Increased U.S. production helped push global oil markets into surplus conditions, contributing to lower oil prices last year. TexasRaiser photo by Eric Kounce.

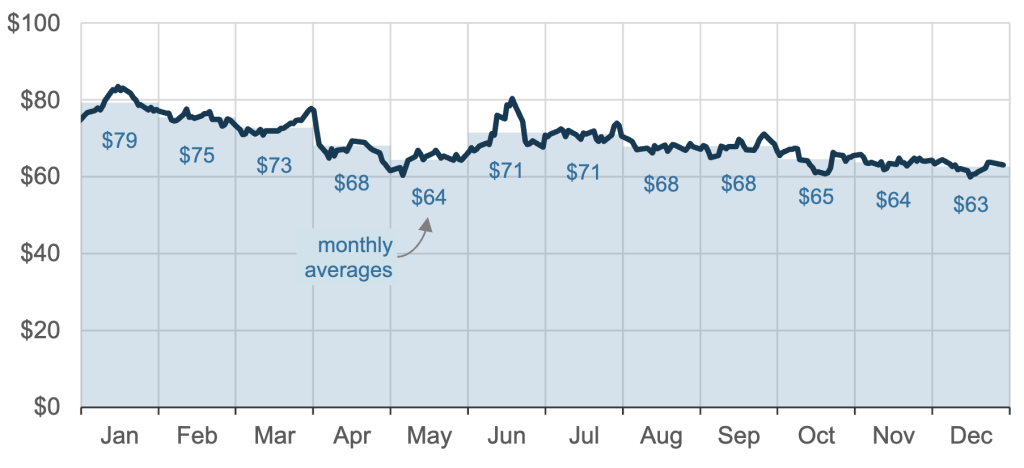

Crude oil prices trended downward through 2025, driven by a global supply glut and slower demand growth, according to a new analysis from the U.S. Energy Information Administration (EIA). In its Today in Energy report published January 5, the agency said that benchmark Brent crude monthly averages fell from around US$79 per barrel early in the year to approximately US$63 per barrel by December — the lowest average since early 2021.

Daily Brent crude oil spot price (2025). EIA graph.

Daily Brent crude oil spot price (2025). EIA graph.

The trend reflects a broader energy-market environment in which production has outpaced consumption and inventories have swelled, creating downward pressure on prices and reshaping market expectations for 2026 and beyond.

The EIA attributed the price decline largely to global oversupply of crude oil, noting significant stock builds in 2025 that were among the largest on record outside of the COVID-19 pandemic period. In its Short-Term Energy Outlook, the agency estimated that world petroleum production exceeded consumption by an average of more than 2.5 million barrels per day in the second half of 2025, contributing to higher inventories.

Reuters reporting on global oil markets later in 2025 echoed this assessment, highlighting that some OPEC+ producers maintained robust output levels even as demand growth faltered, partly to defend market share and compensate for earlier cuts that had tightened balances. The resulting surplus contributed to a downward trend in spot and futures prices.

The EIA also pointed to slower than expected demand expansion as a factor. Although petroleum use continued to grow in 2025, the pace was below historical norms, reflecting broader economic headwinds in major markets, particularly Europe and parts of Asia.

Global energy agency reports from the International Energy Agency (IEA) have noted similar patterns: slower industrial activity and structural shifts in energy consumption have tempered oil demand growth this decade. In its recent World Energy Outlook, the IEA highlighted that while demand will continue rising in absolute terms through the mid-2020s, the growth rate has softened compared with prior forecasts — in part because of energy efficiency gains and shifts toward electrification in key sectors.

Market analysts say that each downturn in crude prices over 2025 occurred against a backdrop of sporadic geopolitical events — including conflicts in the Middle East and supply disruptions in parts of Africa — that temporarily supported prices. However, those interruptions were not enough to counterbalance the broader oversupply trend, according to the EIA.

Bloomberg analysts noted that the market’s sensitivity to macroeconomic signals — particularly Chinese economic data and currency fluctuations — helped accentuate the price slide. Bloomberg cited softening industrial output figures in China in late 2025 as a key factor underpinning reduced crude demand expectations, which in turn contributed to lower crude futures prices.

NPR’s coverage of U.S. energy markets in late 2025 highlighted how falling crude oil prices translated to mixed outcomes for consumers. While retail gasoline prices declined in many regions, utilities and households faced higher electricity costs due in part to weather events, transmission constraints, and regional fuel mix differences. NPR’s reporting underscored that lower oil prices do not uniformly reduce all consumer energy costs, particularly where electricity and natural gas markets are driven by separate dynamics.

For oil producers, the 2025 price slide and inventory builds raise questions about future drilling and investment decisions. Reuters noted that U.S. shale operators are already signalling more cautious capital spending plans if price forecasts remain flat, focusing on efficiency rather than aggressive production growth.

The EIA’s outlook suggests that market balances could tighten if production moderates or if demand surprises to the upside — for example, through unexpected economic growth or accelerated fuel consumption in emerging markets. For now, however, inventories remain elevated and prices subdued relative to recent years’ averages.