Europe Benzene Market Size

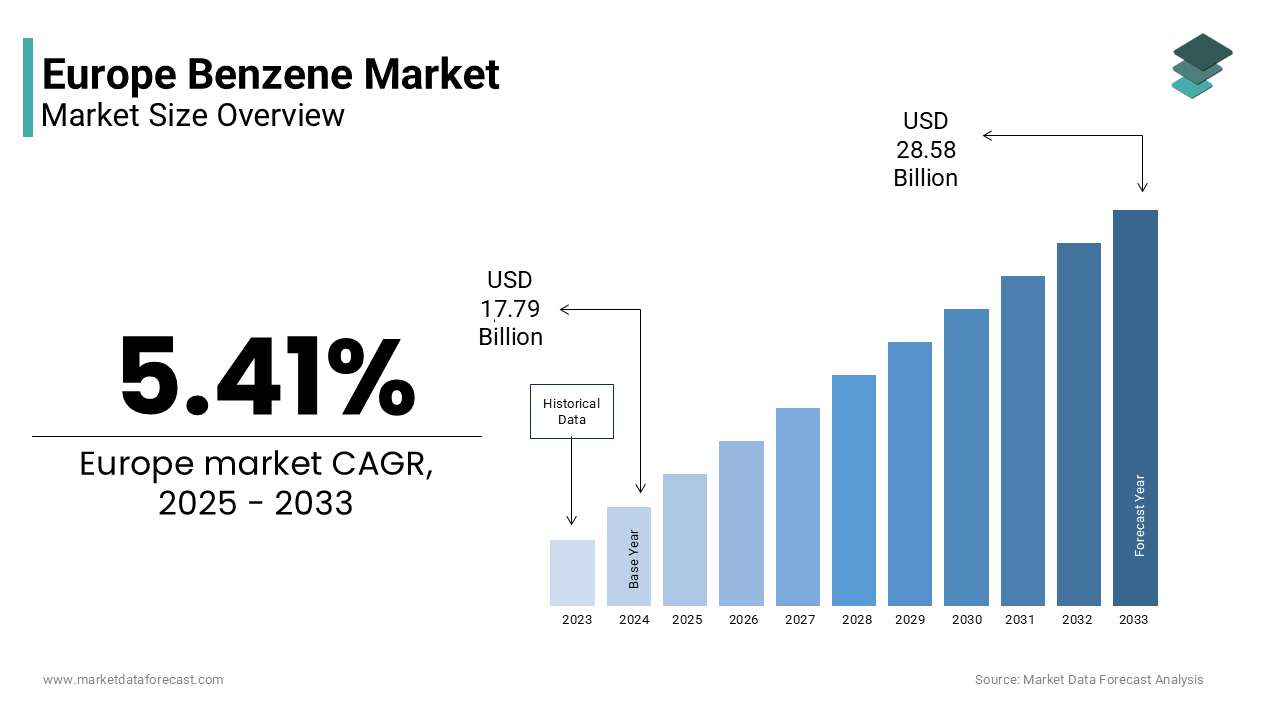

The Europe benzene market size was valued at USD 17.79 billion in 2024 and is projected to reach USD 28.58 billion by 2033 from USD 18.75 billion in 2025, growing at a CAGR of 5.41%.

Benzene is a fundamental, colourless, sweet-smelling, highly flammable liquid hydrocarbon known for its stable ring structure, making it the simplest aromatic compound. Benzene serves as a critical building block for a wide array of downstream chemicals, including styrene, cumene, phenol, cyclohexane and nylon intermediates essential to plastics, synthetic rubber, resins and adhesives. Europe’s benzene ecosystem is tightly interwoven with its petrochemical infrastructure and manufacturing base. Benzene consumption is concentrated within specific industrial areas associated with refining and chemical manufacturing. European chemical plants continue to process large volumes of aromatic chemicals, including benzene derivatives. Authorisation for industrial use of the material, though recognised as a significant health hazard, is granted contingent upon adherence to established control measures and oversight standards. These regulatory and infrastructural realities define a market where supply chain resilience, product stewardship, and feedstock integration determine competitive viability across the continent.

MARKET DRIVERS Robust Demand from Polystyrene and Synthetic Rubber Industries

The sustained consumption of benzene in the production of styrene, a direct derivative, remains a key driver of the European benzene market. Styrene is indispensable for manufacturing polystyrene used in packaging, insulation, and automotive components, as well as synthetic rubbers like styrene butadiene rubber for tyres. The production volume of a specific polymer within the region has been consistently high. A specific chemical component represents a significant proportion of that polymer’s molecular weight, which requires a steady supply of this chemical component at major production sites. Demand from manufacturers of automotive components contributes to this supply requirement. Despite ongoing recovery efforts, the majority of the polymer is not reprocessed, necessitating continuous new production. This structural linkage between benzene and high-volume polymer streams ensures steady industrial pull despite regulatory pressures.

Integration with Refinery and Steam Cracker Operations

Benzene supply in the region is intrinsically tied to the operational dynamics of integrated refineries and naphtha-based steam crackers, which fuel the growth of the European benzene market. These facilities generate it as a co-product during ethylene and propylene production. Unlike regions reliant on coal tar benzene, Europe’s supply stems almost exclusively from petroleum processing. European facilities processed a substantial volume of a specific petroleum product, resulting in a large quantity of a particular chemical byproduct. A significant number of processing facilities within the region utilise specific equipment that can generate an intermediate stream high in that same chemical, which is then separated using established industrial extraction or distillation methods. This integration creates a supply floor that is less susceptible to price volatility than standalone production. Moreover, cracker operators actively manage benzene yield based on market signals, increasing severity to boost aromatics during high-demand cycles. This inherent linkage between fuel and chemical production ensures benzene remains a strategic co-product rather than a marginal output, anchoring its availability in Europe’s petrochemical value chain.

MARKET RESTRAINTS Stringent Regulatory Classification as a Carcinogen

Benzene’s classification as a known human carcinogen under EU Regulation (EC) No 1272/2008 and its inclusion in REACH Annexe XIV for authorisation severely restricts its handling, use, and emission across the European Union, which hampers the growth of the European benzene market. Regulatory frameworks in a particular region establish stringent standards for managing workplace exposure to certain chemical substances, such as benzene. These rigorous control measures, which include requirements for advanced handling systems and continuous monitoring, represent a comprehensive strategy for minimising potential exposure levels in the workplace. The implementation of these compliance measures necessitates considerable resource allocation and modifies standard operating procedures within industrial facilities. The overall effect of these safety requirements is an observable increase in the financial expenditure associated with the production processes for certain derivative products. Furthermore, the EU’s Industrial Emissions Directive requires Best Available Techniques reference documents for all installations using benzene, leading to mandatory upgrades in ventilation, containment and waste gas treatment. The cumulative effect is a regulatory environment that discourages new standalone benzene users and forces existing operators into continuous capital reinvestment, constraining market expansion despite downstream demand.

Volatility in Naphtha Feedstock Pricing and Availability

High sensitivity towards fluctuations in naphtha prices hinders the expansion of the European benzene market. It is a primary feedstock for steam crackers that also serves as a key blending component in gasoline. Since benzene yield correlates directly with naphtha cracking severity, any feedstock cost spike compresses margins for integrated producers who cannot fully pass costs to downstream buyers. Moreover, the EU’s Fit for 55 package has accelerated the decline of internal combustion engine vehicles, reducing long-term gasoline demand and thereby naphtha availability. The dual pressure, rising input costs and shrinking feedstock base, threatens the economic viability of benzene production from traditional routes. Producers face difficult trade-offs between maintaining benzene output and optimising for lower carbon intensity fuels, creating structural uncertainty that undermines investment and supply stability.

MARKET OPPORTUNITIES Development of Bio-Based and Circular Alternatives to Benzene Derivatives

Emerging innovations in renewable chemistry present a strategic opportunity to decouple key benzene-derived products from fossil feedstocks, which is expected to fuel the growth of the European benzene market. While benzene itself remains petrochemical-bound bound its major derivatives, such as styrene and phenol, are now being produced from bio-based sources. Multiple companies are exploring alternative feedstocks for producing aromatic chemicals. One facility is piloting the production of a specific chemical from plant-derived sugars using a thermal process. Another company and a collaborator are assessing methods for producing a different chemical utilising materials sourced from plant cell walls. There has been an increase in investment in European projects aimed at substituting traditional aromatic chemicals with those derived from biological sources or captured carbon dioxide. These pathways align with the EU’s Chemicals Strategy for Sustainability,, prioritises non-toxic circular feedstocks. The EU Ecolabel and Green Public Procurement criteria increasingly favour products with verified renewable content. As these technologies scale, they offer benzene producers a future pathway to maintain relevance in downstream markets while transitioning toward circular models—turning regulatory pressure into an innovation opportunity.

Expansion of On-Purpose Benzene Production via Toluene Disproportionation

European ethylene producers are using more ethane in their crackers due to changing demand, which lowers benzene co-production, and thereby creates new opportunities for the European benzene market. As a result, on-purpose technologies like toluene disproportionation are becoming more popular to guarantee a steady supply of benzene. Toluene disproportionation converts surplus toluene into benzene and xylene streams and is particularly viable in regions with abundant reformate. A notable volume of a specific chemical agent is available within the regional market, driven by a reduction in its demand for solvent applications and changes in fuel production standards. The excess availability of this agent creates a commercial rationale for converting it into a related, high-value material used in the production of plastics and synthetic rubber. In response to this trend, one regional energy producer initiated the development of a conversion facility aimed at securing the supply of this key feedstock. Another major market participant is actively evaluating a similar project to adapt to the shifting supply and demand dynamics for related chemical products. These investments represent a strategic pivot from passive co-product reliance to active market balancing. Europe can ensure a continuous benzene supply for downstream industries, even with changing cracker methods, by using existing aromatics infrastructure and surplus intermediates, thus optimising resource use within the refining sector.

MARKET CHALLENGES Geopolitical Disruption of Aromatics Supply Chains

Vulnerability towards geopolitical instability affecting crude oil and naphtha flows, particularly from Russia, obstructs the growth of the European benzene market. A significant portion of regional energy product imports previously relied on a single major supplier. Following geopolitical changes and infrastructure disruptions, trade volumes from that primary source experienced a sharp decline. This reduction prompted the market to diversify its sourcing, leading to increased reliance on alternative supply regions located further away. The shift in sourcing patterns has been associated with changes in the cost structure for refiners due to the increased transportation distances. This supply shock increased feedstock costs and reduced operational flexibility for integrated crackers. Moreover, benzene itself is traded regionally, and any logistics bottleneck can disrupt deliveries to inland chemical parks like Ludwigshafen and Antwerp. These physical and political vulnerabilities expose the market to sudden cost spikes and allocation constraints. Europe’s pursuit of energy independence necessitates robust aromatics logistics, which is a complex issue requiring coordinated infrastructure investment and strategic inventory planning that has not yet been resolved.

Declining Refinery Capacity and Aromatics Yield in Legacy Assets

The ongoing rationalisation of the region’s refining sector is reducing the installed base capable of producing benzene at scale, which impedes the expansion of the European benzene market. Several refining facilities have ceased operations, while others have transitioned to alternative production methods. This structural change is influenced by evolving environmental policies, reduced demand for traditional fuels, and ageing infrastructure. Operational facilities are generally mature and may lack current technology for efficient processing of certain chemical components. The overall capacity to produce certain aromatic compounds within the European refining system has shown a decline. Consequently, benzene supply is increasingly concentrated in a handful of integrated sites such as ExxonMobil’s Antwerp complex and Shell’s Moerdijk facility. Europe’s benzene supply will become more vulnerable, threatening the competitiveness of downstream chemical manufacturing in the long run, unless strategic investment in aromatic optimisation or new capacity is made.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

5.41%

Segments Covered

By Derivative, Application, and Region

Various Analyses Covered

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Dow Inc., INEOS, LyondellBasell Industries NV Class A, BASF SE, Shell PLC, Reliance Industries Ltd GDR – 144A, Chevron Corp, China Petroleum & Chemical Corp Class H, Marathon Petroleum Corp, LG Chem

SEGMENTAL ANALYSIS By Derivative Insights

The Ethyl Benzene segment led the European benzene market and accounted for a share of 28.6% in 2024. The leading position of the Ethyl Benzene segment is driven by its exclusive role as the precursor to styrene, a monomer essential for polystyrene, synthetic rubber and engineering plastics used across the packaging, automotive and construction sectors. A further driver is the scale of styrene demand in Europe’s manufacturing base. Major integrated complexes operate world-scale ethyl benzene dehydrogenation units ensuring continuous offtake. The structural linkage between ethyl benzene and high-volume polymer streams creates an irreplaceable demand corridor that anchors the derivative’s market position. A different reinforcing factor is the lack of viable substitution pathways. Unlike other benzene derivatives, such as cumene or cyclohexane, which are bio-based alternatives, ethyl benzene remains exclusively petroleum-derived due to the thermodynamic and catalytic specificity of alkylation with ethylene. The technological lock-in ensures that every incremental unit of styrene demand translates directly into benzene consumption. Additionally, integrated crackers optimise benzene yield specifically to feed ethyl benzene units, demonstrating strategic alignment across the value chain. As long as Europe maintains its polymer and tyre manufacturing footprint, ethyl benzene will continue to dominate benzene allocation.

The cyclohexane derivative segment is on the rise and is expected to be the fastest-growing segment in the market by witnessing a CAGR of 5.9 %from 2025 to 2033 due to rising demand for nylon 6 and nylon 66 in automotive and engineering plastics. Cyclohexane is hydrogenated from benzene and serves as the starting material for adipic acid and caprolactam, key monomers in nylon production. Vehicle production consistently integrates specific polymeric materials, such as connectors and air intake manifolds. The total volume of nylon necessitates substantial quantities of the raw material cyclohexane. An observable pattern involves a growing trend toward using lighter-weight materials within the manufacturing process. This material shift is directly influenced by regulations that establish goals for average fleet emissions. The established emission targets encourage manufacturers to substitute traditional metal parts with advanced high-performance polymers. An additional driver is the expansion of European nylon production capacity. An expansion project for a chemical used in fibre and plastic production has been implemented at a European facility, integrating its supply with a linked material production unit. There has been an increase in the output of a specific plastic compound in a production facility in Southern Europe, driven by its application in components for electric vehicles. These investments generally indicate an optimistic outlook regarding future demand for such materials. Industry participants are preparing to meet market targets that call for a specific percentage of recycled content in engineered plastic products. This convergence of regulatory pressure, material innovation and industrial investment positions cyclohexane as the highest growth benzene derivative in Europe’s evolving polymer landscape.

By Application Insights

The chemical Intermediates segment was the largest in the European benzene market by capturing a substantial share in 2024. The supremacy of the chemical Intermediates segment is credited to benzene’s fundamental role as a feedstock rather than a final product. Nearly all benzene consumed in Europe is converted into derivatives such as styrene, cumene, cyclohexane and phenol, which in turn feed downstream industries. This segment’s dominance arises from the structural design of Europe’s integrated petrochemical complexes, where benzene is not stored or traded in bulk but immediately routed to adjacent derivative units. These complexes operate under long-term offtake agreements that minimise market exposure and ensure stable derivative production. The application’s scale is further reinforced by the lack of alternative aromatic building blocks; benzene remains the only commercially viable source for key monomers at industrial volumes. A different critical factor is regulatory classification. Due to its carcinogenicity,y benzene is prohibited for direct use in consumer applications across the EU under REACH Annexe XVII. This legal restriction channels virtually all benzene into closed-loop chemical synthesis, where exposure is controlled. Moreover, the chemical intermediates application is not merely dominant but effectively mandatory, which makes it the sole legitimate pathway for benzene consumption in the region. This regulatory reality ensures that demand is dictated entirely by derivative market dynamics rather than end product trends.

The plastics application segment is expected to exhibit a noteworthy CAGR of 5.4% during the forecast period, d owing to sustained demand for benzene-derived polymers such as polystyrene, ABS and nylon in automotive electronics and construction. Although benzene itself is not present in the final plastic parts, it is embedded in their molecular architecture via intermediates like styrene and caprolactam. The automotive sector is a key driver. The expansion of speciality plastic compounds for electric vehicles also drives the growth of this segment. Battery housings, connectors, and charging infrastructure require high heat resistance, chemical stability and electrical insulation, all properties delivered by benzene-based polymers. The innovations create incremental benzene demand decoupled from general plastic consumption. The expanding use of high-performance aromatic plastics in Europe’s transition to electrified and connected mobility is set to become the most dynamic growth area in the benzene value chain.

REGIONAL ANALYSIS Germany Benzene Market Analysis

Germany outperformed other countries in the European benzene market and accounted for a 24.7% share in 2024 because of its position as the continent’s petrochemical and manufacturing heartland. The country’s market status is defined by dense integration of refineries, steam crackers and derivative plants along the Rhine and Ruhr corridors. A significant volume of a key chemical compound is consumed by the chemical manufacturing sector. Major producers within the industry rely on this compound to create specific intermediate products. These intermediate products, such as those used in engineering plastics and synthetic rubber, support a large downstream manufacturing industry. The production activity of this downstream industry appears to be a primary factor in driving the demand for the foundational chemical compound. Furthermore, Germany hosts Europe’s largest refinery cluster, er including the ExxonMobil and Shell sites in North Rhine-Westphalia, which generate benzene as a co-product from naphtha cracking. This vertical integration ensures stable supply and high utilisation rates. Germany, as a leading industrial powerhouse in Europe, maintains a benzene market fundamentally tied to extensive chemical manufacturing and automotive supply chains.

Netherlands Benzene Market Analysis

The Netherlands followed closely in the European benzene market and captured a 19.6% share in 2024, with its strategic location as Europe’s primary aromatics hub centred on the Port of Rotterdam and the Chemelot industrial park. The country’s market status is anchored by massive integrated complexes, including ExxonMobil’s Rotterdam refinery, Shell’s Moerdijk crack, er and Trinseo’s styrene facility. The processing of this chemical within the country is predominantly concentrated within integrated sites, significantly reducing the volume available for open market trading. An extensive pipeline infrastructure facilitates the direct transfer of the chemical between refineries and chemical plants, bypassing the need for intermediate storage facilities. The country functions as a major logistical hub for the onward shipment of this chemical and its derivatives to several neighbouring nations. A substantial volume of the chemical’s derivatives, specifically styrene and cumene, is directed as exported to nearby markets. This logistical and infrastructural advantage cements the Netherlands’ role as Europe’s central node in the benzene value chain.

France Benzene Market Analysis

France is also a key player in the European benzene market due to its integrated refining and chemical operations, coupled with strategic investments in automotive and aerospace materials. The country’s market status is shaped by TotalEnergies’ Grandpuits and Feyzin complexes, which produce benzene for internal conversion into styrene and phenol. The automotive sector remains pivotal. Vehicle production volume in France has increased. Domestic automotive manufacturers are sourcing specific raw materials, particularly benzene-derived plastic, from suppliers within the country. Significant financial investment has been directed towards developing advanced materials for electric vehicle manufacturing, leading to increased demand for specific polymers like nylon and ABS. The industry is shifting towards integrating advanced materials in new vehicle production. This blend of industrial policy and integrated production sustains France’s strong position in the regional benzene market.

Italy Benzene Market Analysis

Italy experienced a consistent growth in the European benzene market owing to its focus on speciality chemicals and synthetic fibres derived from benzene. The country’s market status is anchored by Versalis (Eni) and Solvay operations in Ferrara and Ravenna, which convert benzene into cyclohexane, caprolactam and styrene for nylon and polystyrene production. The fashion and automotive sectors drive demand for high-performance fibres and compounds. Additionally, Italy’s chemical parks benefit from Mediterranean port access, enabling feedstock imports. This specialisation in high-value derivatives rather than bulk volumes defines Italy’s distinctive role in the European benzene landscape.

United Kingdom Benzene Market Analysis

The United Kingdom is anticipated to expand in the European benzene market from 2025 to 2033 due to its legacy refining infrastructure and transition toward speciality aromatics. The country’s market status has evolved following the closure of several refineries, but remains anchored by the Stanlow complex operated by Essar Oil, which supplies benzene to INEOS’s aromatics and polystyrene units. The UK’s strong pharmaceutical and speciality chemicals sector also consumes benzene derivatives such as phenol and aniline. Furthermore post post-Brexit trade dynamics have increased reliance on domestic benzene supply to avoid EU regulatory delays. The government’s Net Zero Strategy includes support for advanced recycling of polystyrene, potentially creating future circular demand for benzene. Though smaller than continental peers, the UK maintains a resilient, specialised ecosystem focused on high-value conversion and supply chain autonomy.

COMPETITIVE LANDSCAPE

Competition in the European benzene market is defined by a highly integrated and capital-intensive landscape dominated by large petrochemical and energy conglomerates. Players compete not on benzene pricing but on feedstock efficiency, operational reliability and downstream value capture through derivatives like styrene,ene, cyclohexane and phenol. The market is characterised by minimal open trading as most benzene is consumed internally within industrial complexes such as Ludwigshafen, Antwerp and Marl. Regulatory pressure from REACH and the EU Industrial Emissions Directive forces continuous investment in containment monitoring and emission abatement—raising barriers to entry for smaller operators. Geopolitical shifts, including reduced Russian naphtha imports, have intensified focus on supply chain security, prompting investments in alternative production routes. Innovation is increasingly directed toward circular models rather than volume expansion as sustainability imperatives reshape traditional petrochemical paradigms. In this environment, competitive advantage lies in integration, resilience, and strategic alignment with Europe’s decarbonization trajectory.

KEY MARKET PLAYERS

Some of the notable key players in the European benzene market are

Dow Inc INEOS LyondellBasell Industries NV (Class A) BASF SE Shell PLC Reliance Industries Ltd (GDR – 144A) Chevron Corp China Petroleum & Chemical Corp (Class H) Marathon Petroleum Corp LG Chem Top Players in the Market INEOS Group is a leading participant in the European benzene market through its integrated aromatics complexes in Germany, Belgium, and the United Kingdom. The company produces benzene as a co-product in its steam crackers and supplies it to downstream units manufacturing styrene and phenol. INEOS actively aligns its operations with EU sustainability mandates by investing in energy efficiency and emission reduction technologies across its sites. Globally, INEOS leverages its European benzene infrastructure to support polystyrene and synthetic rubber exports to Asia and the Americas, reinforcing its role as a key global supplier of aromatic derivatives while maintaining stringent European environmental and safety standards. BASF SE plays a pivotal role in the European benzene market through its world-scale Verbund integrated site in Ludwigshafen, Germany, where benzene is both produced and consumed internally for caprolactam, cyclohexanone, and aniline synthesis. The companclosed-looploop model minimises open market benzene trading and ensures supply chain resilience. Globally, BASF exports benzene-derived engineering plastics and intermediates to over 90 countries, setting benchmarks for product quality and regulatory compliance. Its commitment to circular chemistry—including chemical recycling of polystyrene—positions benzene as a recoverable feedstock in future circular value chains beyond fossil origins. TotalEnergies SE maintains a strong presence in the European benzene market through its refining and petrochemical operations in France, Belgium and the Netherlands. The company produces benzene at its Grandpuits and Feyzin complexes and channels it into styrene and cumene units for domestic and export markets. In response to EU decarbonization policies, TotalEnergies prioritised energy integration and flare reduction at its aromatics units. Globally, TotalEnergies leverages its European benzene derivatives in speciality polymers and adhesives sold across Africa, Latin America and Asia—demonstrating how regional integration enables worldwide product diversification. Top Strategies Used by the Key Market Participants

Key players in the European benzene market focus on vertical integration by linking benzene production directly to downstream derivative units to ensure feedstock security and operational efficiency. They invest in energy optimisation and emission control technologies to comply with stringent EU environmental and REACH regulations. Companies are exploring purpose production routes, such as toluene disproportionation, to offset declining benzene yields from shifting cracker feedstocks. Strategic debottlenecking of styrene and cyclohexane plants enhances value capture from existing benzene streams. Additionally, ly firms are evaluating circular economy pathways, including chemical recycling of polystyrene to recover benzene precursors. These strategies collectively reinforce supply resilience, regulatory compliance and long-term viability in a carbon-constrained regulatory landscape.

MARKET SEGMENTATION

This research report on the European benzene market has been segmented and sub-segmented based on categories.

By Derivative Type

Alkyl Benzene Cumene Cyclohexane Ethyl Benzene Nitro Benzene Aniline Toluene Phenol Styrene Others

By Application Type

Solvent Chemical Intermediates Surfactants Plastics Rubber Manufacturing Detergent Explosives Lubricants Pesticides Anti-Knock Additives Others

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe