(Bloomberg) — President Donald Trump’s push to unlock Venezuelan crude is strengthening the political case for a proposed pipeline that would allow Canada to ship more oil to China and other Asian markets.

Refineries in the American Midwest are configured to process Canada’s heavy crude. But prices for the commodity slumped Monday as traders worried that the removal of Venezuelan President Nicolas Maduro will clear the way for US access to abundant resources from the South American country, which produces a similar type of oil.

“Once Venezuelan oil is not just unblocked but unsanctioned, it will begin competing more directly with Canadian barrels on the US Gulf Coast,” said Rory Johnston, a researcher at Commodity Context. Venezuelan oil could get to the region “much more cheaply than can barrels shipped by pipeline all the way from Alberta,” he added.

Canada’s oil sands are far north of the US border, thousands of miles from the oil-refining regions of the American south. Danielle Smith, the premier of Alberta, has spearheaded the push for a new pipeline capable of carrying 1 million barrels a day west, to the British Columbia coast, where it could be loaded onto tankers for sale in growing Asian nations.

The forced change of leadership in Venezuela highlights the urgency of such a project, Smith said.

“Recent events surrounding Venezuelan dictator Nicolas Maduro emphasize the importance that we expedite the development of pipelines to diversify our oil export markets, including a new Indigenous co-owned bitumen pipeline to BC’s northwest coast to reach Asian markets,” she posted on social media.

Prime Minister Mark Carney has set a target of doubling Canada’s total exports to non-US markets by 2035, saying the country can never again allow itself to become so economically dependent on the US. Carney has removed some regulatory obstacles to new coastal pipelines — though it would take many years to build one.

Carney told reporters in Paris on Tuesday a functioning Venezuelan economy will produce more oil and that will be better for the country’s people and more stable for the Western hemisphere. But he said Canadian oil will be competitive because it’s low-risk and low cost, and his government is working toward making it cleaner by supporting carbon capture.

“We welcome the prospect of greater prosperity in Venezuela, but we also see the competitiveness of Canadian oil,” he said. “In that context, a pipeline and exports to Asia — we’ve got competitive product and we’d be diversifying our markets.”

The optics of the US courting other energy suppliers may help soften domestic opposition to the idea.

“The events in Venezuela reinforce the need for export diversification, and a pipeline to the west coast would be the best solution,” said Charles St-Arnaud, chief economist at Servus Credit Union.

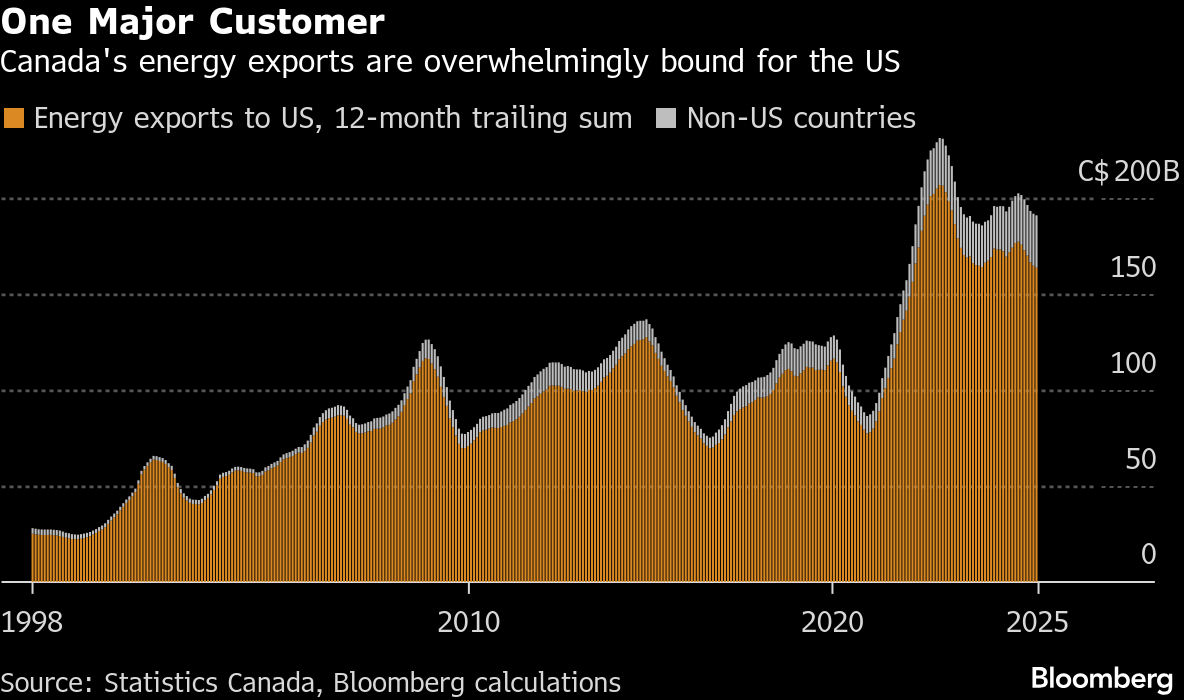

Canada has only one oil pipeline capable of shipping to non-US customers: the Trans Mountain pipeline, which runs to the Vancouver region and has a capacity of about 900,000 barrels a day. That represents a fraction of the more than 4 million barrels that are sent south to the US on an average day, according to US Energy Information Administration data.

Around 70% of that US-bound crude went to the US Midwest last year, meeting the demands of refineries in Indiana, Ohio and other states. But the addition of pipeline capacity to the Gulf Coast has helped Canadian producers replace declining volumes from Venezuela there, too.

Carney has argued that Canada’s economic future depends, in part, on leveraging its natural resources to become an energy superpower. In November, his government signed a memorandum of understanding with Alberta — home to some of the world’s largest oil reserves — that opened the door to Smith’s pipeline idea. That policy has faced backlash and resistance from the government of British Columbia and environmentalists. Steven Guilbeault, a cabinet minister from Quebec, resigned over it.

Conservatives in Canada, meanwhile, argue Carney’s Liberal government hasn’t moved with enough urgency to add more pipeline capacity. Opposition Conservative Leader Pierre Poilievre published an open letter Tuesday calling on Carney to repeal environmental laws that restrain the oil industry.

Canada to China

China, in particular, may emerge as a bigger buyer of Canadian crude if oil production from Venezuela is rerouted. In recent years, most Venezuelan crude exports have flowed to China due to sanctions.

“The Venezuelan heavy crudes are similar quality, so to speak, with heavy crudes from the oil-sands area,” said Alex Cardenas, a Venezuelan immigrant to Canada who has worked in the oil industry in both countries. So rising Venezuelan production would “be a challenge eventually — five, 10 years down the road.”

Cardenas worked for Petroleos de Venezuela SA, the country’s state oil company, before moving to Canada where, most recently, he served as director of downstream strategy for Husky Energy. Years of corruption, mismanagement and US sanctions have caused Venezuela’s oil output to plunge to about 1 million barrels a day, and Cardenas and others have estimated it might take more than five years to double production.

Photographer: Bloomberg

Photographer: Bloomberg

The expansion of Trans Mountain, completed when Justin Trudeau was prime minister, has already helped with export diversification and narrowed the price difference between Canada’s heavy oil and the more easily refined sweet light oil.

Adding more pipeline capacity would help prevent a widening of the spread, even during seasonal fluctuations, St-Arnaud said, ensuring Canada consistently gets a better price.

About 64% of the oil shipped through Trans Mountain last year was destined for China, according to data from Vortexa.

“This is likely to be an accelerant for Canada to diversify away from the US when it comes to sourcing energy demand,” said Bipan Rai of BMO Global Asset Management.

“Canada relies heavily on the US as an export market for crude. That leaves it even more vulnerable to shocks that increase supply over the medium-to-long term — especially if it’s heavy grade like the kind found in the Orinoco Belt,” he said.

(Adds comments from Carney, Poilievre starting in the eighth paragraph.)

©2026 Bloomberg L.P.