As the European markets continue to climb, with the STOXX Europe 600 Index reaching new highs and major indices like Germany’s DAX and France’s CAC 40 showing significant gains, investors are eyeing opportunities in various sectors. Among these opportunities, penny stocks—despite their somewhat outdated name—remain a compelling area for those interested in smaller or newer companies. These stocks can offer surprising value when backed by strong financial health, presenting potential for long-term growth.

Top 10 Penny Stocks In Europe

Click here to see the full list of 287 stocks from our European Penny Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renovalo S.p.A. operates in the construction industry in Italy with a market cap of €16.91 million.

Operations: The company’s revenue comes from its General Contractors segment, totaling €32.81 million.

Market Cap: €16.91M

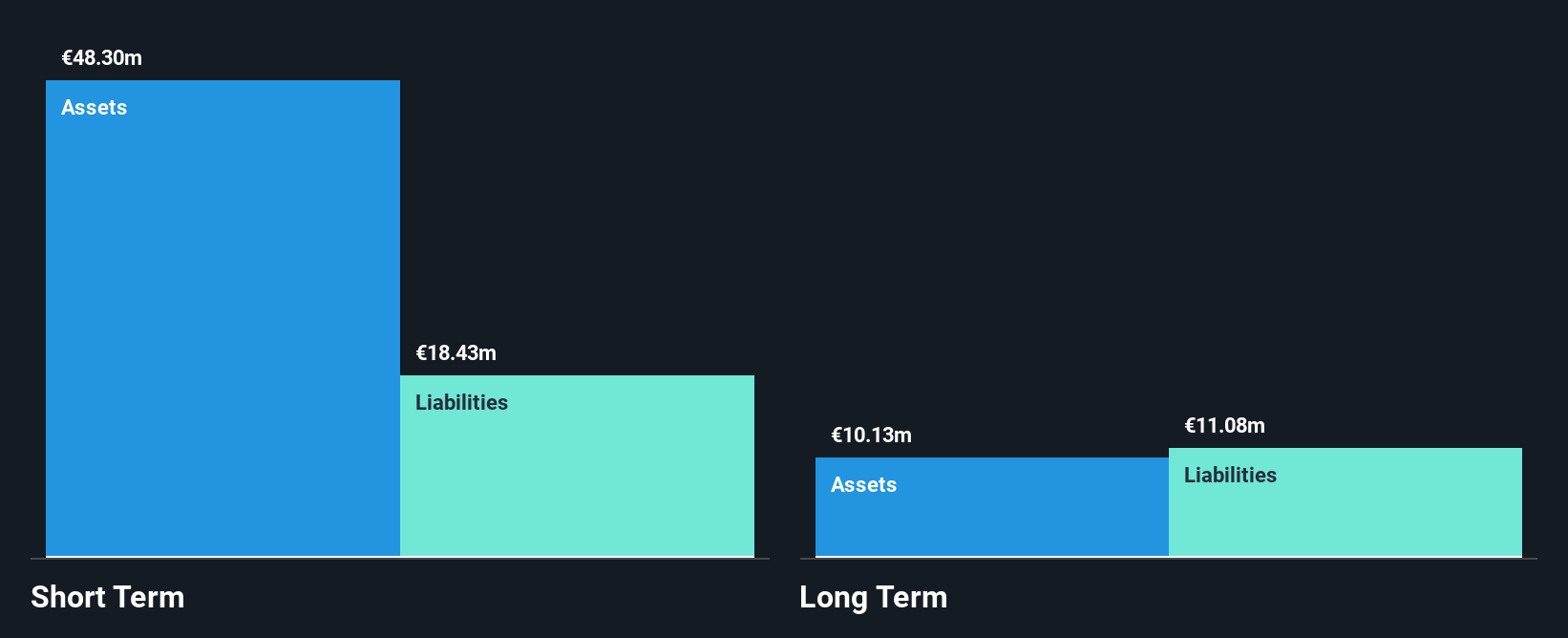

Renovalo S.p.A., with a market cap of €16.91 million, operates in Italy’s construction sector and has generated €32.81 million from its General Contractors segment. Despite being unprofitable with declining earnings over the past five years, Renovalo’s debt is well-covered by operating cash flow at 284.7%, and it holds more cash than total debt, indicating financial resilience. The company’s short-term assets exceed both its short- and long-term liabilities, suggesting solid liquidity management. However, the stock remains highly volatile compared to most Italian stocks, which may pose risks for investors seeking stability in penny stocks.

BIT:RNV Financial Position Analysis as at Jan 2026

BIT:RNV Financial Position Analysis as at Jan 2026

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AROBS Transilvania Software S.A. offers customized software services across Romania, Europe, the United States, Asia, and the Middle East with a market cap of RON688.17 million.

Operations: The company generates revenue through its Software Services (RON305.80 million), Software Products (RON94.51 million), and Integrated Systems (RON36.67 million) segments.

Market Cap: RON688.17M

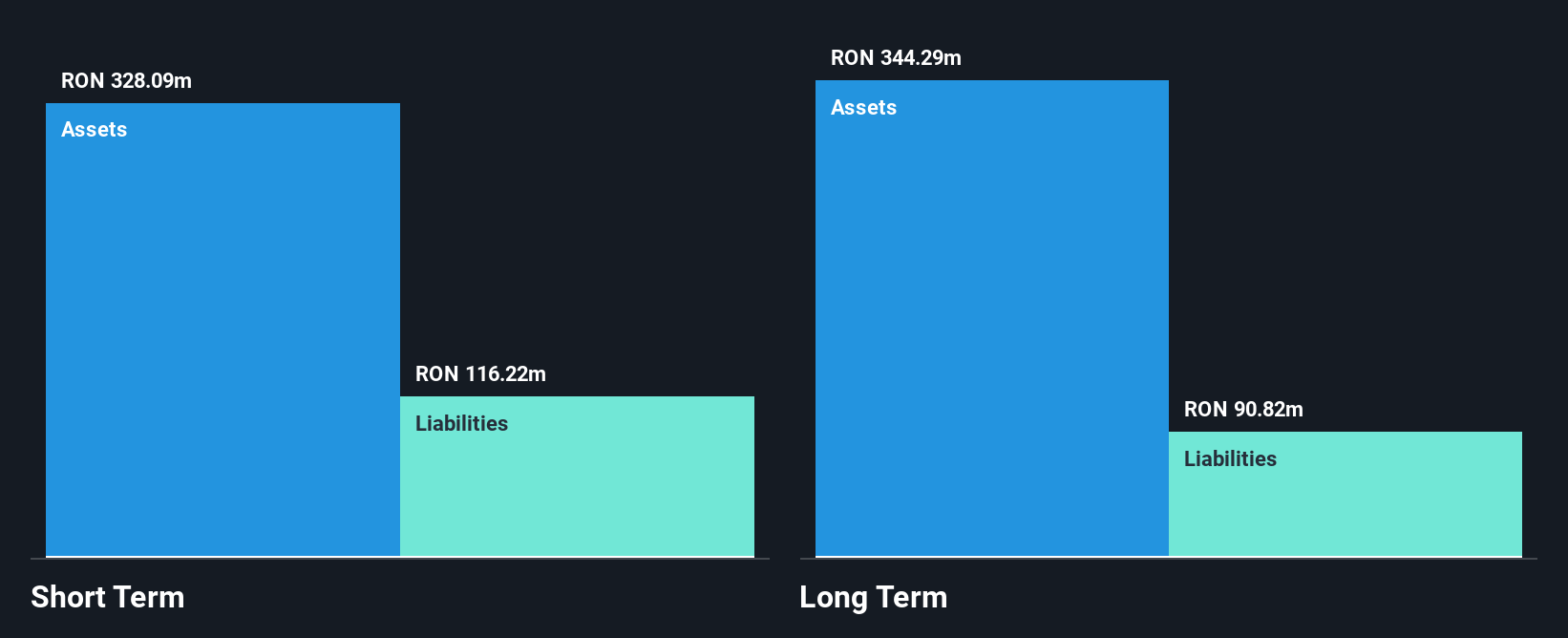

AROBS Transilvania Software S.A., with a market cap of RON688.17 million, has shown significant revenue growth, reporting RON328.48 million for the first nine months of 2025, up from RON306.16 million the previous year. The company demonstrates strong financial health with short-term assets exceeding liabilities and more cash than debt, ensuring liquidity and stability in its operations. Despite a low return on equity at 5.1%, AROBS’s earnings have grown by 21.5% over the past year, surpassing industry averages and indicating potential for further growth in its software services segment while maintaining high-quality earnings without shareholder dilution.

BVB:AROBS Financial Position Analysis as at Jan 2026

BVB:AROBS Financial Position Analysis as at Jan 2026

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planoptik AG manufactures and sells structured wafers in Germany with a market cap of €22.59 million.

Operations: The company’s revenue is primarily derived from its Glass & Clay Products segment, which generated €11.94 million.

Market Cap: €22.59M

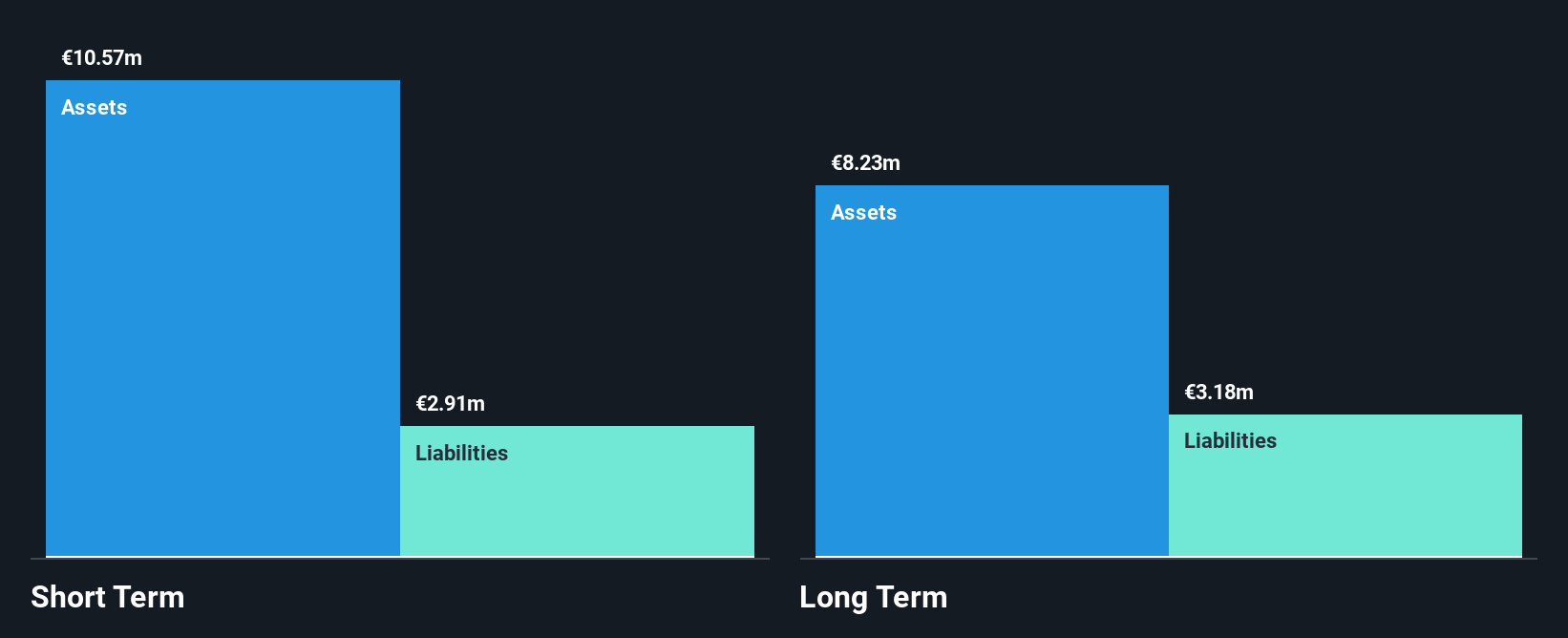

Planoptik AG, with a market cap of €22.59 million, primarily generates revenue from its Glass & Clay Products segment (€11.94 million). The company is debt-free and maintains a stable financial position with short-term assets (€10.6M) exceeding both short-term (€2.9M) and long-term liabilities (€3.2M). Despite high-quality earnings, recent challenges include declining profit margins (3.9% vs 10% last year) and negative earnings growth (-63.4%) over the past year, contrasting with significant growth over five years (25.5% annually). The board’s experience is notable with an average tenure of 10.6 years, though management tenure data is insufficient.

XTRA:P4O Financial Position Analysis as at Jan 2026Summing It All Up

XTRA:P4O Financial Position Analysis as at Jan 2026Summing It All Up

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com