferation of embedded financial servicesacross European commerce platforms is driving demand for alternative data to enable instant underwriting of small and medium enterprises that lack traditional credit histories. The growth of embedded finance and real-time credit assessment in SME lending is expected to significantly boost the growth ofEurope’se alternative data market. Traditional banks often lack transaction-level visibility into these businesses, prompting neobanks and fintech lenders to leverage cash flow data from accounting software,e e-commerce dashboards, rds and payment processors to assess repayment capacity in real time. The EU’s Payment Services Directive 2 mandates secure access to customer transaction data,ata which has accelerated the adoption of cash flow-based scoring models. Companies like Qonto and ioca now approve loans in under 10 minutes by analyzing daily revenue patterns and customer concentration ratios derived from alternative feeds. This shift toward dynamic performance-based credit evaluation is transforming alternative data from a niche investment tool into a core enabler of financial inclusion and economic resilience across Europe’s SME backbone.

MARKET CHALLENGES Fragmented Data Governance Across Member States ComplicatCross-Borderder Deployment

Although the European Union promotes a single market for data, the practical implementation of data rules remains highly fragmented across member states, es creating operational complexity for alternative data providers seepan-Europeanopean scale. The fragmented data governance across member states is likely to slow down the growth of Europe’s alternative data market. For example, geolocation data aggregated to 500-meter resolution may be permissible in the Netherlands but deemed identifiable in Germany under stricter interpretations of the General Data Protection Regulation. Similarly, France’s Digital Republic Act imposes additional transparency requirements on algorithmic decision-making that go beyond EU baseline standards. According to a 2024 study by the Centre on Regulation in Europe, alternative data vendors reported spending an average of 18 months and 2.3 million euros to achieve legal compliance across just five major EU jurisdictions. This regulatory patchwork not only delays time to market but also forces vendors to maintain multiple dataset versions tailored to local norms, thereby increasing costs and reducing interoperability. Until the Data Governance Act and upcoming Data Act achieve full harmonization, Europe’s alternative data market will continue to operate as a collection of national submarkets rather than a unified continental ecosystem.

Ethical Concerns and Algorithmic Bias Undermine Institutional Adoption

Growing awareness of algorithmic discrimination and data-driven inequity is prompting European institutions to scrutinize the ethical implications of alternative data usage, particularly in credit risk, hiring, ing and insurance pricing. The ethical concerns and algorithmic bias undermine institutional adoption whichalsohampersr the growth ofEurope’se alternative data market. For instance, models using mobile top-up frequency or energy consumption patterns as creditworthiness indicators may inadvertently penalize low-income or rural populations. The EU AI Act, which entered into force in August 2024, classifies credit scoring and employment assessment systems as high risk requiring rigorous bias testing, data governance,e and human oversight. Moreover, civil society organizations such as AlgorithmWatch have documented caseswhere retail footfall predictions based on mobile location data systematically undercounted elderly or non-smartphone users, leading to flawed site selection models. These ethical and reputational risks compel institutions to adopt conservative data strategies, slowing market maturation and favoring explainable over black box analytics,s even at the cost of predictive power.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

53.06%

Segments Covered

By Data, End-User, Application, Data Acquisition, and Country

Various Analyses Covered

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities

Countries Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe

Market Leaders Profiled

1010Data Inc., Advan Research Corp, Dataminr Inc., Earnest Analytics Inc, M Science LLC, Preqin Ltd., RavenPack International S.L., Thinknum Alternative Data Inc, UBS Evidence Lab (UBS Group AG), YipitData Inc., FactSet Research Systems Inc., Bloomberg L.P., SandP Global Market Intelligence LLC, Refinitiv Ltd. (LSEG), Neudata Ltd., BattleFin Group Inc., Exabel AS, Nasdaq Data Link (Nasdaq Inc.), Facteus Inc., Eagle Alpha Ltd., TRG Screen Inc.

SEGMENTAL ANALYSIS By Data Insights

The credit and debit card transactions segment was the largest by holding 38.2% of the Europe alternative data market share in 202,4 with the high frequency granularity and financial relevance of payment data, which offers real-time visibility into consumer spending patterns,s retail performance,,ce and macroeconomic trends. According to the European Central Bank, many card payment transactions were recorded across the euro area in 202,4 representing a 9.2% year on year increase driven by digital wallet adoption and contactless payment expansion. The regulatory framework under the Revised Payment Services Directive mandates secure access to transaction data via open banking APIs, enabling licensed third parties to aggregate and anonymize spending flows for institutional use. Asset managers in London and Frankfurt routinely license these datasets to track same-store sales for retail equity,,s while fintech lenders use cash flow chronologies to assess SME creditworthiness. Additionally, the European Commission’s Retail Payments Strategy has accelerated interoperability among national payment systems such as France’s Cartes Bancaires and Germany’s Giroc, arandurther eenrich cross-bordertransaction visibility. The combination of regulatory enablement, transaction scales,le and direct economic linkage ensures card-based data remains the cornerstone of Europe’s alternative data ecosystem.

The satellite and geospatial imagery segment is projected to expand at a CAGR of 24.3% during the forecast period, driven by the emergence of freely available public Earth observation d ata prhigh-resolutionlution constellation, s andartificial intelligence-drivenn analytics that transform pixels into actionable economic indicators. According to the European Space Agency, the Copernicus program delivered over 20 petabytes of satellite data in 2024, with more than 500 commercial entities across Europe leveraging it to monitor oil storage levels,s port container mmovementsnts agricultyieldsal yi,elds and construction activity. Simultaneously, private operators such as Airbus Defence and Space have deployed synthetic aperture radar satellites capable of ccapturing sub-meterresolution imagery regardless of cloud cover or daylight, enabling persistent monitoring of industrial sites in Scandinavia and Eastern Europe. The European Commission’s Destination Earth initiative further promotes integration of geospatial analytics into climate risk modeling with many financial institutions participating in pilot programs by early 2025.

By End User Industry Insights

The BFSI (BaBankingg FinanciaServicesrvces and Insurance) segment held 45.3% of the Europe alternative data market share in 22,,4 with the sector’s urgent need frefor real-timeskassessment,t credit ununderwritingng and alpha generation in alow-yield,d volatile environment. According to the European Banking AuthorityEU-baseded banks now integrate at least one form of alternative data into their credit decision engine,,s with transaction cash flows and utility payment histories supplementing traditional bureau scores ffor file-levellcustomers. In insurance, the use of telematics and IoT sensor data has enabled dynamic pricing of motor and property policies,, ith Allianz and AXAdeploying usage-basedd models across 14 European countries. Additionally, asset managers under the Sustainable Finance Disclosure Regulation increasingly rely on satellite and web-scraped ESG signals to validate corporate sustainability claims. Regulatory sandboxes in France and the Netherlands have further accelerated responsible innovation by permitting controlled testing of novel data sources. These functional imperatives, combined with regulatory tailwind,s cement BFSI as the primary demand engine for alternative data in Europe.

The retail and e-commerce segment is projected to grow to register a fastest CAGR of 21.7% from 2025 to 2033,with the need for real-time competitive intelligence,,e inventory optimizat, e-inventory optimization,ion ,and personalized marketing in an increasingly digital and fragmented consumer landscape. To navigate this complexity,xity retailers, such as Zalando and H&M,lilicense web-scrapedrice and product availability data from thousands of competitor sites to adjust pricing dynamically, while grocery chains like Carrefour use loyalty card transaction aggregates to forecast regional demand shifts. The European Commission’s Digital Markets Act has also increased transparency around platform data practices, enabling brand manufacturers to access previously siloed marketplace analytics from Amazon andBol.commm. Furthermore, the rise of social commerce has spurred demand for sentiment and influencer engagement metrics derived from TikTok and Instagram, which are now integrated into product launch planning. These operational and strategic imperatives transform alternative data from a back-office tool into a frontline growth enabler across Europe’s retail ecosystem.

By Application Insights

The investment signal generation segment accounted in holding 42.3% of the Europe alternative data market share in 2024, with the institutional asset management community’s ongoing search for predictive edges in increasingly efficient and correlated markets. Common signals includesatellite-monitoredd foot traffic at retail locations, shipping AIS data for supply chain disruption alert,s and app download trends as proxies for digital engagement. The low-interest rate environment, which persisted through much of the early 202,0s compressed traditional return sources,ces thereby intensifying demand for uncorrelated alpha. Additionally, the rise of ESG integration has expanded signal types to include emissions estimates from thermal imaging and labor practice indicators from news analytics. The combination of regulatory acceptance,ance analytical maturity and performance pressure ensures investment signal generation remains the central application driver in Europe’s alternative data landscape.

The risk management and fraud detection application is likely to grow athe t fastest CAGR of 23.1% during the forecast period by escalating cyber threat,s regulatory mandat, es and the shift towareal-timeime decisioning in financial service,,s insuranc,e and e-commerce. Institutions now fuse device fingerprinting, behavioral biometrics,s and network graph analytics to identify synthetic identities and account takeover attempts, often before monetary loss occurs. The Revised Payment Services Directive requires strong customer authentication but also permits exemptions for low-risk transactions basedon real-timee risk scoring powered by alternative data. Additionally, the EU’s Anti Money Laundering Authority has endorsed transaction pattern analytics for detecting layering behaviors in real time.

COUNTRY ANALYSIS United Kingdom Alternative Data Market Analysis

The United Kingdom was the top performer in the Europe alternative data market by capturing 24.3% of the market share in 2024. As Europe’s financial capital, the UK hosts the continent’s densest concentration of hedge fund asset managers,and fintech ininnovatorss all of which drive sophisticated demand for predictive risk-oriented datasets. According to the UK’s Financial Conduct Authority, over 220 alternative data vendors were registered to serve institutional clients in 2024, with London-based firms of European data procurement budgets. The country’s early adoption of open banking under the Competition and Markets Authority’s order has created a rich ecosystem of transactional data aggregators such as TrueLayer and Yol,,t which feed anonymized spending flows into investment and credit models. Additionally, the UK’s departure from the EU has not diminished its data leadership,,ip instead enabling more agile regulatory experimentation through the FCA’s Digital Sandbo,,x which approved 47 alternative data pilots in 2024 alone. The presence of global satellite analytics firms like Earth i and partnerships between universities and data providers further reinforce technical capacity. These institutional density,, ty regulatory foresight, and analytical infrastructure factors secure the UK’s continued dominance in Europe’s alternative data value chain.

Germany Alternative Data Market Analysis

Germany was ranked second by holding 19.3% oEurope’spe alternative data market share in 202,4 driven by its industrial ststrengthth data governance r,igor and growing fintech ecosystem. German institutions prioritize alternative data that aligns with strict privacy norms, yet delivers operational and investment value in manufacturing supply chain monitoring and SME credit assessment. According to the German Federal Financial Supervisory Authority, over 58% of German banks integrated cloud-based alternative scoring models in 2024 to serve the country’s 3.5 million Mittelstand enterprises, which often lack standardized financial disclosures. The Fraunhofer Institute reported that industrial firms inBaden-Württembergg and Bavaria increasingly use satellite and logistics data to optimize just-in-time inventory amid persistent supply chain volatility. Germany’s robust data protection culture under the Bundesdatenschutzgesetz has also spurred innovation in privacy-preserving techniques such as federated learning and synthetic data generationn,n which are now commercializeby Berlin-baseded startups like Dataswift. Moreover, the country’s participation in the European High Performance Computing initiative enables complex geospatial and AI analytics at scale. These attributes position Germany as a high integrity high utility market where alternative data adoption is both cautious and deeply embedded in economic reality.

France Alternative Data Market Analysis

France’s alternative data market growth is likely to grow with its advanced regulatory sandbox environment and strategic focus on sovereign data infrastructure. The French financial sector, led by institutions such as BNP Paribas and Amundi,ndi has been an early adopter of alternative data for ESG validation, real-time macro monitoring under the oversight of theAutoritée desMarchéss Financiers, which established Europe’s first alternative data ethics charter in 2022. France’s national data platform, Health Data Hu,b and energy consumption registry provide rich public alternative datasets that complement private sources without violating privacy norms. Additionally, the government’s Artificial Intelligence for Humanity strategy has funded over 30 projects linking satellite IoT and transaction data to climate risk modeling. Paris has also emerged as a hub for ethical AI startups such as Arthur and LightOn that specialize in bias audit and explainability for alternative data models.

Netherlands Alternative Data Market Analysis

The Netherlands alternative data market growth is likely to grow with its role as a digital logistics and data infrastructure nexus. Home to AMS,I X, the world’s largest interexchangexcha,nge and major data centeMicrosoficrooft, and Google, the Netherlands provides the bandwidth and cloud infrastructure necessary for large-scale alternative data processing. Furthermore, the Port of Rotterdam Authority licenses AIS vessel tracking and cargo manifest data to commodity traders and insurers, offering one of Europe’s most transparent industrial data ecosystems. The Dutch Data Protection Authority’s pragmatic approach to anonymization has also encouraged innovation in mobility and retail analytics. These logistica,,l regulat,ory and infrastructural advantages position the Netherlands as a critical enabler and consumer of alternative data in continental Europe.

Switzerland Alternative Data Market Analysis

Switzerland’sland alternative data market growth is likely to grow with its concentration of private banking, assmanagementeme,nt and pharmaceuticaresearchea,rch all of which demand high precision alternative insights. Swiss institutions prioritize data qualquality proven,a nce and neutrality,,ality reflecting tlongstandinging reputation for financial discretion and scientific rigor. The presence of global commodity traders in Geneva, such as Glencore and Trafigura, further drives demand for shipping weather and inventory level analytics sourced from alternative feeds. Switzerland’s non-EU status allows it to operate outside GDPR while maintaining equivalent data protection standards under the Federal Act on Protectionectio,n which facilitates cross-border data flows with both Europe and the United States. Additionally, Zurich and Lausanne host leading AI research labs that collaborate with firms like IQVIA to develop health economics models using anonymized prescription and mobility data.

COMPETITIVE LANDSCAPE ANALYSIS

The Europe alternative data market features a dynamic and fragmented competitive landscape characterized by specialization, regulatoryacumene,n and analytical differentiation rather than scale alone. Global providers such as Thasos Circana and Orbital Insight compete alongside agile European startups like Airlitix and Datapred that offer niche datasets imobilityli, weatherher or industrial telemetry. Competition is less about data volume and more about provenanctransparencyar,ency complianad,iness and contextual relevance to European business practices. The market is bifurcated between vendors serving financial institutions with alpha generation tools and those enabling operational intelligence for retail logistics or public policy. Regulatory complexity acts as both a barrier and ,filt,er favoring players with legal expertise and ethical governance frameworks.

KEY MARKET PLAYERS

A few of the market players in the Europe alternative data market

1010Data Inc. Orbital Insight Thasos Group Circana (formerly IRI and NPD) Advan Research Corp. Dataminr Inc. Earnest Analytics Inc. M Science LLC Preqin Ltd. RavenPack International S.L. Thinknum Alternative Data Inc. UBS Evidence Lab (UBS Group AG) YipitData Inc. FactSet Research Systems Inc. Bloomberg L.P. SandP Global Market Intelligence LLC Refinitiv Ltd. (LSEG) Neudata Ltd. BattleFin Group Inc. Exabel AS Nasdaq Data Link (Nasdaq Inc.) Facteus Inc. Eagle Alpha Ltd. TRG Screen Inc. Top Players In The Market Thasos Group is a leading provider of real-time geospatial intelligence in Europe, specializing in anonymized mobile location data to deliver insights on consumer mobility, retail footfal,, and urban economic activity. The company serves institutionalinvestorso, rs hedgefundsu,nds and retail chains across Western and Northern Europe whigh-frequencyency behavioral datasets that comply strictly with General Data Protection Regulation standards. Thasos enhanced its European footprint by launching a new analytics platform that integrates satellite imagery with mobility trends to assess commercial real estate performance. It also partnered with several Nordic pension funds to develop ESG-compliant foot traffic metrics for sustainable retail exposure. These initiatives reinforce Thasos’s reputation for privacy-centric innovation and deepen its integration into Europe’s investment and strategic planning workflows. Circana plays a pivotal role in the Europe alternative data market through its fusion of consumer panel data, point of sale transactions,s and e-commerce scraping to deliver comprehensive demand signals across retail and consumer packaged goods sectors. The company operates extensive data collection networks inGermanya, France,nce, and the UK enabling granular tracking of branperformancnc,,e pricing elasticity,,,y and channel shift. Circana expanded its digital shelf monitoring capabilities across 12 European markets by incorporating AI-powered image recognition from online retailer sites. It also launched a real-time inflation tracking dashboard for central banks and asset managers using receipt and price tag data from over 8 million weekly transactions. These enhancements position Circana as a critical infrastructure provider for both commercial strategy and macroeconomic analysis in Europe. Orbital Insight contributes to the Europe alternative data market by transforming satellite,dronen,e and aerial imagery into quantifiable economic indicators for finance insurance a,nd public sector clients. The company’s European operations focus on monitoring energy infrastructure,ture agricultural output port through put and construction activity using proprietary computer vision models trained on Copernicus and commercial imagery. Orbital Insight deepened its collaboration with the European Commission’s Joint Research Centre to support Destination Earth climate risk models using real-time land use change detection. It also introduced a new API for European asset managers that delivers weekly oil storage estimates from over 200 terminals across the continent. Top Strategies Used by the Key Market Participants

Key players in the Europe alternative data market primarily pursue strategies centered on regulatory compliance, data fusion,, on domain-specificific analytics. Companies invest heavily in privacy-preserving technologies such as differential privacy, federated llearningg and synthetic data generation to operate within Europe’s stringent data protection framework. Strategic partnerships with public institutions, financial regulators,, and cloud providers enable secure data sharing and scalable processing. Many firms are also shifting from raw data licensing to insight as a service model,s, offering pre-built dashboards and API driven signals tailored to investment risk or operational use cases. Additionally, leading vendors are embedding explainability and bias audit features into their platforms to meet EU AI Act requirements. Geographic expansion is achieved not through broad coverage but through deep localization of data provenance consent mechanisms and sectoral relevance, particularly in ESG supply chain and SME finance verticals.

MARKET SEGMENTATION

This research report on the Europe alternative data market size is segmented and sub-segmented into the following categories.

By Data Type

Credit and Debit Card Transactions E-mail Receipts Geo-location (Foot-traffic) Records Mobile App Usage Harvesting / Agriculture Management Data Social and Sentiment Feeds Web-scraped Data Web Traffic Other Data Types

By End-User Industry

BFSI Retail and E-commerce IT and Telecommunications Automotive and Industrial Manufacturing Oil and Energy Others (Healthcare, Media, etc.)

By Data Acquisition Method

Proprietary Sensor/IoT Feeds Web Crawling and Scraping Transactional/Panel Partnerships Crowd-sourced Platforms Public Records and Filings

By Application

Investment Signal Generation Risk Management and Fraud Detection Competitive and Market Intelligence Customer Behavior Analytics Supply-chain and Logistics Optimization\

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe