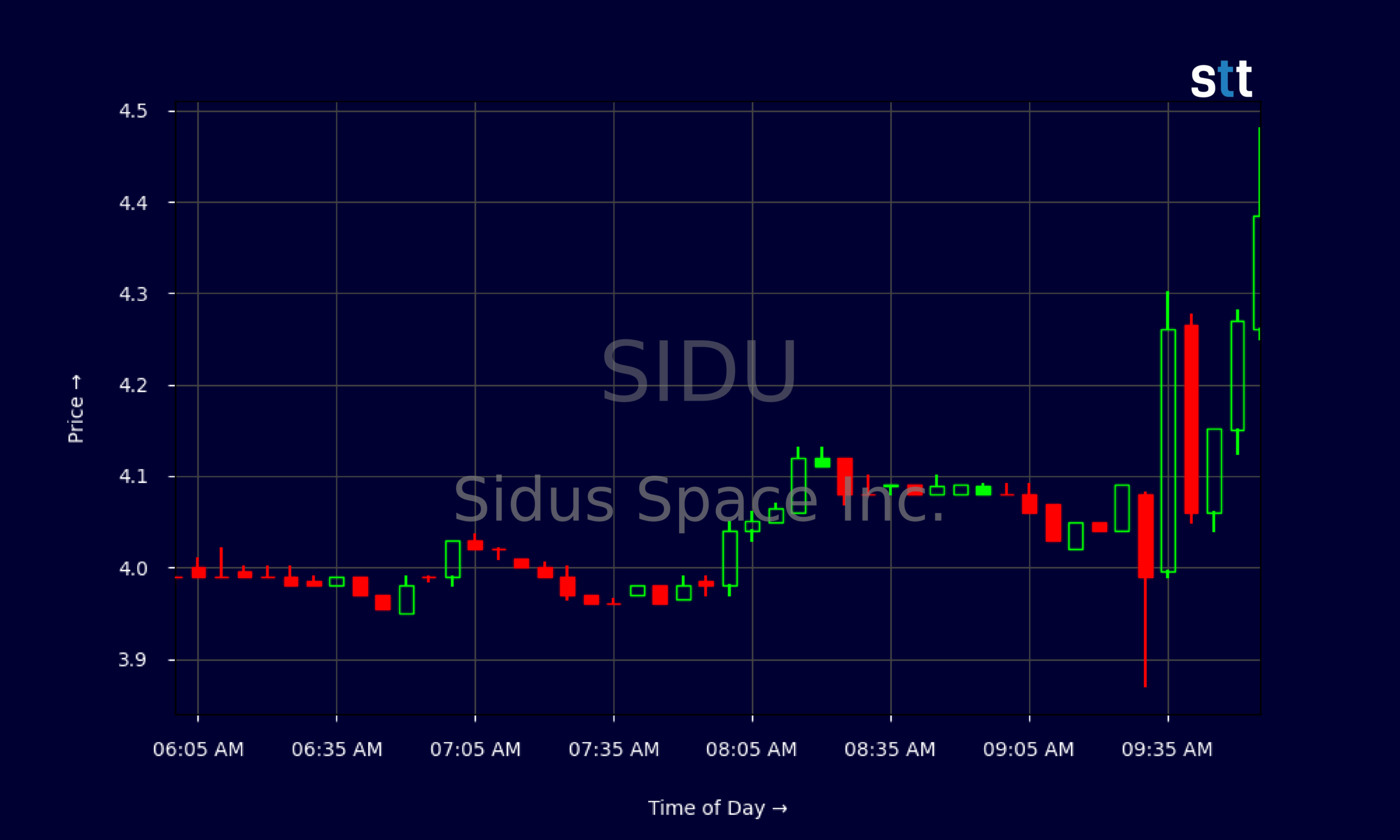

Sidus Space Inc. stocks have been trading up by 9.34 percent, driven by positive sentiments from strategic partnerships.

Following Sidus Space’s announcement of a successful $35 million public offering, the stock experienced a 33% surge. These funds are set for operational and development strategies.

Sidus Space appointed Kelle Wendling, a seasoned aerospace executive, to its Board, which could bolster the company’s strategic capabilities.

Completing an offering of 19.2M shares at $1.30 per piece, Sidus Space raised around $25 million for various growth initiatives, further driving pre-market price increases.

A strategic best-efforts offering netted Sidus $16.2 million, earmarked for diverse operational and developmental plans.

Live Update At 10:01:55 EST: On Tuesday, January 06, 2026 Sidus Space Inc. stock [NASDAQ: SIDU] is trending up by 9.34%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Sidus Space’s Earnings and Financial Snapshot

“Preparation is half the trade. By the time the bell rings, my decisions are nearly made.” As Tim Bohen, lead trainer with StocksToTrade says. In the world of trading, where every moment counts and the stakes are high, relying solely on instinct is risky. By doing so, traders position themselves better to recognize opportunities and mitigate potential risks when the markets open. They deliberate over their strategies and make use of data and trends, ensuring their approaches are not left to chance. Bohen’s insight serves as a reminder that meticulous groundwork is critical in achieving consistent results in trading.

Sidus Space Inc.’s latest financial reports portray an innovative yet challenging landscape. Though recent news indicates an inflow of capital from public offerings, the company’s financial sheets reveal a contrasting tale. The company closed Q3 2025 with a negative cash flow, despite raising significant capital. Operating cash flow stood at -$6.22M, while capital expenditure remained hefty at approximately $1.44M. Such figures mean Sidus Space needs strategic fiscal measures to stabilize its trajectory.

Key ratios signal potential areas of concern. A negative profit margin at -655.39%, alongside an EBIT margin of -676.3%, paints a severe profitability challenge. The revenue pipeline showed a modest $4.67M, emphasizing the need for effective revenue-boosting strategies. From debt dynamics, a low total debt-to-equity ratio of 0.01 reflects prudent capital management, albeit needing efficient asset utilization, given its asset turnover at merely 0.1.

Nevertheless, Sidus’ market activities help mitigate financial strain. The recent $35 million offering significantly uplifted liquidity, enabling investment in essential growth ventures. Furthermore, management’s emphasis on defense and aerospace prospects, coupled with Wendling’s expertise, could catalyze a strategic realignment, potentially optimizing profitability margins through targeted expansion and market capture.

Insights on Recent Market Movements

Strategic Capital Boost

Sidus’s strategic capital initiatives signify a pivotal shift. The $25 million and $16.2 million fundings bear testimony to aggressive financial strategies, vital for addressing present cash flow pressures. These financial endeavors are likened to a lifeline, facilitating SIDU’s mission towards aerospace technological advancement. The substantial capital inflow is key to Sidus’ plans for expanding its manufacturing footprint and advancing product development.

Board Reinforcement

Welcoming Kelle Wendling, with her vast aerospace repertoire, to the fold, Sidus Space is evidently positioning itself for strategic leaps in the domain of space systems, ISR, and FAA markets. Wendling’s tenure at L3Harris Technologies underpins her competencies in fostering growth and cultivating industry relationships, critical to Sidus’ innovative thrust.

Growth Versus Sustainability

The balance between Sidus’ energetic capital maneuvers and its pressing financial constraints sparks an ongoing debate. The stock’s recent escalation by 33% showcases market optimism. Yet, long-term viability hinges on the company’s efficiency in translating strategic funds into profitable ventures, thereby transitioning from present capital dependency towards sustainable operational profits. A delicate dance Sidus executes between nurturing innovation and consolidating financial health.

Conclusion: Navigating Forward

In sum, Sidus Space is journeying through a phase characterized by bold financial strategies paired with market trust-driven stock price ascension. However, true triumph lies within the company’s agility in leveraging newfound funds to sculpt a fiscally robust business framework. With strategic board appointments and a bolstered treasury, Sidus equips itself to navigate the space industry’s vast oceanic opportunities. As traders eye the evolving trajectory, they are reminded that, as Tim Bohen, lead trainer with StocksToTrade says, “If you’re still guessing at the end of your analysis, it’s probably not a trade worth taking.” The fabric of future gains rests intricately on how gracefully Sidus balances its growth ambitions against maintaining fiscal integrity.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.