Sherwin-Williams (SHW) is back in focus after recent trading, with the stock closing at $355.99 and posting mixed short term returns, including a 0.5% decline over the past day and gains across longer periods.

See our latest analysis for Sherwin-Williams.

That 0.5% one day share price pullback comes after a stronger run, with a 7 day share price return of 4.7% and a year to date share price return of 8.6%, while the 5 year total shareholder return of 53.9% points to momentum that has generally been building over a longer stretch.

If Sherwin-Williams has you watching coatings and materials more closely, it could be a good moment to scan fast growing stocks with high insider ownership for other ideas catching early interest.

With Sherwin-Williams trading at $355.99 against an average analyst target around $386 and an internal value score of 0, the key question is whether the shares still offer upside or if the market is already accounting for future growth.

Most Popular Narrative: 7.9% Undervalued

With Sherwin-Williams closing at $355.99 against a narrative fair value of about $386.62, the current pricing sits slightly below that modeled estimate, which leans on explicit long term growth and margin assumptions.

Ongoing construction of a new R&D center and increased R&D investment is expected to accelerate the rollout of premium, environmentally friendly, and specialty coatings that command higher price points, supporting future gross margin expansion and increasing competitive differentiation as sustainability and performance requirements intensify.

Curious how steady top line growth, fatter margins, and a premium future P/E all come together to support that higher fair value? The narrative pins its view on detailed forecasts for revenue, earnings per share, and share count, plus a specific discount rate that turns those future cash flows into today’s number.

Result: Fair Value of $386.62 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, that story could change quickly if weak demand lingers in key end markets or if fixed cost manufacturing squeezes margins harder than analysts currently model.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Valuation Looks Full On Earnings

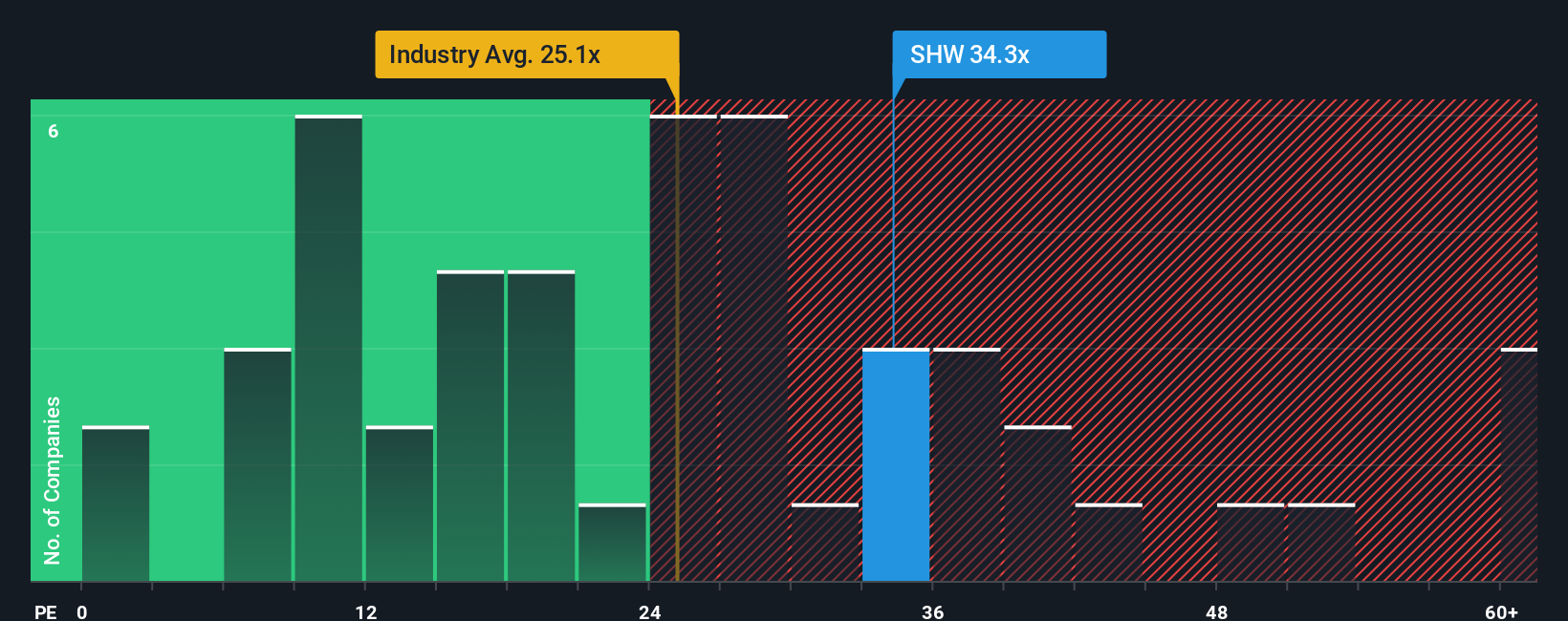

That 7.9% narrative discount sits against a much tougher message from the earnings multiple. At a P/E of 34.1x, Sherwin-Williams trades well above the US Chemicals industry at 25.1x, peers at 26.2x, and even its own fair ratio of 24.7x. This points to limited margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:SHW P/E Ratio as at Jan 2026 Build Your Own Sherwin-Williams Narrative

NYSE:SHW P/E Ratio as at Jan 2026 Build Your Own Sherwin-Williams Narrative

If you see the numbers differently or prefer to test your own assumptions against the market, you can build a custom view in minutes with Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger watchlist, do not stop at one company, your next opportunity could be hiding in the wider market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com