Find companies with promising cash flow potential yet trading below their fair value.

Automatic Data Processing Investment Narrative Recap

To own ADP, you generally need to believe in steady demand for outsourced payroll and HR services, supported by recurring revenue and long client relationships. December’s 41,000 gain in ADP-tracked private payrolls hints at resilient services hiring, but it does not materially change the short term focus on cooling “pays per control” volume and the risk that softer U.S. payroll trends could weigh on organic growth.

Against this backdrop, the upcoming second quarter fiscal 2026 results on 28 January take on added importance, as they will show how December’s stronger service sector payrolls flow through to ADP’s reported volumes and guidance. Investors watching bookings and pay-per-control trends may see this earnings release as a key check on whether recent labor market resilience is enough to offset concerns around slowing payroll growth and retention…

Read the full narrative on Automatic Data Processing (it’s free!)

Automatic Data Processing’s narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and about a $1.0 billion earnings increase from $4.1 billion today.

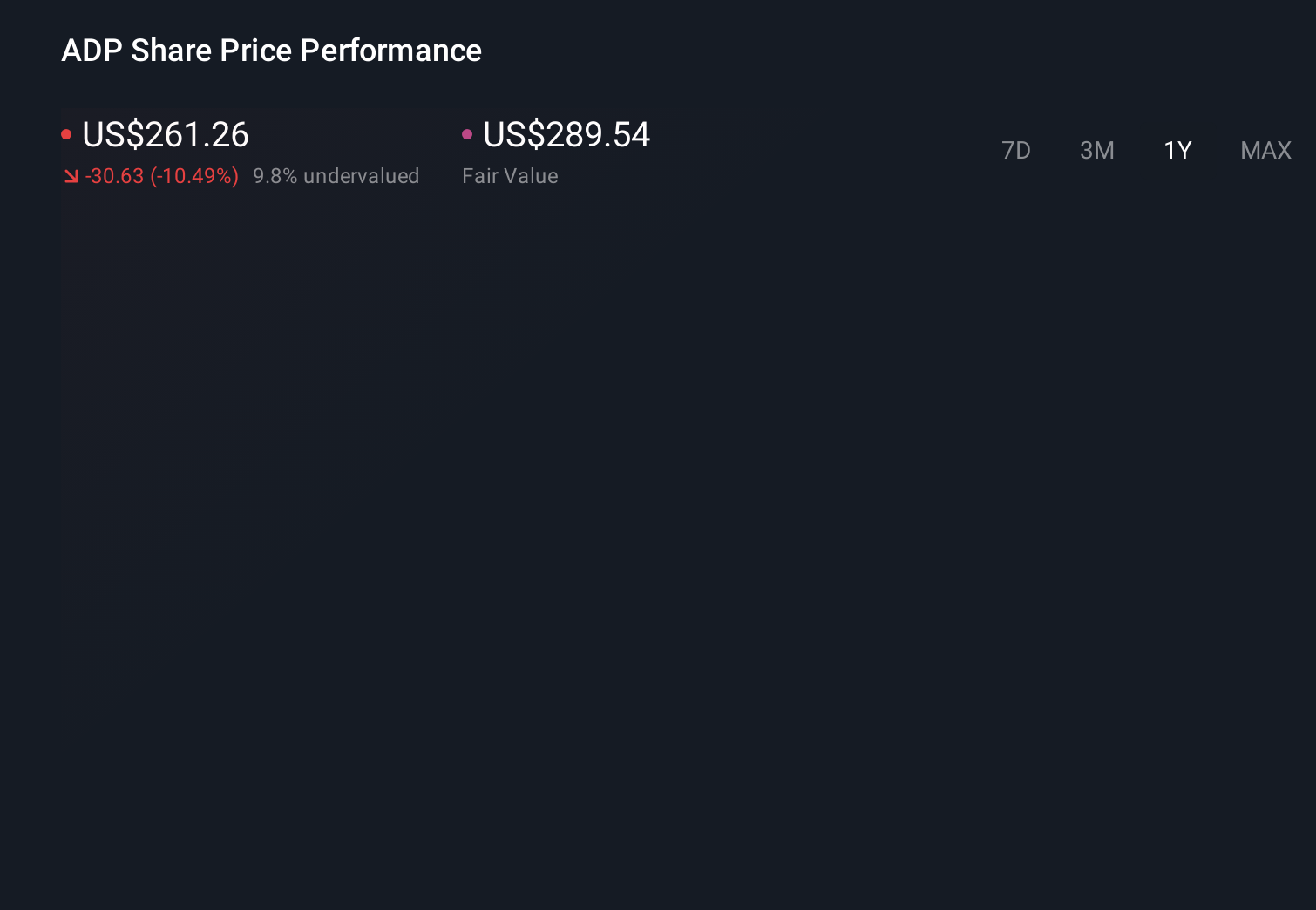

Uncover how Automatic Data Processing’s forecasts yield a $289.54 fair value, a 11% upside to its current price.

Exploring Other Perspectives ADP 1-Year Stock Price Chart

ADP 1-Year Stock Price Chart

Four members of the Simply Wall St Community currently place ADP’s fair value between US$276 and US$387.77, underscoring how far opinions can diverge. As you weigh those views against the risk that slowing U.S. payroll growth and moderating pay per control could pressure ADP’s organic revenue, it is worth exploring several of these alternative perspectives before deciding how this stock fits into your portfolio.

Explore 4 other fair value estimates on Automatic Data Processing – why the stock might be worth as much as 48% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards that could impact your investment decision.Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Automatic Data Processing’s overall financial health at a glance.Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com