Summary:

Japan services PMI slowed to 51.6, weakest since May

New order growth softened despite renewed export demand

Employment rose at fastest pace since mid-2023

Input costs and selling prices accelerated sharply

Business confidence remains historically strong

Japan’s service sector continued to expand in December, but at its slowest pace in seven months, signalling a loss of momentum as 2025 drew to a close, according to the latest survey data from S&P Global.

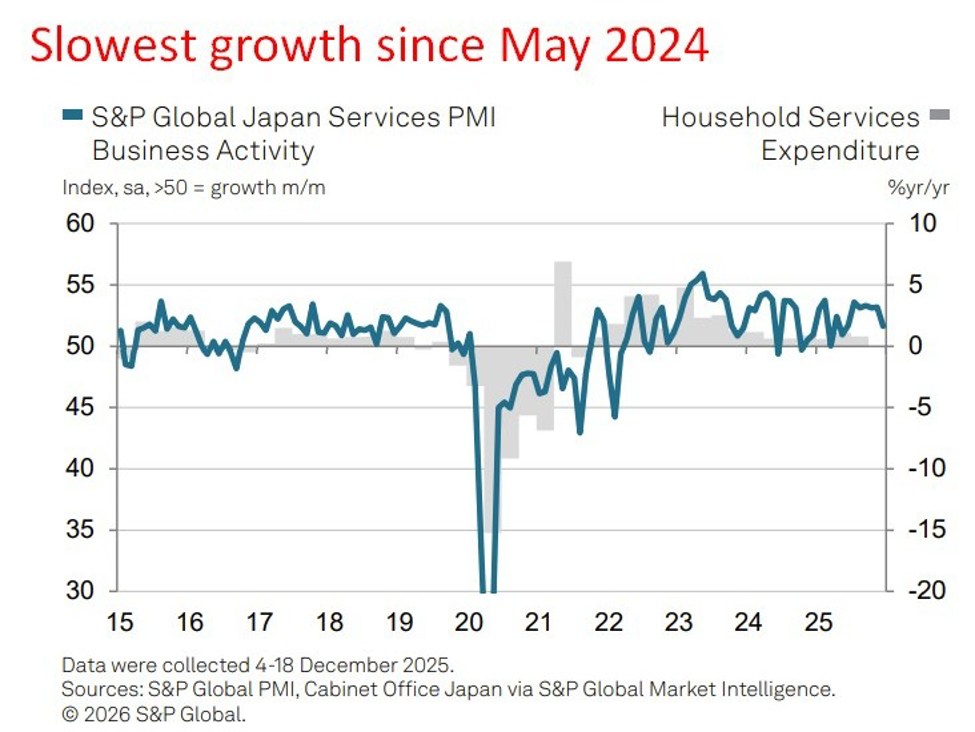

The Services PMI Business Activity Index slipped to 51.6 in December from 53.2 in November, marking the softest pace of expansion since May. While activity remained in growth territory for a ninth consecutive month, the moderation points to cooling demand conditions across large parts of the sector. Finance and insurance firms remained the standout performers, recording the strongest rise in activity among the major service industries surveyed.

New business volumes also increased at a slower and only modest rate, reflecting mixed demand conditions. Some firms cited improved customer flows and new project wins, while others reported subdued client activity. Notably, total new order growth slowed despite a return to growth in export services demand, the first such increase since June, highlighting tentative improvement in foreign demand.

Employment trends remained a clear bright spot. Service-sector hiring accelerated sharply, with staff numbers rising at the fastest pace since May 2023. Firms pointed to higher sales volumes and efforts to fill long-standing vacancies, while a renewed rise in outstanding business suggested growing capacity pressures that supported additional hiring.

Cost dynamics, however, remained challenging. Input cost inflation accelerated to its highest level since May, driven by rising prices for labour, raw materials, fuel, equipment and construction inputs. These pressures were passed through to customers, with output charges rising at a historically strong pace, reinforcing concerns that services-led inflation remains sticky.

The broader private-sector picture also softened. The Composite PMI Output Index eased to 51.1 from 52.0, the slowest expansion since May, as services growth moderated while manufacturing output broadly stabilised after a prolonged downturn. Composite new orders rose only slightly, though foreign demand for goods and services declined at the slowest pace in nine months.

Despite softer momentum, business confidence remained elevated. Firms expressed optimism that new product launches, store openings and improving demand conditions would support activity through 2026, even as they balance rising costs against increasingly price-sensitive customers.