Europe In-flight Catering Services Market Size

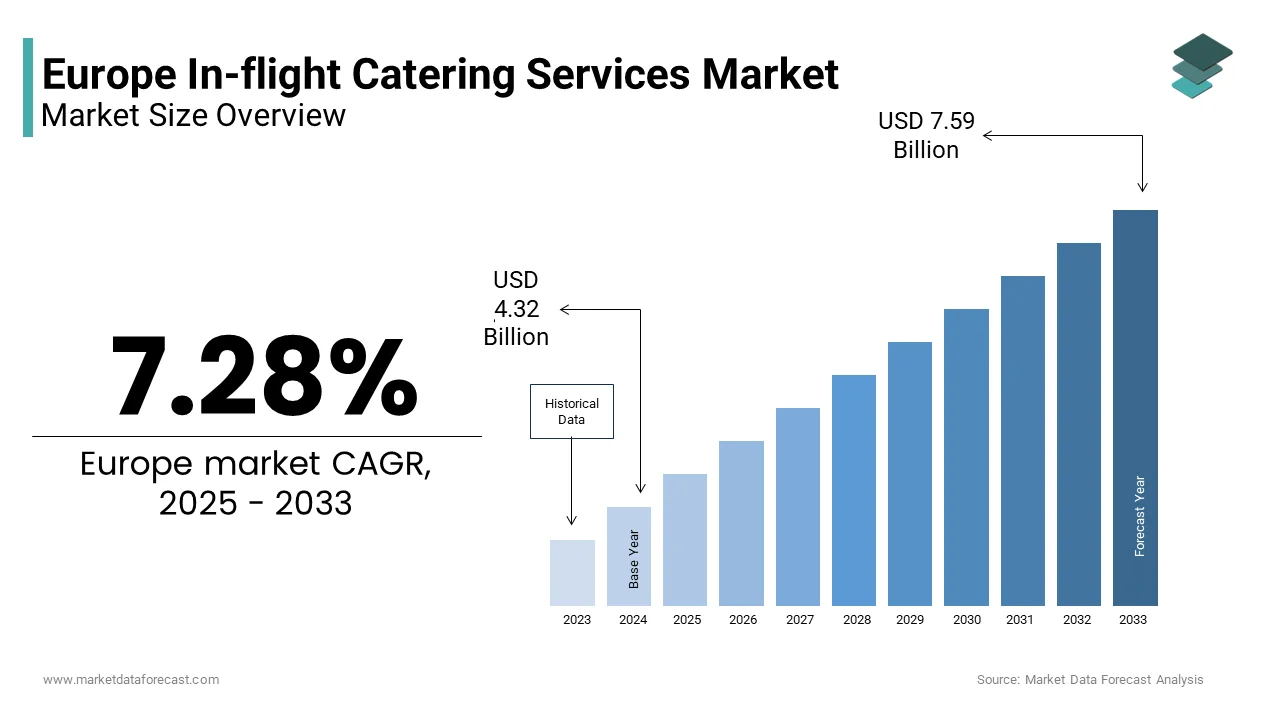

The Europe In-flight catering services market size was valued at USD 4.04 billion in 2024 and is anticipated to reach USD 4.32 billion in 2025 to USD 7.59 billion by 2033, growing at a CAGR of 7.28% during the forecast period from 2025 to 2033.

Current Introduction of the Europe In-flight Catering Services Market

In-flight catering services includes the end-to-end provision of meals beverages snacks and onboard food solutions prepared in specialized facilities and delivered to commercial passenger and cargo aircraft across the continent’s airports. These services span economy to premium classes and must comply with stringent aviation food safety protocols temperature control standards and customs regulations. Unlike conventional food service the segment operates under unique constraints of weight space shelf life and in cabin reheating limitations. The market is intrinsically tied to air passenger volumes which rebounded significantly post pandemic. In 2023, European airports handled passenger volumes approaching pre‑pandemic levels, which is reflecting a strong recovery in air travel. EU food‑safety rules (Regulation (EU) 2017/625) require traceability and official controls for food, including in‑flight catering, mandating appropriate batch documentation. With well over a thousand commercial airports and more than a hundred airlines operating across the region, the in‑flight catering ecosystem supports millions of daily meal assemblies while navigating evolving passenger expectations for dietary inclusivity, sustainability, and culinary authenticity.

MARKET DRIVERS Recovery and Growth of Air Passenger Traffic Across Europe

The Europe in‑flight catering services market is fundamentally driven by the resurgence of air travel following the pandemic disruption. Passenger volumes rebounded strongly in 2023, restoring a large share of pre‑pandemic traffic and re‑establishing in‑flight meal demand across both leisure and business networks. This rebound directly translates to higher meal volumes on long‑haul and short‑haul services and has been especially pronounced at major hubs such as London Heathrow, Paris Charles de Gaulle and Frankfurt. The return of tourism has amplified demand on leisure routes that traditionally feature full meal service. Additionally, the expansion of ultra long‑haul routes from European cities to Asia and the Americas necessitates multi‑meal service cycles per flight. This sustained passenger growth repositions in‑flight catering as a core operational requirement rather than a discretionary airline expense.

Rising Passenger Expectations for Culinary Quality and Dietary Customization

Modern European travellers increasingly view in‑flight meals as an extension of lifestyle and brand experience, demanding greater variety, dietary accommodation and higher culinary standards, which is further boosting the Europe in‑flight catering services market growth. A substantial share of frequent flyers now considers meal quality and dietary options when choosing carriers, and demand for vegan, gluten‑free and allergen‑safe meals has risen. In response, carriers such as Lufthansa and Air France have partnered with high‑profile chefs to design seasonal menus that reflect regional culinary heritage. EU food‑information rules require clear allergen labelling on pre‑packed airline meals, compelling caterers to implement segregated production lines and digital traceability. Airlines commonly offer a broad range of special‑meal types (Kosher, Halal, vegetarian, low‑sodium, etc.), and many passengers pre‑select special meals online on long‑haul services. This shift from standardized mass production to personalized culinary experiences elevates the strategic importance of catering partners and drives investment in flexible kitchen infrastructure and digital ordering integration.

MARKET RESTRAINTS Stringent Food‑Safety and Cross‑Border Regulatory Compliance Burdens

In‑flight catering in Europe operates under a complex web of overlapping food‑safety and import regulations that vary by departure country, destination and airline registry, which is creating significant compliance overhead and restraining the regional market growth. The EU’s food‑hygiene framework sets baseline requirements while member states and destination countries impose additional controls; meals assembled in one jurisdiction for international flights must meet both origin‑country hygiene rules and destination import requirements for animal‑derived products. Regulatory authorities and rapid‑alert systems monitor caterers closely and can require immediate corrective action when public‑health risks are identified. These regulatory layers necessitate redundant testing, segregated storage, extensive documentation and traceability systems, increasing operational complexity and costs, which is an effect that disproportionately impacts smaller regional caterers and raises barriers to market entry and consolidation.

Volatility in Aviation Fuel Costs and Airline Cost‑Cutting Measures

Airlines continue to face volatile fuel markets and elevated operating costs, which is prompting aggressive cost‑management measures that often target ancillary spend including catering and further hampering the growth of the Europe in‑flight catering services market. Many carriers have simplified menus, reduced portion sizes or shifted short‑haul services to buy‑on‑board models; some low‑cost operators now offer food and beverage exclusively as paid add‑ons, and legacy carriers have trimmed hot‑meal offerings on shorter sectors. These commercial responses compress per‑passenger catering budgets and squeeze caterer margins, making long‑term investment in innovation, sustainability or premium product lines more difficult without stable contracting arrangements. In this environment, caterers that can demonstrate operational flexibility, tight cost control and digital ordering efficiencies are better positioned to retain airline partners and capture growth as traffic continues to recover.

MARKET OPPORTUNITIES Integration of Sustainable Packaging and Waste‑Reduction Initiatives

A significant opportunity in the Europe in‑flight catering market lies in adopting eco‑friendly packaging and circular waste systems aligned with EU environmental directives. The EU Single‑Use Plastics Directive restricts a range of single‑use plastic items and requires member states to phase out or reduce certain products, driving demand for compostable, reusable or durable alternatives. Leading caterers such as Gate Gourmet and LSG Sky Chefs have introduced trays and disposables made from sugarcane pulp, bamboo fibre and bio‑based polymers. Several airlines and caterers are piloting returnable meal‑box schemes on short domestic routes that materially cut single‑use waste per flight. The EU’s Farm‑to‑Fork strategy and related procurement guidance encourage use of locally sourced seasonal ingredients, which caterers leverage to reduce supply‑chain emissions and enhance menu authenticity. These initiatives meet regulatory mandates and resonate with environmentally conscious travellers, creating a competitive differentiator for caterers that can credibly demonstrate circularity and traceability.

Expansion of Premium Economy and Business Class Cabins Driving Upscale Demand

Reconfigured cabins with higher premium‑seat density present a high‑value opportunity for the Europe in‑flight catering services market. Airlines are increasing premium‑economy and business‑class capacity to lift revenue per available seat‑kilometre, and these cabins command materially higher catering budgets and guest expectations. Passengers in premium cabins expect restaurant‑quality experiences prompting caterers to operate dedicated premium production lines staffed by trained chefs and equipped with sous‑vide and blast‑chill technology to preserve texture and flavour. Digital pre‑selection platforms enable personalization and reduce waste. As airlines prioritise premium growth to offset cost pressures, this segment offers caterers a path to margin recovery and brand elevation through culinary excellence and service innovation.

MARKET CHALLENGES Labor Shortages and High Staff Turnover in Catering Facilities

The sector faces persistent operational challenges from labour shortages and high attrition in production and logistics roles, which is majorly challenging the growth of the Europe in‑flight catering services market. The work requires food‑handler certification, flexible shift availability and aviation security clearance, which is a combination that is increasingly difficult to recruit for. Many hubs report recruitment gaps and elevated turnover that drive reliance on temporary agencies and increase training burdens. The physically demanding nature of the work, early hours and limited career progression deter younger entrants. Without systemic improvements in working conditions, automation, vocational training and career pathways, the industry’s ability to maintain service standards and scale operations will remain constrained.

Complex Logistics and Time‑Critical Delivery to Aircraft Gates

In‑flight catering operates under extreme time pressure with meals required to be loaded within narrow turnaround windows, which is further challenging the expansion of the Europe in‑flight catering services market. This demands flawless coordination between production kitchens, transport fleets and airport ground handlers. Delays in security screening, customs clearance or gate access can force airlines to use backup meals or forgo service, creating reputational risk. The just‑in‑time nature of production limits inventory buffers and increases waste when flights are cancelled or passenger counts change. Dynamic schedules and peak‑season volatility further stress logistics, increasing costs and limiting scalability for caterers serving multiple airlines or airports without dedicated infrastructure.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

7.28%

Segments Covered

By Food, Flight, Aircraft Seating Type and Region.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe

Market Leaders Profiled

Flying Food Group, DO & CO Aktiengesellschaf, Gategroup, The Emirates Group, Newrest Group Services SAS, SATS Ltd, IGS Ground Services, KLM Catering Services, Fleury Michon Airline Catering, Carlos Aviation Catering Network GmbH

SEGMENTAL ANALYSIS By Food Insights

The meals segment dominated the market by holding 41.6% of the European market share in 2024. European aviation regulations and passenger expectations mandate structured meal service on flights exceeding four hours. The European Union Aviation Safety Agency requires airlines to provide appropriate catering on long‑haul scheduled services to ensure passenger welfare during extended journeys. In recent years European carriers operated a very large number of long‑haul departures, with most long‑haul flights typically serving multiple full meals per passenger. Legacy carriers like Lufthansa, Air France and British Airways maintain dedicated meal assembly lines producing large daily volumes at their hub airports. These meals must meet strict temperature control standards, which is consistent with European food safety guidance. The operational complexity and regulatory non‑negotiability of meal provision on these routes cement meals as the foundational and highest‑volume component of in‑flight catering across the continent.

The beverages segment is the fastest growing in the Europe in‑flight catering services market and is predicted to witness the fastest CAGR of 9.12% over the forecast period owing to the premium beverage branding and the rise of non‑alcoholic sophistication. European airlines are increasingly collaborating with iconic beverage producers to enhance in‑flight experience and generate ancillary revenue. In 2024, Air France renewed a long‑standing partnership with a premium champagne house offering vintage champagne in business and first class while some carriers feature curated regional wine selections chosen by sommeliers. These partnerships extend beyond alcohol with carriers featuring premium coffee and specialty tea blends. Recent EU guidance on origin labeling has encouraged airlines to highlight local beverage heritage. Industry reporting shows a growing number of premium beverage brands have active in‑flight distribution agreements with European carriers, and this trend has accelerated since 2021. These curated selections transform beverage service into a high‑value sensory experience that passengers associate with airline quality and cultural identity, driving both consumption and brand loyalty.

By Flight Insights

The full-service carriers segment held the leading share of 62.9% of the Europe in‑flight catering services market in 2024. The growth of the full-service segment in this regional market is attributed to their comprehensive food service mandates across all cabin classes and route lengths. European full-service carriers operate the continent’s densest long‑haul networks with major legacy airlines collectively serving many intercontinental destinations. On these flights, airlines are contractually and reputationally obligated to provide multiple hot meals, snacks and beverage rounds. For example, a London–Tokyo flight may serve dinner, breakfast and a mid‑flight snack, creating substantial per‑passenger food and beverage loads in premium cabins. Full-service carriers account for the vast majority of long‑haul departures from EU airports, ensuring sustained high‑volume demand for complex meal assembly. These airlines also maintain strict culinary standards often involving celebrity chef collaborations and seasonal menu rotations that require advanced production planning and quality control. This operational depth and service obligation create a structural advantage that low‑cost carriers cannot replicate.

The low‑cost carriers segment is the fastest growing in the Europe in‑flight catering services market and is expected to exhibit a CAGR of 10.1% over the forecast period due to the expansion of buy‑on‑board models and ancillary revenue strategies. Low‑cost carriers are transforming in‑flight catering from a cost center into a profit center through curated retail offerings. Industry surveys show the vast majority of European low‑cost airlines now offer buy‑on‑board menus and that average passenger spend on onboard retail has risen materially since 2019. Ryanair and other carriers have launched partnerships and premium retail items that generate significant annual food revenue. Similarly, other low‑cost carriers feature locally inspired snacks to enhance regional appeal. These programs require sophisticated logistics for inventory rotation, brand compliance and onboard merchandising as these functions increasingly outsourced to specialized catering partners. As low‑cost carriers expand route networks and flight frequencies this retail‑oriented model creates a new high‑volume, scalable demand stream distinct from traditional complimentary service.

By Aircraft Seating Class Insights

The economy class segment led the market by holding 74.9% of the regional market share in 2024. The leading position of economy class segment in this regional market can be credited to the vast majority of aircraft capacity across both short and long‑haul operations. Modern European aircraft feature economy class configurations ranging from around 150 to over 300 seats per plane to ensure massive scale in meal demand. On a typical A320 operating intra‑European routes economy comprises the bulk of capacity while on long‑haul widebodies it still represents a substantial share. Airlines like easyJet and Ryanair operate all‑economy fleets while legacy carriers maintain high‑density configurations to maximize yield. Crucially on flights over 90 minutes many full‑service carriers continue to provide complimentary meals in economy, which is a practice that generates very large annual volumes of economy meals across EU carriers. Even on low‑cost carriers economy passengers drive buy‑on‑board sales with a significant share purchasing at least one food item per flight according to passenger spend data. The sheer volume of economy travelers combined with either mandated or incentivized food service ensures this segment remains the backbone of catering operations in terms of logistics scale and production throughput.

The business class segment is the fastest growing in the Europe in‑flight catering services market and is estimated to grow at a CAGR of 11.5% over the forecast period due to the cabin reconfiguration and premium experience differentiation. European airlines are deliberately expanding business class capacity to capture high‑yielding passengers on both long and medium‑haul routes. Several carriers have increased business class seat counts on new widebody deliveries and reconfigured long‑haul cabins to offer more premium seats. These new cabins feature lie‑flat seats and enhanced service expectations requiring sophisticated multi‑course meals comparable to fine dining. Business class meals are materially more expensive to produce than economy meals, reflecting premium ingredients, specialized preparation techniques and bespoke presentation. The preparation involves sous‑vide cooking, blast‑chilling and artisanal plating that demands dedicated kitchen zones and skilled culinary staff. With business class representing a growing share of long‑haul capacity across European carriers, this structural shift creates a high‑value growth corridor for caterers capable of delivering restaurant‑quality consistency at scale.

COUNTRY ANALYSIS United Kingdom In‑Flight Catering Services Market Analysis

The United Kingdom led the market by accounting for 20.9% of the regional market share in 2024. The leading position of the UK in the European market is driven by London’s status as a global aviation hub and the presence of major international carriers. According to the UK Civil Aviation Authority, over 170 million passengers passed through UK airports in 2023, with Heathrow alone handling roughly 80 million—the highest in Europe. British Airways operates one of the continent’s most extensive long‑haul networks, requiring over 100,000 meal assemblies daily at its Heathrow and Gatwick catering facilities. The UK also hosts global catering leaders like Gate Gourmet and LSG Sky Chefs, which operate massive production centers serving multiple airlines and handling complex logistics for widebody and short‑haul fleets alike. Post‑Brexit, the UK’s independent food‑safety and customs arrangements have necessitated separate compliance systems, creating both complexity and opportunity for specialized providers. Additionally, the rise of premium economy on routes to North America and Asia has increased per‑passenger meal spend and driven demand for upgraded menu tiers and enhanced service presentation. This combination of traffic volume, carrier presence, and operational sophistication ensures the UK remains the market’s commercial and logistical epicentre.

Germany In‑Flight Catering Services Market Analysis

Germany commanded for a significant share of the Europe in‑flight catering services market in 2024. The growth of Germany in the European market is anchored by Frankfurt and Munich airports which serve as primary hubs for Lufthansa and its Star Alliance partners. According to national aviation statistics, over 140 million passengers travelled through German airports in 2023, with a large share on international routes that require full meal service. Lufthansa’s catering division and partners such as Do & Co-operate some of Europe’s largest in‑flight kitchens at Frankfurt and Munich, producing tens of thousands of meals daily with a strong emphasis on German culinary heritage, seasonal sourcing, and sustainability. The country’s stringent food‑safety regulations under the Federal Office of Consumer Protection mandate rigorous traceability and allergen control, influencing production standards across the EU. Germany’s central location in Europe also makes it a key logistics node for catering distribution to neighbouring countries and for repositioning equipment and supplies across hub networks. This blend of hub traffic, regulatory rigor, and culinary branding solidifies Germany’s position as a high‑quality, high‑volume market leader.

France In‑Flight Catering Services Market Analysis

France holds a prominent share of the Europe in‑flight catering services market, distinguished by its integration of gastronomic excellence and national culinary identity into in‑flight service. French airports handled well over a hundred million passengers in 2023, with Paris Charles de Gaulle serving as Air France’s global hub and a major transfer point for intercontinental traffic. Air France’s partnerships with renowned chefs and its “La Première” gourmet program set a benchmark for premium in‑flight dining, while the carrier’s sourcing strategies emphasize regional producers and appellation‑protected products. The national carrier sources a large proportion of its dairy produce and wine from certified French suppliers within close proximity to its Paris catering facilities, reinforcing freshness and provenance in premium cabins. France’s strict appellation controls and food‑origin laws further elevate meal authenticity, and the country’s leadership in sustainable aviation initiatives has driven adoption of compostable packaging, waste‑reduction systems, and supplier sustainability criteria. This fusion of culinary prestige, environmental responsibility, and hub scale ensures France’s influential role in shaping premium in‑flight catering standards across Europe.

Spain In‑Flight Catering Services Market Analysis

Spain accounts for a substantial share of the Europe in‑flight catering services market. The dominance of Spain in leisure and tourism traffic and a broad mix of carrier types operating from its airports are propelling the Spanish market growth. Spanish airports processed well over 150 million passengers in 2023, with a very large portion attributable to international tourists and seasonal leisure flows. Major hubs like Madrid‑Barajas and Barcelona‑El Prat serve as gateways for both European and transatlantic leisure routes where meal service is often enhanced to reflect Spanish culinary identity. Iberia and its franchise partners feature tapas‑inspired menus with regional specialties such as Iberian ham, Manchego cheese, and Rioja wine incorporated into premium offerings. The rise of ultra long‑haul leisure routes has increased demand for multi‑meal service cycles and more elaborate provisioning. Additionally, low‑cost and hybrid carriers operating from Spanish bases drive high‑volume buy‑on‑board programs featuring local snacks like tortilla and churros, creating a diverse catering ecosystem. This tourism‑driven demand combined with culinary branding creates a dynamic, high‑throughput market with strong seasonal peaks.

Netherlands In‑Flight Catering Services Market Analysis

The Netherlands holds an important share of the Europe in‑flight catering services market, leveraged by Amsterdam Schiphol’s role as a major European transfer hub and KLM’s global network and cultural branding. Dutch airports handled tens of millions of passengers in 2023, with Schiphol connecting a large number of destinations worldwide and serving as a key redistribution point for transfer traffic. KLM’s in‑flight catering emphasizes Dutch heritage with iconic items such as stroopwafels and Dutch dairy featured across cabin classes, and the airline’s partnerships with catering providers include dedicated production lines for allergen‑free and sustainable meals using locally sourced dairy and vegetables. The Netherlands’ leadership in circular‑economy policies has driven adoption of reusable serviceware, comprehensive waste‑sorting systems, and supplier sustainability requirements in catering facilities. Schiphol’s stringent environmental and operational regulations have also pushed caterers toward electric delivery fleets, energy‑efficient kitchens, and tighter turnaround logistics. This combination of hub connectivity, cultural identity, and sustainability innovation positions the Netherlands as a forward‑looking and highly efficient market in Europe’s in‑flight catering landscape.

COMPETITIVE LANDSCAPE

Competition in the Europe in-flight catering services market is shaped by a dual focus on operational excellence and culinary differentiation. The landscape features global giants regional specialists and airline owned caterers all vying for long term contracts in a highly regulated environment. Differentiation hinges on menu authenticity allergen control sustainability credentials and digital integration rather than price alone. Full-service carriers prioritize premium experience and compliance driving demand for chef crafted meals and traceable sourcing while low-cost carriers seek scalable retail-oriented solutions with strong margins. Regulatory complexity under EU food safety and single use plastics directives raises entry barriers and favors established players with robust compliance systems. Labor shortages and logistics fragility further intensify the advantage of incumbents with integrated airport infrastructure. Meanwhile the rise of premium economy cabins creates a high value middle ground where innovation in presentation and ingredient quality can command premium pricing. This multifaceted arena rewards companies that balance industrial scale with gastronomic authenticity within Europe’s unique regulatory and cultural context.

KEY MARKET PLAYERS

A few of the market players dominating the Europe in-flight catering services market are

Flying Food Group LSG Group Gate Gourmet DO & CO Aktiengesellschaf Gategroup The Emirates Group Newrest Group Services SAS SATS Ltd IGS Ground Services KLM Catering Services Fleury Michon Airline Catering Carlos Aviation Catering Network GmbH Top Players In The Market LSG Group is a global leader in airline catering with a commanding footprint across the Europe in-flight catering services market. Headquartered in Germany the company operates over 200 production facilities worldwide including major hubs in Frankfurt London and Madrid serving more than 300 airlines. In Europe LSG provides comprehensive meal solutions ranging from economy trays to premium multi course menus often developed in collaboration with celebrity chefs. The company emphasizes digital integration and sustainability through its SkyChefs brand which features allergen-controlled production lines and eco-friendly packaging. In 2024 LSG launched its SmartKitchens initiative in Europe incorporating AI driven demand forecasting and automated assembly lines to reduce food waste and improve efficiency. These innovations reinforce its position as a strategic partner for both full service and low-cost carriers navigating post pandemic recovery. Gate Gourmet is a premier provider of in-flight catering services with extensive operations across Europe’s busiest airports including Heathrow Charles de Gaulle and Zurich. The company serves a diverse client portfolio from legacy carriers to ultra long-haul low-cost operators delivering over 260 million meals globally each year. In Europe Gate Gourmet distinguishes itself through culinary innovation sustainable sourcing and robust compliance with EU food safety standards. The company partners with national culinary institutions to create regionally inspired menus that reflect local gastronomy. In 2024 Gate Gourmet expanded its buy on board retail program across European low-cost carriers introducing premium snack boxes and craft beverage pairings. It also implemented a closed loop packaging system using compostable materials at its UK and French facilities. These initiatives align with evolving passenger expectations and regulatory mandates strengthening its competitive edge. Newrest is a French multinational with a strong presence in the Europe in-flight catering services market operating over 50 airline catering units across the continent. The company combines traditional French culinary expertise with modern operational efficiency serving carriers such as Air France KLM and TAP Air Portugal. Newrest emphasizes local sourcing seasonal menus and circular economy principles integrating sustainability into every stage of meal production. The company’s “Farm to Tray” program ensures that over 65% of ingredients in its European operations are sourced within 250 kilometers of production facilities. In 2024, Newrest launched a digital meal pre selection platform for premium passengers enabling personalized dining experiences on long haul routes. It also invested in electric ground support fleets at Amsterdam and Lisbon airports to reduce logistics emissions. These actions reflect its commitment to quality sustainability and passenger centric innovation. Top Strategies Used by the Key Market Participants

Key players in the Europe in-flight catering services market are investing in digital meal pre selection platforms to enhance personalization and reduce waste. They are expanding buy on board retail programs with premium locally inspired offerings to boost ancillary revenue. Companies are implementing sustainable packaging solutions and electric logistics fleets to comply with EU environmental regulations. Strategic partnerships with national chefs and beverage brands elevate culinary identity and brand differentiation. Additionally, they are adopting AI driven production systems for demand forecasting and automated assembly to improve efficiency and food safety across high volume operations.

MARKET SEGMENTATION

This research report on the Europe in-flight catering services market is segmented and sub-segmented into the following categories.

By Food Type

Meals Bakery and Confectionary Beverages Other Food Types

By Flight Type

Full-service Carriers Low-cost Carriers

By Aircraft Seating Class

Economy Class Business Class First Class

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe