Europe Epoxy Resins Market Size

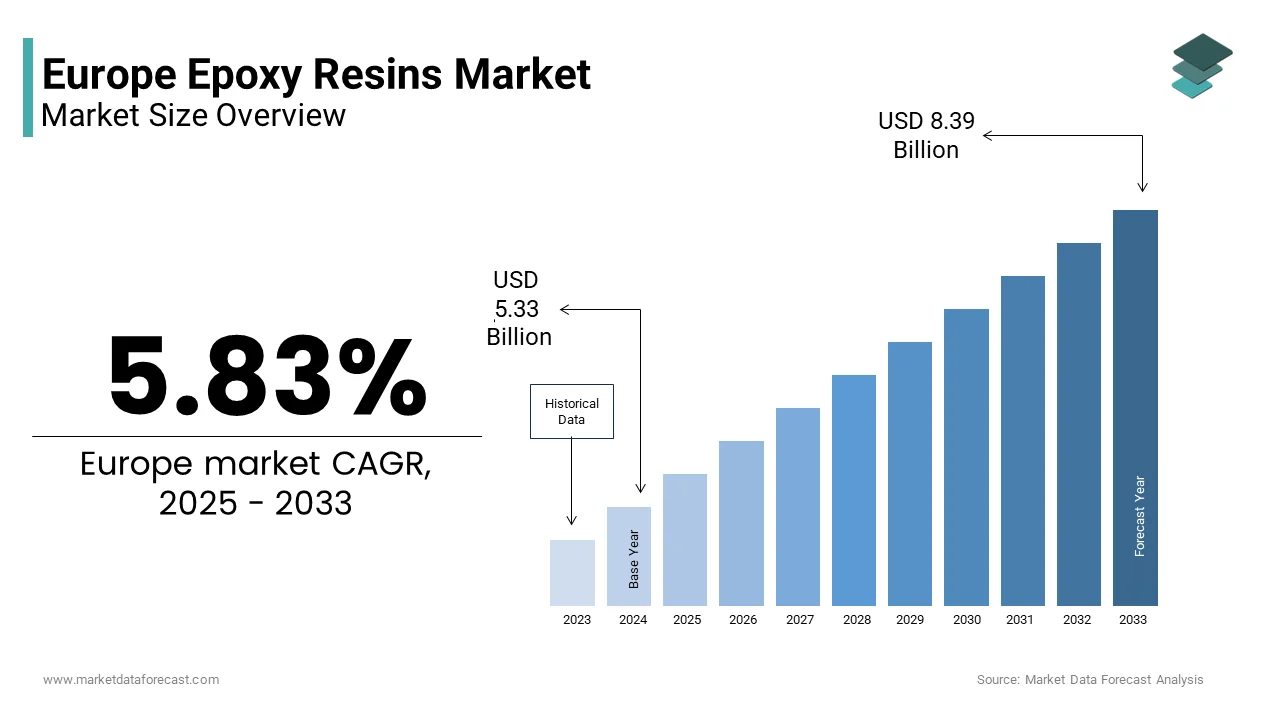

The Europe epoxy resins market size was valued at USD 5.04 billion in 2024 and is anticipated to reach USD 5.33 billion in 2025 and USD 8.39 billion by 2033, growing at a CAGR of 5.83% during the forecast period from 2025 to 2033.

Current Introduction Europe Epoxy Resins Market

Epoxy is a class of thermosetting polymers, widely utilized across industrial, construction, and electronics sectors due to their exceptional mechanical strength, chemical resistance, and adhesion properties. In the European context, these materials serve as foundational components in wind turbine blade manufacturing, printed circuit boards, and protective coatings for infrastructure. The market operates within a tightly regulated environmental framework where sustainability imperatives increasingly influence material selection and process innovation. As per Eurostat, industrial production of basic organic chemicals, which includes precursors to epoxy formulation,,s expanded by 2.1% in 2, by reflecting steady downstream demand. Additionally, the European Chemicals Agency has intensified scrutiny on substances of very great concern, which affects raw material availability and reformulation timelines. Concurrently, the European Union’s Circular Economy Action Plan has accelerated the integration of bio-based epoxies into niche applications, although fossil-derived variants remain dominant.

MARKET DRIVERS Expansion of Renewable Energy Infrastructure Fuels Epoxy Resin Consumption

Europe’s aggressive decarbonization agenda has unprecedented growth in renewable energy installations, directly amplifying demand for epoxy resins as essential matrix materials in composite components. The expansion of renewable energy infrastructure is fuelling the growth of Europe epoxy resins market. The European Commission’s Net Zero Industry Act further targets 45 gigawatts of annual wind manufacturing capacity by 2030, which is necessitating a parallel expansion in high-performance resin supply chains. Each multi-megawatt turbine blade typically consumes between 10 and 15 metric tons of epoxy resin, depending on length and design complexity. As per WindEurope, cumulative wind capacity in the European Union reached 236 gigawatts by the end of 2024, rreinforcing long-termresin demand.

Growing Adoption of Electric Vehicles Drives Demand for High-Performance Epoxy Systems

The rapid electrification of the automotive sector has created a robust new demand channel for specialized epoxy resins used in power electronics, battery encapsulation, and electric motor insulation. The growing adoption of electric vehicles in major countries is also boosting the growth of Europe epoxy resins market. Each electric vehicle typically integrates 3 to 5 kilograms of epoxy resins, primarily in inverters, on-board chargers, and battery management systems, where thermal stability, dielectric strength, and adhesion under thermal cycling are non-negotiable. The shift toward800-voltt architectures in premium models further intensifies material performance requirements, favoring advanced cycloaliphatic and flame-retardant epoxy grades. Additionally, automotive original equipment manufacturers are increasingly mandating low-volatile organic compound and halogen-free formulations by aligning with the EU’s End of Life Vehicles Directive.

MARKET RESTRAINTS Stringent Regulatory Policies on Hazardous Chemicals Limit Raw Material Access

The significant headwinds from increasingly rigorous chemical regulations that restrict access to key raw materials, notably epichlorohydrin and bisphenol A, both classified under evolving regulatory scrutiny is restricting the growth of Europe epoxy resins market. As per the European Chemicals Agency, bisphenol A was added to the Candidate List of Substances of Very High Concern, triggering mandatory communication obligations across supply chains and incentivizing substitution even in applications where alternatives remain technically immature. Epichlorohydrin faces parallel constraints under the Registration, Evaluation, Authorisation and Restriction of Chemicals framework, with authorization requirements projected to tighten further by 2026. These regulatory barriers not only escalate production expenses but also delay time to market for new formulations. Furthermore, the European Commission’s Chemicals Strategy for Sustainability aims to eliminate all hazardous substances from consumer products by 2030, a target that indirectly pressures industrial formulations through downstream customer requirements. Consequently, manufacturers must navigate a complex landscape of authorization timelines, substitution feasibility, and performance trade-offs, which collectively dampen market fluidity and innovation velocity.

Volatility in Petrochemical Feedstock Prices Undermines Cost Stability

The fluctuations in the pricing of petroleum-derived feedstocks, such as benzene, propylene, and chlorine, which constitute the foundational inputs for bisphenol A and epichlorohydrin synthesis is additionally hampering the growth of Europe epoxy resins market. This volatility directly propagates through the value chain, as benzene, a primary precursor to bisphenol A, saw spot prices in the Rotterdam ARA hub swing between 780 and 1,120 euros per metric ton during the same period, as documented by Platts European Petrochemical Assessments. Such instability complicates long term contracting strategies and erodes margin predictability for resin producers. The 2024 Red Sea shipping disruptions, for instance, extended raw material lead times by up to 21 days, according to the European Petrochemical Association, amplifying inventory carrying costs. These structural supply vulnerabilities constrain the ability of epoxy formulators to offeprice-competitiveve solutionsagainst Asian counterparts benefiting from integrated naphtha cracking complexes.

MARKET OPPORTUNITIES Advancement in Bio-Based Epoxy Technologies Opens New Application Frontiers

Innovations in renewable feedstocks are progressively enabling the commercial viability of bio-based epoxy resins in Europe, offering a pathway to align with circular economy mandates while capturing premium segments in consumer electronics and sustainable construction. The advancement in bio-based epoxy technologies opens new application frontiers, which is expected to boost the growth of Europe epoxy resins market. Derived from lignin, vegetable oils, and eugenol, these alternatives reduce carbon footprints by up to 45% compared to conventional petroleum-based counterparts, as confirmed by lifecycle assessments published by the Joint Research Centre of the European Commission in 2024. Companies, such as Sicomin and Entropy Resins, have already launched certified bio epoxy systems with bio content exceeding 37%, targeting marine and architectural applications where environmental certification influences procurement decisions. Furthermore, the European Committee for Standardization introduced EN 17945 in early 2025 with a test method for quantifying renewable carbon content, which accelerates specification adoption across public infrastructure tenders. While current market penetration remains below 5%, the performance parity achieved in flexural strength and glass transition temperature for certain formulations signals imminent scalability. This technological maturation coincides with rising corporate demand for science-based environmental targets, thereby positioning bioepoxiesas a strategic growth vector beyond compliance-driven substitution.

Resurgence in Aerospace and Defense Composite Demand Enhances Specialty Resin Prospects

The aerospace and defense sectors are undergoing a material renaissance driven by fleet modernization, lightweighting mandates, and supply chain reshoring, all of which elevate demand for high Tg and flame-retardant epoxy formulations. As per the European Defence Agency, combined defense expenditure among EU member states reached 253 billion euros in 2024, with 18% allocated to next-generation air platforms requiring advanced composites. Simultaneously, Airbus reported a 31% year on year increase in commercial aircraft deliveries in 2024, with each A350 utilizing over 6 metric tons of epoxy-based prepregs in primary structures. These applications demand resins compliant with stringent aerospace standards such as AMS and EN 2593, which govern outgassing, fire resistance, and long-term durability. The European Space Agency’s Clean Space Initiative further promotes the use of low-outgassing epoxies in satellite components, with over 22 European satellite missions launched in 2024 alone. This confluence of defense modernization, commercial aviation recovery, and space industrialization creates a high-value niche for European epoxy specialists capable of meeting exacting certification and performance benchmarks.

MARKET CHALLENGES Escalating Competition from Alternative Thermoset and Thermoplastic Matrices Intensifies Market Pressure

Epoxy resins in Europe confront mounting competitive displacement from alternative polymer systems, notably unsaturated polyesters, vinyl esters, and emerging thermoplastic composites that offer cost or processing advantages in specific applications. This factor is likely to be a challenge for the growth of Europe epoxy resins market. Simultaneously, thermoplastic matrices, such as polyetheretherketone and polyamide, are gaining traction in automotive under-the-hood components where recyclability and faster cycle times outweigh the performance benefits of thermosets. Additionally, in wind energy, polyurethane resin systems have demonstrated shorter curing times and reduced viscosity, enabling larger blade production with lower energy input, a factor leveraged by Siemens Gamesa in its newest offshore turbine models. These material shifts are reinforced by original equipment manufacturers’ design for disassembly mandates under the EU Ecodesign for Sustainable Products Regulation, which inherently favors thermoplastics. Consequently, epoxy resin suppliers must continuously justify premium pricing through demonstrable performance differentials or risk erosion in traditional strongholds, where regulatory or circular economy criteria override pure technical specifications.

Technical Barriers in Recycling Thermoset Epoxy Waste Limit Circular Economy Integration

The inherent chemical cross-linking of thermoset epoxy resins presents formidable technical obstacles to mechanical or chemical recycling, thereby constraining end of life management and triggering regulatory and reputational risks. The technical barriers are solely to limit the growth of Europe epoxy resins market. Unlike thermoplastics, which can be remelted and reprocessed, epoxy composites decompose rather than flow when reheated, rendering conventional recycling methods ineffective. Emerging techniques, such as solvolysis and pyrolysis, remain largely confined to pilot scale, with recovery yields and significant energy penalties, as documented by the Joint Research Centre’s 2024 assessment of composite recycling pathways. The wind energy sector alone is projected to generate 52,000 metric tons of blade waste annually by 2030, per WindEurope estimates, yet industrial-scale recycling infrastructure does not exist today. The EU’s upcoming End of Life Products Regulation, slated for 2026, will likely impose extended producer responsibility obligations, compelling resin suppliers to internalize waste handling costs. Meanwhile, the lack of standardized labeling for resin types in composite laminates complicates automated sorting at recovery facilities.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

5.83%

Segments Covered

By Raw Material, Application, and Country Analysis

Various Analyses Covered

Global, Regional, and Country-Level Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe

Market Leaders Profiled

3M, Aditya Birla Chemicals, Arkema, BASF, Bitrez Ltd, Covestro AG, DIC Corporation, DuPont, Huntsman International LLC, Leuna-Harze GmbH, Olin Corporation, POLYNT-REICHHOLD GROUP, Sika AG, Sir Industriale, Solvay, Spolchemie, Westlake Corporation

SEGMENTAL ANALYSIS By Raw Material Insights

Among raw material types, Diglycidyl Ether of Bisphenol A (DGBEA) segment was accounted in holding 58.2% of the European epoxy resins market share in 2024, with its balanced rereactivityy excellent adhesion, ion, and versatility across coatings, composites, and electronics. Its molecular structure enables easy modification for tailored performance, which aligns with the diverse technical requirements of European manufacturing. According to the European Resin Producers Association, over 800000 metric tons of DGBEA-based resins were consumed across the EU in 2024, primarily in protective industrial coatings and printed circuit laminates. Unlike niche resins, such as glycidylamine or novolac, which serve specialized high-temperature applications, ns DGBEA offers cost-effective performance for mainstream industrial use. Additionally, European regulatory frameworks have granted DGBEA extended authorization under REACH for critical applications, such as aerospace and energy infrastructure, providing stability despite environmental scrutiny on bisphenol A.

The aliphatic epoxy segment is projected to expand at a CAGR of 7.2% from 2025 to 20,33 with rising demand fUV-stable non-yellowinging resins in outdoor architectural coatings and photovoltaic encapsulants. Unlike aromatic systems, aliphatic epoxies exhibit superior resistance to solar ddegradationn making them ideal for solar panel edge seals and clear topcoats on infrastructure. According to the European Solar Industries Association, over 42 gigawatts of photovoltaic capacity were installed in Europe in 2,024 with each gigawatt requiring an estimated 25 to 30 metric tons of aliphatic epoxy for module encapsulation and junction box potting. Leading producers, such as Hexion and Allnex, have expanded aliphatic resin production in Germany and the Netherlands to meet this demand.

By Application Insights

The Paints and coatings segment was the largest by holding 41.2% of the Europe epoxy resins market share in 20,24 with the sector’s reliance on epoxy systems for high durability, corrosion resistance, and chemical inertness essential attributes for industrial infinfrastructure marine assets,ets and chemical processing facilities. The segment is further propelled by stringent EU directives, such as the Industrial Emissions Directive, which mandates asset longevity and reduced maintenance frequency, thereby favoring high-performance epoxy linings over conventional alternatives. Additionally, the renovation wave under the European Green Deal, which targets energy efficiency upgrades in 35 million buildings by 2030, has elevated demand for epoxy floor and wall systems in public infrastructure projects. These structural and regulatory tailwinds ensure paints and coatings remain the cornerstone application for epoxy resins in Europe.

The wind turbines segment is likely to witness the fastest CAGR of 9.8% from 2025 to 2033, which is directly tied to Europe’s accelerated deployment of onshore and offshore wind capacity as part of its net-zero roadmap. Each modern offshore turbine with a capacity exceeding 10 megawatts utilizes between 12 and 18 metric tons of epoxy resin in its blades, which must withstand decades of salt spray and extreme loads. The European Commission’s Net Zero Industry Act further mandates domestic production of 45 gigawatts of wind turbine components annually by 2030, compelling manufacturers like Vestas and Siemens Gamesa to localize composite supply chains. This localization trend has spurred investment in epoxy resin blending facilities near blade production sites in Hull, UK, a nd Cuxhaven, Germany. Additionally, innovations in rapid cure and low viscosity epoxy systems have enabled longer blade designs exceeding 115 meters, which are essential for next-generation turbines. T

COUNTRY ANALYSIS Germany Epoxy Resins Market Analysis

Germany was the top performer of the European epoxy resins market share by holding 22.3% othe market f share in 2024. Positioned as the continent’s industrial powerhouse, Germany’s demand is anchored in its advanced automotive electronics and machinery sector,s which relies heavily on high-purity epoxy formulations for encapsulation, adhesion,n and insulation. The country hosts major production sites for global players, such as Hexion, Huntsman, and Olin, enabling just-in-time supply to automotive clusters in Bavaria and Baden-Württemberg. Germany’s Energiewende policy has also driven significant investment in wind turbine blade manufacturing along the North Sea coast, further amplifying composite demand. Additionally, the country’s strict adherence to REACH and Blue Angel certification standards has acceleratedthe adoption of low-emission and halogen-free epoxy systems. These technical, regulatory, a nd industrial synergies solidify Germany’s leadership in both volume and formulation sophistication within the European epoxy landscape.

France Epoxy Resins Market Analysis

‘sFrance’s epoxy resins market was ranked second by holding 14.3% of share in 2024, with its robust aerospace defense and nuclear energy sectors, which require high-performance volatiles and glycidylamine-based epoxies for extreme environments. Additionally, France’s extensive nuclear fleet, comprising 56 reactors, relies on epoxy-based grouts and coatings for radiation shielding and containment integrity, as confirmed by the French Nuclear Safety Authority. The state-led France 2030 investment plan has allocated 1.2 billion euros to advanced materials innovation, further supporting domestic R&D flame-retardant and bio-based epoxy systems. Public infrastructure renewal under the France Relance program has also boosted demand for protective epoxy coatings in bridges, ttunnelsls and rail networks.

United Kingdom Epoxy Resins Market Analysis

The United Kingdom epoxy resins market growth is likely to grow with its leadership in offshore wind and specialty chemicals. The UK is Europe’s largest offshore wind market with over 14.7 gigawatts of installed capacity,,ity as reported by Renewables UK, and hosts major blade manufacturing facilities in Hull and the Isle of Wight that consume significant volumes of structural epoxy resins. Concurrently, the UK remains a hub for specialty epoxy formulators, such as Scott Bader and Iggesund, which serve the marine, automotive, and electronics sectors with tailored solutions. The Offshore Wind Industry Council’s target of 60 gigawatts by 2030 implies a tripling of current blade production, necessitating proportional growth in resin consumption.

Italy Epoxy Resins Market Analysis

Italy’s epoxy resins market growth is likely to grow with its strong presence in design-oriented construction, automotive refinish, and marine coatings sectors that prioritize aesthetic durability and color retention. The renovation of historic infrastructure under Italy’s National Recovery and Resilience Plan has further amplified demand for breathable yet protective epoxy systems suitable for heritage sites. Additionally, Italy’s marine industry,ry centered in Genoa and La Spezia, utilizes epoxy-based antifouling and hull coatings compliant with EU biocidal product regulations. The country is also home to major composite producers serving luxury automotive and yachting brands such as Ferrari and Benetti, which demand high gloss and impact-resistant epoxy finishes. Although Italy imports most of ithebase resin, it excels in value-added formulation and application expertise, making it a key market for premium epoxy solutions focused on performance and visual quality.

Netherland Epoxy Resins Market Analysis

The Netherlands epoxy resins market growth is likely to grow with its role as a logistics, energy,y and chemical innovation hub. According to Statistics Netherlands, the chemical sector contributed 12.3 billion euros to national GDP in 202, with epoxy derivatives playing a key role in semiconductor encapsulants and composite intermediates. The Netherlands is also at the forefront of offshore wind deployment, with projects like Hollandse Kust Zuid adding 3.3 gigawatts in 2024, alone requiring extensive use of epoxy composites. Companies, such as Aliancys and Royal DSM, operate R&D centers in the country focused on recyclable and bio-based epoxy systems aligned with the Dutch National Circular Economy Program. Moreover, the country’s stringent building codes following the Groningen earthquakes have increased demand for epoxy-based structural strengthening systems in public infrastructure.

COMPETITIVE LANDSCAPE ANALYSIS

The Europe epoxy resins market features intense competition characterized by technological differentiation, regulatory agility, and supply chain resilience among global and regional players. Leading companies such as Hexion, Huntsman, and Olin compete not on price alone but on formulation precision, compliance with REACH, and the ability to support complex applications in wind energy, electronics, and aerospace. The market is further shaped by niche European formulators who specialize in high-purity or customized systems for automotive and construction sectors, creating a dual-tier competitive structure. Competitive intensity is amplified by the accelerating shift toward sustainable chemistries, which ddemandcontinuous innovation in bio-based and recyclable epoxies. At the same time, raw material access, regulatory uncertainty, and recycling limitations impose common industry-wide challenges that drive collaboration alongside rivalry.

KEY MARKET PLAYERS

A few of the market players in the Europe epoxy resins market are

3M Aditya Birla Chemicals Hexion Inc Arkema BASF Bitrez Ltd Covestro AG DIC Corporation DuPont Huntsman International LLC Leuna-Harze GmbH Olin Corporation POLYNT-REICHHOLD GROUP Sika AG Sir Industriale Solvay Spolchemie Westlake Corporation Top Players In The Market Hexion Inc maintains a significant presence in the European epoxy resins market through its advanced formulation capabilities and extensive product portfolio tailored for aerospace, automotive, and wind energy applications. The company operates multiple production and R&D facilities across Germany and the Netherlands, enabling rapid response to regional regulatory and technical demands. Hexion intensified its focus on sustainable solutions by launching a new line of low-volatility cycloaliphatic epoxy resins designed for photovoltaic encapsulation and electric vehicle power modules. It also partnered with European wind turbine manufacturers to co-develop rapid-cure systems that reduce blade production cycle times. These initiatives reinforce its commitment to innovation and alignment with Europe’s decarbonization and circular economy goals. Huntsman Corporation plays a pivotal role in Europe’s epoxy resins landscape by supplying high-performance formulations for electronics, composites, and infrastructure protection. The company leverages its European technical service centers in Belgium and Switzerland to support customers with application-specific resin design and regulatory compliance. In recent years, Huntsman has prioritized sustainability by introducing bio-based epoxy hardeners derived from castor oil and expanding its epon renewable product line. It completed a capacity upgrade at its Basel facility to meet growing demand for halogen-free laminates in printed circuit boards. Huntsman’s strategy emphasizes performance consistency, regulatory foresight, and close collaboration with European original equipment manufacturers to drive material adoption in high-value sectors. Olin Corporation contributes to the European epoxy resins market through its vertically integrated supply chain and strong focus on specialty applications in electrical insulation and protective coatings. The company produces epichlorohydrin and liquid epoxy resins at its facility in Ijzendoorn, Netherlands, ensuring reliable raw material access for downstream formulators. Olin enhanced its European footprint by certifying several new formulations under the EU Ecolabel scheme and expanding its portfolio of low chloride resins for semiconductor encapsulation. It also collaborated with European rail operators to develop fire-retardant epoxy systems compliant with EN 45545 standards. These actions underscore Olin’s strategic intent to align its product development with Europe’s safety, environmental, and industrial modernization priorities. Top Strategies Used by the Key Market Participants

Key players in the Europe epoxy resins market primarily adopt strategies centered on product innovation, regulatory compliance, and regional capacity expansion. Companies invest heavily in research and development to create bio-based, halogen-free, and rapid-cure formulations that meet evolving environmental standards and application needs. Strategic partnerships with wind energy and electric vehicle manufacturers enable co-development of tailored resin systems that enhance performance while reducing processing time. Vertical integration is another critical approach, with major producers securing control over epichlorohydrin and bisphenol A supply to mitigate feedstock volatility.

MARKET SEGMENTATION

This research report on the Europe epoxy resins market is segmented and sub-segmented into the following categories.

By Raw Material Insights

DGBEA (Bisphenol A and ECH) DGBEF (Bisphenol F and ECH) Novolac (Formaldehyde and Phenols) Aliphatic (Aliphatic Alcohols) Glycidylamine (Aromatic Amines and ECH) Other Raw Materials

By Application Insights

Paints and Coatings Adhesives and Sealants Composites Electrical and Electronics Wind Turbines Other Applications

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe