Europe Nutritional Supplements Market Size

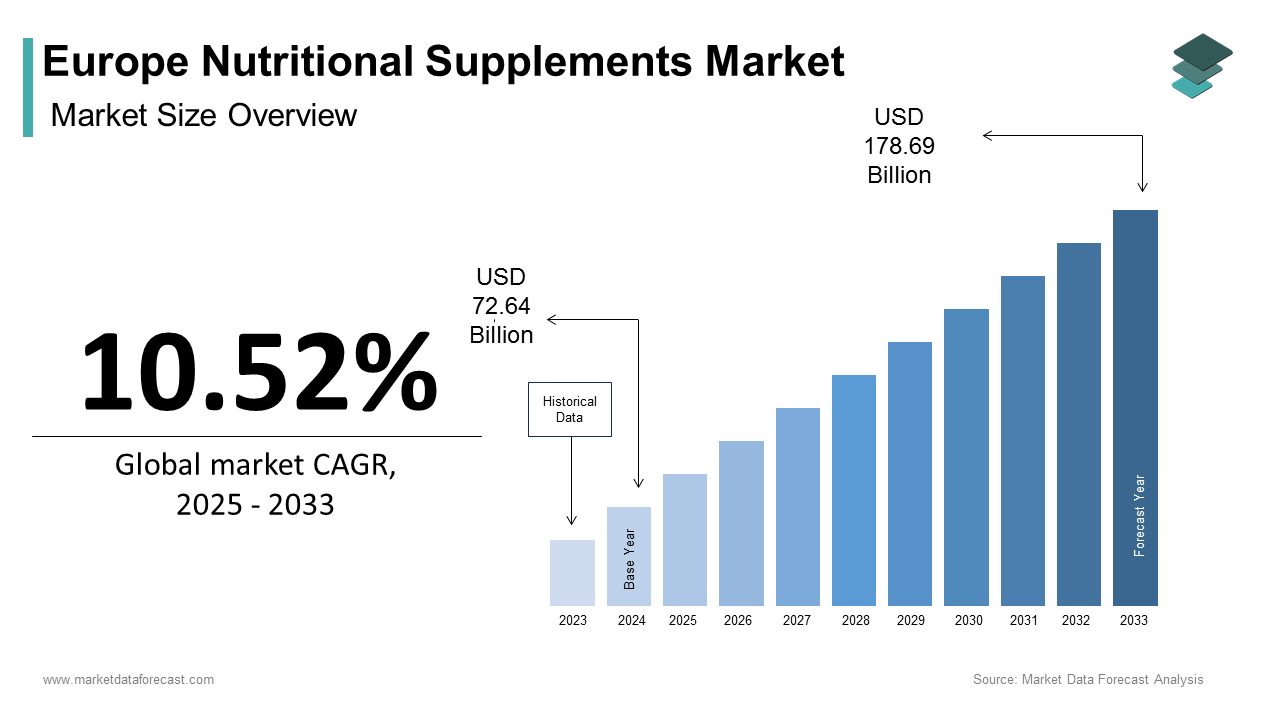

The Europe nutritional supplements market size was calculated to be USD 72.64 billion in 2024 and is anticipated to be worth USD 178.69 billion by 2033, growing from USD 80.28 billion in 2025 at a CAGR of 10.52% during the forecast period.

Nutritional supplements refer to the vitamins, minerals, herbal extracts, and specialized formulations designed to address dietary gaps, enhance wellness, and support targeted health outcomes. Unlike markets driven purely by trend, Europe’s supplement landscape is shaped by robust regulatory frameworks, aging demographics, and rising consumer engagement with preventive health. The EU’s harmonized rules under the Food Supplements Directive strictly govern ingredient safety, dosage limits, and labeling, fostering a high-trust environment but also limiting innovation speed. According to research, the European Union population is consistently aging, leading to an increasing number and share of older individuals across most member states and driving higher demand for related health support products. Simultaneously, A significant portion of the European population lives with chronic health conditions, which often necessitate physician-recommended dietary and lifestyle adjustments, including supplementation. This convergence of demographic pressure, regulatory precision, and health consciousness defines a mature yet dynamically evolving market where scientific credibility and compliance are as critical as product efficacy.

MARKET DRIVERS Aging Population Driving Demand for Targeted Health Support

The region’s rapidly aging society is a key accelerator of sustained demand in the nutritional supplements market. With life expectancy exceeding 81 years in many Western and Southern European countries, older adults increasingly seek products that support mobility, cognitive function, and immune resilience. According to Eurostat, the proportion of Europeans aged 65 and over reached 21.3 percent in 2023 and is projected to surpass 26 percent by 2040. This demographic shift towards an older population is projected to continue increasing the share of seniors in the coming decades. The use of dietary supplements generally increases with age, particularly among women. Health bodies in some countries, like Italy, highlight widespread vitamin D insufficiency and provide recommendations for supplementation among at-risk populations, including the elderly. Moreover, public healthcare systems in countries like the Netherlands and Sweden now include dietary counseling that often incorporates evidence-based supplementation for osteoporosis and sarcopenia prevention. This institutional and behavioral alignment transforms supplements from optional wellness items into integral components of healthy aging strategies across the continent.

Rising Prevalence of Micronutrient Deficiencies Amid Dietary Shifts

The region faces a silent epidemic of micronutrient inadequacies, driven by processed food reliance, plant-based diets, and reduced sun exposure, which is one of the major factors propelling the expansion of the Europe nutritional supplements market. This is despite food abundance. Micronutrient deficiencies are a public health concern in parts of Europe, with significant numbers of adults in Northern Europe experiencing insufficient vitamin D levels, and a substantial portion of women of childbearing age across the EU exhibiting insufficient folate levels. The growing shift toward plant-based eating, often accelerated by environmental concerns, raises risks of deficiencies in key nutrients like vitamin B12, iron, and zinc, which are predominantly found in animal products. Studies indicate that many vegans face challenges in maintaining adequate B12 status without supplementation or fortified foods. Public health responses are emerging, with some countries implementing fortification programs. For example, Finland mandates vitamin D fortification in certain dairy products and spreads, a policy that has been associated with a notable reduction in deficiency rates over time. These nutritional gaps, validated by scientific and governmental sources, create consistent demand for scientifically formulated supplements that bridge the divide between modern diets and physiological needs.

MARKET RESTRAINTS Stringent and Fragmented Regulatory Frameworks Across Member States

Inconsistent national rules on food supplements create major hurdles for market entry and innovation, even with the EU Food Supplements Directive in place, which in turn hampers the growth of the Europe nutritional supplements market. Vitamins and minerals have harmonized regulations, but herbal and novel ingredients are subject to varied national rules. For example, Denmark has an outright ban on ashwagandha in food supplements. The Netherlands has proposed a ban and issued warnings, but it is not definitively banned yet, and authorities are in a consultation period. Germany has issued risk assessments recommending caution, but has not enacted a formal ban, with the botanical extract still available in the market. The lack of EU-wide harmonized rules for botanicals and other non-vitamin/mineral ingredients means that companies face significant challenges when expanding across Member States, often encountering different national regulations, which leads to delays or the need for reformulation. This fragmented regulatory framework is a major issue for the industry. The European Commission’s ongoing evaluation of the Food Supplements Directive acknowledges these gaps, highlighting that most commonly used botanicals lack an EU-wide harmonized status, leading to continued market complexity. This regulatory patchwork increases compliance costs, particularly for small and medium enterprises lacking legal resources. Consequently, innovation is stifled, and consumers in certain countries face limited access to globally established ingredients, undermining the single market principle and fragmenting product availability across Europe.

Skepticism Among Healthcare Professionals and Scientific Gatekeepers

Persistent skepticism from medical and scientific communities influences prescribing behavior and public perception, despite consumer enthusiasm, which inhibits the expansion of the Europe nutritional supplements market. In countries like France and Sweden, physicians are trained to prioritize pharmaceutical interventions over nutraceuticals unless strong clinical evidence exists. Recent data indicate that the availability of innovative treatments in Europe is declining, with a significant portion of newly approved medicines failing to secure full public reimbursement across the region. European regulatory standards for food supplements remain stringent, as oversight bodies continue to reject a vast majority of submitted health claims, particularly for probiotics and herbal enhancers, due to a lack of robust scientific substantiation. This stringent evidence threshold, while protecting consumers, limits marketing narratives and slows category expansion. As a result, even clinically promising ingredients struggle to gain mainstream medical endorsement, creating a credibility gap that brands must bridge through independent research and transparent communication.

MARKET OPPORTUNITIES Expansion of Personalized and Genomics-Based Supplementation

The convergence of digital health and nutrigenomics is providing a major growth area in the Europe nutritional supplements market. Advances in affordable DNA testing and AI-driven health analytics now enable tailored formulations based on genetic predispositions, metabolic profiles, and lifestyle data. Demand for direct-to-consumer genetic testing services in Europe has experienced substantial growth, with a significant number of users indicating an interest in using the results for nutritional recommendations. Startups have partnered with pharmacies and wellness clinics to offer supplement plans adjusted for MTHFR gene variants, vitamin D receptor efficiency, or caffeine metabolism. The EU’s General Data Protection Regulation provides a trusted framework for handling sensitive health data, enhancing consumer confidence. Moreover, there is a growing interest among health-conscious younger European adults in personalized nutrition approaches, and a notable portion of this demographic expresses a willingness to pay a premium. This shift from one size fits all to precision supplementation represents a structural opportunity for brands that integrate science, digital tools, and regulatory compliance into compelling consumer journeys.

Integration of Supplements into Pharmacist-Led Preventive Care Models

Pharmacies across the region are evolving into primary wellness hubs by creating a trusted channel for evidence-based supplement distribution, which is likely to promote fresh expansion possibilities in the Europe nutritional supplements market. In countries like Italy, Spain, and Belgium, pharmacists are legally authorized to provide nutritional counseling and recommend supplements for subclinical conditions such as mild iron deficiency or seasonal immune support. Pharmacies across the region have increasingly allocated a significant portion of their retail space to high-end supplement offerings. There has been a consistent upward trend in the number of pharmacies engaging in this category expansion over the past several years. A notable trend involves the introduction of tools designed to guide customers toward suitable supplement choices based on individual health profiles. The increasing policy focus on prevention positions pharmacists as critical governance agents, leveraging their advisory role to ensure the supplement market matures with scientific rigor and public safety in mind.

MARKET CHALLENGES Misinformation and Proliferation of Unsubstantiated Health Claims Online

The digital explosion has amplified access to supplements but also flooded consumers with misleading or pseudoscientific health narratives, which continues to degrade the growth of the Europe nutritional supplements market. Social media influencers and e-commerce platforms frequently promote products with exaggerated benefits, such as “detox” blends or “miracle” weight loss pills, unsupported by clinical evidence. Many popular supplements sold online feature marketing claims that do not align with established safety guidelines or scientific consensus. This misinformation erodes consumer trust in legitimate products and complicates public health messaging. Regulatory systems face challenges in effectively managing non-compliant products entering the market. There is a recurring pattern of consumer safety notifications related to illegal ingredients found in supplements, including undeclared pharmaceutical compounds. The resulting confusion leads consumers to either overuse ineffective products or dismiss supplements entirely, which affects the category’s potential in preventive health. Combating this requires coordinated action from regulators, platforms, and ethical brands to elevate transparency and scientific literacy.

Intensifying Competition from Private Label and Mass Retail Brands

Mounting pressure from private label offerings by major retailers, which leverage price advantage and shelf dominance to capture share from branded players, impedes the Europe nutritional supplements market. Supermarkets like Carrefour, Aldi, and Tesco now offer extensive supplement ranges under their own labels, often priced below premium brands. These products benefit from high foot traffic and consumer trust in the parent retailer, even when scientific backing is minimal. In Germany, for instance, dm Drogerie’s “Biotin Plus” line outsells several established vitamin brands despite containing standard formulations. This trend pressures branded companies to justify premium pricing through clinical studies, traceability, or sustainability credentials, factors less visible to average shoppers. Continued retail consolidation heightens the risk of commoditization, which may suppress the innovation and quality necessary for a market prioritizing efficacy and safety.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

10.52%

Segments Covered

By Product Type, Health Concern, Distribution Channel, And Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Nestlé Health Science, Bayer AG, GlaxoSmithKline plc, DSM-Firmenich, Abbott Laboratories, Amway Corporation, Herbalife Nutrition, Danone S.A., Arkopharma, Perrigo Company plc, Solgar Inc., Vitabiotics Ltd., Swisse Wellness Europe, Orthomol Pharmazeutische Vertriebs GmbH, Doppelherz

SEGMENTAL ANALYSIS By Product Type Insights

The vitamins segment was the largest in the Europe nutritional supplements market by accounting for a 34.4% share in 2024. The supremacy of the vitamins segment is attributed to widespread awareness of essential micronutrients, strong scientific backing, and integration into national public health strategies. Vitamin D deficiency, in particular, has become a continental concern. According to sources, a significant portion of the adult population in certain Northern and Central regions exhibits low serum levels of a specific vitamin during the colder months. National responses reinforce consumption. Mandatory fortification of certain food items in a Northern European nation is associated with a notable decrease in the prevalence of this same vitamin deficiency. Additionally, multivitamin formulations are widely recommended by pharmacists for elderly populations and pregnant women. In a Southern European country, the majority of prenatal care guidelines include the supplementation of folic acid and B complex vitamins. The category’s regulatory clarity under the EU Food Supplements Directive, permitting well-defined dosages of vitamins A through K, further ensures consistent availability and consumer trust, which strengthens vitamins as the cornerstone of Europe’s supplement landscape.

The sports supplements segment is predicted to witness the highest CAGR of 9.6% from 2025 to 2033 due to rising participation in fitness culture, professionalization of amateur athletics, and mainstreaming of performance nutrition beyond elite circles. Adults in several Northern European nations demonstrate a consistent commitment to structured physical activity, which supports a steady market for specialized nutritional supplements. There is a notable consumer focus on products such as amino acids, protein concentrates, and hydration solutions among those maintaining frequent exercise routines. The inclusion of strength and conditioning in national health guidelines has further legitimized usage. Official health guidance has evolved to recognize the potential benefits of protein intake for older demographics, particularly when paired with strength-based activities. Shifting perspectives on age-related muscle maintenance have contributed to a broader acceptance of supplementation as a component of healthy aging. Simultaneously, esports and wellness influencers are normalizing sports nutrition among younger demographics. This blend of public health alignment, cultural shift, and demographic broadening positions sports supplements as the most dynamic growth vector in the European market.

By Health Concern Insights

The immunity enhancement segment led the Europe nutritional supplements market by capturing a 28.7% share in 2024. The prominence of the immunity enhancement segment is credited to enduring consumer prioritization of preventive defense against infections. The legacy of recent global health events has permanently altered wellness behavior. Citizens are increasingly using supplements to support immune function, with certain vitamins and botanicals being preferred. National health authorities have reinforced this trend. Health guidance emphasizes adequate intake of particular nutrients for maintaining normal immune responses. Retail data corroborates sustained demand. Immunity supplements account for a considerable share of yearly supplement purchases, remaining relevant outside winter. Furthermore, the aging population’s vulnerability to respiratory infections has normalized daily immune support among seniors, particularly in Southern Europe. This deep-rooted multi-demographic adoption, backed by both public perception and institutional validation, cements immunity as the top health-driven segment.

The bone and joint health segment is estimated to register the fastest CAGR of 10.2% during the forecast period, owing to Europe’s aging demographic and rising osteoporosis prevalence. A notable trend indicates that a significant proportion of the aging population experiences bone-related fractures. The healthcare costs associated with treating these fractures represent a substantial financial burden on the system. National osteoporosis societies in Italy, Spain, and Sweden have launched public awareness campaigns promoting calcium, vitamin D, and collagen supplementation as part of fracture prevention protocols. There has been a recent expansion in clinical practice guidelines recommending preventative nutrient supplementation for the elderly population. Additionally, active aging trends drive demand among younger cohorts. Data suggests a substantial percentage of middle-aged adults are proactively using specific supplements aimed at supporting joint health. This dual focus on therapeutic and preventive care across age groups fuels structural growth in this segment.

By Distribution Channel Insights

The pharmacies and drug stores segment held the prominent share of 41.2% of the Europe nutritional supplements market in 2024. The leading position of the pharmacies and drug stores segment is driven by Europe’s pharmacy-centric healthcare culture and consumer trust in professional advice. Unlike in other regions where supplements are treated as general merchandise, European pharmacies position them as health solutions subject to pharmacist oversight. According to sources, a notable share of European countries legally empower pharmacists to provide nutrition counseling, enhancing product credibility. In Germany and Italy, pharmacy exclusivity laws restrict certain high-potency supplements, such as high-dose vitamin D or iron, to licensed outlets, reinforcing their medical relevance. As per a study, many Europeans consider pharmacy-sold supplements safer and more effective than those from supermarkets. Major chains like Apoteket in Sweden and Boots in the UK have further professionalized the category through in-store consultations and digital health tools. This regulatory, cultural, and professional alignment makes pharmacies the dominant and most trusted channel for supplement distribution across the continent.

The online retailers segment is anticipated to witness the fastest CAGR of 12.4% from 2025 to 2033. The rapid expansion of the online retailers segment is fuelled by digital health engagement, convenience, and access to specialized or international brands not available in physical stores. According to research, a considerable percentage of Europeans aged 16 to 55 purchased health products online in the past year, with supplements among the top three categories. The rise of subscription models, offering personalized vitamin packs delivered monthly, has further accelerated adoption. Regulatory clarity under the EU Digital Services Act has also boosted consumer confidence by requiring transparency in ingredient sourcing and health claims. Additionally, online platforms enable detailed product education through videos, expert reviews,s and clinical summaries, appealing to informed buyers. Improved logistics and seamless cross-border shipping through e-commerce are transforming how accessible and personalized the European supplement market is for consumers.

REGIONAL ANALYSIS Germany Nutritional Supplements Market Analysis

Germany outperformed other countries in the Europe nutritional supplements market and captured a 19.8% share in 2024. The dominance of the German market is propelled by its robust pharmacy network,rk disciplined consumer base, and strong regulatory environment. The country’s Apotheken system ensures that supplements are dispensed with professional guidance, fostering trust and consistent usage. According to sources, thousands of public pharmacies operate nationwide, with supplements accounting for a portion of non-prescription health product sales. Public health initiatives further drive demand. Germany also leads in sports nutrition, with the German Olympic Sports Confederation endorsing evidence-based supplementation for amateur athletes. Strict enforcement of the Food Supplements Directive minimizes misleading claims, reinforcing market integrity. This combination of institutional support, consumer literacy, and regulatory rigor makes Germany the most mature and influential supplement market in Europe.

United Kingdom Nutritional Supplements Market Analysis

The United Kingdom was the second-largest player in the Europe nutritional supplements market and held a 15.4% share in 2024, with high digital adoption, diverse product innovation, and strong consumer health awareness. British households are among Europe’s most active supplement users. As per sources, a portion of adults took at least one dietary supplement in 2023, with multivitamins and vitamin D leading consumption. The NHS’s updated physical activity guidelines now include protein supplementation recommendations for older adults, legitimizing sports nutrition beyond athletic circles. Online channels thrive; a notable share of UK supplement sales occurs digitally, driven by subscription services and direct-to-consumer brands like Huel and Nutri Advanced. Post Brexit, the UK’s independent regulatory framework under the Food Standards Agency has enabled faster approval of novel ingredients, attracting global brands seeking EU plus market access. This agile, innovation-friendly ecosystem ensures the UK remains a high-velocity, trend-setting market in the European supplement landscape.

France Nutritional Supplements Market Analysis

France is moving ahead steadfastly in the Europe nutritional supplements market, where usage is deeply integrated into preventive health culture and medical practice. French consumers exhibit a strong preference for scientifically validated formulations, particularly those endorsed by healthcare professionals. According to research, a portion of supplement sales occurs through pharmacies, where pharmacists provide tailored advice based on individual health profiles. The government actively supports micronutrient sufficiency. France also leads in botanical innovation, with traditional herbs like ginseng and rhodiola gaining traction under strict ANSES safety evaluations. Additionally, the “Médecine Douce” movement has normalized natural health approaches, driving demand forclean-labell, traceable products. This blend of medical integration, regulatory scrutiny, and cultural openness to holistic wellness defines France’s sophisticated and stable supplement market.

Italy Nutritional Supplements Market Analysis

Italy is also a key player in the Europe nutritional supplements market, with demand strongly influenced by its aging population and Mediterranean health paradigm. A notable share of Italians are aged 65 or older, creating a sustained need for bone joint and cardiovascular support products. Supplements are commonly recommended during routine medical visits, particularly for osteoporosis prevention. Despite a diet rich in olive oil and vegetables, micronutrient gaps persist. Pharmacies dominate distribution, with chains like Farmaclick offering digital health consultations that include supplement planning. Additionally, the “Made in Italy” wellness ethos favors locally produced, natural formulations, supporting domestic brands like Aboca. This fusion of demographic pressure, clinical integration, and artisanal quality sustains Italy’s position as a high-value, health-conscious supplement market.

Spain Nutritional Supplements Market Analysis

Spain is experiencing rapid growth in the Europe nutritional supplements market due to rising health literacy, fitness culture, and public health initiatives. The country’s active aging population fuels demand for immunity and joint health products. Simultaneously, younger demographics are embracing wellness. Spain’s warm climate belies a hidden vitamin D paradox, despite abundant sunshine, indoor lifestyles, and sun protection practices leading to deficiency rates in urban centers like Madrid and Barcelona. Pharmacies remain the primary channel, but online sales are growing fastest. National campaigns promoting nutritional sufficiency during pregnancy and menopause further institutionalize supplement use. This dual current of generational health awareness and policy support positions Spain as a dynamic and expanding market in Southern Europe.

COMPETITION OVERVIEW

The Europe nutritional supplements market features intense competition driven by a mix of multinational corporations, regional specialists, and private label manufacturers. Established players leverage strong brand recognition, extensive distribution networks, and continuous innovation to retain consumer loyalty. Competition is further intensified by rising demand for personalized and preventive health solutions,s which encourages companies to differentiate through unique formulations, functional ingredients, and digital health integration. Regulatory harmonization across European Union member states creates both opportunities and compliance challenges. New entrants often focus on niche segments such as plant-based or allergen-free supplements to carve out market space. Sustainability, transparency, and scientific validation have become critical competitive parameters. Major firms also compete through strategic alliances, clinical research initiatives,s and enhanced e-commerce strategies to meet evolving consumer expectations and secure long term market relevance.

KEY MARKET PLAYERS

A few major players of the Europe nutritional supplements market include

Nestlé Health Science Bayer AG GlaxoSmithKline plc DSM-Firmenich Abbott Laboratories Amway Corporation Herbalife Nutrition Danone S.A Arkopharma Perrigo Company plc Solgar Inc Vitabiotics Ltd Swisse Wellness Europe Orthomol Pharmazeutische Vertriebs GmbH Doppelherz Top Strategies Used by the Key Market Participants

Key players in the Europe nutritional supplements market employ several strategic approaches to maintain competitiveness. Product innovation remains central with companies developing science-backed formulations that address emerging health concerns such as immunity, stress management, and gut health. Strategic acquisitions and partnerships enable swift market entry and technology integration. Investment in sustainable and clean-label ingredients aligns with evolving consumer preferences. Companies also enhance digital engagement through personalized health platforms and direct-to-consumer e-commerce models. Geographic expansion within Europe and localization of product offerings help capture diverse demographic demands. Regulatory compliance and transparent labeling further bolster brand credibility and consumer loyalty across the region.

Leading Players in the Market BASF SE plays a significant role in the Europe nutritional supplements market through its human nutrition division, which supplies high-quality vitamins,s carotenoids, and omega-3 fatty acids to supplement manufacturers across the region. The company has been actively investing in research and development to enhance ingredient bioavailability and sustainability. In recent years, BASF has expanded its production capacity in Europe and launched plant-based nutrient solutions to meet rising consumer demand for clean-label products. Its strategic collaborations with local distributors have reinforced its presence in the European market, while its global supply chain ensures consistent delivery to customers worldwide. Nestlé Health Science contributes substantially to the Europe nutritional supplements market by offering science-backed products targeting gut health, immunity, and metabolic wellness. The company has strengthened its position through continuous innovation, including the development of personalized nutrition platforms and microbiome-focused formulations. Recently, Nestlé Health Science acquired a majority stake in a French biotech firm specializing in probiotic technologies to enhance its gut health portfolio. It also launched new supplement lines tailored for aging populations and athletes across key European markets,s demonstrating its commitment to addressing specific consumer health needs and expanding its global footprint. GlaxoSmithKline Consumer Healthcare maintains a robust presence in the Europe nutritional supplements sector with well-recognized brands such as Centrum and Caltrate that cater to daily wellness and bone health. The company focuses on evidence-based formulations and transparent labeling to appeal to health-conscious European consumers. To reinforce its market position, GSK has invested in digital health platforms that offer personalized nutrition advice and has expandede-commercee capabilities to improve product accessibility. It also collaborates with healthcare professionals and pharmacies across Europe to promote preventive health strategies and enhance consumer trust in its global nutritional offerings. MARKET SEGMENTATION

This research report on the Europe nutritional supplements market has been segmented and sub-segmented based on product type, health concern, distribution channel, and region.

By product Type

Vitamins Minerals Herbal Supplements Sports Supplements Weight Management Supplements Other Nutritional Supplements

By Health Concern

Immunity Enhancement Heart Health Bone and Joint Health Digestive Health Skin and Hair Health Other Health Concerns

By Distribution Channel

Pharmacies and Drug Stores Mass Merchandisers Online Retailers Health Food Stores Natural Product Stores

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe