While big tech dominated headlines in 2025, one of the year’s most surprising winners came from a far more futuristic corner of the market, quantum computing. D-Wave QuantumQBTS delivered more than 200% share-price gain in 2025, dramatically outperforming many established technology leaders.

For context, NVIDIA NVDA, the flagship name of the AI boom, rose roughly 38.8% in 2025, while Advanced Micro DevicesAMD advanced about 77.3%, supported by stronger data-center momentum and growing investor confidence in its AI and high-performance computing roadmap. Other tech heavyweights such as Apple AAPL and MicrosoftMSFT posted far more modest growth of 8.6% and 14.7%, respectively. Against this backdrop, QBTS’s performance stood out as one of the most aggressive upsides in the technology space. Overall, the broader Computer and Technology space gained 26% during this period.

QBTS 2025 Stock Comparison With Big Tech

Image Source: Zacks Investment Research

Throughout 2025, D-Wave reported rapid revenue growth, expanded customer adoption and recorded strong liquidity and continued progress in commercial quantum systems and services. As enterprises and governments increasingly explored practical quantum applications, investor sentiment shifted toward pure-play quantum leaders.

Can D-Wave Sustain Its Aggressive Momentum in 2026?

Real-world Deployment: D-Wave Quantum has entered 2026 with a level of commercially deployable technology that a few quantum computing companies can currently match. Unlike its peers, which are still focused primarily on research milestones, D-Wave already has production-grade quantum systems in operation, paying enterprise and government customers and long-term system contracts scheduled to begin generating revenues in 2026. The deployment of Advantage2 systems in the United States and Europe, including the EUR 10 million Italian agreement, provides tangible visibility into 2026 revenues and supports the company’s claim that quantum computing can deliver real-world value today.

Strong 2026 Outlook: D-Wave’s outlook for 2026 is based on its hybrid quantum strategy, combining annealing systems available today with a longer-term gate-model roadmap built on superconducting technology. D-Wave closed 2025 with more than 100 revenue-generating customers, growing enterprise deal sizes and expanding use cases across manufacturing, logistics, defense, financial services and pharmaceuticals. Proven results such as dramatic reductions in scheduling times, faster incident response for public safety agencies and measurable efficiency gains for industrial clients, strengthen the case for broader adoption in 2026 as customers move from proofs of concept into production deployments.

Solid Finance: With over $800 million in cash, high gross margins and a scalable Quantum Computing as a Service platform capable of supporting significant incremental demand, D-Wave has the resources to invest aggressively while maintaining discipline.

Key Risks That Could Temper D-Wave’s 2026 Growth Trajectory

Despite its strong momentum, D-Wave faces several challenges that could constrain growth in 2026. Revenues remain relatively small and uneven, with lumpy system sales and long deal cycles that can delay recognition. While customer adoption is expanding, many engagements are still early-stage and require conversion from pilots to sustained production use. The company also continues to post operating losses, meaning profitability depends on scaling QCaaS utilization and closing larger contracts. In addition, rising competition in quantum technologies and heightened investor expectations following the 2025 stock surge could increase volatility if execution falls short.

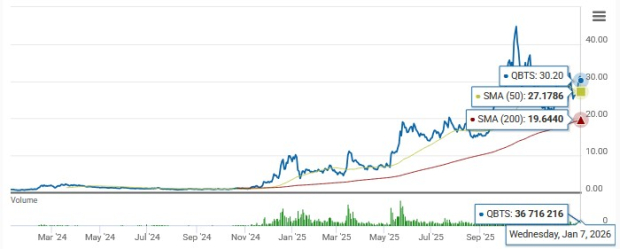

D-Wave Quantum Stock Trades Above 50-Day and 200-Day SMAs

D-Wave Quantum’s trading above its 50-day and 200-day moving averages suggests that recent buying pressure aligns with the longer-term upward trend, supporting a bullish technical structure. From investors’ point of view, this trend signals strong momentum and a confirmed bullish trend.

50- and 200-Day SMAs

Image Source: Zacks Investment Research

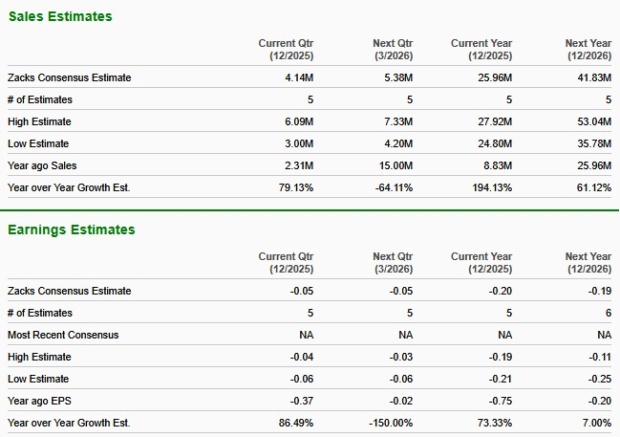

Meanwhile, for QBTS, the Zacks Consensus Estimate for 2026 loss per share of 19 cents implies a 7% improvement from 2025. The estimated figure for 2026 revenues is pegged at $41.8 million, implying 61.1% growth from the year-ago period.

Image Source: Zacks Investment Research

Lofty Valuation

QBTS’ forward 12-month price/sales (P/S) ratio of 164.2 is far above the industry average, as you can see below.

Image Source: Zacks Investment Research

Hold QBTS Now

At current levels, QBTS is better suited for holding than chasing, even though it outperformed both NVIDIA and AMD in 2025 by a wide margin. The stock has already priced in much of the expected 2026 growth, leaving limited near-term upside despite improving fundamentals and strong momentum. While D-Wave’s technology progress and revenue outlook remain encouraging, uneven revenue timing, ongoing losses and a stretched valuation increase the risk of volatility for this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next big thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).