The ever-increasing complexity of the US tariff landscape has been in evidence for months, but the dawn of 2026 provides a direct measure of just how much additional paperwork US importers must wade through one year into Trump 2.0.

The benchmark of tariff complexity is the so-called tariff book — formally known as the Harmonized Tariff Schedule of the United States — which is the central reference point for importers on what they have to pay the government.

The “basic” version for 2026 was just released and clocks in at over 4,500 pages. That’s more than 100 pages longer than last year (and an 800-page increase from 2017, when Trump first took office).

It’s just one indicator of the increased complexity that comes with a large dash of uncertainty for businesses so far in 2026 as the Supreme Court weighs how much of this new maze of regulations will pass legal muster.

The looming Supreme Court decision, which could be handed down as soon as Friday morning, is already presenting market risks. The complexity issue comes in addition to the tariffs themselves, which the Yale Budget Lab calculates at an average rate for consumers of 16.8%.

Read more: How Trump’s tariffs affect your money

President Trump addresses House Republicans on Tuesday in Washington, D.C. (Alex Wong/Getty Images) · Alex Wong via Getty Images

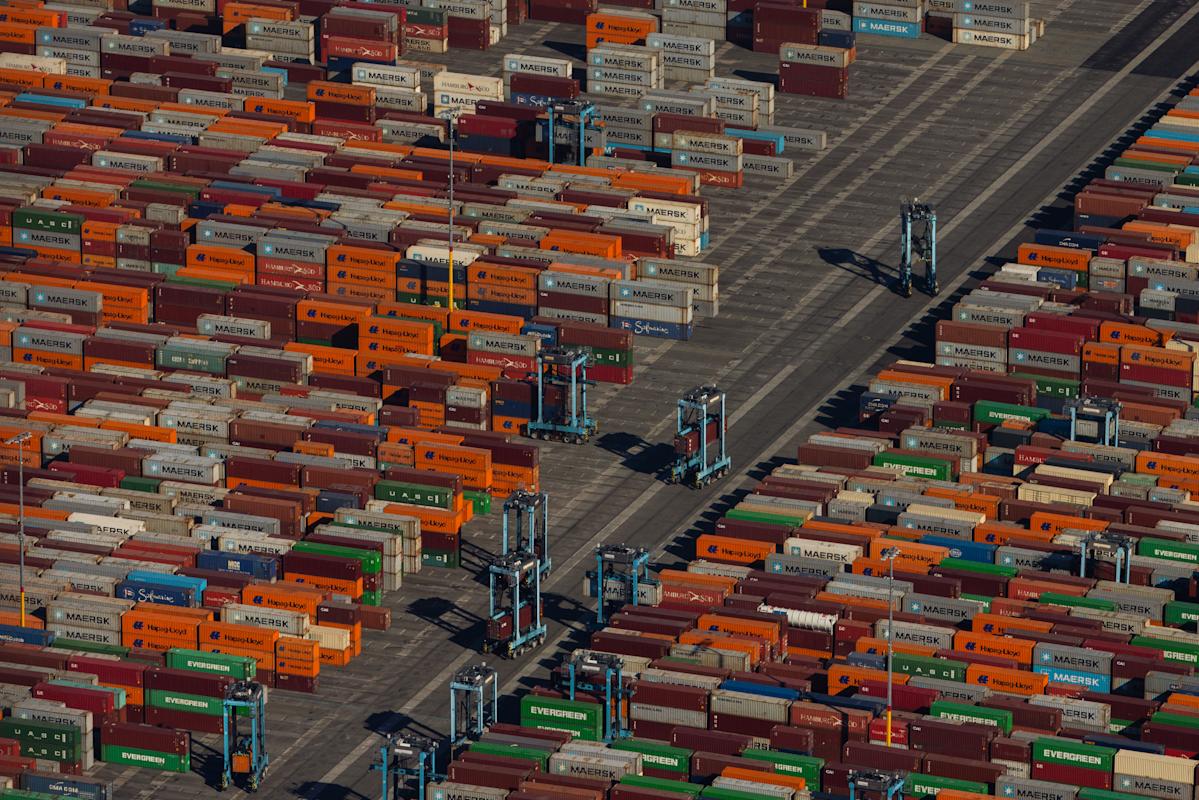

Businesses, as well as the ports where tariffs are calculated, have long argued that the complexity of tariffs — in addition to the costs of paying them — are an increasingly significant burden.

Scott Lincicome, a vice president at the Cato Institute’s Trade Policy Studies department, took a deep look at the complexity issue late last year and found that “navigating the U.S. tariff system has gone from relatively easy to mind-numbingly difficult,” with an economic cost for business that “is likely staggering.”

He calculates that 17 different tariff measures now apply to significant US imports and must be accounted for — up from three in 2017.

Many of the changes seen over the past year can be found in Chapter 99 of the tariff book, which begins on page 3,320 and is focused on “temporary modifications established pursuant to trade legislation.”

In other words: Trump’s flurry of executive moves this past year.

Goods of every variety — ignition coils, hydraulic backhoes, and countless others — are painstakingly listed in the document and linked to a statistical reporting number, which then correlates to different rates.

Lincicome noted that the costs of paying tariffs themselves is plenty significant.

“Less discussed, however, is a regulatory burden that’s at least as substantial,” he said.