The Office of the Advocate for Small Business Capital Formation recently issued its Staff Report for fiscal year 2025, which provides information on the Office’s activities. As do prior reports, this Report provides a perspective and data on capital formation related to small and emerging businesses and exempt offerings; data related to mature and later-stage businesses; and data related to initial public offerings and small public companies. Small public companies include U.S. public companies with a public float less than or equal to $250 million (calculated based on the methodology specified in the Report). The Report describes the continuing challenges faced by small businesses in accessing capital, whether to meet operating expenses, expand their businesses, pursue new opportunities, or access credit. The Report notes that 13% of the U.S. population qualifies as an accredited investor. These individuals qualify principally on the basis of household net worth (10%), household net income (3%), personal income (3%), and specialized expertise (2%). Accredited investors remain fundamental to private capital.

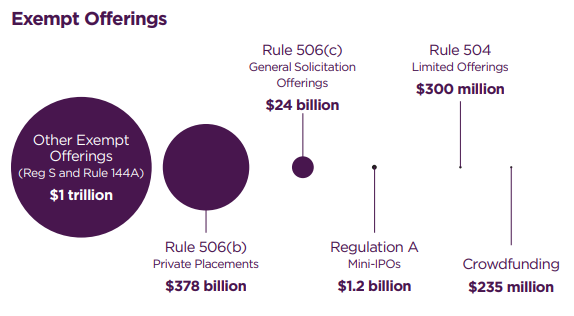

Companies (not pooled funds) continue to rely on exempt offerings in order to raise capital. Information on exempt offerings as well as other offerings is provided for the period from July 1, 2024 to June 30, 2025. During this period, companies raised $378 billion in Rule 506(b) private placements; $24 billion in Rule 506(c) offerings; $1.2 billion in Regulation A offerings; $300 million in Rule 504 offerings; $235 million in Reg CF offerings; and $1 trillion in other exempt offerings (this includes Rule 144A and Regulation S offerings). As we always note, these numbers are understated since, following the adoption of the bad actor provisions in 2013, many investment banks encourage companies to rely on Section 4(a)(2) for private placements in which they act as placement agents. Over the same time period, companies raised $47 billion in IPOs and $1.4 trillion in other registered offerings.

U.S. public companies raised $1.5 trillion (64% of capital raised) from investors and U.S. private companies raised $840 billion (36% of capital raised) from investors during the applicable period. The Report examines how companies in different industries raise capital. Not surprisingly, companies in the banking and financial services sector overwhelmingly rely on registered offerings. Technology companies and energy companies largely rely on registered offerings. By contrast, companies in the real estate sector rely heavily on private capital for funding. According to the Report, over the past three years, operating companies raising capital under Regulation D were most often in their first few years of operations. While this is no doubt accurate, it seems a bit misleading. Larger companies usually retain a financial intermediary—an investment bank—to assist with capital raising efforts and small public companies almost invariably do so. Banks prefer to rely on Section 4(a)(2) instead of Regulation D Rule 506(b) for various reasons. So, the statement may leave readers with a misimpression regarding the use of exempt offerings.

The Report notes that at the end of 2024, there was $126 trillion invested in pooled investment vehicles, distributed as follows: $40 trillion in assets in registered funds; $31 trillion in assets in private funds; and $55 trillion in assets invested in separately managed accounts. Over the same period referenced above, pooled funds raised $1.9 trillion in Rule 506(b) private placements; $169 billion in other exempt offerings (this includes Rule 144A and Regulation S offerings); and $100 billion in Rule 506(c) offerings. Now, the Report notes that while pooled funds accounted for most of the amounts (in proceeds) raised under Regulation D, pooled funds accounted for a little less than half of the number of offerings. Pooled vehicles raised $11 billion in IPOs and $11 billion in other registered offerings. The Report notes that a total of $10.3 trillion flowed into funds, or $478 billion of net cash, during the period. These numbers are interesting given the increased focus on private assets and the SEC’s focus on retail access to private assets through registered funds. Interestingly, the Report notes that the vast majority of capital raised in Regulation D offerings by pooled funds is raised by 3(c)(7) funds—these are limited to qualified purchasers, so they are not available to retail investors.

[View source.]