Overview

Oil prices diverged from the broader trend of rising metals and North American natural gas. WTI fell to lows near US$55/bbl, driven by abundant U.S. supply, growing output from Canada and Guyana, and continued flexibility from OPEC, which together outpaced demand growth.

Profoundly impacted by past downturns, Canadian producers became resilient, supported by stronger balance sheets and reduced debt. Years of disciplined effort to build a more robust sector are paying off. Additionally, the recent Memorandum of Understanding between Alberta and Ottawa signals progress toward narrowing the broad policy gap that had emerged. A significant change in trend for the CAD/USD exchange rate followed soon after the accord was announced.

Natural gas was the standout performer, with Henry Hub briefly touching US$5.00/MMBtu and Alberta prices exceeding CAD$3.00/MMBtu. While hard to quantify precisely, increased LNG exports from Canada’s West Coast and the U.S. Gulf Coast were key contributors.

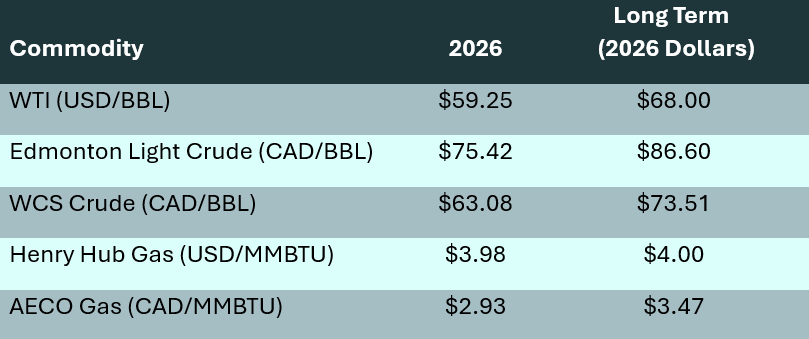

GLJ maintains its fundamentals-based view, holding Henry Hub at US$4.00/MMBtu and revising its long-term real WTI forecast to US$68.00/bbl. This adjustment reflects expectations for a supply-heavy market: OPEC+ restoring barrels, U.S. shale sustaining record productivity, and additional non-OPEC growth. Demand remains steady at roughly 1% annually. This reinforces a structurally well-supplied market and anchors crude prices slightly below prior assumptions while remaining consistent with balanced global fundamentals.

Oil Prices

Multiple indicators point to a market flush with crude. Chinese onshore inventories are at record highs. U.S. production set new records in September 2025, while Guyana is on track to exceed 1 MMbbl/d soon. American crude oil volumes in storage are climbing above recent lows. American Crude imports of Canadian crude reached record highs in 2025.

An oft overlooked factor is the explosive growth in liquids production in the United States and Canada. The USA reports near 14 MMbbl/d of crude oil production, but nearly 22 MMbbl/d of liquids. Many of these liquids enter the refining system parallel to the oil.

These and other factors pushed year-end Cushing prices into the US$55–57/bbl range. At the same time, they underscore the industry’s ability to boost efficiency and meet steadily rising global demand.

GLJ expects today’s supply-demand imbalance to eventually reverse but, as always, the timing remains uncertain.

Natural Gas

Despite strong supply growth in the U.S. and Canada, natural gas prices held firm. LNG Canada reached 71% utilization (1.28 Bcf/d) in December 2025, according to RBC. U.S. LNG exports remain robust. Total gas exports, including LNG and pipeline deliveries to Mexico, now at an impressive 24 Bcf/d.

Henry Hub January delivery trades above US$4.25/MMBtu, while AECO exceeds CAD$3.00/MMBtu, even as weather moderates. GLJ notes that only the Permian Basin continues to show strong supply growth. This raises questions about how much further U.S. gas output can expand, even as a US$4.00/MMBtu Henry Hub price could incentivize drilling.

Canadian LNG volumes are now material, and future projects appear increasingly likely following progress in Ottawa–Edmonton negotiations. While Western Canada has ample storage and production capacity, there is no doubt Canadian resources can meet growing LNG demand. The question remains on what fraction of LNG export supply will come from organic production growth, and how much from reallocation of current supply levels.

Global LNG

Global LNG benchmarks softened in Q4 2025 as supply availability improved and regional demand cooled. In Europe, Dutch TTF trades near US$9.75/MMBtu, with UK’s NBP at similar levels. Storage remains comfortable: European gas inventories are 64% full, while LNG storage sits at 41% capacity. In Asia, the JKM benchmark still holds above US$10/MMBtu, reflecting higher transportation costs and other reasons.

Key drivers include surging U.S. LNG exports and lingering oil-linked pricing for seaborne LNG, both contributing to downward pressure. Looking ahead, risks remain: potential overbuild of liquefaction capacity, sluggish European economies, and even the possibility of Russian gas re-entering the market.

GLJ’s forecast values for key benchmarks are as follows:

Authors

Leonard Herchen

Mr. Herchen joined GLJ in 1993 and is principally responsible for international and Canadian frontier evaluations and reservoir studies. He is skilled in providing reserves and resource opinions, corporate evaluations, economic models, reservoir advisory services and resource supply studies. Mr. Herchen is also responsible for the firm’s commodity market analyses and price forecasting; he has offered expert witness testimony on pipeline tolls, economic damages and land valuation.

Yuchen Wang

Yuchen Wang is a Senior Energy Analyst at GLJ. Yuchen manages pricing forecasts and modelling for various energy companies. Yuchen works with clients to address questions on pricing trends and actively monitors global commodity pricing trends. Yuchen has a master’s degree in economics from the University of Calgary.

Nicson Do

Nicson Do is an Engineer at GLJ. He has conducted a wide variety of conventional and unconventional reservoir engineering and economic evaluations in the Western Canadian Sedimentary Basin. Nicson is a member of GLJ’s commodity pricing team and also assists in developing GLJ’s Spotfire dashboards for use in data analytics. Nicson is a P. Eng, and holds a Master of Science in Chemical Engineering from the University of Calgary.

Share This:

More News Articles