AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Cintas Investment Narrative Recap

To own Cintas, you need to believe in the long term value of outsourced uniform and facility services across core industries, even as work patterns evolve. Wells Fargo’s upgrade to “Overweight” reinforces confidence in that outsourcing theme but does not materially change the near term focus on execution against rising cost pressures and competition from more automated or tech enabled rivals.

The recent decision to raise fiscal 2026 revenue and EPS guidance is the most relevant backdrop to Wells Fargo’s more positive stance, as it reflects management’s view of current business conditions. This guidance update sits alongside ongoing buybacks and reinforces why some analysts see room for continued growth, while still leaving open questions about how Cintas will respond if physical workplace demand softens further.

Yet, against this constructive picture, investors should still be aware of the risk that growing remote and hybrid work could…

Read the full narrative on Cintas (it’s free!)

Cintas’ narrative projects $12.8 billion revenue and $2.4 billion earnings by 2028.

Uncover how Cintas’ forecasts yield a $214.56 fair value, a 10% upside to its current price.

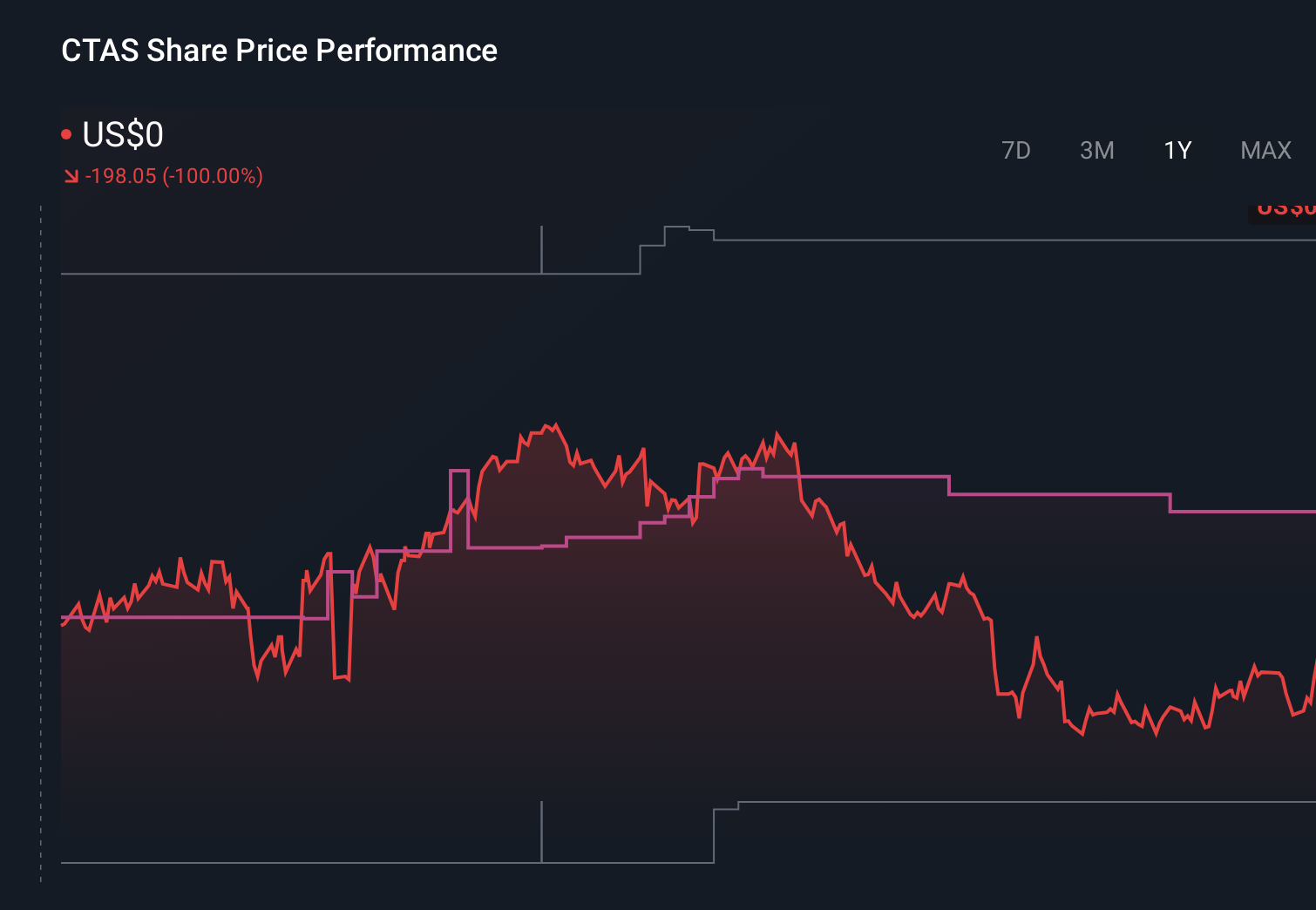

Exploring Other Perspectives CTAS 1-Year Stock Price Chart

CTAS 1-Year Stock Price Chart

Four members of the Simply Wall St Community currently estimate Cintas’ fair value between US$159.84 and US$214.56, underscoring how far opinions can stretch. Set against this range, the risk that remote and hybrid work reduces demand for uniforms and facility services gives you an additional angle to consider when weighing Cintas’ future performance.

Explore 4 other fair value estimates on Cintas – why the stock might be worth 18% less than the current price!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com