In a move that could link two emerging pillars of Alaska’s economic future, Glenfarne Alaska LNG and Donlin Gold have signed a preliminary agreement to explore delivering Alaska natural gas to the 45-million-ounce Donlin Gold project in Southwest Alaska.

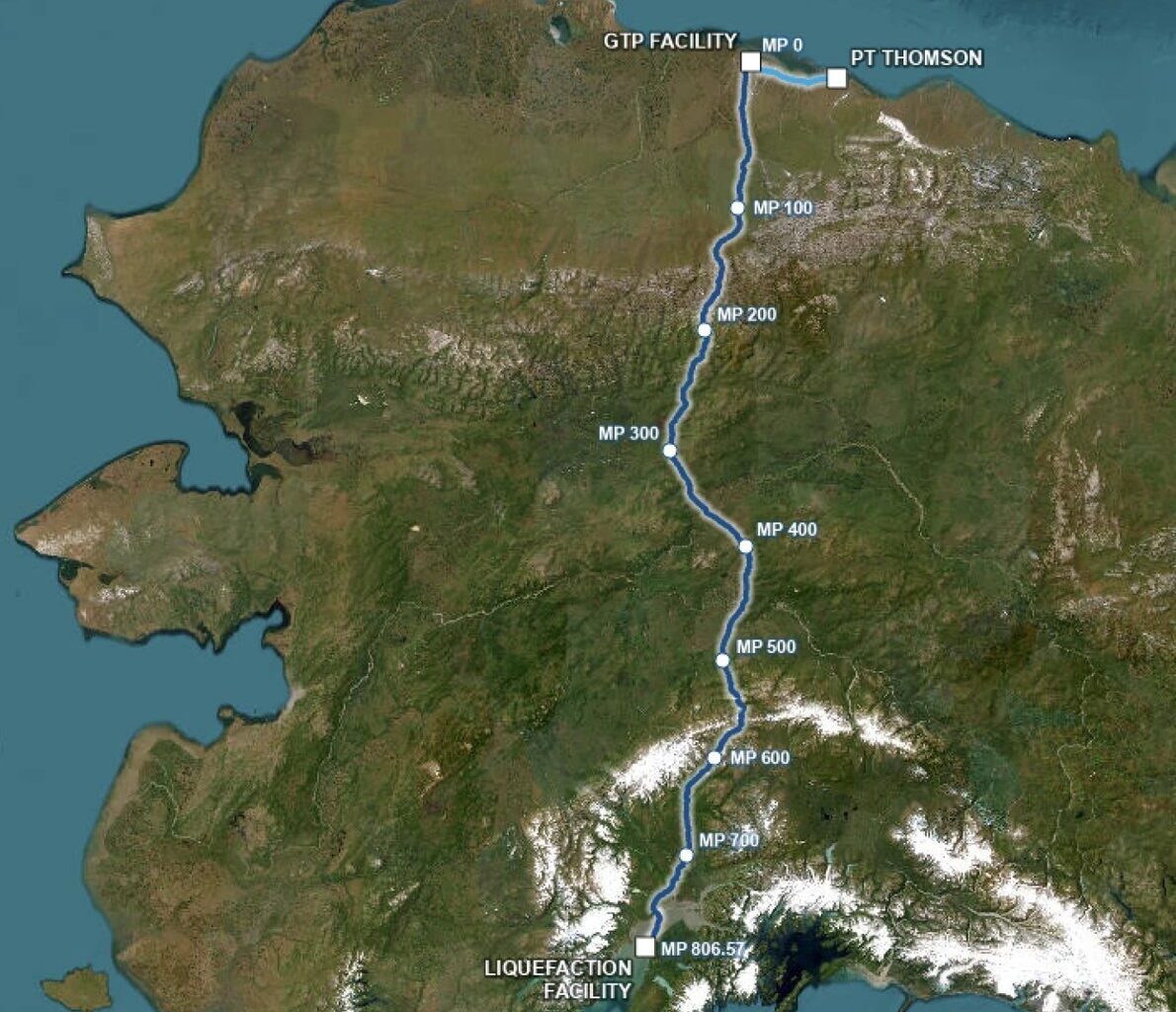

Glenfarne is the majority owner and developer of the Alaska LNG Project, which includes a 42-inch-diameter, 800-mile-long pipeline designed to deliver Alaska North Slope natural gas to international markets via a liquefied natural gas facility in Southcentral Alaska, as well as for in-state use.

“Alaska LNG offers abundant low-cost natural gas that will enhance the economics and facilitate development of energy-intensive mining projects in Alaska,” said Glenfarne Alaska LNG President Adam Prestidge.

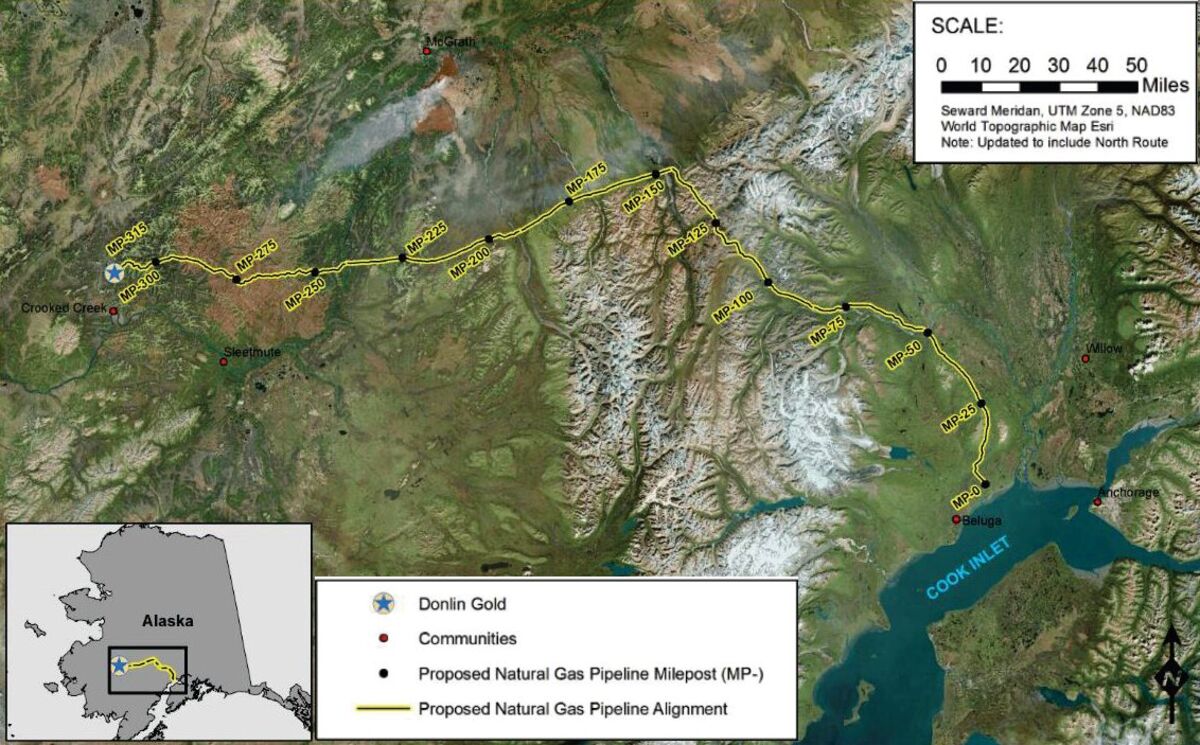

Donlin Gold, a joint venture owned 60% by Novagold Resources Inc. and 40% by Paulson Advisors, plans to build a 315-mile pipeline from Southcentral Alaska into Southwest Alaska to fuel the energy needs of a future mine at its namesake mine project.

Under a letter of intent announced Jan. 8, the companies will begin formalizing an agreement for Donlin Gold to purchase up to 50 million cubic feet of natural gas per day from the Alaska LNG pipeline. The agreement also outlines cooperation on evaluating the most effective approach to developing a pipeline to Donlin and a power plant to supply electricity to the mine.

“A reliable, secure supply of economic natural gas from Alaska LNG has the potential to substantially enhance our ability to unlock value and upside potential in Donlin Gold,” said John Paulson, president of Paulson Advisors. “Glenfarne’s global energy experience is well suited to provide a long-term turnkey energy solution that helps advance this opportunity.”

By leveraging the infrastructure, expertise, and labor force that Glenfarne would assemble to build the Alaska LNG pipeline, the collaboration could lower costs and accelerate the timeline for constructing what would effectively be a spur line to the Donlin project. Glenfarne’s involvement could also facilitate future delivery of energy to communities and projects across Southwest Alaska.

“As Donlin moves into what we hope to be the largest single gold mine in the United States, natural gas from Alaska LNG could offer significant benefits not only for the mine, but for the entire Southwestern Alaska region,” said Novagold President and CEO Greg Lang.

Securing a 50-million-cubic-feet-per-day anchor client could also strengthen the economics of the Alaska LNG project and help lower the cost of delivering North Slope gas to other in-state customers.

“Adding a foundational customer like Donlin Gold, one of the largest known undeveloped gold deposits in the world, to Alaska LNG provides significant volume discount benefits that will result in lower energy costs for Alaska consumers,” said Prestidge. “As we continue to bring on more pipeline customers, the cost of gas for Alaskans will continue to go down.”

Donlin Gold is currently finalizing an updated feasibility study that will provide detailed economic and engineering parameters for what is anticipated to be a roughly one-million-ounce-per-year gold mine. The study is expected to incorporate plans for the pipeline and natural-gas-fueled power system now being evaluated in cooperation with Glenfarne.

“We look forward to working with Glenfarne to unlock the value of both of these world-class Alaskan resources: Donlin Gold and Alaska LNG,” Lang said.