Ukraine’s international reserves rose by more than 30% during 2025, hitting a record $57.3 billion, according to preliminary data released by the National Bank of Ukraine (NBU).

The increase underscores the scale of external financial support sustaining the country during Russia’s full-scale invasion. This assistance has helped Ukraine maintain macrofinancial stability and build reserves that can also serve as a buffer against unexpected emergencies.

Follow our coverage of the war on the @Kyivpost_official.

As of Jan. 1, 2026, Ukraine’s reserves stood at $57.29 billion – the highest level since independence, the NBU wrote.

In December alone, reserves increased by 4.6% compared to November, primarily due to inflows from international partners that exceeded the NBU’s foreign currency sales and the government’s external debt repayments, the central bank wrote in a press release.

The NBU said several factors shaped reserve dynamics in December, including large government inflows, central bank interventions on the foreign exchange market, and the revaluation of financial instruments.

Government inflows outpace debt payments

In December, $6.92 billion flowed into the government’s foreign currency accounts with the NBU. This included:

$3.91 billion via World Bank accounts $2.70 billion from the European Union under the Ukraine Facility instrument $303.8 million raised through the placement of domestic government debt securities

Over the same period, Ukraine spent $668.4 million on servicing and repaying foreign currency public debt. This included:

$212.9 million to the World Bank $212.7 million on domestic government debt securities $182.2 million in payments on government derivatives $5 million to repay the loans of the European Bank for Reconstruction and Development (EBRD), $2.1 million to repay the European Investment Bank (EIB), and $53.5 million other international creditors.\

In addition, Ukraine repaid $171.4 million to the International Monetary Fund (IMF), the NBU reported.

Other Topics of Interest

Zelensky Arrives in Cyprus as Country Takes Over EU Council Presidency

The trip follows high-stakes talks in France, where Zelensky met with key allies to finalize what officials called “robust” security guarantees for Ukraine as part of a potential peace deal.

Central bank interventions remain heavy, but it’s seasonal

On the foreign exchange market, the NBU sold $4.70 billion in December and bought $0.5 million, resulting in net foreign currency sales of $4.70 billion – almost 1.7 times higher than in November.

The central bank said the increase in interventions reflected seasonal factors, including higher budget spending and a pickup in business activity at year-end. Compared to December 2024, however, FX interventions declined by 13%.

The revaluation of financial instruments also played a significant role. In December, reserves rose by $1.16 billion due to changes in market values and exchange rate fluctuations, the NBU said.

Historic high reserves for Ukraine’s economy

Overall, Ukraine’s international reserves increased by 30.8% in 2025. During the year, the country received a record $52.4 billion in international financial assistance, according to the NBU’s balance sheet data.

The largest contributions came from the European Union ($32.7 billion), the World Bank ($13.2 billion), Canada ($3.4 billion), the IMF ($0.9 billion), and the Council of Europe Development Bank ($0.2 billion).

Ukraine also received $2.0 million from the UK under the Extraordinary Revenue Acceleration (ERA) initiative, though these funds were not included in reserves due to their targeted use.

In addition, Ukraine raised more than $3.3 billion in 2025 from the placement of foreign currency domestic government debt securities. Together with external aid, these funds helped cover $6.8 billion in foreign currency public debt servicing and repayments, $3.2 billion in IMF repayments, and $36.2 billion in the NBU’s net FX sales to smooth excessive exchange rate fluctuations under its managed flexibility regime.

“The record growth in international reserves during a full-scale war has been driven by the synergy of three key factors,” the press release quoted NBU Governor Andriy Pyshnyy. These include strong international support, the stable functioning of the domestic debt market, and the central bank’s policy framework combining interest rate tools, exchange rate management, and capital flow measures.

“In 2026, Ukraine expects to receive over $45 billion from international partners. This is our safety margin to ensure uninterrupted financing of the country’s defense and reconstruction needs and to maintain stability in the FX market,” Pyshnyy said.

The current reserve level is sufficient to cover 5.9 months of future imports, the NBU said. Data on international reserves and foreign exchange liquidity are published monthly, with preliminary figures released by the seventh day after the reporting month ends and revised data by the 21st day.

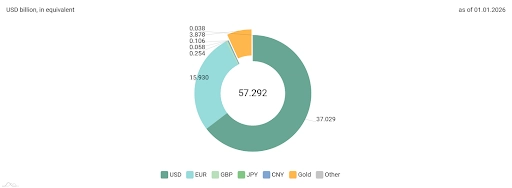

Structure of Ukraine’s international reserves by currency as of Jan. 1, 2026. According to Ukraine’s central bank (NBU), most reserves are held in US dollars, euros and gold. The remainder includes holdings in British pounds, Japanese yen, and Chinese yuan. Source: NBU website

Structure of Ukraine’s international reserves by currency as of Jan. 1, 2026. According to Ukraine’s central bank (NBU), most reserves are held in US dollars, euros and gold. The remainder includes holdings in British pounds, Japanese yen, and Chinese yuan. Source: NBU website

Structure of Ukraine’s international reserves by currency as of Jan. 1, 2026. According to Ukraine’s central bank (NBU), most reserves are held in US dollars, euros and gold. The remainder includes holdings in British pounds, Japanese yen, and Chinese yuan. Source: NBU website

The international reserves of Ukraine’s central bank mostly consist of US dollars ($37 billion), while 27.8% are held in euros (equivalent to almost $16 billion), according to NBU data as of Jan. 1, 2026.

Gold accounts for 6.8% of the reserves, or almost $3.9 billion. The remainder is held in British pounds, Japanese yen, and Chinese yuan.