The world is in a constant state of evolution, with the energy market in particular jumping from one trend to another as the market shifts. While the vast majority of the world has developed frameworks to integrate the renewable energy sector through several substantial projects, 2026 is set to see the US gas market expanding to new levels as demand increases for non-Russian gas supply. Enbridge, one of the largest energy companies in North America, has recently announced that it has awarded the contract for a new deep-water pipeline in the Gulf of Mexico.

The expansion of the US gas market has been led by the US President

Donald Trump said that on his first day in office, the US would expand and drastically increase the output capacity of its gas market. Following the latest sanctions on Russia and its energy companies, international buyers have been searching furiously for a non-Russian gas supplier, step in the United States to save the day. The US is the number one gas producer by capacity in the world, and for good reason, too.

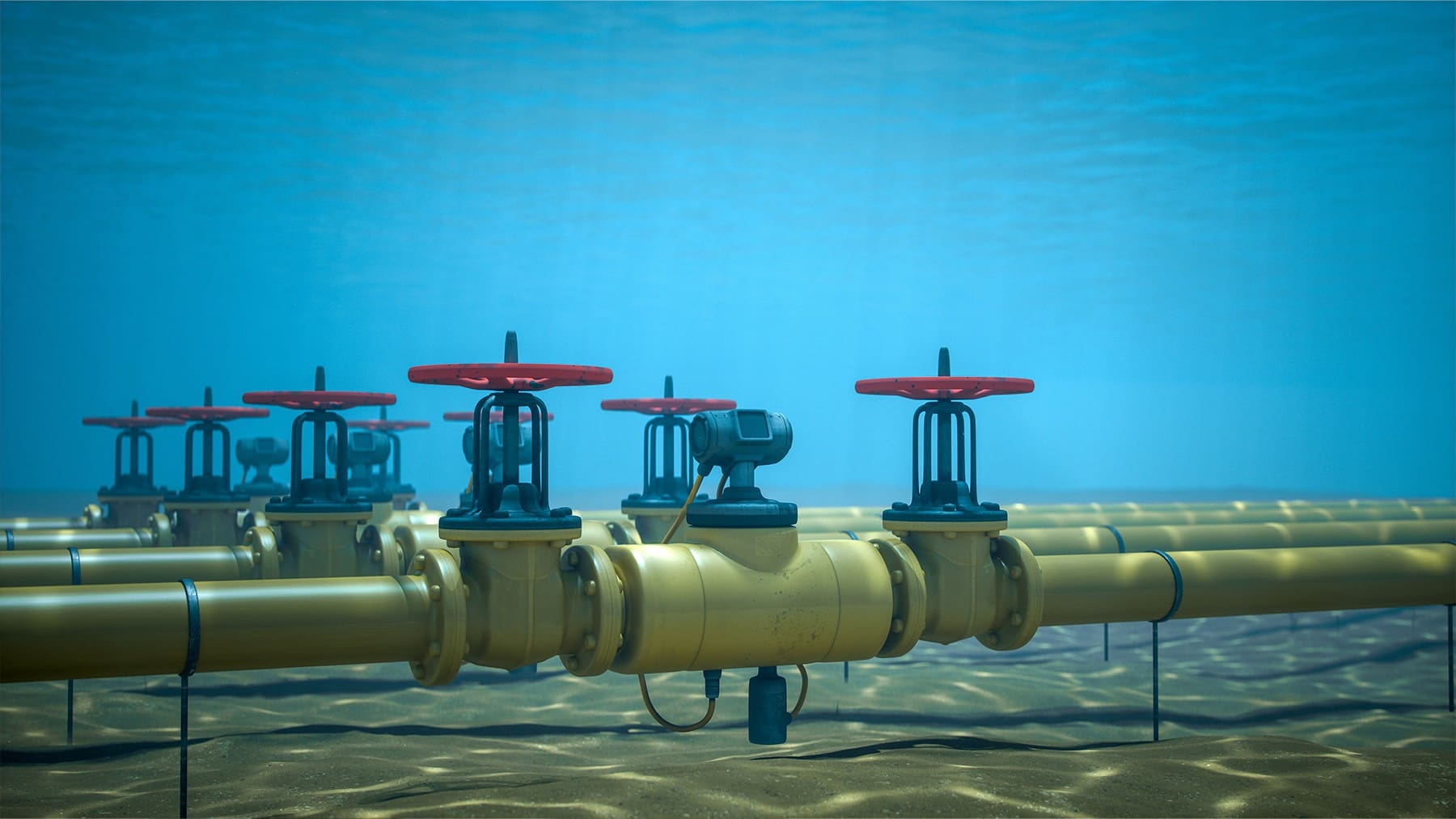

Enbridge is a Canadian-based energy company with substantial assets in North America, and recently announced that it has awarded the contract for a new deep-water pipeline in the Gulf of Mexico to none other than Allseas. The project calls for four deepwater crude oil and gas pipelines to be built in the central Gulf of Mexico region, or the Gulf of America if you lean a bit to the right of the political spectrum.

Enbridge to boost Gulf of Mexico assets with new midstream development

The new project that has been awarded to Allseas aims to expand the essential transport capacity of gas and oil resources as well as strengthen energy infrastructure in a part of the world that has become a major driver of the expansion of conventional gas and oil projects, with even more being planned for the next few years.

Allseas will handle the responsibility of developing the new pipelines for Enbridge

The contract that Enbridge has awarded to Allseas builds on the company’s long-term role in the oil and gas market in the Gulf of Mexico. Allseas has been operating in the Gulf for well over three decades, and Enbrridge will be aiming to benefit from Allseas’ substantial expertise in the region. Enbridge’s plan covers over 515 kilometers of export pipelines that stem from the deepwater Keathley Canyon in the Gulf.

Allseas will construct 321 kilometers of 24-inch and 26-inch oil pipeline that will run down to the Green Canyon 19 (GC19) platform. Additionally, Allseas will also be constructing a 12-inch gas pipeline that will run approximately 195 kilometers to connect to Enbridge’s Magnolia Gas Gathering System. The Gulf of Mexico has become the cornerstone of the US energy market, with several energy companies developing plans for the region over the coming years.

The offshore construction project will be executed by Allseas’ dynamically positioned pipelay vessel, Solitaire, over the next two years, with a target of 2028 at the very latest for project completion.

Global pipeline development is set to surge this year and beyond

Allseas will lean on its significant experience in the pipeline construction sector to bring the project to fruition. At the moment, Allseas has installed over 8,000 kilometers of subsea pipeline all over the world. New reports and data predict a surge in new pipeline construction this year, marking the continued growth of the sector and the international community’s reliance on gas and oil. The Gulf of Mexico, along with the Permian Basin, will lead the US into a new era of dominating the traditional oil and gas markets.