Europe Self-Checkout Systems Market Size

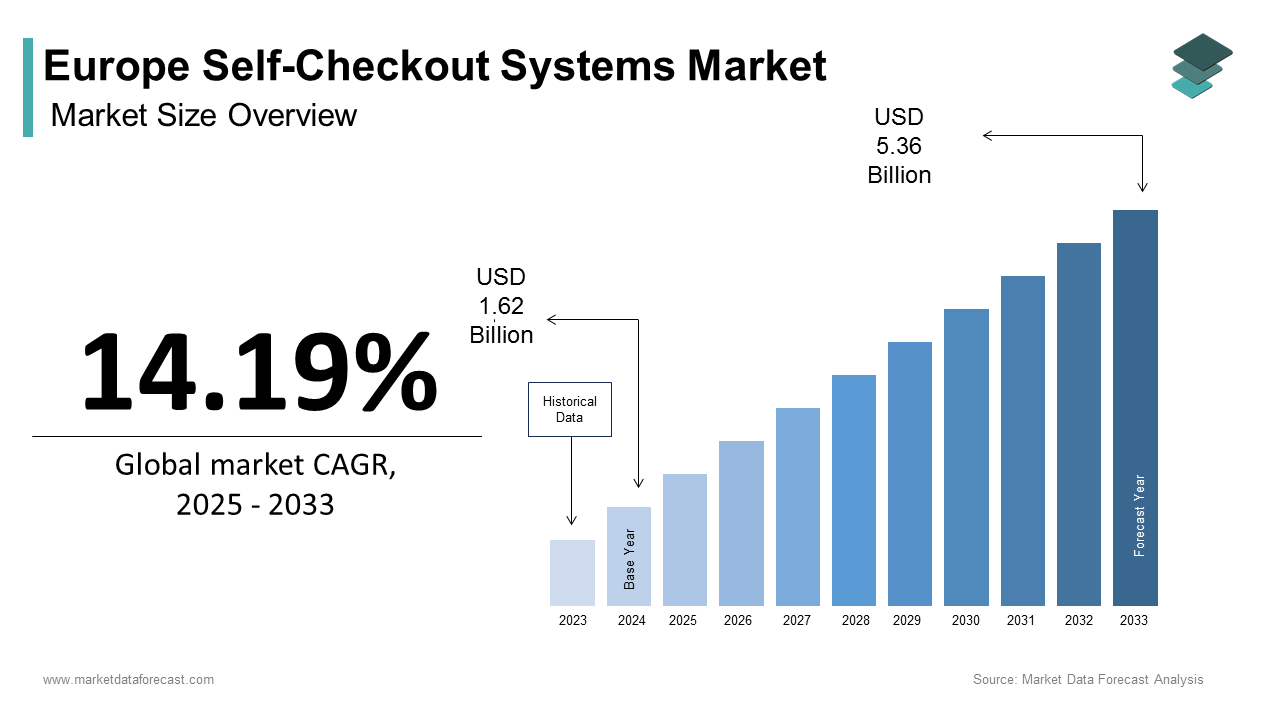

The Europe self-checkout systems market size was calculated to be USD 1.62 billion in 2024 and is anticipated to be worth USD 5.36 billion by 2033, growing from USD 1.85 billion in 2025 at a CAGR of 14.19% during the forecast period.

Self-checkout systems in Europe represent a technological integration within retail environments that empowers consumers to scan, pay, and bag their purchases without direct cashier intervention. These systems are increasingly embedded in supermarkets, convenience stores, and specialty retail formats across the region, which reflects a broader shift toward operational efficiency and digital consumer engagement. The deployment of such systems aligns with Europe’s accelerating digitization of commerce and growing consumer preference for autonomous service experiences. According to Eurostat, retail trade volumes in the EU grew in 2024, which reflects increased adoption of digital and self-service retail technologies. As per the European Commission, consumer surveys indicate rising use of self-service kiosks and digital transaction methods across Europe. The European retail sector employed approximately 28 million people in 2024, as noted by Eurofound, which indicates the scale of the industry as it explores labor optimization strategies amid persistent staffing shortages, particularly in frontline roles. These dynamics collectively frame the contextual environment within which self-checkout systems are evolving, which is not merely as transactional tools but as integral components of a digitally reconfigured retail landscape across Europe.

MARKET DRIVERS Rising Labor Shortages Intensify Retailers’ Reliance on Automation

Europe’s retail sector faces an acute workforce deficit that is compelling businesses to adopt self‑checkout systems as a strategic response to chronic understaffing, which is majorly propelling the self-checkout systems market growth in Europe. According to Eurofound, the retail industry continues to struggle with widespread vacancies across the EU, with frontline cashier positions among the most difficult to staff. In Germany, industry associations note a sharp year‑on‑year increase in unfilled retail roles, which reflects demographic constraints and shifting labor market expectations. The UK’s Office for National Statistics corroborates this trend, which indicates that nearly one‑third of retail businesses cited staffing shortages as their primary operational challenge in early 2025. These labor gaps disproportionately affect urban centers, where turnover rates remain high. Consequently, retailers are increasingly turning to self‑service technologies to maintain service continuity without proportional increases in payroll. Major chains such as Carrefour and Tesco have accelerated the rollout of self‑checkout lanes, not only to offset staffing gaps but also to reallocate human resources to higher‑value customer service functions. Consumer willingness reinforces this shift: surveys by the European Consumer Organisation show that a majority of shoppers prefer self‑checkout when queues exceed three minutes. Labor scarcity functions as a sustained catalyst for self‑checkout adoption, independent of market size projections.

Consumer Preference for Speed and Contactless Transactions Drives Adoption

European shoppers are demonstrating a pronounced inclination toward faster and minimally interactive payment methods, which is a behavioural trend that significantly bolsters demand for self‑checkout systems and contributes to the regional market expansion. According to the European Central Bank, contactless payments accounted for the vast majority of point‑of‑sale transactions in the euro area during 2024, which indicates broad comfort with automated and touchless financial interactions. This digital fluency extends to retail environments, where surveys show that younger consumers in particular prefer completing purchases without cashier involvement. In Sweden and the Netherlands, grocery shoppers report frequent use of self‑checkout lanes, reflecting deeply embedded cultural acceptance of autonomous retail practices. The post‑pandemic emphasis on reduced physical interaction continues to resonate, with many consumers across France, Italy, and Spain viewing self‑service systems as cleaner and more hygienic alternatives. Retailers have responded by optimizing store layouts to prioritize self‑service zones, with chains like Edeka and Sainsbury’s reporting significant reductions in average checkout time following the installation of next‑generation self‑checkout units. Efficiency expectations, hygiene consciousness, and payment digitization together establish a robust foundation for ongoing self‑checkout integration across European retail settings.

MARKET RESTRAINTS Persistent Vulnerability to Theft and Inventory Shrinkage

Despite technological advancements, self‑checkout systems in Europe remain susceptible to both intentional theft and unintentional scanning errors, leading to significant inventory shrinkage that deters some retailers from full‑scale adoption, which is one of the major restraints to the growth of the European self-checkout systems market. According to the European Retail Security Network, shrinkage linked directly to self‑service transactions represents a substantial share of recorded losses across participating retailers. In the UK, the British Retail Consortium reported rising incidents of non‑recorded or under‑scanned items at self‑checkouts, with high‑value, small‑form‑factor products such as cosmetics and electronics disproportionately affected. Germany’s federal police documented thousands of reported cases of deliberate self‑checkout fraud in 2024, which reflects both opportunistic behaviour and systemic vulnerabilities in current detection mechanisms. While artificial intelligence and weight sensor integration have improved loss prevention capabilities, Fraunhofer Institute research notes that these measures remain inconsistent across legacy systems still in operation in parts of Southern and Eastern Europe. Retailers face the dual challenge of balancing consumer autonomy with loss mitigation, often resulting in the deployment of supervisory staff near self‑service zones, thereby partially offsetting labor cost savings. Until more universally effective anti‑theft protocols are standardized across vendors, shrinkage will remain a tangible operational restraint on the unchecked proliferation of self‑checkout systems.

Complex Integration with Legacy Retail Infrastructure

Many European retailers, particularly small to mid‑sized operators, encounter substantial technical and financial barriers when attempting to integrate modern self‑checkout systems with outdated point‑of‑sale and inventory management infrastructures, which is inhibiting the self-checkout systems market growth in Europe. As per the European DIGITAL SME Alliance, a majority of independent retailers across Southern and Central Europe still rely on legacy software platforms lacking APIs compatible with contemporary self‑service hardware. According to a 2024 survey by the European Retail Federation, more than half of retailers delayed or scaled back self‑checkout deployment plans due to incompatibility with existing back‑end systems such as loyalty programs, supply chain data, or fiscal compliance reporting. In countries like Italy and Greece, where fiscalization laws mandate real‑time transaction reporting to tax authorities, the absence of standardized middleware solutions complicates compliance when using third‑party self‑checkout vendors. According to the European Commission’s Digital Economy and Society Index, fewer than 40% of European retail enterprises possess the internal IT capabilities required for seamless system interoperability. Even large retailers face challenges: in Belgium, a major supermarket chain disclosed millions of euros in unexpected integration costs during a nationwide rollout. Technical complexities inflate implementation budgets and extend deployment timelines, often diminishing return on investment and deterring broader adoption, particularly among cost‑sensitive market participants.

MARKET OPPORTUNITIES Expansion into Non‑Traditional Retail Verticals

Self‑checkout systems are experiencing growing adoption beyond supermarkets and hypermarkets, extending into pharmacies, convenience stores, and apparel retailers across Europe, which is a promising opportunity in the European self-checkout systems market. For instance, a growing share of European pharmacies installed self‑service kiosks between 2023 and 2024, primarily to manage rising prescription volumes without expanding counter staff. In the convenience segment, according to the German Retail Federation, urban kiosks and small grocers have rapidly increased deployment of compact self‑checkout units, driven by the need to serve high‑footfall locations with minimal staffing. Fashion retailers are beginning to pilot hybrid fitting‑room self‑checkout stations, which enable customers to pay for items without returning to a central register. Trials conducted by H&M in Sweden and Spain demonstrated higher conversion rates when self‑payment options were available within fitting areas. Public sector retail spaces such as museum gift shops and transportation hubs are also deploying these systems to reduce cash handling and improve throughput. According to Eurostar, shorter queue times at its London and Paris terminals follow the installation of touchless self‑checkout points. This diversification reflects a broader reimagining of self‑service technology, not as a grocery‑specific solution but as a versatile transactional interface adaptable to Europe’s multifaceted retail ecosystem.

Integration of Biometric and AI‑Driven Personalization Capabilities

Emerging advancements in artificial intelligence and biometric recognition are transforming self‑checkout systems from passive transaction points into intelligent and personalized retail interfaces, which is another notable opportunity in the European self-checkout systems market. According to the Fraunhofer Institute trials, AI‑powered self‑checkouts capable of recognizing returning customers via anonymized facial signatures reduced average transaction time by double‑digit percentages in Germany during 2024. In the Netherlands, Albert Heijn piloted voice‑assisted self‑service lanes that increased add‑on purchases, as the system suggested complementary items based on real‑time basket analysis. The European Data Protection Supervisor has endorsed privacy‑preserving biometric implementations that use on‑device processing without storing personally identifiable data, which is opening a compliant pathway for wider deployment. Additionally, the European Institute of Innovation and Technology documented higher loyalty program enrollment at stores featuring personalized self‑checkout greetings and dynamic discount offers. Across France, Belgium, and Finland, hundreds of retailers are testing next‑generation self‑service units that merge payment, scanning, and personalized marketing in a single interface. The convergence of AI, data privacy, and consumer experience positions self‑checkout systems not merely as cost‑saving tools but as strategic platforms for competitive differentiation in Europe’s retail environment.

MARKET CHALLENGES Technical Malfunctions and System Downtime Disrupt Operational Continuity

Self‑checkout systems in Europe frequently experience hardware and software failures that interrupt transactional flow and erode consumer confidence, particularly during peak shopping hours, which is challenging the growth of the European self-checkout systems market. According to the European Consumer Organisation, technical malfunctions such as barcode scanner failures, payment gateway disconnects, and software freezes remain common across monitored retail outlets. In Italy, the competition authority recorded thousands of consumer complaints related to self‑checkout unreliability in 2024, with most citing unresolved technical issues that forced them to seek staff assistance or abandon purchases. A TÜV Rheinland reliability audit found that systems older than three years experienced failure rates several times higher than newer models, primarily due to outdated firmware and mechanical wear. These disruptions carry tangible consequences: studies by the European Institute for Retail Technology estimate that each minute of self‑checkout downtime during weekend peak hours translates into measurable sales losses for mid‑sized stores. Furthermore, inconsistent user interface designs across vendors confuse consumers, particularly older demographics, with Eurostat’s digital inclusion survey noting that many shoppers aged 65+ report difficulty completing transactions independently. Until standardization of reliability benchmarks and vendor accountability mechanismisre enforced, operational volatility will persist as a material challenge to seamless consumer adoption and retailer satisfaction.

Data Privacy and Regulatory Compliance Complexities Under GDPR

The deployment of self‑checkout systems in Europe intersects with stringent data governance requirements under the General Data Protection Regulation (GDPR), which is creating persistent compliance burdens for retailers and technology providers. According to the European Data Protection Board, numerous formal inquiries into self‑service system data practices were initiated across EU member states in 2024, which is primarily concerning the collection and retention of transaction metadata, biometric identifiers, and behavioural analytics. In France, CNIL fined major retailers for storing anonymized video footage from self‑checkout zones beyond the legally permissible retention window. Similarly, the Irish Data Protection Commission issued guidance clarifying that even aggregated shopper movement data derived from self‑service sensors constitutes personal data if linked to loyalty card usage. Compliance complexity is further compounded by fragmented national interpretations of GDP, R, as Germany requires explicit opt‑in consent for AI‑driven basket analysis, while Spain permits such processing under legitimate interest provisions, as noted in the European Data Protection Supervisor’s harmonization report. Retailers must therefore navigate a labyrinth of jurisdictional requirements, often necessitating custom configurations for each market, which inflates operational costs and delays deployment. A European Retail Federation survey found that most retailers cite data compliance as a top concern when evaluating new self‑checkout vendors. Until greater regulatory alignment is achieved, legal uncertainties will continue to impede innovation and constrain the functional scope of self‑service systems across the EU.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

14.19%

Segments Covered

By Type, Component, End User, And Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

NCR Corporation, Diebold Nixdorf, Fujitsu Limited, Toshiba Global Commerce Solutions, ITAB Shop Concept AB, ECR Software Corporation, Pan-Oston Corporation, StrongPoint ASA, Gilbarco Veeder-Root, MetroClick, Flooid Limited, shopreme GmbH, GK Software SE, Scandit AG

SEGMENTAL ANALYSIS By Type Insights

The fixed segment dominated the market by holding 76.5% of the European market share in 2024. The dominance of the fixed self-checkout systems segment in the European market is driven by their deep integration into established retail infrastructure, particularly in large format grocery and hypermarket environments, where space and throughput are optimized for permanent fixtures. According to the European Retail Federation, over 92% of supermarkets with more than 1,000 square meters of sales area in Western Europe operate at least four fixed Self-checkout lanes, which is reflecting long term capital investment in stationary units. A primary driver is consumer familiarity and reliability. Fixed systems offer consistent performance with integrated weight sensors, receipt printers, and payment terminals, reducing transaction failure rates. As per a 2024 study by TÜV Rheinland, fixed units exhibited a system uptime of 98.6% compared to 92.1% for mobile variants, reinforcing retailer confidence. Additionally, regulatory frameworks in countries like Germany and France mandate fixed fiscalization hardware for tax compliance, making permanent installations a legal necessity. The European Commission’s Digital Retail Compliance Report noted that 86% of fiscal-compliant Self-checkout deployments in 2024 were fixed due to certified hardware requirements. These structural, operational, and legal factors collectively sustain the dominance of fixed Self-checkout systems across Europe.

The mobile-based self-checkout systems segment is the fastest-growing segment in the Europe market and is expected to expand at a CAGR of 16.6% over the forecast period, owing to the rising adoption of smartphone-enabled shopping in compact and high-traffic retail formats. Unlike fixed units, mobile systems leverage consumer-owned devices or handheld scanners provided in-store, enabling true roaming checkout that eliminates physical queues. A key growth catalyst is the proliferation of scan and go applications in convenience and specialty retail. According to the European DIGITAL SME Alliance, 57% of urban convenience stores in the Netherlands and Sweden launched mobile Self-checkout pilots in 2024, with average transaction completion times reduced to under 90 seconds. Additionally, labor cost pressures are accelerating deployment. As per Eurofound, mobile solutions reduce staffing needs by up to 30% in stores under 300 square meters, which is a critical advantage in high-wage economies like Denmark and Switzerland. Retailers such as REWE in Germany and Carrefour City in France reported a 22% increase in customer throughput after introducing mobile checkout, as documented by the European Retail Round Table. The flexibility, scalability, and alignment with Europe’s mobile-first consumer behavior position mobile-based systems as the most dynamic segment in the Self-checkout landscape.

By Component Insights

The solutions segment held 70.6% of the Europe self-checkout systems market share in 2024. The dominance of the solutions segment in the European market can be credited to the capital-intensive nature of initial deployments, particularly among large retailers modernizing legacy checkout infrastructure. According to the European Institute for Retail Technology, over 120,000 new Self-checkout units were installed across the EU in 2024, with hardware representing 74% of total system expenditure. Retail modernization mandates are a key driver. National retail digitization strategies, such as France’s “Retail of the Future” initiative, have allocated over 850 million euros in public-private funding since 2022 to upgrade point of sale systems, directly boosting hardware demand. As per the French Ministry of Economy, 94% of funded projects included fixed Self-checkout kiosks with integrated fiscal printers. Furthermore, consumer expectations for seamless transactions necessitate robust hardware; the European Consumer Organisation found that 68% of shoppers consider payment terminal responsiveness and scanner accuracy as critical to self-service satisfaction. This emphasis on physical reliability ensures sustained investment in solutions. Additionally, European safety and electrical standards (EN 60950 and EN 62368) require certified hardware, which limits software-only rollouts and reinforces the solutions segment’s centrality in market architecture.

The services segment is the fastest-growing component of the Europe self-checkout systems market and is predicted to register a CAGR of 15.8% over the forecast period, owing to the shift from one-time hardware sales to recurring revenue models centered on system performance and uptime. Retailers increasingly prioritize operational continuity over initial cost, leading to long-term service contracts. As per the European Retail Federation, 71% of European retailers signed multi-year managed service agreements in 2024, up from 48% in 2021. Predictive maintenance powered by Internet of Things telemetry is a major enabler. According to the Fraunhofer Institute for Reliability and Microintegration, AI-driven diagnostics reduced unplanned downtime by 41% in German pilot stores during 2024. Additionally, cybersecurity concerns are elevating service demand. The European Union Agency for Cybersecurity documented a 33% year on year increase in point-of-sale malware attacks in 2024, which is prompting retailers to outsource secure software patching and compliance monitoring. Companies like NCR and Diebold Nixdorf now derive over 40% of their European Self-checkout revenue from services, according to financial disclosures submitted to the European Securities and Markets Authority. This transition toward performance-based partnerships underscores the strategic rise of the services segment.

By End User Insights

The retail segment commanded the overwhelming dominance in the Europe self-checkout systems market in 2024. This concentration is rooted in the high-volume transactional nature of grocery and general merchandise stores, where labor efficiency and checkout speed directly impact profitability. According to Eurostat, Europe’s retail sector processed over 28 billion in-person transactions in 2024, with Self-checkout adoption rising fastest in food retail, which accounts for 61% of all self-service installations. Supermarkets and hypermarkets are the primary adopters due to standardized product barcoding and basket sizes that simplify scanning. As per the European Food and Drink Association, 89% of packaged food items sold in the EU carry globally unique EAN 13 barcodes, enabling reliable optical recognition, which is a prerequisite for Self-checkout viability. Furthermore, large retailers have the capital to absorb implementation costs. According to the European Retail Round Table, the top 10 European grocery chains invested a combined 1.2 billion euros in self-service technology in 2024 alone. Consumer behaviour reinforces this trend as the European Commission’s Consumer Market Survey found that 76% of Europeans have used Self-checkout in a grocery setting, compared to only 12% in non-retail contexts. The convergence of product standardization, transaction scale, and consumer familiarity ensures retail’s continued hegemony in the Self-checkout ecosystem.

The hospitality segment is estimated to witness a CAGR of 18.4% over the forecast period in this regional market, owing to the post pandemic labor shortages and the integration of self-service into experiential dining and accommodation models. Urban hotels and quick-service restaurants are leading the adoption. According to the European Hotel Association, 44% of four-star and above hotels in major European cities introduced lobby based Self-checkout kiosks for check-in, incidental purchases, and minibar billing in 2024. In the food service domain, the European Federation of Quick Service Restaurants reported that 38% of members deployed self-ordering and payment stations, reducing front desk staffing needs by up to 25%. A critical enabler is the rise of integrated property management systems; as per Hospitality Technology Europe, 62% of new hotel builds in Germany and Spain in 2024 included self-service modules compatible with Opera and Maestro platforms. Moreover, traveller preferences are shifting as Eurostar’s 2024 passenger survey revealed that 67% of business travellers prefer hotels with self-service options for added convenience and reduced wait times. Unlike retail, hospitality leverages Self-checkout not just for efficiency but as a premium touchpoint, which is redefining service expectations across the European experience economy.

REGIONAL ANALYSIS United Kingdom Self-Checkout Systems Market Analysis

The United Kingdom led the market in the European self-checkout systems market in 2024 by holding 23.5% of the European market share. The dominance of Germany in the European market is driven by the early adoption, mature retail infrastructure, and strong consumer familiarity. Self‑service technology has been mainstream in British supermarkets since the early 2000s, with Tesco operating over 9,000 self‑checkout units nationwide as of 2024, showing how scale and maturity sustain leadership. According to the British Retail Consortium, 81% of UK grocery shoppers used self‑checkout at least once per week in 2024, the highest frequency in Europe, proving how consumer behaviour drives consistent usage. Post‑Brexit labor constraints intensified automation reliance as the Office for National Statistics reported a 29% decline in EU‑born retail workers between 2020 and 2024, showing how workforce shortages accelerate technology adoption. The Department for Business and Trade noted over 1,200 autonomous retail pods deployed in London, Manchester, and Birmingham in 2024, which indicates how regulatory flexibility enables innovation. Sainsbury’s investment of £150 million in 2025 to upgrade its fleet to AI‑enhanced units demonstrates how capital commitment sustains competitive advantage.

Germany Self-Checkout Systems Market Analysis

Germany commanded the second-largest share of the European self‑checkout systems market in 2024. The growth of Germany in the European market is majorly driven by engineering precision, regulatory compliance, and a dense retail network. According to the Federal Statistical Office’s 2024 digital commerce survey, 73% of German consumers reported satisfaction with supermarket self‑checkout experiences, showing how trust supports adoption. Germany’s fiscalization laws require all electronic cash registers to use certified security devices; the Federal Central Tax Office reported over 250,000 compliant units in operation by December 2024, proving how regulation standardizes deployment. According to the Handelsverband Deutschland, 86% of Edeka and Rewe stores operate at least six self‑checkout lanes, showing how retailer commitment ensures widespread availability. Vendor consolidation, with Diebold Nixdorf dominating supply, reflects how engineering excellence supports reliability.

France Self-Checkout Systems Market Analysis

France is estimated to witness a prominent CAGR in the European self‑checkout systems market over the forecast period, owing to the digitization initiatives and urban retail penetration. The France Relance recovery plan allocated €320 million to retail digital transformation between 2021 and 2024, showing how state funding accelerates infrastructure rollout. According to the French Ministry of Economy, this supported over 18,000 new self‑service units installed nationwide, proving how policy directly expands capacity. INSEE reported that 69% of Parisian shoppers used self‑checkout monthly in 2024 compared to 48% nationally, showing how urban density drives adoption. Carrefour alone operates 5,200 self‑checkout points across France, demonstrating retailer leadership. France’s “anti‑waste for a circular economy” law mandates digital receipts, reducing paper consumption by 3,200 tons annually, as verified by ADEME, showing how sustainability aligns with self‑checkout systems.

Netherlands Self-Checkout Systems Market Analysis

The Netherlands is predicted to account for a noteworthy share of the European self‑checkout systems market over the forecast period, owing to its population size, reflecting retail density, and technological openness. According to Statistics Netherlands (CBS), 85% of adults made at least one self‑service retail transaction in 2024, the highest per capita rate in the EU, showing how digital engagement drives adoption. Albert Heijn operates self‑checkout in 100% of its 980 stores, with 41% of digital transactions via mobile self‑service in 2024, proving how innovation sustains usage. With 78% of the population living in cities, compact geography enables rapid diffusion. The Dutch Retail Association reported that 92% of convenience stores in Amsterdam, Rotterdam, and Utrecht use self‑checkout, often integrated with transport systems, showing how ecosystem integration accelerates adoption.

Spain Self-Checkout Systems Market Analysis

Spain is estimated to witness a healthy CAGR in the European self‑checkout systems market over the forecast period, owing to the tourism and labor dynamics. According to the National Statistics Institute (INE), Spain welcomed 87 million international tourists in 2024, showing how visitor demand sustains kiosk adoption in airports and supermarkets. The Spanish Ministry of Labour reported a 34% vacancy rate in frontline retail roles in tourist hotspots in 2024, proving how staffing shortages accelerate automation. Mercadona deployed over 3,000 self‑checkout units nationwide, 60% in high‑traffic urban and coastal locations, showing how retailers respond to seasonal demand. Spain’s smartphone penetration of, 89% as per the Spanish Data Protection Agency, supports mobile self‑checkout adoption, showing how digital readiness complements retail automation.

COMPETITION OVERVIEW

Competition in the Europe self-checkout systems market is characterized by intense technological differentiation, strategic alliances anservice-centricic business models among a mix of global technology firms and specialized regional providers. Leading players continuously refine user experience through artificial intelligence, biometric verification, and multilingual interfaces to meet Europe’s diverse consumer expectations. Regulatory complexity, particularly around fiscal compliance and data privacy, demands deep local expertise, creating barriers for new entrants and favouring incumbents with established legal and technical frameworks. Retailers increasingly evaluate vendors not only on hardware reliability but also olong-termrm support, cybersecurity resilience, and integration with existing enterprise systems. This has shifted competition from product features alone to holistic retail technology partnerships. Simultaneously emerging startups focusing on mobile and scan-and-go solutions are challenging the traditional models, particularly in convenience and hospitality segments, fostering innovation and accelerating market evolution across the region.

KEY MARKET PLAYERS

A few major players of the Europe self-checkout systems market include

NCR Corporation Diebold Nixdorf Fujitsu Limited Toshiba Global Commerce Solutions ITAB Shop Concept AB ECR Software Corporation Pan-Oston Corporation StrongPoint ASA Gilbarco Veeder-Root MetroClick Flooid Limited shopreme GmbH GK Software SE Scandit AG Top Strategies Used by the Key Market Participants

Key players in the Europe self-checkout systems market employ a range of strategic initiatives to reinforce their competitive standing. Product innovation remains central with companies investing heavily in artificial intelligence-enabled fraud prevention, seamless payment integration, and ergonomic design enhancements. Strategic partnerships with national retailers and government bodies facilitate regulatory compliance and large-scale deployment. Expansion of service-based revenue models, including managed maintenance, cybersecurity support, and cloud monitoring, transforms traditional hardware vendors into technology partners. Geographic diversification within Europe focuses onhigh-growthh markets such as Spain and the Netherlands, where labor shortages and digital readiness accelerate adoption. Lastly, companies prioritize sustainability by designing modular,r recyclable units and reducing energy consumption, aligning with Europe’s green retail mandates and enhancing brand perception among environmentally conscious clients.

Leading Players in the Europe Self-checkout Systems Market NCR Corporation maintains a significant presence in the European self-checkout systems market through its extensive portfolio of retail technologies and deep integration capabilities with leading European supermarket chains. The company has prioritized sustainability and user experience by launching its next generation of eco conscious Self-checkout units featuring energy-efficient components and modular designs that reduce electronic waste. In 2024, NCR expanded its partnership with Edeka in Germany to deployAI-drivenn fraud detection across hundreds of stores. It also introduced cloud-based remote management tools that allow retailers to update software and monitor performance in real time, strengthening its value proposition beyond hardware alone. Diebold Nixdorf is a pivotal contributor to the European Self-checkout landscape with a strong footprint in Germany, France, and the United Kingdom, where its systems are widely adopted by major grocery and department store retailers. The company has recently intensified its focus on service-led offerings by rolling out predictive maintenance powered by Internet of Things sensors and machine learning analytics. In early 2025, Diebold Nixdorf launched a cybersecurity enhancement program across its European self-service fleet to address rising threats to point of sale systems. It also collaborated with national fiscal authorities to ensure compliance with evolving tax reporting mandates, reinforcing trust among regulated retail environments. Toshiba Global Commerce Solutions actively shapes the Europe self-checkout systems market through innovation in mobile and fixed hybrid solutions tailored for urban retail formats. The company has deepened its engagement with European retailers by introducing bilingual and multilingual user interfaces that cater to diverse consumer populations in cities like Brussels, Barcelona, and Stockholm. In late 2024, Toshiba integrated its Self-checkout platforms with leading European loyalty programs, enabling personalized promotions at the point of sale. It also launched a pilot with a major Dutch convenience chain to test biometric age verification for age-restricted purchases, demonstrating its commitment to responsible automation and regulatory alignment. MARKET SEGMENTATION

This research report on the Europe self-checkout systems market has been segmented and sub-segmented based on type, component, end user, and region.

By Type

By Component

By End User

Retail Hospitality Others

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe