Crypto analyst Julio Moreno questioned “whale accumulation” narratives, citing exchange wallet consolidation as distorting on-chain optics.

Dogecoin (DOGE) led the daily gains, followed by Cardano (ADA) and Ripple’s XRP (XRP), as the entire cryptocurrency market remained in the green on Friday.

Following its rally on the second day, Dogecoin (DOGE) was one of the session’s best performers, trading around $0.1435 and up roughly 13.4%, with approximately $14.4 million in liquidations concentrated primarily on the short side, according to Coinglass data. On Stocktwits, retail sentiment around Dogecoin remained in the ‘extremely bullish’ territory, as chatter levels changed from ‘high’ to extremely high’ over the day.

Cardano (ADA) traded near $0.396, up about 10.7% in the last 24 hours, and liquidations totaled around $3.3 million, with short positions accounting for the majority as late bearish bets were unwound. On Stocktwits, retail sentiment around Cardano remained in the ‘bullish’ territory, with chatter improving from ‘normal’ to ‘high’ levels over the past day.

Ripple’s XRP (XRP) was trading near $2.02, up approximately 8.0% on the day, as liquidations increased to around $11.4 million, primarily due to shorts being forced out as price momentum accelerated. On Stocktwits, retail sentiment around XRP improved from ‘bearish’ to ‘bullish’, as chatter levels improved from ‘normal to ‘high’ over the past day.

Liquidity Backdrop Improves Bitcoin

Bitcoin (BTC) traded around $90,260, up about 2% for the day. Over the last 24 hours, BTC liquidations totaled to $111.3 million, with shorts accounting for nearly $94.9 million versus $17.3 million in long liquidations. On Stocktwits, retail sentiment around Bitcoin turned from ‘bearish’ to ‘bullish’ territory, with chatter around the coin improving from ‘low’ to ‘normal’ levels over the past day.

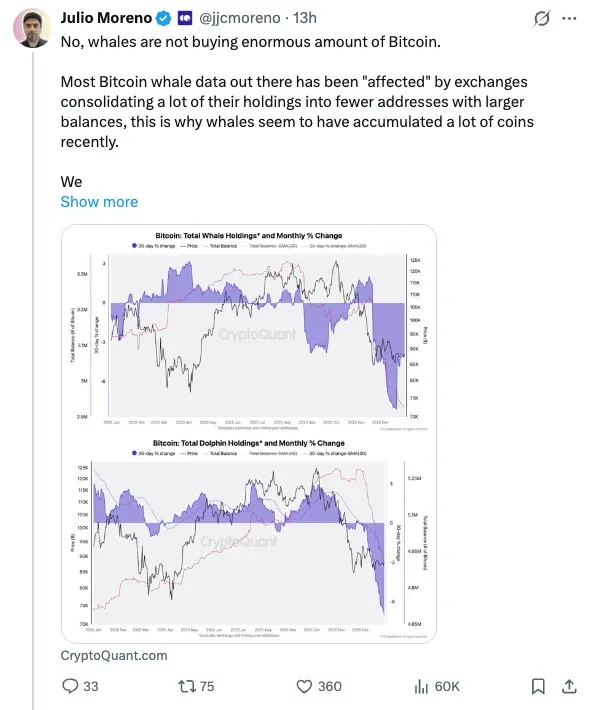

Previously, on-chain market watchers noted that long-term holders (LTHs) had recently become net accumulators of Bitcoin. However, CryptoQuant analyst Julio Moreno disputed such claims on X.

Moreno explained that much of the apparent increase in whale addresses is due to exchanges consolidating balances into fewer, larger wallets, distorting on-chain optics. Datasets that exclude exchange addresses show a decline in whale balances, as does a similar trend among 100-1,000 BTC wallets, which are frequently used as a proxy for ETF-sized holdings.

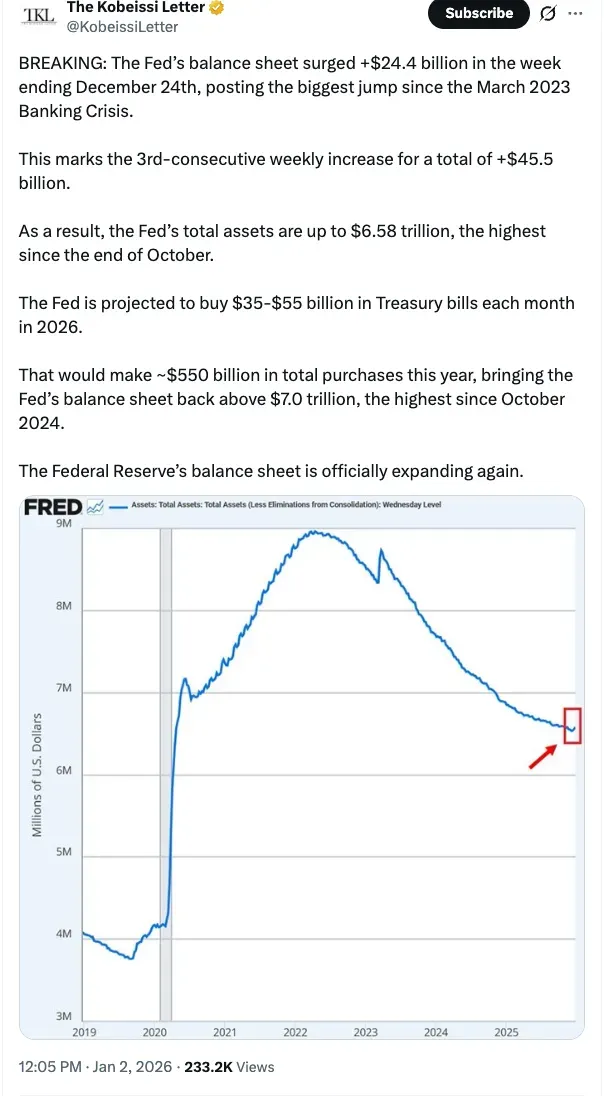

Kobessi Letter points to the Federal Reserve Balance Sheet. | Source: @KobeissiLetter/X

Kobessi Letter points to the Federal Reserve Balance Sheet. | Source: @KobeissiLetter/X

Furthermore, according to The Kobessi Letter, the Federal Reserve’s balance sheet increased by $24.4 billion during the week ending December 24—representing the largest weekly rise since the March 2023 banking crisis. This shift may serve as a liquidity tailwind for cryptocurrencies, which often act as high-beta proxies.

Altcoins Rise As Short Covering Boosts ETH and SOL

Ethereum (ETH) outperformed Bitcoin (BTC) in daily gains, trading near $3,124, up nearly 4.2% in 24 hours. ETH saw roughly $124.9 million in liquidations, with shorts accounting for the vast majority of forced closures — indicating that leverage drove the move. On Stocktwits, retail sentiment around Ethereum improved from ‘bearish’ to ‘neutral’ zone, while chatter improved from ‘low’ to ‘normal’ levels over the past day.

Solana (SOL) was trading at $132.8, up about 5.1% in the last 24 hours, and had approximately $22.5 million in liquidations, with short positions accounting for the majority. On Stocktwits, retail sentiment around Solana remained in the ‘bearish’ territory, with ‘normal’ chatter levels over the day.

Binance Coin (BNB) rose to around $877.8, up about 1.9%, while liquidations remained relatively low at around $2 million, suggesting the move was more spot-driven than leverage-led. On Stocktwits, retail sentiment around Binance Coin remained in the ‘bullish’ territory, with ‘normal’ chatter levels over the day.

TRON (TRX) was trading at around $0.289, up about 1.1% on the day, with only about $30,000 in liquidations. On Stocktwits, retail sentiment around Tron improved from ‘bearish’ to ‘neutral’ zone, with chatter improving from ‘low’ to ‘normal’ levels over the past day.

Crypto markets turned green, with shorts accounting for approximately $329.4 million and longs accounting for $66.1 million over the last 24 hours.

Read also: Trump Token Extends Slide Despite Fresh Buzz Around Trump Mobile

For updates and corrections, email newsroom[at]stocktwits[dot]com