Introduction: A New Age of Democratized Capital

The global crowdfunding industry has emerged as one of the most transformative forces in modern finance. By enabling individuals, entrepreneurs, and organizations to raise funds directly from a distributed pool of contributors, crowdfunding bypasses traditional intermediaries such as banks, venture capital firms, and institutional lenders. Over the last decade, this model has evolved from small community fundraisers into a multi-billion-dollar ecosystem that supports innovation, social impact, creative ventures, and business growth.

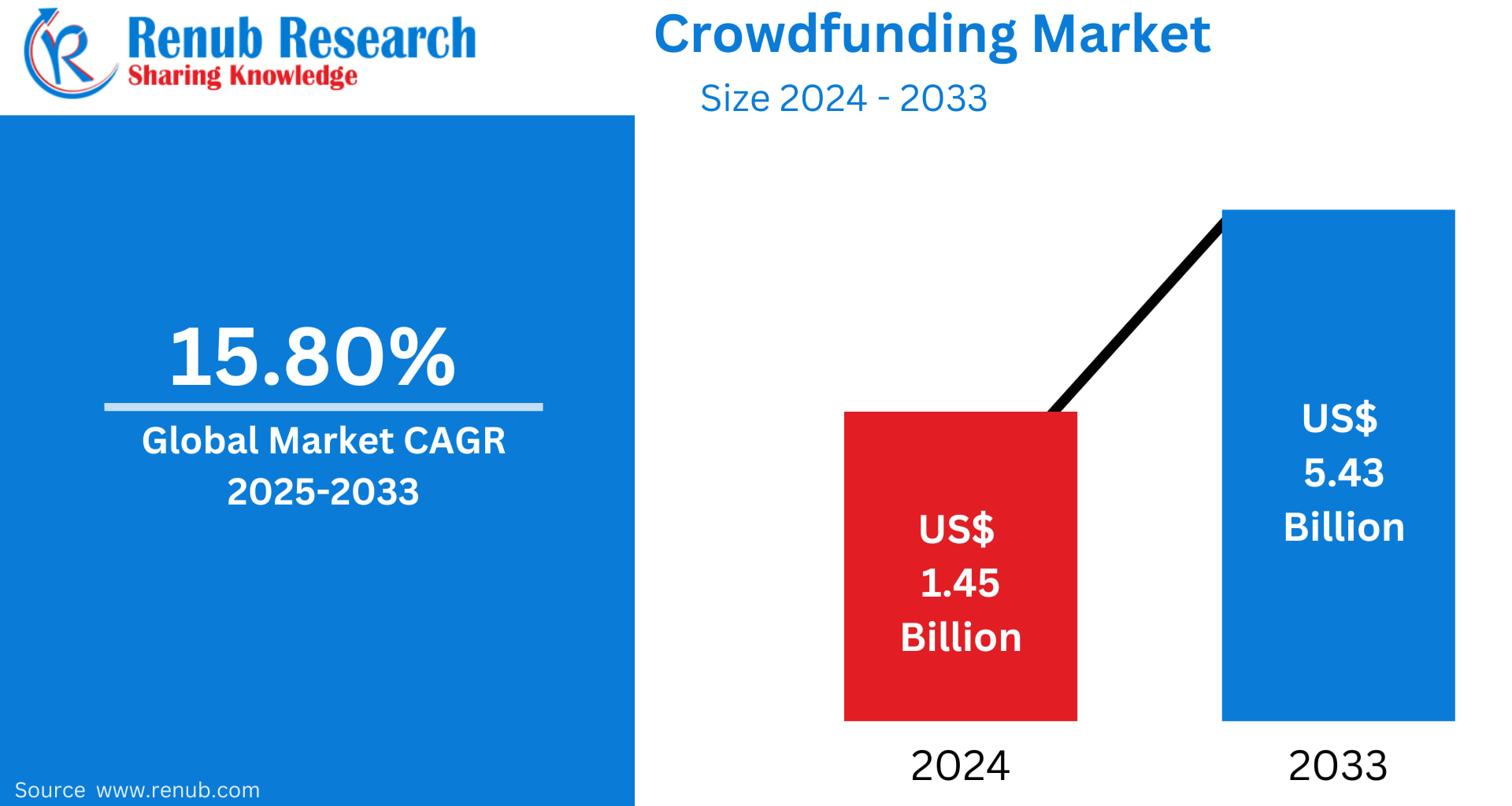

According to Renub Research, the global crowdfunding market was valued at US$ 1.45 billion in 2024 and is projected to expand to US$ 5.43 billion by 2033, registering a strong CAGR of 15.82% from 2025 to 2033. This growth reflects rising digital adoption, investor appetite for alternative assets, and regulatory frameworks that increasingly support online capital formation.

This article provides a comprehensive companies analysis of the global crowdfunding market, highlighting leading players, strategic developments, and the structural forces shaping the future of alternative finance.

Global Crowdfunding Market Overview

Crowdfunding functions as a decentralized fundraising mechanism where capital is sourced from a large group of individuals via online platforms. Unlike conventional finance, it allows entrepreneurs to validate ideas directly with consumers, communities to fund social initiatives, and investors to access early-stage opportunities.

Key Market Drivers

Digitalization of Financial Services: Widespread internet access and mobile adoption have lowered entry barriers for both fundraisers and contributors.

Rising Startup Culture: Entrepreneurs increasingly rely on crowdfunding to test demand and secure early capital without surrendering control to traditional investors.

Growing Investor Participation: Retail investors are seeking alternative assets that offer diversification beyond equities, bonds, and real estate.

Regulatory Support: Governments across the U.S., Europe, and Asia are introducing frameworks that legitimize equity and peer-to-peer crowdfunding.

Social Media Integration: Platforms leverage viral sharing and storytelling to expand campaign reach globally.

Challenges

Despite strong momentum, the market faces hurdles such as regulatory complexity, investor protection concerns, project failure risks, and fraud prevention. However, improvements in compliance mechanisms, transparency standards, and platform governance are steadily addressing these risks.

List of Leading Companies in the Crowdfunding Market

1. Alibaba Group Holding Ltd.

Established: 1999

Headquarters: Hangzhou, China

Website: www.alibabagroup.com

Revenue: US$133.1 billion (2023)

Alibaba Group is a global technology and e-commerce giant that indirectly supports crowdfunding through its expansive digital infrastructure, payment ecosystems, and marketplace platforms. Its core businesses—Taobao, Tmall, and Cainiao—enable merchants and entrepreneurs to test product ideas, generate pre-orders, and raise working capital through community-based demand. Alibaba’s cloud computing services and fintech capabilities further empower platform-driven fundraising models across Asia and beyond.

2. Kickstarter, PBC

Established: 2009

Headquarters: Brooklyn, New York, USA

Website: www.kickstarter.com/about

Kickstarter is one of the world’s most recognized reward-based crowdfunding platforms, dedicated to creative projects across technology, publishing, games, design, film, and music. As of April 2025, over 277,000 projects had raised approximately US$ 8.71 billion from 24.1 million backers. Its community-driven model allows creators to exchange tangible rewards or experiences rather than equity, making it a preferred choice for artists, innovators, and cultural entrepreneurs.

3. Indiegogo, Inc.

Established: 2008

Headquarters: San Francisco, California, USA

Website: www.indiegogo.com/about/our-story

Indiegogo pioneered open access crowdfunding and supports reward-based, donation-based, and equity campaigns. With approximately 15 million monthly visitors, the platform charges a standard 5% campaign fee plus payment processing costs. Since regulatory changes in 2016, Indiegogo has partnered with MicroVentures to offer equity investments, enabling both accredited and non-accredited investors to participate in startup financing.

4. GoFundMe

Established: 2010

Headquarters: San Francisco, California, USA

Website: gofundme.com

GoFundMe dominates the donation-based crowdfunding segment, supporting causes ranging from medical expenses and disaster relief to community initiatives and education. Between 2010 and early 2024, more than 150 million users donated over US$ 30 billion through the platform. Its acquisition of CrowdRise strengthened its nonprofit and charity fundraising capabilities, reinforcing its position as the largest global fundraising platform.

5. Fundable

Established: 2011

Headquarters: Powell, Ohio, USA

Website: fundable.com

Fundable is a SaaS-based platform designed specifically to help startups raise capital from angel investors and venture capitalists. It offers a guided fundraising approach, providing entrepreneurs with campaign setup tools, investor outreach features, and educational resources. Fundable’s emphasis on business-focused fundraising distinguishes it from donation-based platforms.

SWOT Analysis of the Crowdfunding Market

Crowdcube – Strength Analysis

Established Platform and Strong Brand Reputation in Equity Crowdfunding

Crowdcube is one of Europe’s leading equity crowdfunding platforms, recognized for its robust infrastructure and investor-friendly design. Its compliance with regulatory standards and transparent investment processes enhances trust among users. The platform simplifies early-stage investing for both novice and experienced investors while offering startups a credible alternative to venture capital. Crowdcube’s strong brand equity and partnerships with high-growth companies reinforce its leadership in the European alternative finance market.

Crowdcube – Opportunity Analysis

Expansion into New Markets and Diversified Funding Models

Crowdcube has significant growth potential by expanding into emerging markets where startup funding remains limited. Diversifying into debt crowdfunding, tokenized securities, and sustainability-focused investment vehicles could broaden its user base. Adoption of blockchain for transaction transparency and AI for investor matching would further strengthen operational efficiency and platform trust.

SeedInvest Technology, LLC – Strength Analysis

Regulatory Compliance and High-Quality Deal Flow

SeedInvest is one of the most reputable equity crowdfunding platforms in the United States, fully registered with the SEC and FINRA. Its rigorous due-diligence process ensures that only a select group of startups are listed, maintaining high investment quality. The platform’s technology-driven interface, strong compliance framework, and investor protection measures position it as a trusted gateway for alternative investments.

SeedInvest – Opportunity Analysis

Leveraging Digital Innovation and Strategic Partnerships

SeedInvest can expand by integrating AI-driven analytics for personalized investment recommendations and blockchain for enhanced transaction security. Partnerships with venture capital firms, accelerators, and international crowdfunding networks could broaden its deal pipeline. Educational tools for new investors also present opportunities for deeper engagement and long-term platform growth.

Fundly – Strength Analysis

Versatile and User-Friendly Fundraising Platform

Fundly’s intuitive interface and flexible fundraising tools make it accessible for individuals, nonprofits, and community organizations. Its emphasis on storytelling, social sharing, and mobile integration drives campaign visibility and donor engagement. Transparent pricing and customization features enhance its appeal across diverse fundraising categories.

Fundly – Opportunity Analysis

Technology Integration and Strategic Partnerships

Fundly can strengthen its market position through AI-powered campaign optimization, blockchain-based donation tracking, and partnerships with NGOs, corporate CSR programs, and philanthropic networks. Expansion into emerging markets where digital fundraising is still developing could significantly increase its global footprint.

Recent Developments in the Crowdfunding Market

February 2025: Wefunder reported 129% year-over-year revenue growth in Q2 2024, with over 6,700 investors contributing more than US$ 19 million, signaling rising institutional interest in equity crowdfunding.

January 2025: Malaysia’s Securities Commission highlighted equity crowdfunding and peer-to-peer financing as critical tools for MSME growth, reflecting increased government support in Southeast Asia.

December 2024: Honeycomb Credit acquired Raise Green, consolidating the industry and expanding its service portfolio.

October 2024: Pago raised EUR 2.3 million (US$ 2.5 million) through 225 private investors on SeedBlink, showcasing the ability of European platforms to facilitate large-scale fundraising rounds.

Crowdfunding Market Forecast and Competitive Landscape

Historical Trends

The market has transitioned from donation-driven community projects to structured financial instruments supporting equity, debt, and real estate investments. Early growth was fueled by creative industries and social causes, while recent expansion is driven by fintech innovation and regulatory clarity.

Forecast Analysis

Renub Research projects the market to grow from US$ 1.45 billion in 2024 to US$ 5.43 billion by 2033, driven by digital infrastructure expansion, increased investor participation, and institutional adoption of alternative finance.

Market Share Outlook

Equity crowdfunding and peer-to-peer lending are expected to capture increasing market share as investors seek higher-yield alternatives. Platforms offering cross-border investments, compliance automation, and AI-based analytics are likely to outperform competitors.

Strategic Company Analysis Framework

For major players such as Alibaba Group, Kickstarter, Indiegogo, GoFundMe, Fundable, Crowdcube, SeedInvest, Fundly, Patreon, Wefunder, CircleUp, Fundrise, StartEngine, AngelList, EquityNet, Ketto, DreamWallets, and others, comprehensive evaluation includes:

Company Overview & Business Model

Leadership & Governance

Product and Platform Offerings

Sustainability Initiatives

Revenue Performance

Strategic Developments (M&A, Partnerships, Investments)

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

This framework enables stakeholders to assess competitive positioning, scalability, and long-term viability.

Final Thoughts

The crowdfunding market is no longer a niche financing option—it is a mainstream financial ecosystem reshaping how capital is raised, allocated, and democratized. With a projected value of US$ 5.43 billion by 2033 and a 15.82% CAGR, the sector is positioned for sustained global expansion.

Leading platforms are differentiating themselves through regulatory compliance, technological integration, and strategic partnerships. As blockchain, AI, and cross-border investment models mature, crowdfunding will continue to blur the lines between retail participation and institutional finance.

For entrepreneurs, investors, and policymakers alike, crowdfunding represents more than funding—it embodies a shift toward inclusive, transparent, and digitally driven capital markets. The companies that prioritize trust, innovation, and user empowerment will define the next era of alternative finance.