JPMorgan European Discovery Trust (LON:) is benefiting from improved performance under the management of Jon Ingram, Jack Featherby and Jules Bloch, who took over the reins at the beginning of March 2024. The managers are bullish on the prospects for European small-cap equities, which have lagged during a volatile time in the market, despite being one of the best-performing asset classes over the long term. Ingram, Featherby and Bloch employ a team-based approach to stock selection, seeking ‘hidden gems’, as a large percentage of the market’s performance has traditionally come from a few exceptional names. In recognition that there is heightened performance risk in macroeconomic, rather than fundamentally driven stock markets, the managers have prudently made changes to the portfolio, such as reducing the maximum size of its active stock weightings. The number of holdings has also been increased to the wider end of the typical 60–90 range.

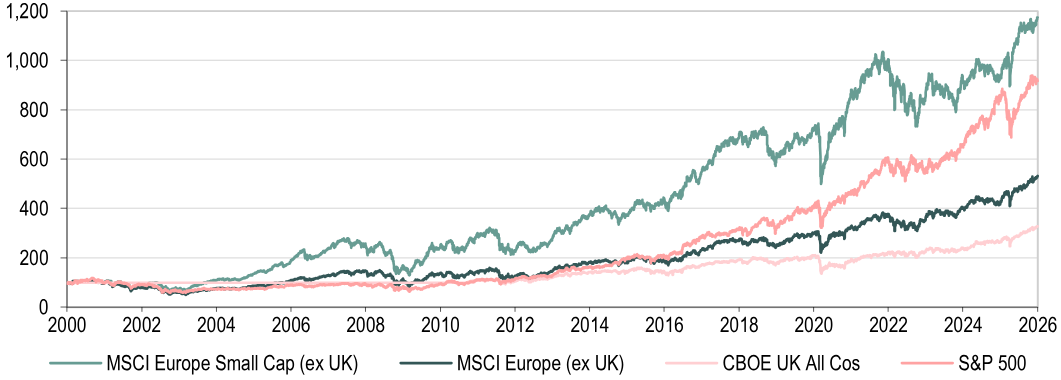

Exhibit 1: European Small Caps Are Among The World’s Best Long-Term Performers

Source: Morningstar, Edison Investment Research

Why Consider JEDT?

It looks like an opportune time to consider European small-cap equities, which are trading at an attractive valuation, within a favourable investment backdrop. This asset class should be a major beneficiary of both German fiscal stimulus and improved sentiment if there is a resolution to the war in Ukraine. The managers note that international investors have been taking more of an interest in European equities and that if demand trickles down the capitalisation spectrum, it could be very favourable for the performance of European small-cap equities.

The managers believe that attractively valued, high-quality stocks with positive momentum outperform the market, so any potential investment must elicit a positive response to three straightforward questions: is it a good business; is it attractively valued; and is the outlook improving? To support this successful, repeatable investment process, the managers are able to draw on the significant resources of JPMorgan. This includes access to Spectrum, which is a proprietary risk-management tool, providing a live view of the active risk in the portfolio across a wide range of top-down and bottom-up measures.

NOT INTENDED FOR PERSONS IN THE EEA

JEDT: Undiscovered, Small-Cap European Growth

Bloch, Ingram and Featherby have a clearly defined investment philosophy. They seek hidden gems as they believe that attractively valued, high-quality stocks with positive momentum outperform the market. While these are small companies now, they have potential to be the industry giants of tomorrow, such as the following large European companies: ASML (86x share price appreciation in the 20 years to the end of 2024), Sartorius (75x) and Atlas Copco (34x). 80% of European long-term winners come from three sectors: technology, industrials and healthcare.

Structural long-term growth trends are represented in JEDT’s portfolio, such as digitisation (Bechtle – upgrading IT and Scout24 – a real estate platform); decarbonisation (Bilfinger – engineering services and Accelleron – turbochargers); and healthcare innovation (Glanbia – sports nutrition and Cosmo – acne treatment). Another potential growth avenue can be disciplined M&A; JEDT has holdings in electrical installation company Spie, which undertook nine M&A deals in 2025 to strengthen its position in the fast-growing German power distribution market, and sealing company Hexpol, which has made 11 deals since 2016, generating 6% annual EBIT growth and a 15% return on invested capital.

During H225 (ending 31 March 2025), JEDT’s managers implemented some important enhancements to their process and risk management. The strategy of seeking undiscovered small companies that can become the leaders of tomorrow tended to work best in rising markets but struggled during periods of volatility caused by macroeconomic uncertainty. Hence, the managers reduced the trust’s exposure to macroeconomic risks, such as US tariffs, and have increased the focus on bottom-up stock selection, targeting companies driven by idiosyncratic, stock-specific factors.

Highlights of H126 (ending 30 September 2025)

Performance: JEDT’s NAV and share price total returns of +20.7% and +21.0% were solidly ahead of the benchmark MSCI Europe (ex UK) Small Cap Net Total Return Index’s +15.4% total return.

Revenue and dividends: net revenue return increased by 45.5% to 15.6p per share. An unchanged 3.0p per share interim dividend has been announced. The final dividend payment will be dependent on the total income for FY26 and the level of revenue reserves, which were c £57.6m at the end of H126.

Share repurchases: during the period, c 17.6m shares were bought back and placed in treasury, which equalled c 15.7% of the share base; buybacks have continued in H226.

Bloch’s Perspectives On The Investment Backdrop

The managers remain positive on the outlook for European small-cap stocks. Bloch says that this is an amazing asset class, with one of the best long-term performances. In aggregate, European small-cap companies grow around 2–3% per year faster than their larger peers, which leads to a greater compound value effect over the long term. The manager highlights that there is a double discount when investing in European small-cap stocks. He says that European stocks are attractively valued compared with a very stretched US market, and within Europe, small caps are more attractively valued than large-cap stocks, which is unusual given their higher growth prospects. The last time small-cap stocks were relatively inexpensive versus large-cap names occurred in 2000, and in the subsequent five years European small-cap stocks significantly outperformed. Bloch considers that JEDT is well-positioned as a long-term compounding asset class, which is very attractively valued.

The manager notes that European small-cap companies are poised to benefit from two major events. First is the planned €1tn German fiscal stimulus, which he thinks is a massive game changer, as outside of the COVID-19 period, there has been a lack of spending in the country. Targeted areas for capex include infrastructure, defence and the electricity grid. Bloch suggests that this spending will benefit European companies, particularly domestic-focused small-cap businesses.

Second, the manager believes that European domestic sentiment will improve if there is a resolution to the war in Ukraine, which should be particularly favourable for the performance of small-cap stocks. He notes that recently, when there was increased news about a potential peace deal, small-cap stocks outperformed.

Regarding US tariffs, Bloch says there was much uncertainty in the first half of 2025 in terms of changing tariff rates and exemptions, which made it difficult to manage a business. However, discussions with companies suggest that since July 2025 the dust has settled. The manager notes that there was a modest tariff impact on Q325 European company earnings. He believes that small-cap businesses are in a better position versus larger companies as they have a more domestic focus, although there have been some secondary economic effects at smaller firms in terms of a slowdown in investment decisions.

Current Portfolio Positioning

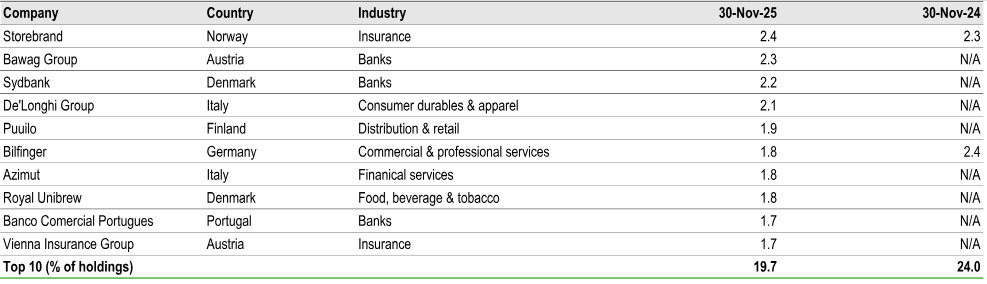

As shown in Exhibit 2, at the end of November 2025, JEDT’s top 10 positions made up 19.7% of the portfolio, which was a notable reduction compared with 24.0% 12 months earlier. There were two names common to both periods. The lower top 10 concentration is a conscious decision and part of the managers’ efforts to reduce risk during a period of elevated macroeconomic uncertainty. Within the portfolio, active bets have been reduced from a maximum of c 3% to c 2%.

Exhibit 2: JEDT’s Top 10 Holdings at 30 November 2025

Source: JEDT, Edison Investment Research. Note: N/A where not in end November 2024 top 10.

Looking at how the portfolio is broken down by market cap (Exhibit 3), at the end of November 2025, there was a lower allocation to mid-cap stocks year-on-year. This was due to the active decision to have a greater exposure to smaller European companies.