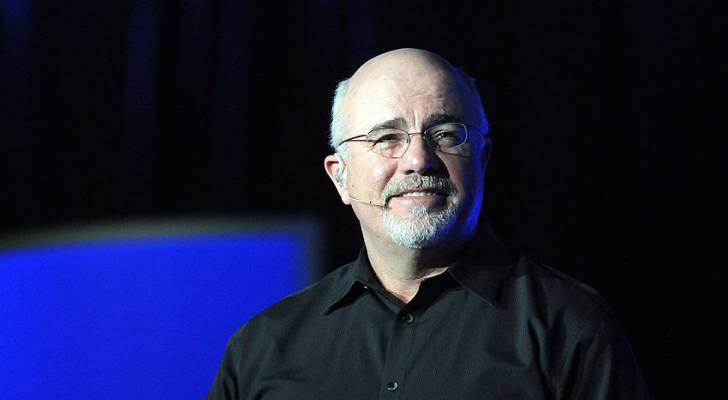

Jackson Laizure / Getty

Moneywise and Yahoo Finance LLC may earn commission or revenue through links in the content below.

In a May episode of The Ramsey Show, Dave Ramsey shared that the two major things he believes help people become millionaires are “steadily investing in retirement” and having “a paid-for house (1).”

According to Ramsey, “those two are the biggest two elements that we see cause people to be a millionaire.”

That being said, saving for retirement and paying off a home are two of the hardest things for Americans to do in the current economy.

While mortgage rates recently dropped to 5.99% from their record highs of about 7% in 2022 (2), the median sale price of a home remains high at $433,261 as of November 2025 (3).

Alongside the affordability crisis, a study by AARP found that 61% of adults aged 50+ are worried they won’t have enough money to support them in their retirement, and 20% have no savings at all (4).

These realities may be enough to deter you from thinking you can reach that millionaire milestone, but in a recent blog post titled ‘How to Become a Millionaire,’ Ramsey said it himself: “No matter how old or young you are, it is never too late or too early to get started (5).”

The total American household debt hit $18.59 trillion in the third quarter of 2025, rising by $197 billion from the previous quarter, according to the Federal Reserve Bank of New York (6).

The more debt you’re burdened with, the more difficult it will be to pay off your home. Hence, paying off your other debts helps you pay off your home and get one step closer to a seven-figure net worth.

As mortgage rates have come down from the 2022-highs and are currently hovering around three-year lows, refinancing your mortgage at a lower interest rate could help you pay it off faster.

Plus, shopping around and getting multiple quotes from lenders can help you save substantially. According to LendingTree, borrowers could save an average of $80,024 over the life of a 30-year fixed-rate mortgage — or roughly $2,667 a year — by shopping around and choosing the best rate offered (7).

Story Continues