Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Constellation Brands Investment Narrative Recap

To own Constellation Brands, you need to believe its premium Mexican beer portfolio can offset softer trends elsewhere and justify ongoing investment in capacity and marketing. The latest earnings beat reinforces beer as the key near term catalyst, while the biggest risk remains that weaker demand and modest expected beer sales growth could limit how much upside that strength can deliver. Overall, the surprise result tweaks sentiment more than it changes the core risk reward picture.

Against this backdrop, the company’s active share repurchase program, supported by significant projected free cash flow, is especially relevant. Ongoing buybacks, combined with regular dividends, highlight management’s emphasis on returning cash to shareholders even as they invest in brewery expansion in Mexico. For investors, this capital return story now sits alongside questions about whether recently revised, lower beer growth expectations will prove conservative or…

Read the full narrative on Constellation Brands (it’s free!)

Constellation Brands’ narrative projects $9.7 billion revenue and $2.2 billion earnings by 2028. This implies a 1.2% yearly revenue decline and an earnings increase of about $2.6 billion from -$442.3 million today.

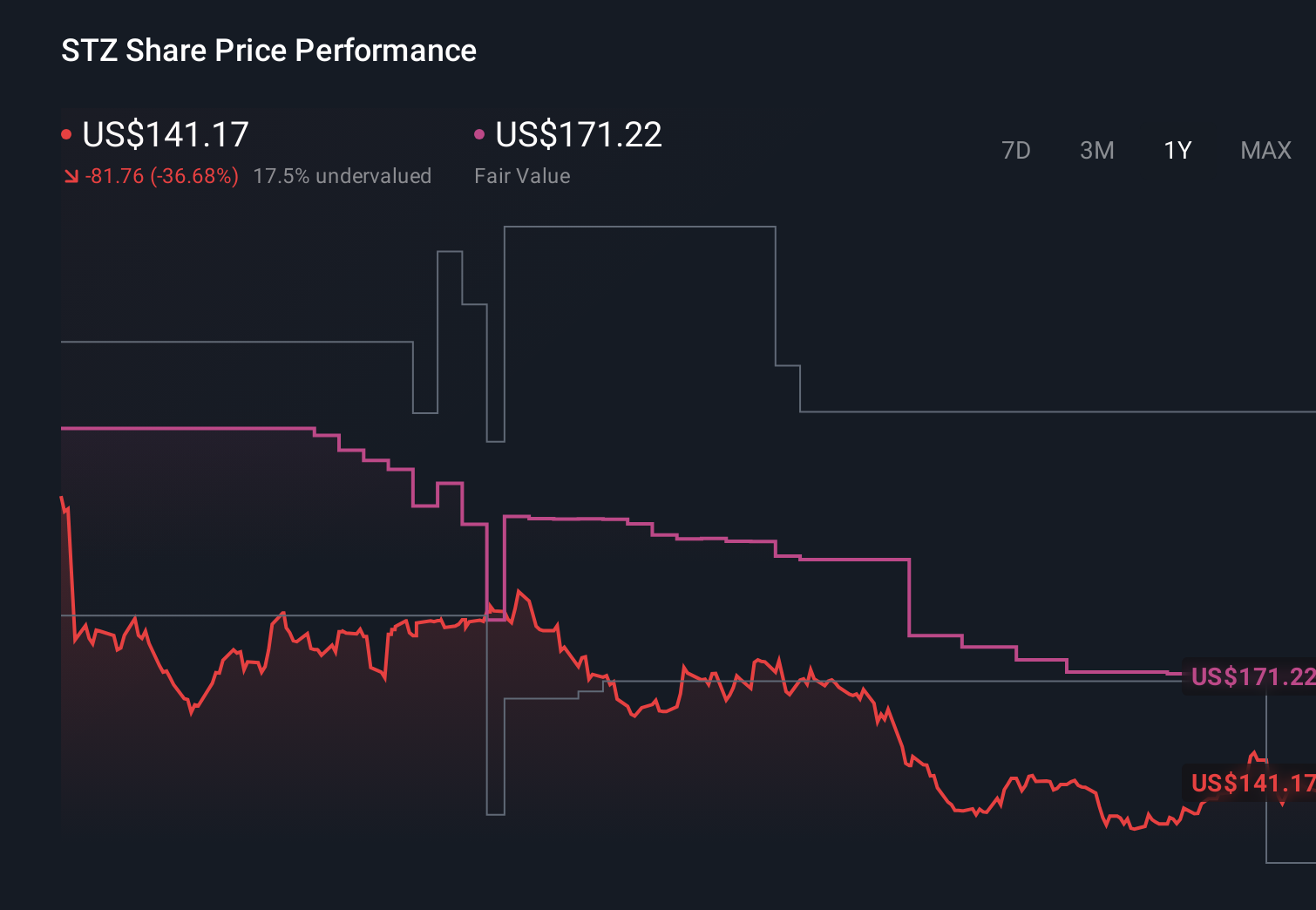

Uncover how Constellation Brands’ forecasts yield a $171.22 fair value, a 21% upside to its current price.

Exploring Other Perspectives STZ 1-Year Stock Price Chart

STZ 1-Year Stock Price Chart

Sixteen members of the Simply Wall St Community currently see fair value for Constellation Brands ranging from about US$118 to roughly US$325 per share, underscoring how far opinions can diverge. Against that backdrop, the company’s focus on premium beer brands and capital returns sits alongside concerns that more modest expected beer sales growth could constrain how quickly performance improves, so it is worth comparing several of these viewpoints before deciding how this stock fits your portfolio.

Explore 16 other fair value estimates on Constellation Brands – why the stock might be worth 16% less than the current price!

Build Your Own Constellation Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com