Singapore is a 277-square-mile thermodynamic miracle, or perhaps a financial one, depending on which ledger you prefer to read.

I’ve spent enough time looking at industrial clusters to know that space is the ultimate friction point.

In Singapore, that friction is becoming heat.

Data from the IEA and regional market trackers reveals a country that has built an empire on “transformation”…taking raw inputs it doesn’t own and turning them into high-value outputs the rest of the world craves.

It refined 1.7 million terajoules of oil products in 2023 alone, serving as the lungs of Asian maritime trade…

But the lungs are getting crowded.

The official narrative paints a picture of a “Global LNG Hub” and a “Digital Capital of Southeast Asia.” The reality is a city-state redlining its physical and energetic capacity.

When you look at the raw numbers, Singapore’s energy imports sit at a staggering 279% of its total supply. It doesn’t just use energy; it processes it, re-exports it, and breathes it.

Now, a new problem has entered the ecosystem: the Data Center.

Why the Grid Can’t Go Green Overnight

To understand the digital future, you have to look at the pipes.

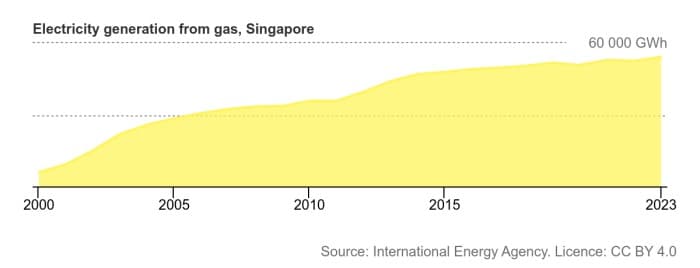

Singapore’s electricity generation is almost entirely a monoculture. Natural gas accounts for roughly 94% of the total power mix. While the marketing brochures talk about solar PV and 2030 efficiency targets, the physical reality is that renewables currently account for a measly 3.5% of electricity generation.

Natural gas is often called a “bridge fuel,” but in Singapore, it’s the only ground underfoot.

For years, the plan was to “liberalize” this dependence into a trading win. The government launched the “SLiNG” price index, hoping to become the Wall Street of LNG. It was a noble attempt to find the “market price” for an island with no resources. But market indices require the one thing Singapore couldn’t manufacture: volume.

The SLiNG died quietly in 2019, choked out by a lack of liquidity.

Now, the strategy has shifted from the “Invisible Hand” to the “Iron Grip.” Data from the IEA and recent policy shifts show the birth of Singapore GasCo, a state-owned central procurer. They have realized that in a world of volatile energy prices, a small island shouldn’t be a trader; it should be a buyer with a very big stick.

They are doubling down on infrastructure to match this centralized muscle.

Because they’ve run out of land on Jurong Island, the expansion is moving onto the water. The country is currently commissioning a Floating Storage and Regasification Unit (FSRU), a massive ship that acts as a mobile lung for the power grid. It’s designed to push regasification capacity from 10 million tonnes to 15 million per year…

It is a $1 billion hedge against the fact that solar panels simply don’t fit in a city-state this dense.

Every kilowatt-hour used to power a “green” data center in Jurong is almost certainly coming from a gas turbine burning molecules bought by a state agency.

The carbon footprint isn’t disappearing…it’s being consolidated.

The government’s goal to peak emissions by 2030 is a collision course with the reality of 1 GW of existing data center capacity.

In a country where domestic energy production is effectively zero…unless you count burning municipal waste, which provides 90% of the tiny sliver of domestic energy they do have…every new server rack is a new debt to the global commodity market.

The Data Center Dilemma: Quality Over Kilowatts

Singapore is currently the 8th largest data center market on the planet. That is an absurd statistic for a nation smaller than the city of Lexington, Kentucky.

To maintain this, companies like ST Engineering are dropping $88 million on new seven-story facilities. But the land is gone. The easy power is gone.

“Singapore’s global significance should be evaluated based on the quality of the workloads… rather than just capacity metrics.” – Jason Brown, JLL.

When an analyst tells you to focus on “quality” rather than “capacity,” they are telling you the growth story is over.

You don’t talk about “value-added compute” when you have enough land to build a 500-megawatt campus. You talk about it when you are forced to choose between powering a hospital or a new AI training cluster.

The industry is responding with “retrofitting”…trying to squeeze more compute into the same square footage. It’s the digital equivalent of high-intensity farming. But more density means more heat, and more heat in a tropical climate means more electricity for cooling.

It is a feedback loop that the balance sheet is starting to feel.

The Johor Spillover: Malaysia’s Gain, Singapore’s Ghost

When a market hits a hard ceiling, the capital doesn’t vanish; it leaks.

We are seeing a massive shift in demand across the border into Johor, Malaysia. NTT and other giants are building massive campuses there because Singapore simply can’t say “yes” anymore.

Singapore is becoming the “Headquarters” while Malaysia becomes the “Engine Room.”

This creates a strange geopolitical friction. Singapore wants to remain the hub, but it is increasingly reliant on regional power linkage and trade agreements to keep its own lights on.

There is talk of Small Modular Reactors (SMRs) and undersea cables from Australia…

It sounds like science fiction because the present reality is so tight.

The hidden cost here is the loss of sovereignty over the supply chain. When you import 100% of your crude and 100% of your gas, your “hub” status is a privilege granted by the stability of global shipping lanes.

One major disruption in the Malacca Strait, and the “Digital Capital” becomes a collection of very expensive, very silent black boxes.

Thermodynamics Always Wins

Singapore is a master of efficiency. Their energy intensity…the amount of energy used per dollar of GDP…has improved by 39% since 2000. They are squeezing every drop of value out of every joule.

But efficiency has a limit.

You cannot “efficient” your way out of the fact that data centers require raw, baseload power. You cannot “label” your way out of a 94% gas-dependent grid if you want to be a green leader.

The city-state is a victim of its own success. It built the world’s most efficient transformation engine, only to find that the world now wants to transform data, not just oil.

Singapore will remain a titan of finance and a crucial node in the global network. But the era of limitless physical expansion is dead. The future here is a high-stakes game of triage, deciding which “high-value workloads” are worth the precious, imported gas required to run them.

The island is full. Now, the real work begins.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com