Canada Goose Holdings (TSX:GOOS) has seen mixed share performance recently, with a 3.4% decline over the past day and a small gain over the past month, while remaining lower year to date.

See our latest analysis for Canada Goose Holdings.

At a share price of CA$17.91, Canada Goose Holdings combines a weak year to date share price return of 3.55% with a much stronger 1 year total shareholder return of 21.26%, so recent momentum looks softer than the longer term rebound.

If this kind of mixed performance has you thinking about other opportunities, it could be a good time to widen your watchlist and check out fast growing stocks with high insider ownership.

With Canada Goose posting CA$1,372.9m in revenue and CA$26.4m in net income, plus annual growth in both, the key question is whether the current CA$17.91 share price leaves potential upside on the table or already reflects expectations for future performance.

Most Popular Narrative: 11% Undervalued

The most followed valuation view puts Canada Goose Holdings’ fair value at CA$20.12 per share, compared with the last close at CA$17.91, suggesting some upside according to that model.

The analysts have a consensus price target of CA$20.606 for Canada Goose Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$28.0, and the most bearish reporting a price target of just CA$14.0.

Want to see what is behind that fair value gap? The narrative leans on steady revenue expansion, higher profit margins, and a future earnings multiple that assumes real progress. Curious which specific growth path and profitability mix need to line up for those numbers to hold?

Result: Fair Value of $20.12 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, that fair value story can unravel if weaker demand in markets like the U.K. and Japan persists, or if higher marketing and store costs squeeze margins.

Find out about the key risks to this Canada Goose Holdings narrative.

Another View: Rich Multiples Raise Questions

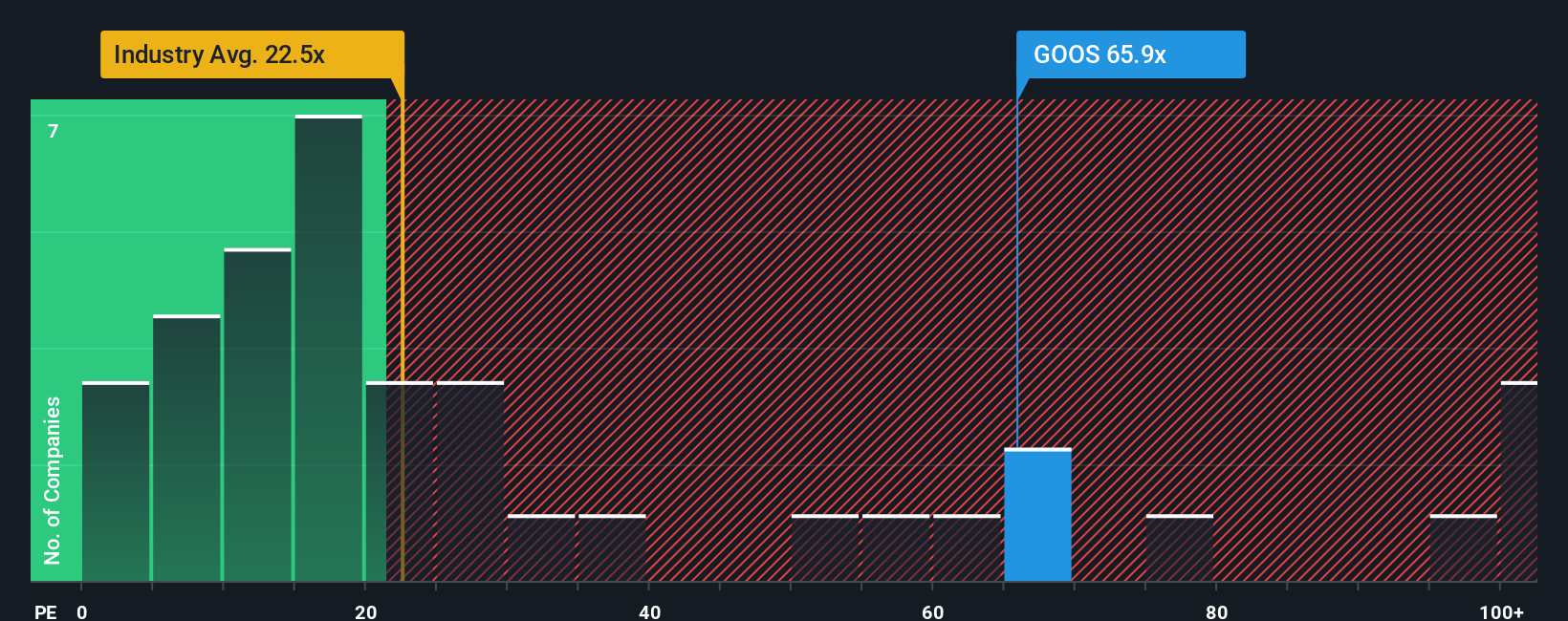

The fair value narrative points to an 11% undervaluation, but the P/E picture tells a different story. Canada Goose trades on a P/E of 65.9x, compared with a fair ratio of 26.9x, the North American Luxury average of 22.5x, and a peer average of 59.8x. This points to a full, even stretched, valuation if earnings do not meet expectations.

That kind of gap can work in your favour if profit grows as forecast, but it can also unwind quickly if sentiment or earnings disappoint. How comfortable are you with paying well above what the fair ratio and industry suggest the market could move towards?

See what the numbers say about this price — find out in our valuation breakdown.

TSX:GOOS P/E Ratio as at Jan 2026 Build Your Own Canada Goose Holdings Narrative

TSX:GOOS P/E Ratio as at Jan 2026 Build Your Own Canada Goose Holdings Narrative

If you are not on board with this view or simply prefer to test the assumptions yourself, you can build a tailored thesis in just a few minutes, starting with Do it your way.

A great starting point for your Canada Goose Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Canada Goose does not fully match your style, do not park your cash on the sidelines. Use curated screeners to surface fresh ideas that fit your approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com