With the possible exception of the president, no person has more sway over the fortunes of the United States economy than the chair of the Federal Reserve. Because the Fed controls the U.S. money supply, sets interest rates, regulates banks, and provides liquidity in an emergency, the chair’s decisions help determine the pace of inflation, the strength of the labor market, the stability of the financial system, and the cost of a mortgage. If the country faces an economic crisis, the chair’s job is to get us out of it.

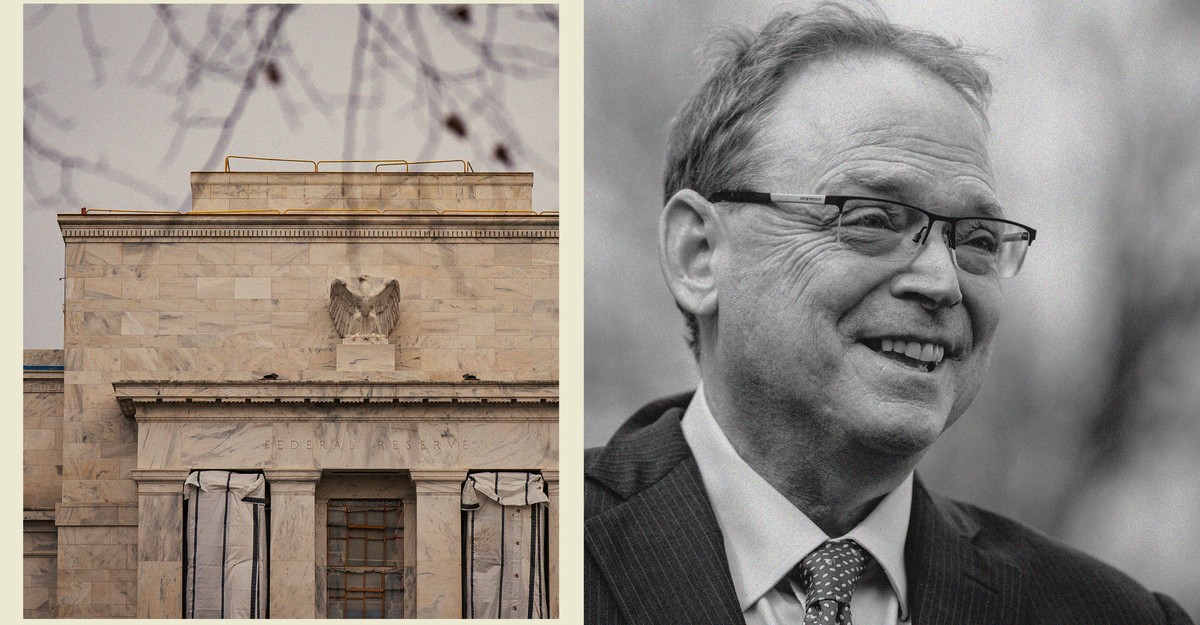

Soon, this all-important position might be held by Kevin Hassett, the current director of Donald Trump’s National Economic Council. No doubt, Hassett is a Trump loyalist. And there’s reason to fear that, as chair, he will do Trump’s bidding, undermining the central bank’s independence and marking a new stage in the president’s control over the American economy.

When Trump nominated Hassett to chair his first-term Council of Economic Advisors, in 2017, the Washington economics establishment was delighted. A bipartisan group of influential economists, including top advisers for former Presidents George W. Bush and Barack Obama as well as two former chairs of the Federal Reserve, wrote a letter urging the Senate to confirm him. As evidence of Hassett’s qualifications, the letter cited his “record of serious scholarship on a wide range of topics”; his stellar résumé, which included stints at the Federal Reserve and Treasury Department; and his efforts to “reach out to a wide range of people from across the ideological spectrum.”

Hassett is now the front-runner to succeed Jerome Powell as Fed chair when Powell’s term ends in May, and some of the experts who endorsed Hassett for the CEA are similarly pleased about the prospect of him overseeing the central bank. “I think he’d be a good Fed chair,” Mark Zandi, the chief economist at Moody’s Analytics, who has known Hassett for more than a decade and signed the 2017 letter, told me. “He’s smart, curious, willing to debate, and has a good working relationship with the president. Those are the qualities you need for this job.”

A close examination of Hassett’s record, alongside conversations with nearly a dozen of his former peers and colleagues, however, suggests that what was true about him in 2017 might not be true today. Over the past decade, Hassett has become an unapologetic Trump propagandist in ways that the phrase good working relationship doesn’t quite capture. In his years working for Trump, Hassett has proved willing to change his beliefs, misrepresent basic facts, and endorse dangerous conspiracy theories, all in an apparent effort to please the president. His obsequiousness probably explains why he is now on the verge of running the Fed, and introduces the possibility of a central bank willing to uncritically carry out the president’s wishes, economic consequences be damned.

Before his MAGA career, Hassett, who didn’t respond to multiple interview requests, spent several decades as a respected conservative economist. He received his Ph.D. in economics from the University of Pennsylvania in 1990, before going to work as an economics professor at Columbia Business School, a researcher at the Federal Reserve, and, in 1997, a resident scholar (and later director of economic-policy studies) at the American Enterprise Institute. At the time, AEI was the preeminent conservative think tank in Washington. Over the next two decades, Hassett wrote op-eds for The New York Times, The Washington Post, and The Wall Street Journal; appeared frequently on cable news; and advised the Republicans George W. Bush, John McCain, and Mitt Romney on their presidential runs.

Like most conservative economists at the time, Hassett was a staunch deficit hawk, an advocate of higher levels of immigration, and, above all else, an unabashed free trader. During the Bush and Obama years, he called for major deficit reductions, defended the global trade system, and proposed that the U.S. double its intake of immigrants to boost GDP growth. In 2011, when Trump was floating a run for the presidency, Hassett wrote an op-ed eviscerating his proposal for a 25 percent tariff on all imports from China. “He appears to still have a tin ear on tax policy,” Hassett wrote of Trump, whose plan, he argued, “would be terrifyingly similar to the Smoot-Hawley tariffs that set off a trade war in 1930, and helped turn the stock market crash of 1929 into the Great Depression.”

The pre-MAGA version of Hassett had his share of questionable judgment calls. In September 1999, just months before the dot-com crash, he co-authored a book predicting that the Dow Jones would quadruple over the next three to five years. (This did not occur until 2021.) In November 2010, with unemployment at nearly 10 percent and the economy still in the throes of a recession, Hassett signed an open letter warning that the Fed’s efforts to boost the economy could trigger hyperinflation. The Fed ignored the letter, and inflation remained near or below 2 percent for the next decade.

Still, Hassett maintained a solid reputation among Washington insiders. Several of the signatories of the 2017 letter told me they believed that Hassett would be an adult in the room who would help prevent Trump from acting on his most dangerous impulses. (Much of the MAGA right opposed Hassett’s nomination for the same reason.) During the first two years of Trump’s presidency, this proved to be true. Although Hassett often defended the president’s decisions publicly, he was known to privately argue for a more conventional approach on issues such as immigration and trade. He was even willing to suggest that Trump was not omnipotent. When asked in a 2019 interview whether he supported Trump’s demand that the Fed slash interest rates, Hassett responded, “It’s not my job at CEA to give the Fed advice. My job at CEA is to remind people to respect the independence of the Fed.”

Then, in June 2019, Trump somewhat abruptly announced Hassett’s departure. The president’s first-term trade war with China was heating up and his spat with Powell was intensifying. Just a week before, Hassett had been excluded from a White House meeting in which the president decided to impose higher tariffs on Mexico, The New York Times reported.

In March 2020, Hassett was asked to return to the CEA to assist with the White House’s COVID response. Trump was busy downplaying the severity of the new coronavirus and insisting that the country had to swiftly reopen. If Hassett’s independence had gotten him pushed out the year before, he wouldn’t make the same mistake again. A few weeks after his return, the CEA released a model projecting that COVID deaths had already peaked and would drop to almost zero by mid-May. Experts immediately pointed out that Hassett had used a misleading method known as a cubic fit to make the mortality data appear less frightening.

“I was, quite frankly, pretty shocked that this had come from Kevin,” Dean Baker, a progressive economist who co-wrote several papers with Hassett and signed the 2017 letter supporting his nomination, told me. “It was the kind of thing that no serious analyst would ever produce.” Jason Furman, who chaired the CEA under Obama and had also signed the 2017 letter, tweeted at the time that the model might represent “the lowest point in the 74 year history” of the council. Hassett defended the chart by claiming that it wasn’t intended as a “forecast” but instead “just a different way of visualizing the model.”

At the time, many economists who had long known Hassett, including Baker, considered the cubic-fit episode a fluke. What they didn’t realize was that Hassett was, by his own account, in the midst of a profound ideological shift. In November 2021, Hassett published a retrospective of his time in the Trump administration called The Drift: Stopping America’s Slide Towards Socialism. It reads like a conversion experience. In it, Hassett describes his journey from an establishment figure who was deeply skeptical of Trump to a MAGA soldier who believed that Trump was engaged in an existential fight to save the U.S. from catastrophe. “Donald Trump found himself in the middle of a much bigger historical battle than the simple fight against Joe Biden or Hilary Clinton,” Hassett wrote. “He came to power determined to arrest and reverse the Drift to socialism. The entire Donald Trump saga only makes sense if one views him as a powerful opposition to the Left’s quest to defeat capitalism and turn the United States into a socialist country.”

Upon his return to the White House in 2025, Trump brought back a mere handful of his most trusted advisers from his first term. Hassett was among them. In January, he was appointed the head of Trump’s National Economic Council, and quickly emerged as one of the administration’s most important surrogates. Whenever the president floated some bizarre policy idea, issued a new threat, or told a brazen lie about the state of the economy, Hassett would be one of the first people on cable news justifying it. Gone were the carefully chosen language, the adherence to factual reality, and the reports of behind-the-scenes dissent that had characterized Hassett’s first two years working for Trump.

In April, the president announced his “Liberation Day” tariffs—the ones that would have introduced sky-high import duties on nearly every single country, as well as a few uninhabited islands, based on an incoherent formula. Hassett, the once ardent free trader, boasted on TV that Trump’s policy was an act of genius that would remake the global trade system for the better, raise gobs of revenue, and boost American industry. A week later, the president decided to implement a 90-day pause, and Hassett went back on TV to claim that this seemingly abrupt move had been the president’s real intention from the beginning. “This is the plan that he was pursuing all along,” he told Fox News. Hassett has so routinely delivered obvious untruths—such as that inflation had “come way down” at a moment when it had increased over the previous five months—that a genre of viral clip has emerged in which Hassett is fact-checked by the moderator.

Nor has Hassett’s remit been limited to economic policy. During Trump 2.0, he has gone so far as to endorse the president’s conspiratorial accusations against disfavored individuals. In July, he suggested that cost overruns on the renovation of the Federal Reserve’s headquarters could provide sufficient legal pretext for the president to fire Jerome Powell, saying that the Fed had “a lot to answer for” on the matter. In August, he called Trump’s flimsy mortgage-fraud accusations against Fed Governor Lisa Cook “serious” and implied that they could provide cause to fire her, as Trump did. (Subsequent reporting suggests that Cook did not list multiple homes as her primary residence in order to secure more favorable loan terms or receive tax exemptions, as the charges against her alleged. The question of whether Trump can fire Cook and other Fed officials is now before the Supreme Court.) When, in that same month, Trump responded to a negative jobs report by calling the data “rigged” and firing the head of the Bureau of Labor Statistics, Hassett defended the decision, citing a supposed “partisan pattern” in the data and claiming that U.S. statistical agencies had a long history of manipulating numbers in favor of Democrats. “That moment was a turning point for me,” Baker said. “This wasn’t just another Trump talking point. It was a completely baseless attack on empirical reality. And Kevin just went along with it.”

Many of those who have long known and respected Hassett have begun to worry that he’s lost credibility as an independent thinker and economist—a dangerous possibility for someone who is leading the race to become the head of the country’s central bank. “I’ve known Kevin since he was a grad student, and I’ve long respected him as an economist, but I think he’s been too willing to sacrifice some of his professional credibility to maintain his standing in Trump world,” Gregory Mankiw, a conservative economist at Harvard University who served as CEA chairman under George W. Bush, told me. “To say I’m disappointed is a grotesque understatement,” Alan Blinder, a Princeton economist who previously served on Bill Clinton’s CEA and as the second-highest-ranking member of the Federal Reserve, told me. “When you say inflation is falling when it’s rising; when you favor firing Chair Powell for no good reason; when you attack the very data that we depend on to understand reality—you’ve crossed multiple lines with me and I think almost all economists.” (Both Blinder and Mankiw signed the 2017 letter supporting Hassett for the CEA.)

Even so, other economists are sanguine about Hassett’s possible appointment as Fed chair. Hassett might have to parrot Trump’s talking points in order to get the job, they argue, but once he has it, he will be free to make his own independent decisions, at which point his training as a mainstream economist will kick back in. “I don’t think Kevin has changed his views very much over the years,” a conservative economist who has known Hassett for several years and requested anonymity to speak freely, told me. “I think he’s figured out that there is a certain set of positions he has to take if he’s going to retain the confidence of the president so he can do his job effectively.”

In fact, several economists who support Hassett’s nomination told me they believe that his close personal relationship with Trump would be an asset as Fed chair. If Trump started putting pressure on the Fed to lower interest rates to 1 percent, as he has suggested on several occasions, Hassett could calmly explain to the president that this would likely backfire. With anyone else, Trump would surely lash out at such a suggestion, but because Trump knows and trusts Hassett, he will be far more likely to listen and respect the decision. “I think you need someone for the job who has the president’s confidence and trust,” Zandi said. “And I don’t think there are many people other than Kevin who have that.”

This view of Hassett would be more persuasive if he hadn’t published a manifesto heralding Trump as a messianic figure. Notably, The Drift was published back in November 2021, before Trump became the clear front-runner for the 2024 Republican nomination; it would have gone to the printers at a time when Trump’s political career appeared to be over. Throughout the book, Hassett acknowledges that “president Trump is gone now” and urges his fellow Republicans to carry the flame forward. If this was all a ploy to manipulate Trump into someday appointing him Fed chair, it was one hell of a long con.

“He’s absolutely a true believer,” a conservative economist who has known Hassett for many years and requested anonymity to avoid retribution from the White House, told me. “You can’t get up every day and say things you know are wrong and that will hurt the nation and live with that cognitive dissonance. You believe what you need to believe or you quit.”

There’s no big mystery about what Trump wants the next Fed chair to do: immediately cut interest rates. Last month, the president deemed the central bank’s recent rate cut of a quarter of a percentage point “a rather small number” that should have been “at least doubled.” He has called for slashing rates to “1 percent and maybe lower than that” within a year. (They are currently about 3.75 percent.) “I won’t have anybody on the Federal Reserve that when you have good news, that means you automatically raise interest rates through the roof in order to kill inflation,” Trump recently told The Wall Street Journal. On Truth Social last month, the president was even more explicit: “Anybody that disagrees with me will never be the Fed Chairman!”

Hassett has said and done little to demonstrate that he would resist the president’s wishes. In a recent interview meant to calm the nerves of his critics, Hassett asserted that “the job of the Fed is to be independent,” but added that he “would be happy to talk with the president every day until both of us are dead.” He has also endorsed Trump’s call to “at least double” the current pace of cuts, and said that the Fed has “plenty of room” to cut even further.

The last time a president leaned on a loyal Fed chair to juice the economy with lower rates, the results were ugly. In 1970, Richard Nixon appointed one of his top economic advisers, Arthur Burns, to lead the central bank. He made clear that he expected looser monetary policy in the run-up to the 1972 elections, even as prices were rising. Burns delivered, and Nixon won reelection. But that move is now widely understood to have contributed to the double-digit inflation that roiled the country during the ’70s and ended only after a new Fed chair raised interest rates high enough to trigger a recession. “I worry Trump-Hassett would be even worse than Nixon-Burns,” Blinder, a historian of monetary policy, told me. “Burns at least put up some resistance to Nixon’s wishes.”

The chair of the Federal Reserve does not set interest rates unilaterally; they are determined by a 12-member board that votes eight times a year. One thing that’s changed under Trump, though, is the stability of the board from one administration to the next. When he moved to fire Cook, Trump was attempting to establish a broad right to dismiss Fed governors at will and nominate more pliant candidates to replace them.

If the Supreme Court hands Trump a victory in the Cook case, the president will gain effective control over the central bank. Although this eventuality is somewhat unlikely, the consequences could be disastrous. The Fed’s most important asset is its credibility: the belief, held by investors, bond traders, and business leaders, that the central bank will do whatever it takes to keep prices stable—even when that course of action is politically unpopular. Filling the central bank with partisans willing to lower rates on command would erode, if not completely decimate, that trust.

Recent history has not been kind to leaders who have embarked on a similar path. From 2019 to 2022, Turkish President Recep Tayyip Erdoğan packed his country’s central bank with loyalists who dramatically cut interest rates even as prices were rising. In turn, inflation spiraled even higher, at one point reaching 85 percent. Foreign investors panicked, triggering a fire sale of Turkish government bonds. Long-term interest rates spiked, the value of the Turkish lira cratered, and the country appeared on the verge of hyperinflation. Erdoğan changed course in 2023 and brought in new central-bank leadership who jacked interest rates to nearly 50 percent and plunged the country into a recession in a desperate effort to restore credibility. More than two years later, unemployment remains high and inflation is still running at more than 30 percent. “I’ve always mocked those who warn of ‘bond vigilantes’ or say the U.S. is going to end up like Turkey or Argentina,” Baker told me. “But if Trump really did gain control of the Fed, that kind of scenario would suddenly feel a lot less ridiculous.”

The powers of a Trumpian Fed would extend beyond control over interest rates. The central bank also decides which institutions can have access to the financial system; control of it would give Trump the power to “debank” enemies of his choosing, including major universities, companies he considers too “woke,” and left-leaning foundations. The Fed also has an emergency lending authority with almost zero practical constraints. “It’s an infinite money pit,” Lev Menand, a professor at Columbia Law School who previously worked for the Federal Reserve Bank of New York, told me in September. Nothing can really stop the Fed “from lending trillions of dollars to the president’s priorities.”

If the Supreme Court rejects Trump’s firing of Cook, as is widely expected, the future of the Fed will be less grim, but hardly sunny. Hassett will then have to persuade a majority of the voting committee to go along with his plans. Burns, who was among the most famous academic economists of his era, was able to pull that off. There’s no guarantee Hassett would be able to do the same.

Even so, as the central bank’s voting board shifted from a technocratic body guided by consensus to a partisan battleground between those attempting to do the president’s bidding and those trying to hold the line, its decisions would become far less predictable. Investors might question whether a divided Fed could successfully navigate a future financial crisis or inflationary spike. In response, they might begin to sell some of their U.S. Treasury holdings, which would, in turn, send interest rates on car, home, and student loans even higher. (The interest rate on long-term U.S. Treasury bonds rose when Hassett emerged as the front-runner early last month, and several major bond investors have expressed concerns over his appointment.) “The Fed is widely viewed as the anchor of stability for the entire U.S. economy—the entire global economy, in fact,” Blinder said. “So if the Fed starts acting erratically, that’s a recipe for all kinds of market volatility.”

For most of his career, Kevin Hassett would no doubt have agreed with that analysis. The fate of the economy could soon depend on whether he still does.