Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kyndryl Holdings Investment Narrative Recap

To own Kyndryl today, you need to believe it can keep shifting from legacy, low margin infrastructure contracts toward higher value AI, cloud and consulting services, while managing deal timing volatility. The IntelliMake collaboration with Wayne State is directionally aligned with that shift but is unlikely to change the key near term catalyst of hyperscaler and consulting signings growth, or the main risk of revenue pressure from legacy contract run off and delayed renewals, in the short term.

The IntelliMake AI manufacturing hub is tightly linked to Kyndryl’s Agentic AI Framework and Kyndryl Bridge, reinforcing its push into higher margin AI and digital transformation services that support its mix shift and margin expansion aims. Among recent announcements, the ongoing build out of agentic AI offerings and labs network is especially relevant, as it showcases how Kyndryl is trying to convert its AI and automation capabilities into recurring, services led transformation projects across industries.

However, investors should also be aware that ongoing revenue erosion in legacy focus accounts could still…

Read the full narrative on Kyndryl Holdings (it’s free!)

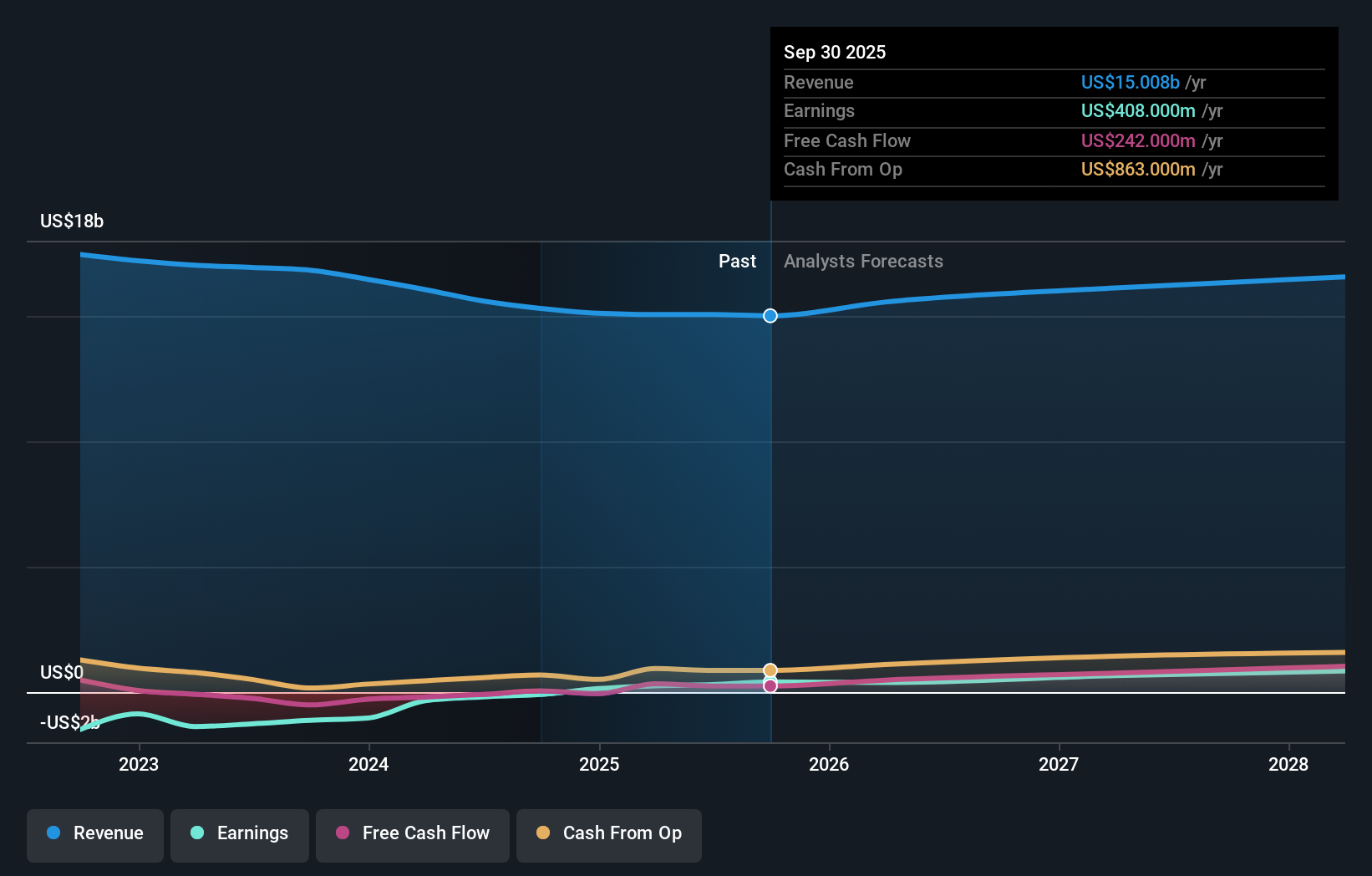

Kyndryl Holdings’ narrative projects $16.7 billion revenue and $1.1 billion earnings by 2028. This requires 3.6% yearly revenue growth and a roughly $800 million earnings increase from $297.0 million today.

Uncover how Kyndryl Holdings’ forecasts yield a $37.60 fair value, a 38% upside to its current price.

Exploring Other Perspectives KD Earnings & Revenue Growth as at Jan 2026

KD Earnings & Revenue Growth as at Jan 2026

Nine members of the Simply Wall St Community value Kyndryl between US$26.06 and US$75.41, highlighting very different views on upside. You should weigh those against the risk that legacy contract run off and deal timing keep revenue growth uneven, potentially affecting how quickly the business mix can shift toward higher margin AI and consulting work.

Explore 9 other fair value estimates on Kyndryl Holdings – why the stock might be worth just $26.06!

Build Your Own Kyndryl Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com