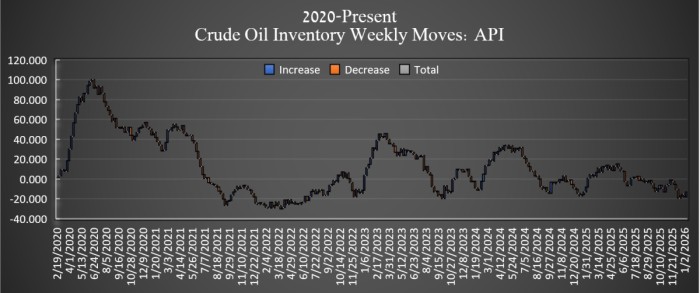

The American Petroleum Institute (API) estimated that crude oil inventories in the United States saw a build of 5.27 million barrels in the week ending January 9. Crude oil inventories sagged by 2.8 million barrels in the week prior.

The Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 200,000 barrels to 413.7 million barrels in the week ending January 9. Inventories in the SPR have been steadily increasing over the last year as the US Administration seeks to return the national stockpile to its former glory.

US production fell during the week of January 2 to 13.811 million bpd, down from 13.827 million bpd in the week prior, according to the latest EIA data. This is 248,000 bpd more than this same time last year.

At 3:09 pm ET, Brent crude was trading up on the day at $65.38 (+2.36%). Brent is now roughly $4 up from this time last week as the market digests President Trump’s veiled comments on Iranian protests and the Federal Reserve. WTI was also trading up on the day, by $1.47 (+2.47%) at $60.97.

Along with a build in crude oil, gasoline inventories saw another large increase this week as well, gaining 8.23 million barrels in the week ending January 9. In the week prior, gasoline inventories grew by 4.4 million barrels. As of last week, gasoline inventories were 3% above the five-year average for this time of year, according to the latest EIA data. According to independent oil analyst Tom Kloza, historically, last week qualifies as the lowest gasoline demand month on the calendar.

Warning–historically, last week qualifies as the lowest gasoline demand month on the calendar. Weekly EIA measurements as follows: 2025 – 8.325m/b/d; 2024-8.269m/b/d; 2023-7.558m/b/d; 2022 – 7.906m/b/d; and 2021 – 7.532m/b/d. Average number of 7.918-million b/d. Ebb tide likely.

— Tom Kloza (@TomKloza) January 13, 2026

Distillate inventories also rose in the reporting period, gaining 4.34 million barrels, after gaining 4.9 million barrels in the week prior. Distillate inventories were still 3% below the five-year average as of the week ending January 2, the latest EIA data shows.

Cushing inventory—the inventory kept at the delivery hub for the WTI Crude futures contract—rose by 945,000 barrels, after increasing by 700,000 barrels in the prior week.

More Top Reads From Oilprice.com