The Netherlands attracts the world’s largest companies with its lenient financial rules – and the biggest 15 firms saved billions of euros in taxes in recent years, a Follow the Money analysis shows.

Some 5 trillion euros flow through the Netherlands each year, yet very little of that money is taxed in the country. The Dutch treasury gets about 650 million euros in taxes of that money, according to thelatest estimate, or 0.013 per cent.

On paper, the Netherlands does not look like a tax haven. Its official corporate tax rate is 25.8 per cent. That’s comparable to rates elsewhere in Europe, which typically range between 20 and 30 per cent.

In practice, however, multinationals rarely pay anything close to that rate: The effective tax rate is often about 15 per cent.

FTM examined the 15 largest multinationals by the revenue they report in the Netherlands. These companies alone channelled 675 billion euros through the country between 2023 and 2024 – that’s more money than the GDP of Belgium or Sweden, for example.

Our journalism is only possible thanks to the trust of our paying members. Not a member yet? Sign up now

Many of those companies used tax avoidance tactics in the Netherlands even if they’re established there, according to the analysis. That’s legal as it is not tax evasion – a deliberate attempt to not pay taxes that are owed – but does raise ethical and political questions.

For certain multinationals, such as Uber and Netflix, their Netherlands-based headquarters handle virtually all global revenue outside the U.S.

The tax advantages are hard to ignore. Interests, royalties, and dividends can typically enter and leave the Netherlands tax-free for multinationals.

There is also the participation exemption – which the Netherlands sets at 100 per cent. If a subsidiary of a company based in the Netherlands is already liable for tax abroad, it doesn’t have to pay tax again to the Dutch authorities. The rule was designed to prevent double taxation, but in reality, it can result in no tax being paid at all. This applies no matter whether the related company is based in a low- or no-tax jurisdiction, such asSwitzerland or Luxembourg.

Plus, several of the Netherlands’ biggest 15 multinationals are oil, gas, and mining companies, the FTM analysis found. That’s because the Netherlands has a large number of treaties with countries rich in those resources. Such treaties set out how money can be moved back and forth between the two and how much tax is to be paid – often at an advantageous rate for the company.

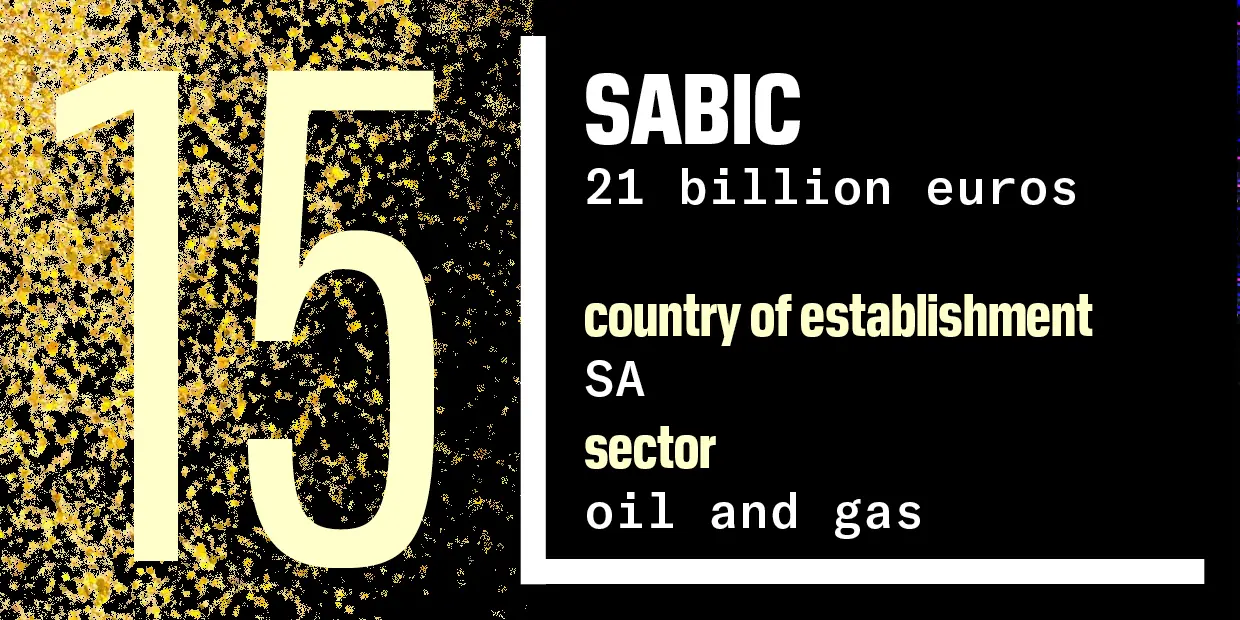

SABIC International Holdings is the Dutch subsidiary of the Saudi petrochemical company, registered in Sittard. SABIC is 70 per cent owned by state oil company Aramco.

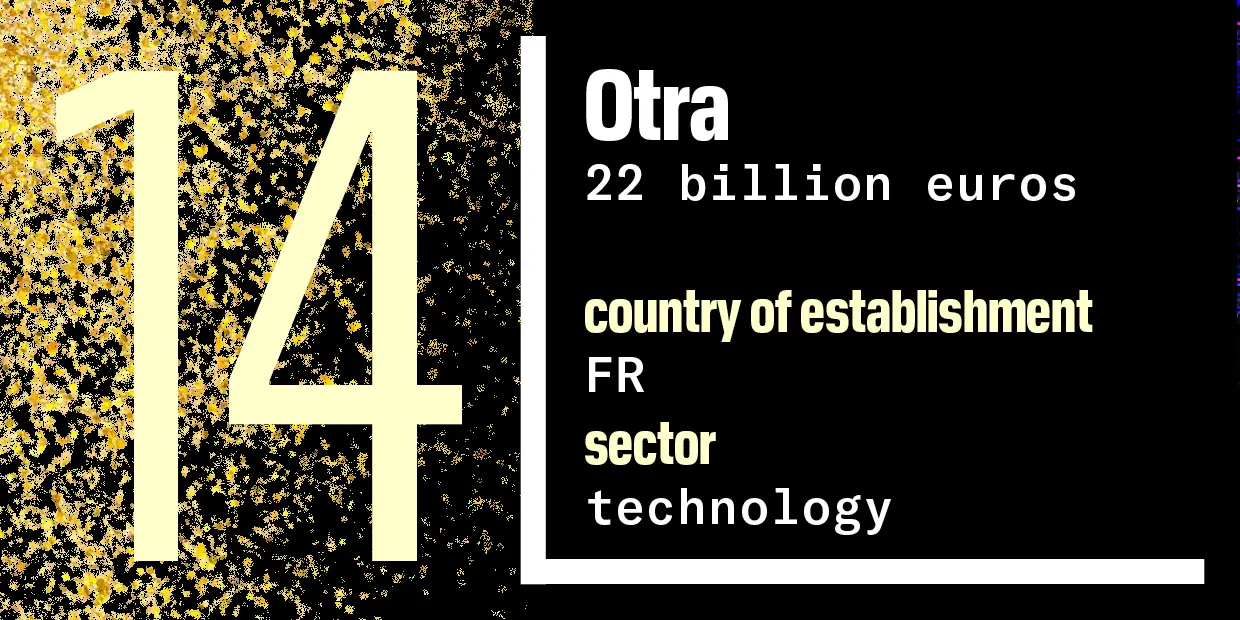

Otra is part of France’s Sonepar, a wholesaler specialising in electrical equipment for businesses. Shares that were held in the Netherlands have since been transferred to the French division, according to the annual report. Otra made some 9 billion euros in 2024 – untaxed in the Netherlands.

“Otra … does not benefit from any special tax regime,” a Sonepar spokesperson said.

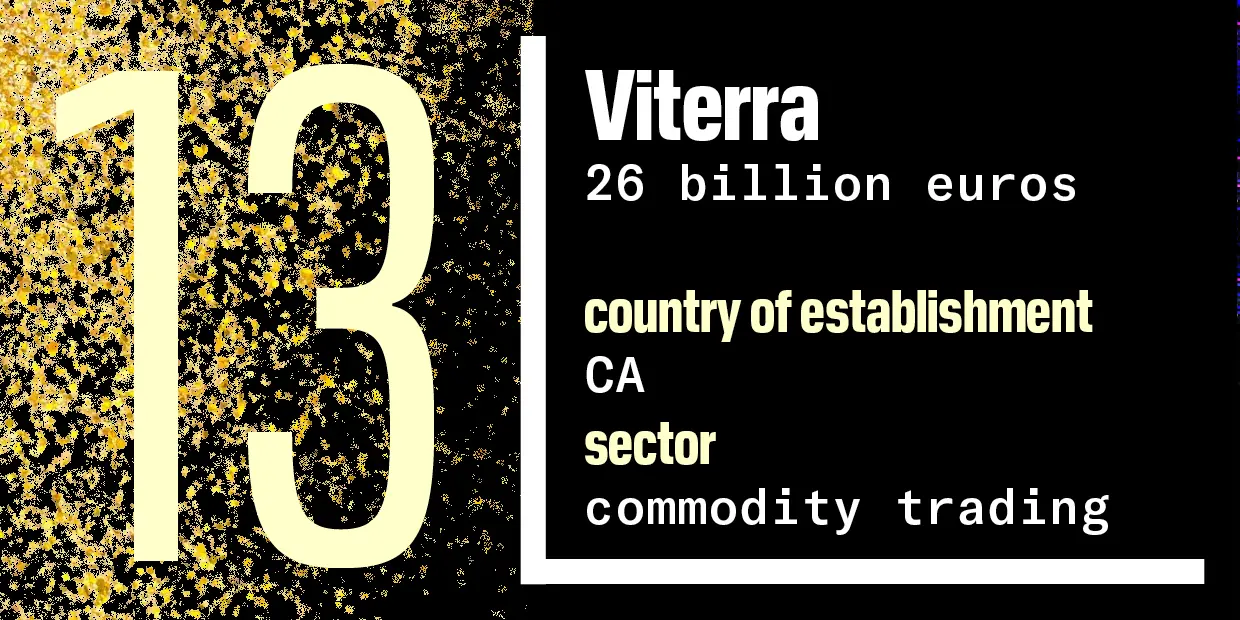

Viterra is originally a Canadian grain trader, now owned by Swiss trading house Glencore. This summer, Viterra merged with industry peer Bunge – which means that Viterra might no longer feature on the list next year. Bunge declined to answer FTM’s questions, arguing that it is based in Geneva.

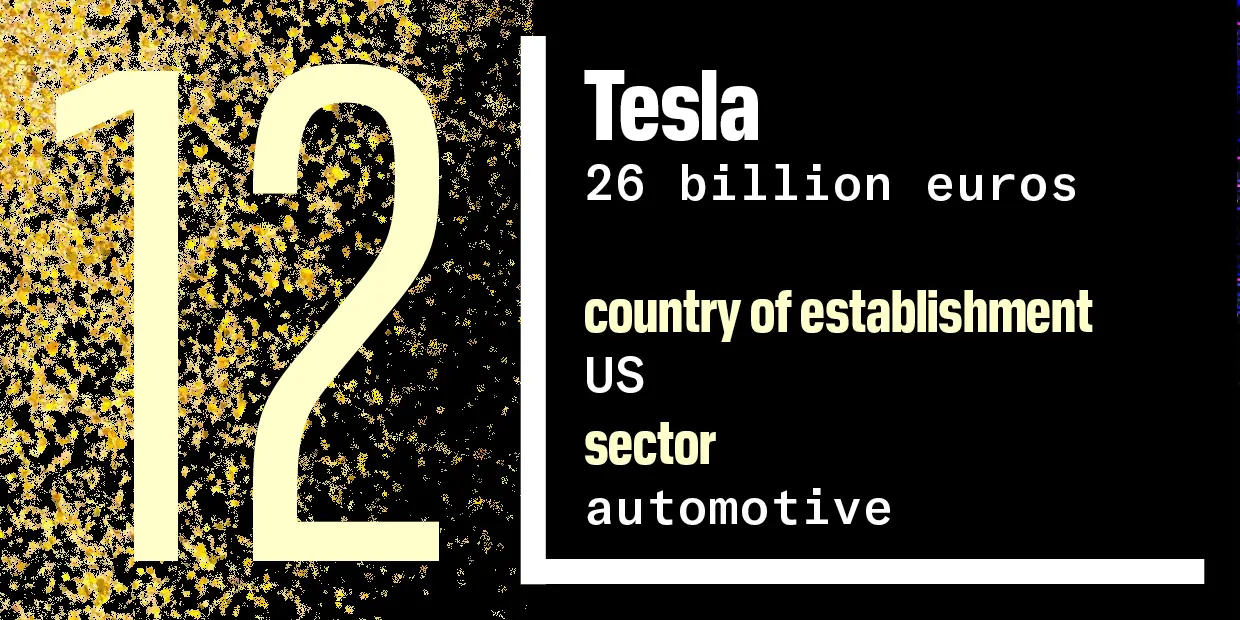

Tesla established its European headquarters in Amsterdam in 2013 – and has raised concerns with its tax structure. There’s no 2024 annual report yet.

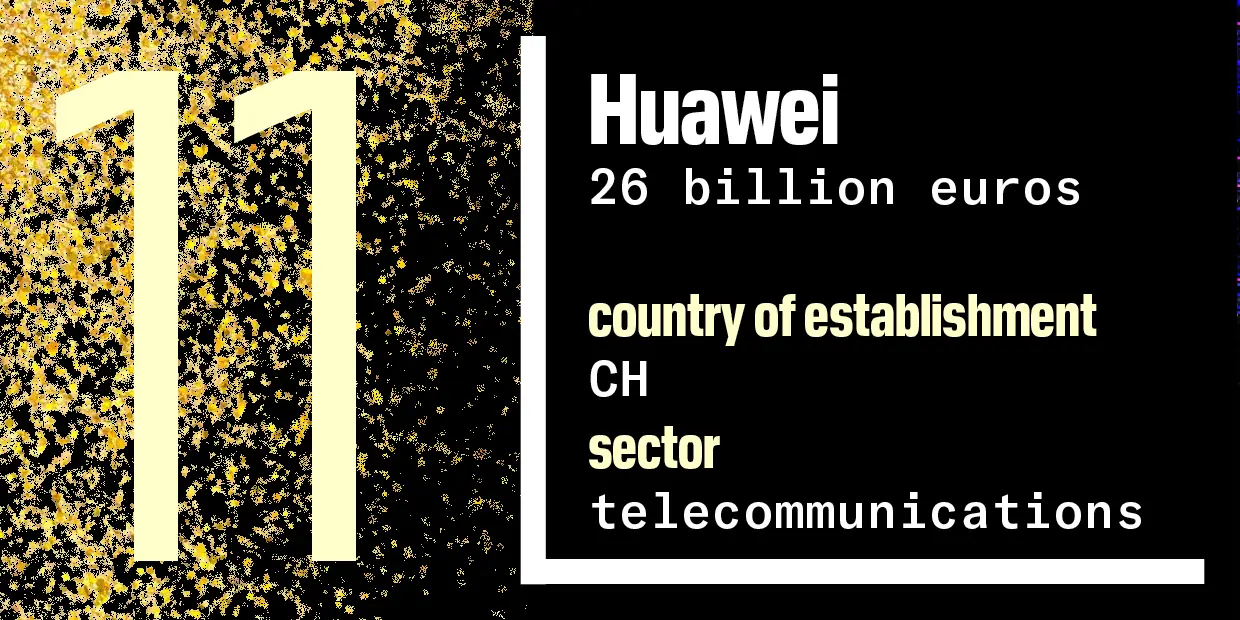

Huawei’s holding company in the Netherlands includes 16 subsidiaries spread across the globe.

The structure under which Huawei was incorporated in the Netherlands was “a well-established and commonly used legal form for both international and local companies in the Netherlands”, a company spokesperson said, adding that Huawei’s Dutch branch “operates in accordance with Dutch laws and regulations”.

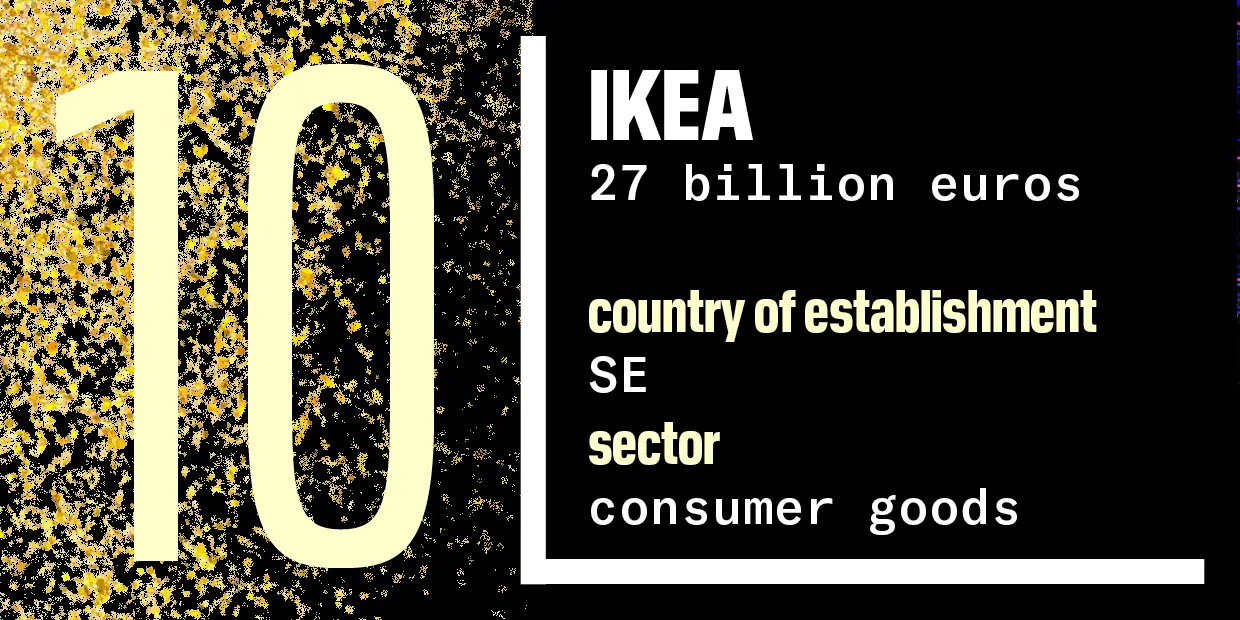

Inter IKEA Systems, a subsidiary of Inter IKEA Holding, owns the intellectual property of the furniture store. It owns only one store in Delft (in addition to some in the Baltics) – all other shops are franchises, which have to pay royalties to Delft for the use of the brand and the store concept.

Royalties can enter and leave the Netherlands tax-free. The European Commission suspects that, through that scheme, IKEA may also have effectively received state aid from the Netherlands. That is why Brussels launched an investigation in 2017 and expanded it in 2020. The probe is ongoing.

“Inter IKEA Group has fully co-operated by responding to the questions of the European Commission,” an Inter IKEA spokesperson said.

Originally hailing from Sweden, IKEA has been Dutch since 1982. Since 2023, Inter IKEA has been owned by a newly established foundation in Liechtenstein.

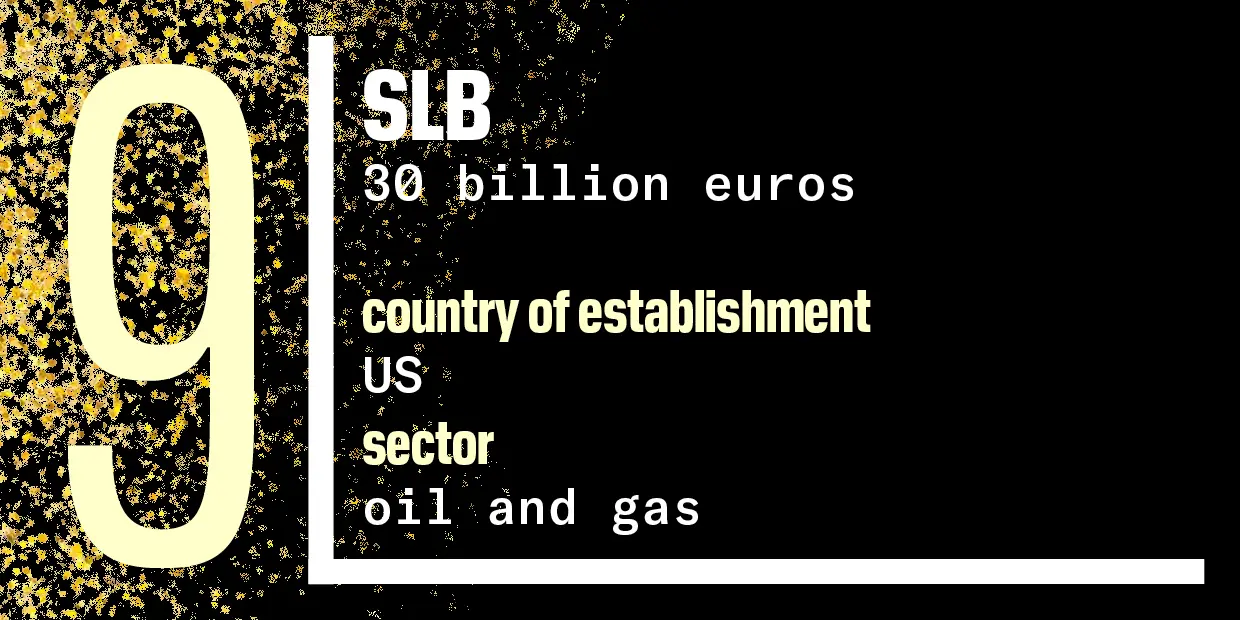

Engineering company SLB, which provides services to the oil and gas industry, was previously listed as Schlumberger Limited Dutch Branch. The firm was founded in Curaçao, but executive tasks are carried out from The Hague. The company, which operates in more than 100 countries, is owned by the French Coste family and is managed by Bertrand Coste.

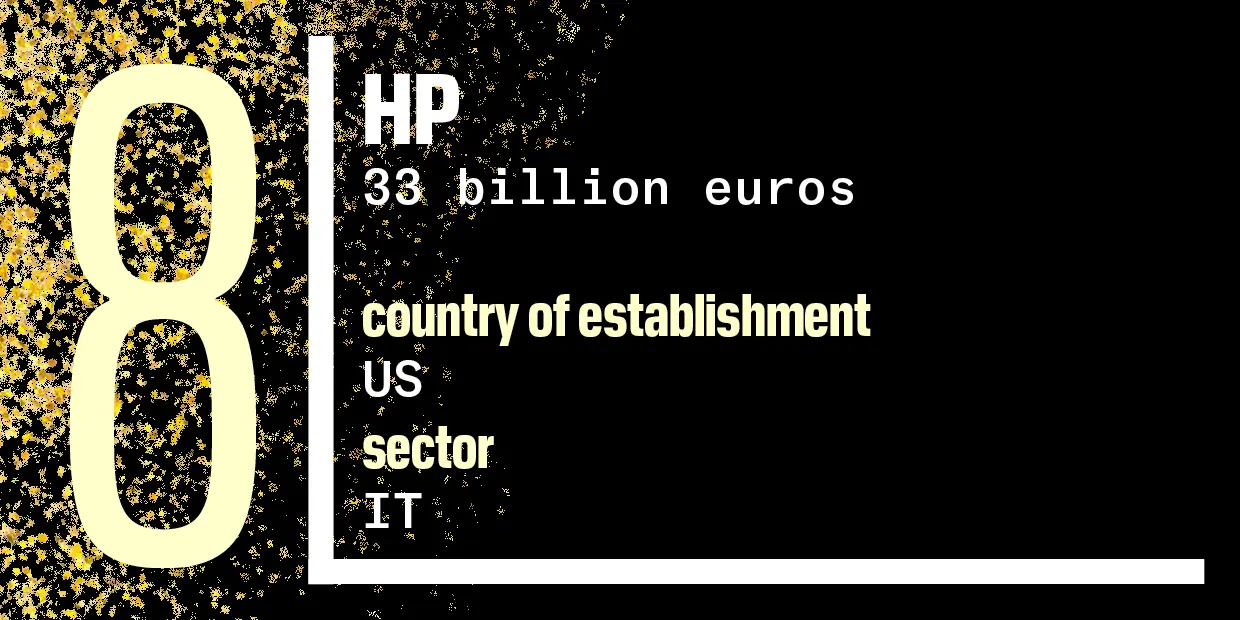

Perseus Holding is a holding company – a firm that holds shares of another company – of computer giant Hewlett-Packard (HP) and has 88 subsidiaries around the world. A significant part of HP’s activities outside the U.S. is routed through this company. The ultimate parent company is located in Singapore.

Perseus Holding pays substantial royalties to entities within the same multinational, whose location is not disclosed in the annual reports. In 2022, it paid 2.2 billion dollars in royalties, and1.5 billion dollars in 2023.

In 2023, it paid an effective tax rate of 11 per cent.

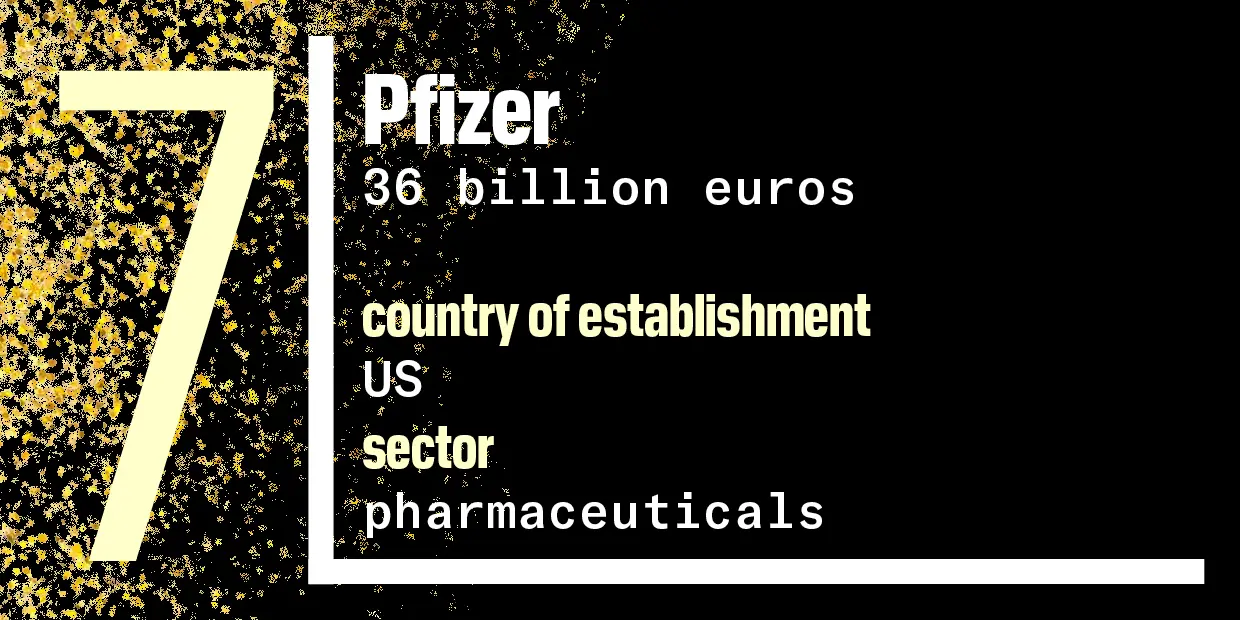

Pharmaceuticals International is the holding company of pharma giant Pfizer, which covers all activities outside the U.S., and has 190 subsidiaries in 165 countries.

Since the partners are located in the tax haven of Delaware, they are liable for tax there and not in the Netherlands.

According to its annual reports, Pfizer also uses entities in Singapore and Puerto Rico, jurisdictions known for giving tax breaks to large companies.

A spokesperson for Pfizer said that the company complied with the law in all countries where it operates.

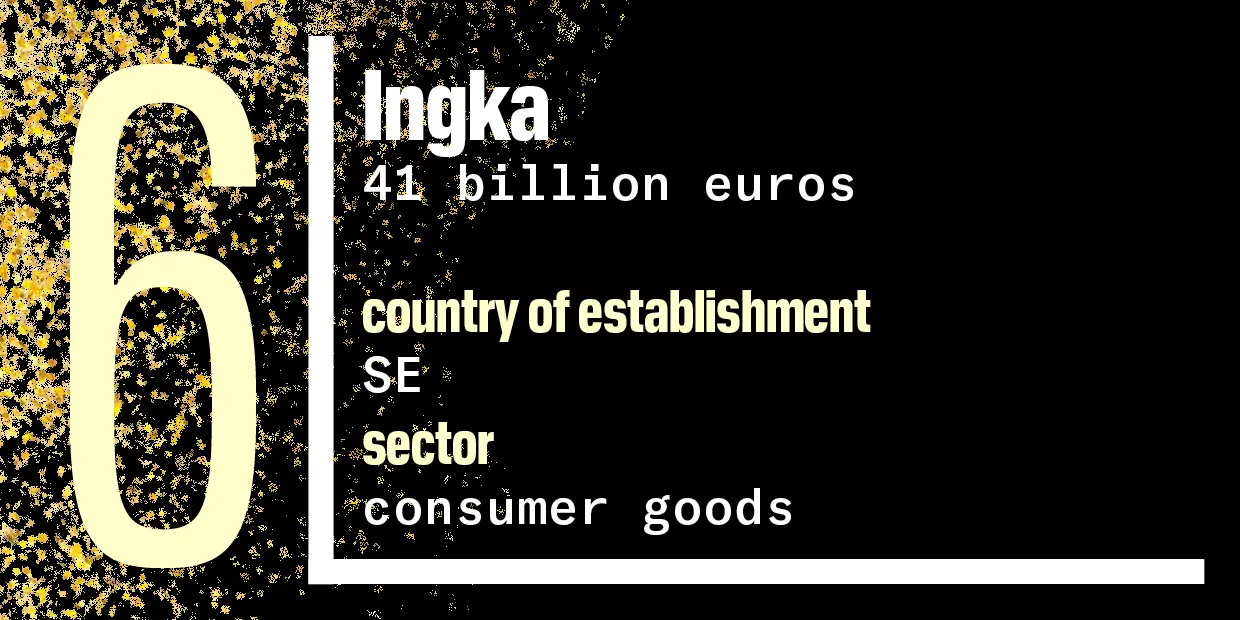

Ingka Holding is IKEA’s largest franchisee and owns 411 stores around the world – meaning that IKEA somewhat features twice on this list, even though Ingka, based in Leiden, is a different company to Inter IKEA in Delft.

Ingka Holding is owned by the Ingka Foundation. Proceeds from the Ingka Foundation, in turn, go to the IKEA Foundation, one of the largest charities in the world. This foundation is committed to curbing global warming.

“The Ingka Group is constantly working to simplify the way it operates and its structures as part of its ongoing transformation,” an Inga spokesperson said.

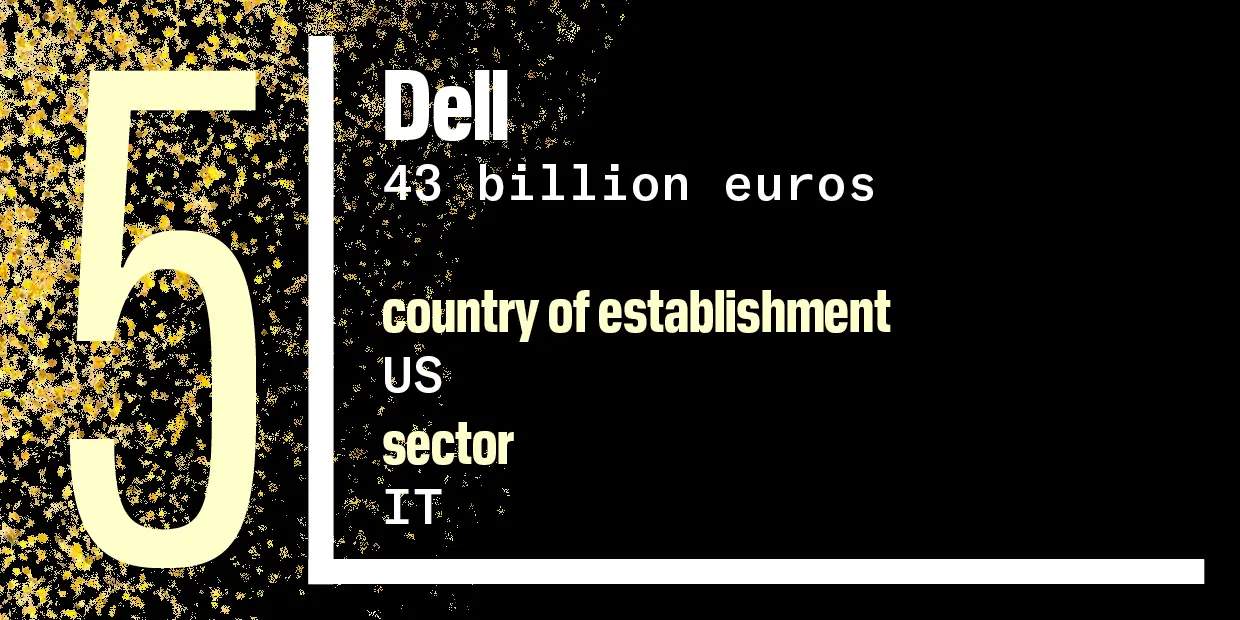

The Dutch company Dell Global has 27 subsidiaries around the world, which sell relatively inexpensive PCs and laptops.

The Dutch company transfers its income to Singapore, where it is subject to a special tax regime. Because the company is liable for tax there, the Dutch company can make use of the participation exemption (see above) and isn’t taxed in the Netherlands.

The effective tax rate for 2024 was over 13 per cent. This is considerably higher than in 2022, when it was only 3 per cent.

A Dell spokesperson said that the effective tax rate could vary for several reasons and declined to comment on individual companies within its corporate structure.

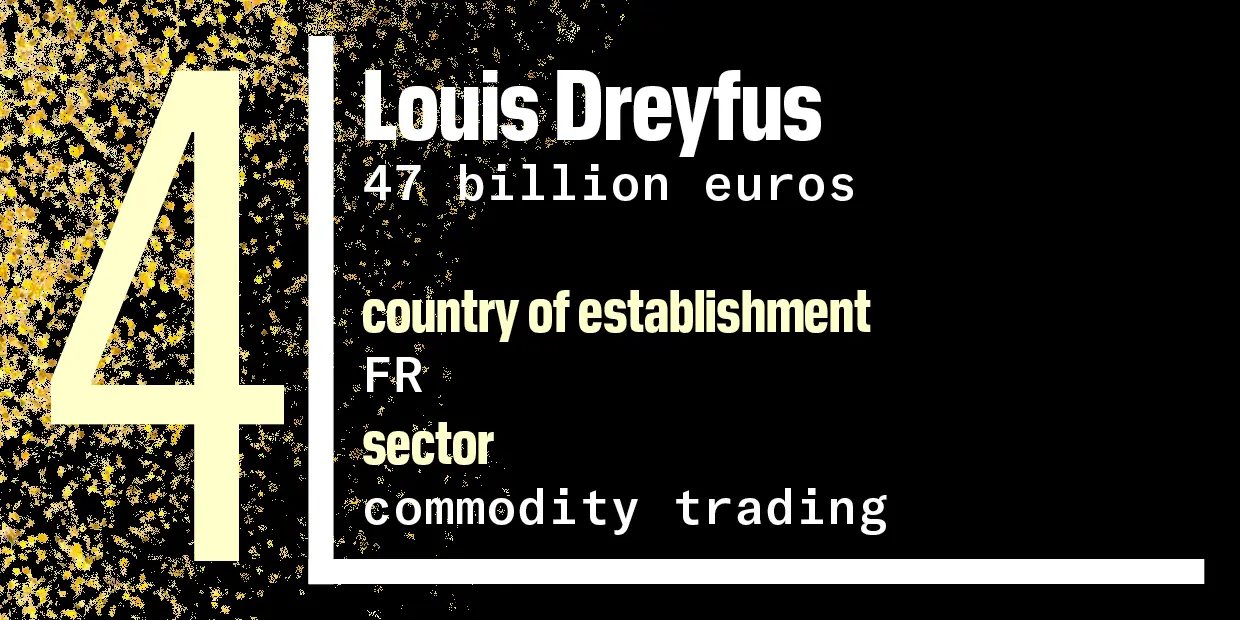

Louis Dreyfus, founded in France in 1851, is the world’s largest grain trader and also deals in agricultural products such as animal feed, coffee, cotton, oilseeds, rice and sugar.

Louis Dreyfus uses the Netherlands to issue bonds, among other things. The holding company, which employs two people, has revenues of 679 million euros. These revenues are largely exempt from Dutch corporation tax by making use of the participation exemption for international subsidiaries.

A Louis Dreyfus spokesperson did not respond to questions, instead referring to the company’s financial reports.

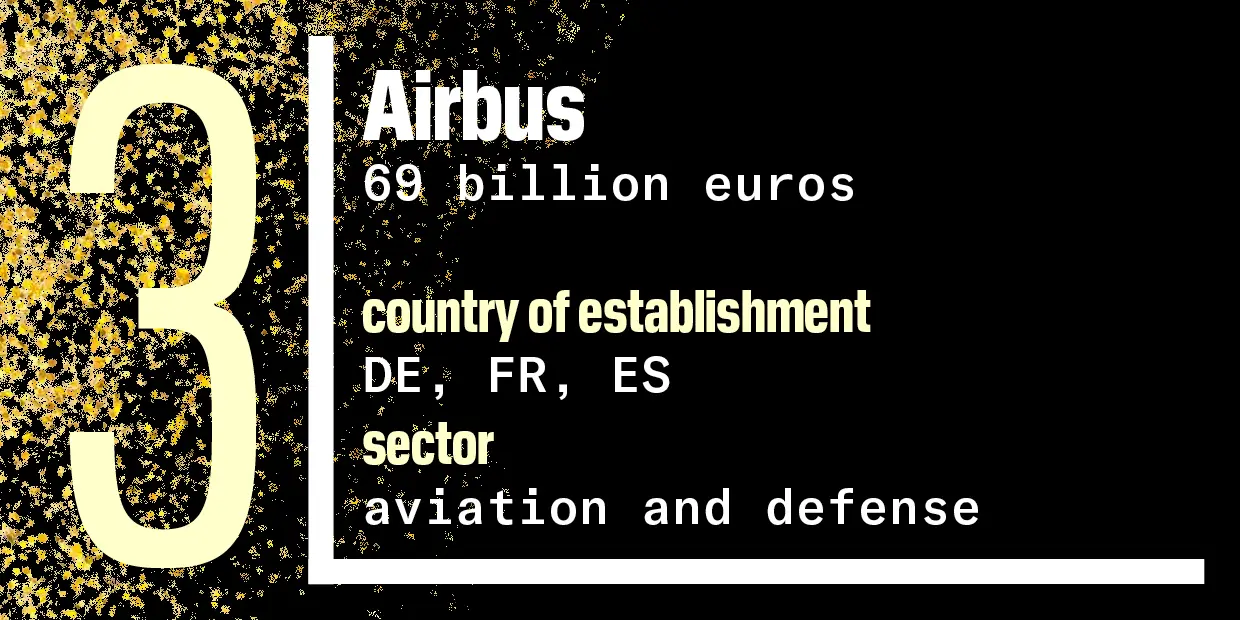

European aircraft and defence equipment manufacturer Airbus has factories in Germany, France, and Spain. The holding company is based in the Netherlands.

Airbus was suspected of paying bribes in 16 countries between 2008 and 2015. The Dutch judicial authorities are, in general, not pursuing cases of foreign corruption or money laundering because prosecution does not serve Dutch interests. That is why it was not the Netherlands but France, the United Kingdom and the U.S. that uncovered the corruption and enforced a settlement of 3.6 billion euros.

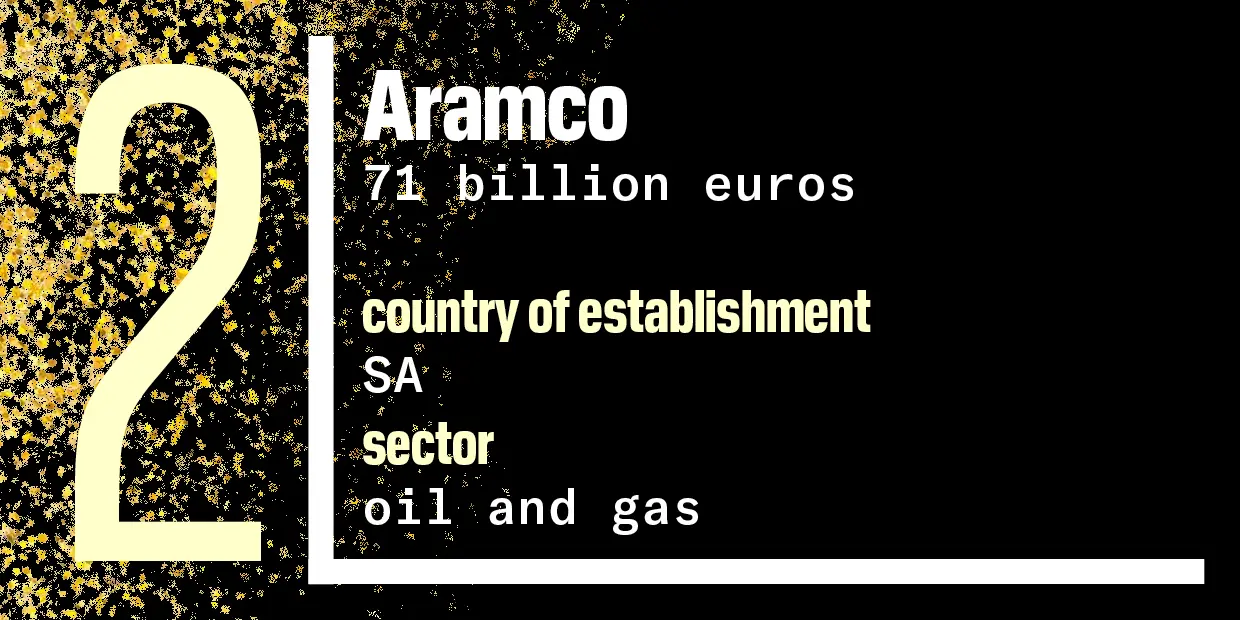

Almost all oil and gas companies in the world use the Netherlands in their corporate structure, leveraging the country’s bilateral tax treaties with most resource-rich nations.”. The deals set out how much tax will be charged on both sides.

Aramco’s European headquarters has been located in The Hague since 2009, where the employees are responsible for tasks ranging from project management and technological developments to legal affairs. For these activities, the Dutch entity can charge operating companies in other countries a fee, and that money can then be transferred back and forth tax-free.

When asked for comment, Aramco referred to its website.

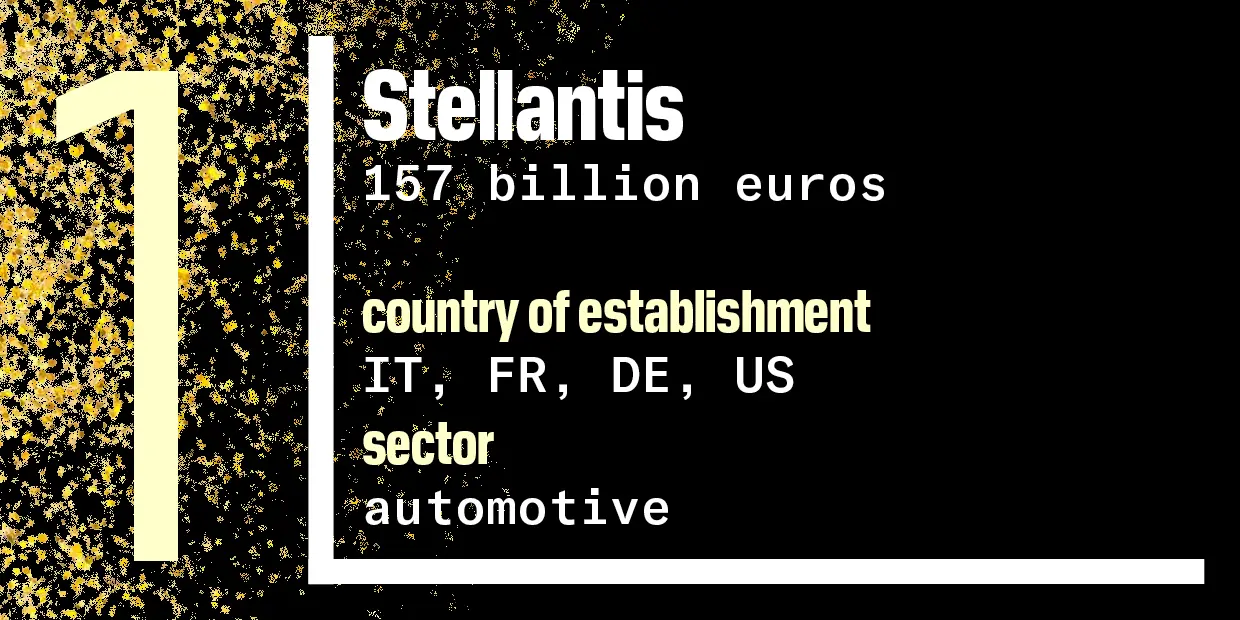

Stellantisis the largest company in the Netherlands in terms of turnover. That’s not bad for a company that, according to its spokesperson, employs barely 50 people. The net profit of this public limited company amounted to 5.5 billion euros in 2024.

Among other things, Stellantis offsets profits against costs, such as high depreciation elsewhere.

Methodology

The figures for many holding companies in this list are consolidated, which means that the results of all subsidiaries at home and abroad are included. In some cases, this involves dozens or even hundreds of companies. The holding company usually receives the profits of the subsidiaries in the form of dividends, which can enter the Netherlands tax-free. However, the turnover reported by these holding companies may include amounts that have not passed through the Netherlands.

The list is based on the most recent information from the Dutch trade register, accessed through company.info – most of it from 2024, some from 2023. As the data is entered manually by Company.info employees, there can be errors. Tips are welcome.

Many multinationals prepare their annual reports in dollars, including those of Dutch entities. Turnover figures quoted in dollars have been converted at an exchange rate of 0.92 euros, the average for the years 2023 and 2024.

Read more

Fold in