사진 확대

사진 확대 The U.S. Federal Reserve (Fed), which lowered its key interest rate to 3.5~3.75% due to three consecutive cuts last year, is expected to expand its division over further cuts this year.

Fed Director Stephen Myron, a representative figure for President Donald Trump, told Fox Business on the 6th (local time), “The monetary policy is very tight and weighing on the economy. A rate cut of more than 1 percentage point this year is justified.” Director Myron has insisted on a big cut (a 0.5 percentage point cut in the base rate) in all three previous Federal Open Market Committee (FOMC).

“The U.S. economy is expected to continue to grow solidly this year, but this outlook will not be able to be maintained unless the Fed lowers its key interest rate,” Myron added.

Myron, who actually represents President Trump’s demand for a significant rate cut, will serve until the 31st. Currently serving as the chairman of the White House Economic Advisory Committee (CEA), he is likely to serve a second term as a Fed board member.

Earlier, the Fed announced only one cut this year through a dot plot at the FOMC in December last year. However, the market is predicting at least two cuts.

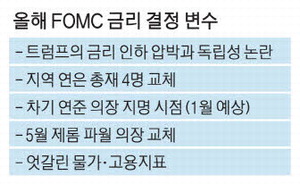

Above all, many changes are expected in the composition of FOMC this year, which is expected to affect interest rate decisions. The gap between the members is already so wide that the Fed’s rate cut was decided in December last year at the FOMC amid opposition from three members.

In particular, Fed Chairman Jerome Powell will be replaced in May due to the expiration of his term, and four local Federal Reserve Bank (Fed) governors will be changed from this year. Minneapolis Fed President Neal Kashkari recently cautioned CNBC that “interest rates are close to neutral given the current U.S. economy,” adding, “It depends on the data coming out soon to determine the Fed’s behavior.” Governor Kashkari, Philadelphia Fed President Anna Paulson, Dallas Fed President Rory Logan and Cleveland Fed President Beth Hammack will have new interest rate voting rights this year. Many of them are classified as ‘hawks’. Conflicts are expected to be inevitable with President Trump’s members, including Director Myron, Fed Director Christopher Waller, and Fed Director Michelle Borman.

According to the Chicago Mercantile Exchange (CME) FedWatch, the probability of a rate cut in January is only 17.2%, and the possibility of a freeze is 82.8%. Although the Consumer Price Index (CPI) was stable at 2.7% in December last year, some pointed out that the statistics are distorted, and December employment indicators are also expected to be a variable.

Another variable is that President Trump’s early nomination of a candidate for the next chairman could act as a pressure factor on the Fed. [New York correspondent Lim Sung Hyun]