AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Gartner Investment Narrative Recap

To own Gartner, you need to believe its subscription research and advisory model can stay essential even as clients experiment with cheaper AI tools. The Oakmark Funds’ buying on AI-related weakness broadly supports the view that AI disruption is a key near term risk, but the news itself does not materially change the main short term catalyst, which remains Gartner’s ability to keep clients engaged and renewing despite softer earnings and slower revenue growth.

Gartner’s recent “future of work” trends, focused on AI’s impact on employees and HR, tie directly into that catalyst by reinforcing its relevance to senior decision makers who are wrestling with AI adoption. If those insights help keep Gartner positioned as a must have adviser for AI and workforce decisions, that may support its efforts to defend contract value and pricing even as clients look harder at costs and alternatives.

However, while many investors focus on AI as a growth story, they should also be aware of how cheaper AI tools could…

Read the full narrative on Gartner (it’s free!)

Gartner’s narrative projects $7.4 billion revenue and $821.8 million earnings by 2028. This requires 4.7% yearly revenue growth and a $478.2 million earnings decrease from $1.3 billion today.

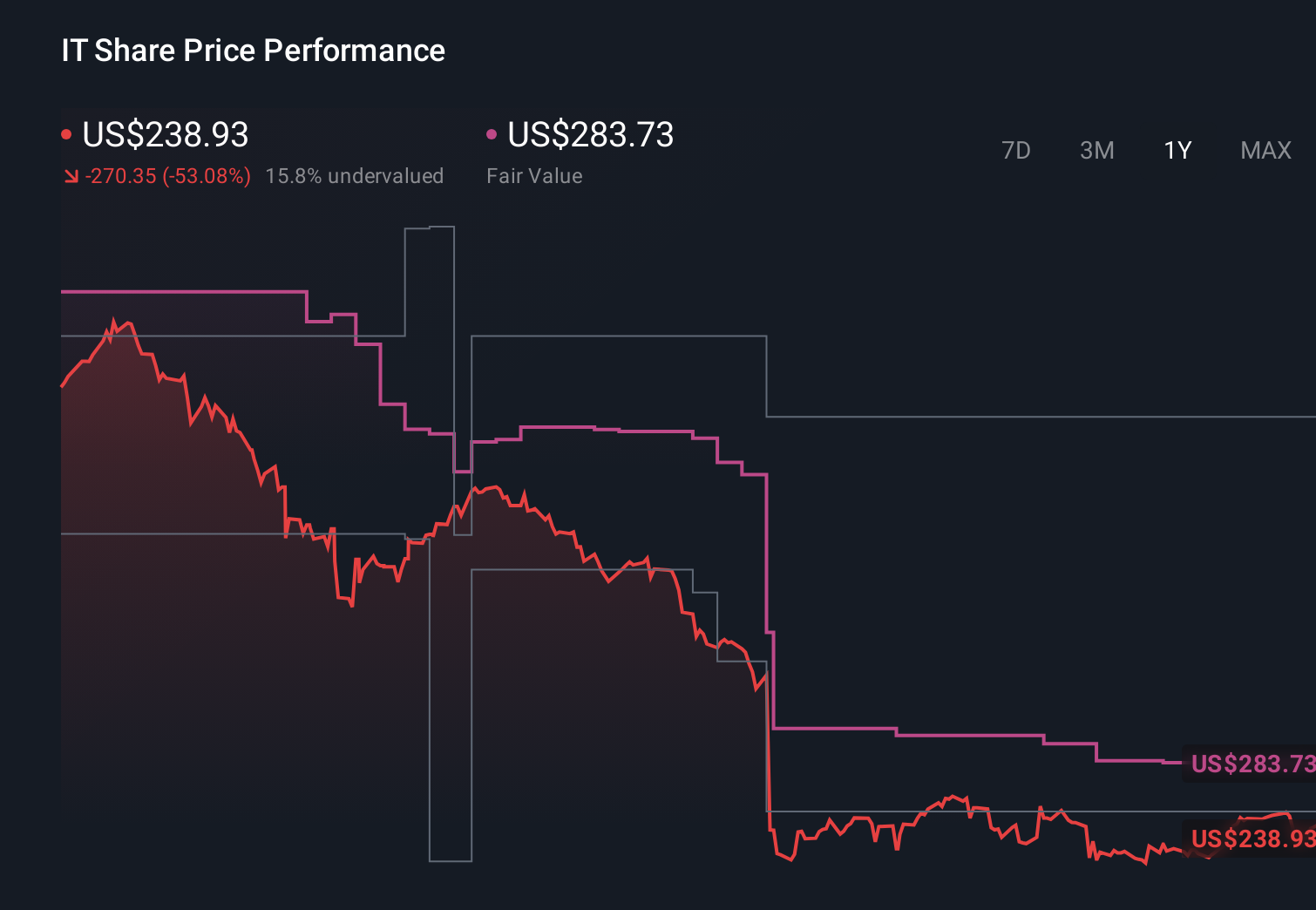

Uncover how Gartner’s forecasts yield a $283.73 fair value, a 19% upside to its current price.

Exploring Other Perspectives IT 1-Year Stock Price Chart

IT 1-Year Stock Price Chart

Three fair value estimates from the Simply Wall St Community span roughly US$279.56 to US$420.71 per share, underlining how far apart individual views can be. When opinions differ that much, it is worth weighing the risk that generative AI and low cost tools could eat into Gartner’s core research subscriptions and reshape expectations for its longer term performance.

Explore 3 other fair value estimates on Gartner – why the stock might be worth just $279.56!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Seeking Other Investments?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com