CNO Financial Group (CNO) is drawing attention after recent trading left the shares with mixed short term returns but strong multi year total returns. This is prompting investors to reassess the insurer’s current valuation.

See our latest analysis for CNO Financial Group.

At a recent share price of US$41.54, CNO has seen weaker short term share price returns over the past month and year to date. Its one year and multi year total shareholder returns remain materially positive, which suggests earlier optimism is being tempered as investors reassess growth prospects and risk.

If CNO’s recent swing in sentiment has you thinking about where else capital could work, it might be worth scanning fast growing stocks with high insider ownership as another source of ideas.

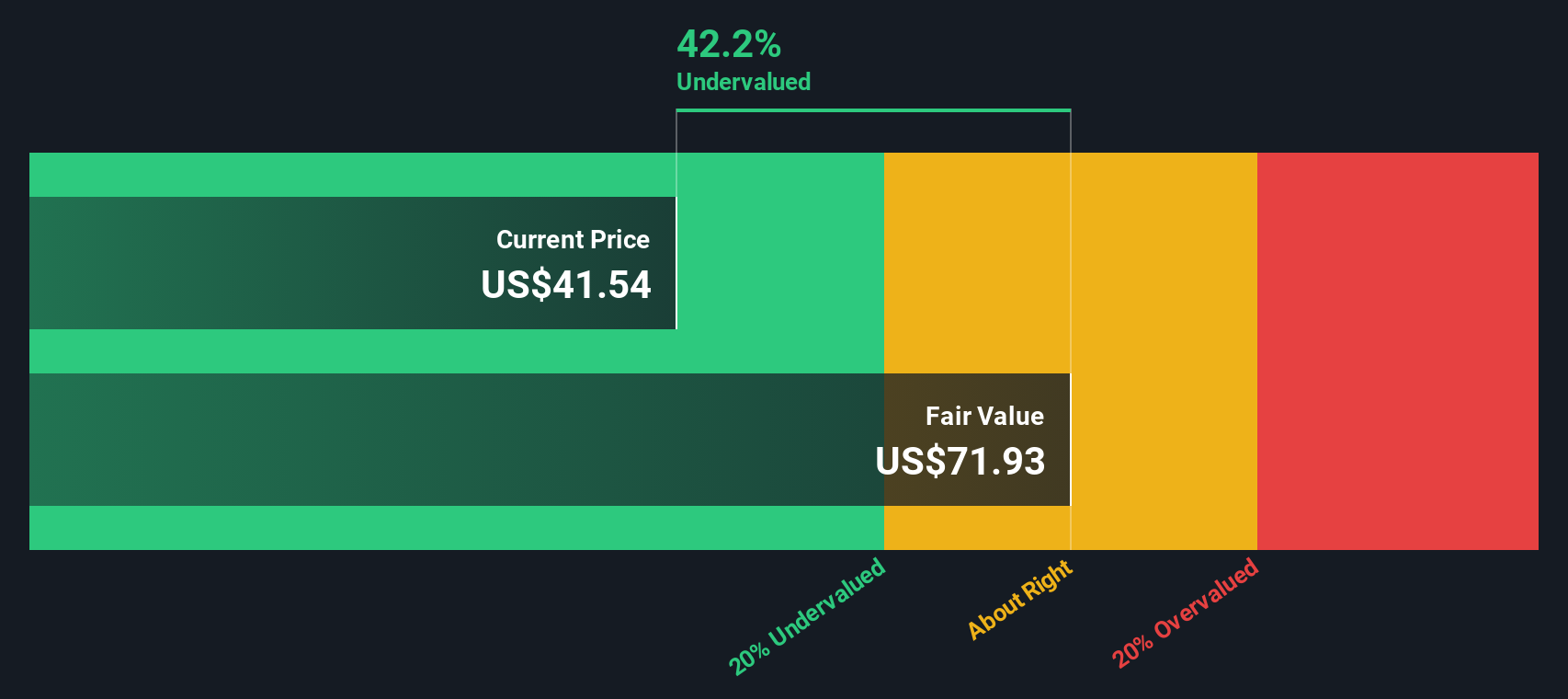

With CNO trading at US$41.54, at a discount to a US$47.25 analyst price target and an indicated intrinsic discount of about 42%, investors may ask whether this represents a genuine opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 9.7% Undervalued

The most followed narrative sees CNO Financial Group trading below an assessed fair value of US$46, compared with the recent close at US$41.54, and builds that view on detailed earnings and margin assumptions.

Accelerating growth in annuity and life/health policy sales, particularly driven by a rapidly aging U.S. population (11,000 Americans turning 65 each day) and increased focus on retirement income solutions, is expanding CNO’s addressable market and supporting consistent, repeatable revenue gains. Strong momentum in digital and web-based direct-to-consumer channels, as evidenced by 39% year-over-year growth and over 30% of D2C leads now from digital sources, is reducing customer acquisition costs and is expected to drive further margin expansion and scalability.

Curious what kind of revenue path and margin profile have to line up to support that valuation gap, and how earnings per share and future P/E assumptions fit together? The narrative leans heavily on the mix of fee based products, profitability targets and a specific discount rate to bridge today’s price to that higher fair value mark.

Result: Fair Value of $46 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, that upside story can crack if interest rates stay low and squeeze investment income, or if long term care claims revert to more costly patterns.

Find out about the key risks to this CNO Financial Group narrative.

Another Take On CNO’s Valuation

Our DCF model suggests CNO shares at US$41.54 sit around 42% below an estimated fair value of US$71.68, which points to an undervalued picture that is much stronger than the 9.7% gap implied by the narrative. Which view do you think better matches your own assumptions?

Look into how the SWS DCF model arrives at its fair value.

CNO Discounted Cash Flow as at Jan 2026 Build Your Own CNO Financial Group Narrative

CNO Discounted Cash Flow as at Jan 2026 Build Your Own CNO Financial Group Narrative

If the story here does not quite fit how you see CNO, or you prefer to test the inputs yourself, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your CNO Financial Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking For More Investment Ideas?

If CNO has your attention, do not stop there; use the Simply Wall St Screener to uncover more stocks that might fit your style and goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com