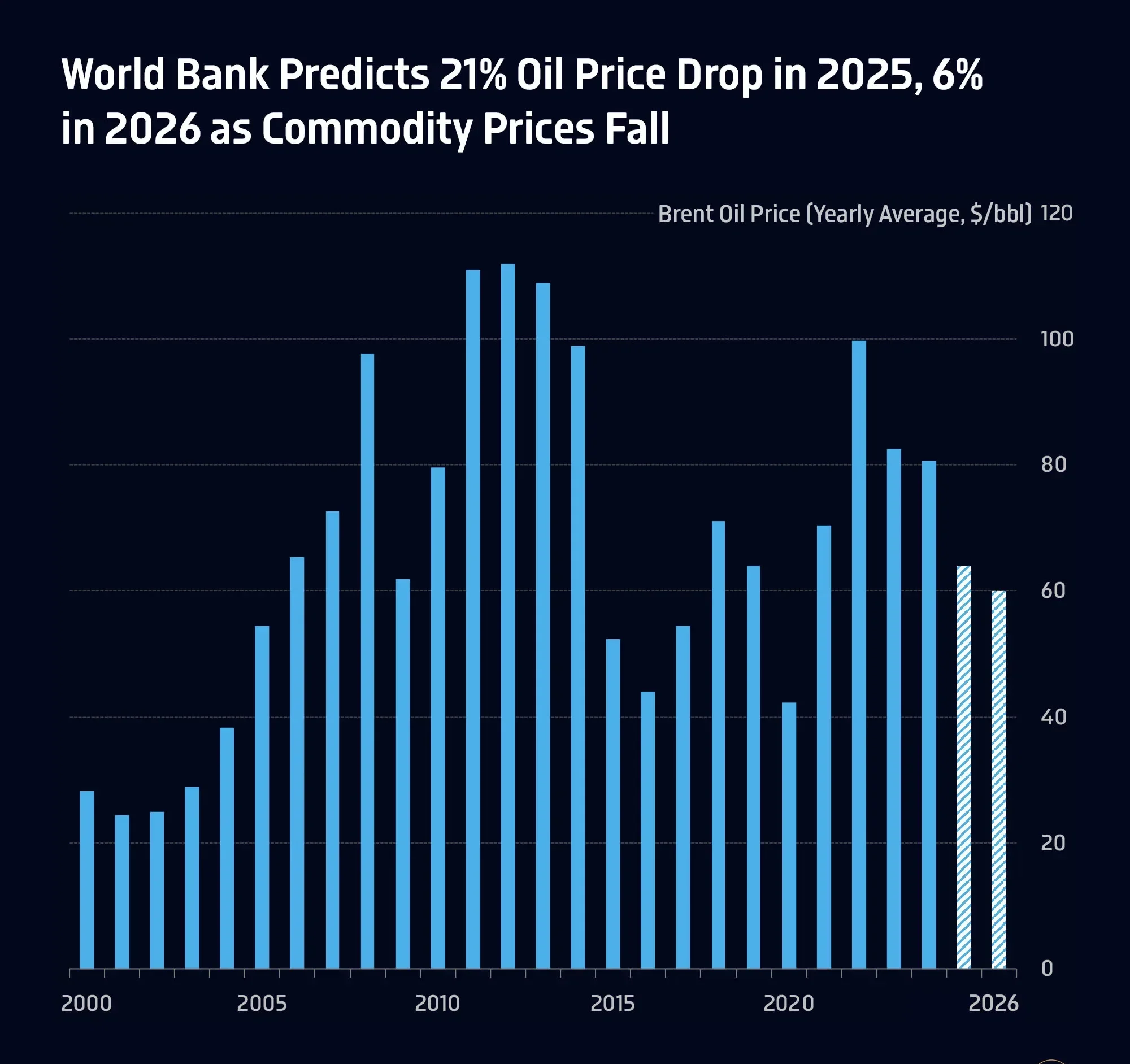

Brussels, Belgium – January, 2026 — As highlighted by Brussels Morning Newspaper, European financial markets entered the new year amid notable volatility as oil drops sharply, prompting a broad reassessment of risk, inflation expectations, and sector performance. The move reflects a convergence of easing geopolitical pressure, shifting diplomatic signals, and renewed confidence in non-energy sectors, particularly technology and consumer industries.

The early weeks of 2026 have underscored how energy pricing continues to shape investor behavior across asset classes. With crude benchmarks moving lower, market participants are adjusting strategies not only within commodities, but also across equities, currencies, and fixed income.

Energy Prices Adjust to Lower Risk Premiums

Crude oil has long carried a geopolitical premium, especially during periods of tension involving major producing regions. As oil drops, that premium is being unwound, reflecting a perception that near-term supply disruptions are less likely than previously assumed.

Traders note that this adjustment does not stem from a single policy decision, but rather from a gradual shift in expectations. Markets often react to the direction of political and diplomatic signals before tangible outcomes emerge, making energy prices particularly sensitive to sentiment.

European Economies Feel Immediate Effects

Europe, as a major energy-importing region, experiences rapid economic effects when oil drops. Lower crude prices feed into transportation costs, manufacturing inputs, and household energy bills, easing pressure on both businesses and consumers.

Economists across the continent are revisiting growth and inflation forecasts, factoring in the potential relief provided by cheaper energy. While challenges remain, the shift offers a measure of breathing room for economies navigating fragile recoveries and structural transitions.

Diplomatic Signals and Market Psychology

One senior commodities analyst said,

“Energy markets react first to changing expectations, and oil prices often move well before policy decisions are confirmed.”

Energy markets respond not only to supply and demand data, but also to political tone. Recent diplomatic messaging has been interpreted as reducing the likelihood of escalation in sensitive regions, contributing to the latest price movements.

In this environment, oil drops serve as a barometer of collective market psychology. The decline reflects confidence that dialogue may prevail over confrontation, at least in the near term, altering assumptions that had supported higher prices.

Equity Markets Gain From Energy Relief

As crude prices declined, equity markets across Europe and beyond moved higher. Lower energy costs are widely seen as supportive for corporate margins and consumer spending, encouraging investors to rotate into growth-oriented sectors.

Technology shares, industrials, and consumer-focused companies have benefited as oil drops, reinforcing the divergence between energy stocks and the broader market. This pattern highlights how shifts in one sector can ripple through the wider financial system.

Energy Producers Face Market Pressure

While consumers and energy importers gain relief, producers face renewed pressure when oil drops. Share prices of exploration and production companies have softened, reflecting concerns over near-term revenue and capital expenditure plans.

Analysts caution, however, that the current decline does not automatically signal a prolonged downturn. Production discipline, inventory management, and long-term demand trends continue to play critical roles in shaping the sector’s outlook.

Inflation Expectations Begin to Ease

Oil prices are a key driver of headline inflation. As oil drops, inflation expectations across Europe have moderated, influencing bond yields and currency valuations.

Central banks are closely monitoring these developments, aware that sustained declines in energy costs could alter the timing and pace of future policy decisions. The relationship between energy prices and monetary policy remains a central theme for markets in 2026.

Global Trade Benefits From Lower Fuel Costs

Lower oil prices tend to reduce transportation and logistics expenses, supporting global trade flows. Shipping, aviation, and manufacturing sectors often see cost advantages when fuel prices decline.

In this context, oil drops contribute to improved competitiveness for exporters and importers alike, reinforcing optimism in trade-dependent economies and sectors.

Emerging Markets Navigate Uneven Impact

The effects of falling oil prices vary widely across emerging economies. Importers benefit from reduced energy bills, while exporters face tighter fiscal conditions and revenue pressures.

As oil drops, policymakers in these regions are reassessing budgets and economic priorities, highlighting the uneven global consequences of energy price movements.

Strategic Reserves and Energy Policy

Governments continue to view strategic petroleum reserves as a tool for managing energy security. Lower prices may influence decisions on replenishment or release, depending on national priorities.

Market participants are evaluating how policy responses could interact with current trends if oil drops persist, adding another layer of complexity to energy market dynamics.

Technology and Speed Amplify Market Moves

Advances in data analytics and real-time trading have accelerated market reactions. Information now flows faster than ever, amplifying price movements across commodities and equities.

This acceleration means that when oil drops, adjustments can be swift and widespread, reinforcing momentum and shaping investor behavior across multiple markets.

Investor Caution Remains Despite Optimism

Despite gains in equities and easing inflation pressure, investors remain cautious. Geopolitical risks have not disappeared, and energy markets remain vulnerable to sudden shifts in tone or policy.

Periods in which oil drops often remind market participants of the importance of diversification and risk management, particularly in a global environment defined by uncertainty.

Energy Transition Shapes the Bigger Picture

The current decline unfolds alongside ongoing efforts to transition toward cleaner energy sources. Investment in renewable, efficiency, and electrification continues to influence long-term demand expectations.

While oil drops in the short term, structural trends suggest a gradual transformation of energy markets over the coming decades, reshaping how investors assess risk and opportunity.

Europe’s Economic Outlook Adjusts

For Europe, lower oil prices offer potential support at a time of delicate economic balance. Reduced energy costs can strengthen consumption and industrial output, contributing to modest growth improvements.

As oil drops, economists are adjusting forecasts to reflect these benefits, while remaining mindful of broader challenges such as productivity, demographics, and global competition.

Global Markets Stay Interconnected

Energy prices, equity performance, and currency movements remain tightly linked. Developments in one market quickly influence others, underscoring the interconnected nature of the global financial system.

The current phase, marked by oil drops, illustrates how shifts in expectations can transmit rapidly across borders and asset classes.

Watching the Signals Ahead

Investors are now focused on inventory data, production trends, and economic indicators for confirmation of current market direction. Diplomatic developments and policy guidance will also remain closely watched.

Whether oil drops further or stabilizes will depend on how these factors align in the weeks and months ahead.

Energy Markets at a Defining Moment

The opening chapter of 2026 suggests that energy markets are undergoing a period of reassessment. Lower prices reflect easing tension and shifting expectations, but they also reveal how fragile sentiment can be. As Europe and global markets navigate this environment, the balance between opportunity and risk will continue to shape economic and financial outcomes.