North America Residential Cold Climate Heat Pump Market Size

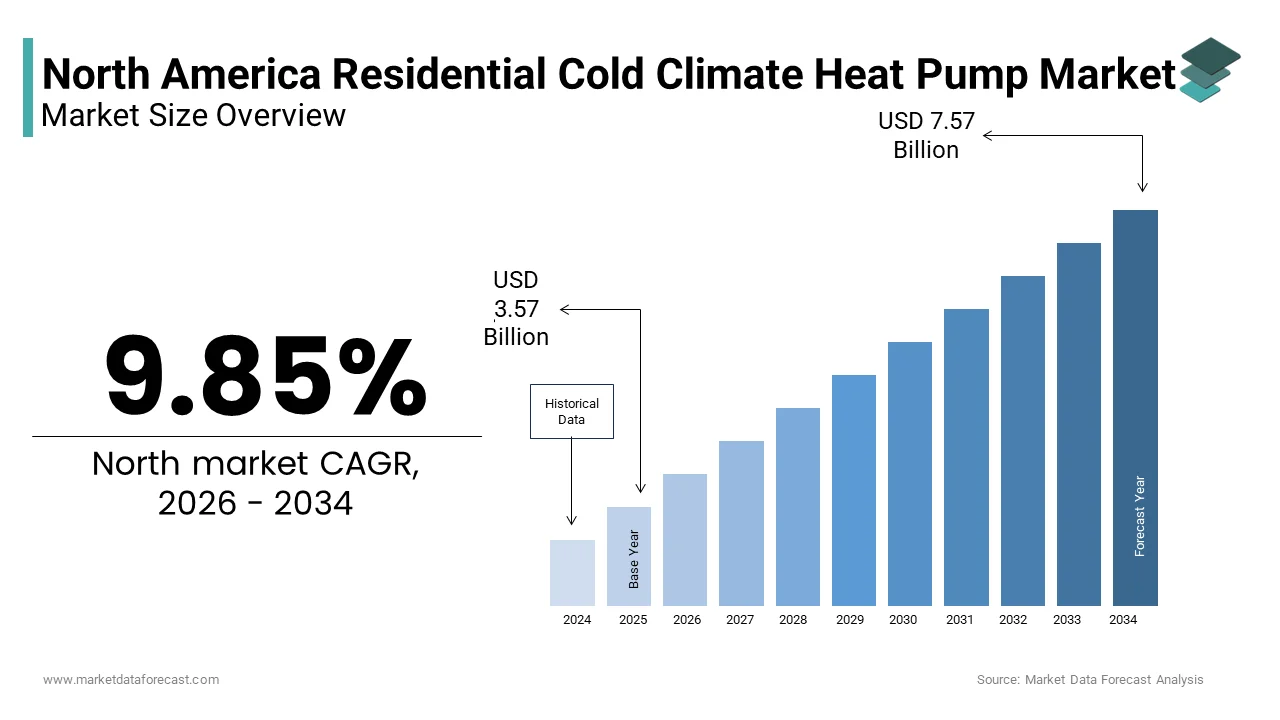

The North America residential cold climate heat pump market size was valued at USD 3.25 billion in 2025 and is anticipated to reach USD 3.57 billion in 2026 and USD 7.57 billion by 2034, growing at a CAGR of 9.85% during the forecast period from 2026 to 2034.

The residential cold climate heat pumps are heating, ventilation, and air conditioning systemsdesigned to provide efficient heating and cooling solutions in regions with severe winter temperatures. These advanced systems utilize variable refrigerant flow technology, enhanced compressors, and improved defrost mechanisms to maintain optimal performance even when outdoor temperatures drop below freezing. Unlike conventional heat pumps that struggle in temperatures below 25°F, cold climate heat pumps can effectively operate in conditions as low as -13°F while maintaining energy efficiency. The technology incorporates advanced inverter-driven compressors, optimized refrigerant circuits, and supplementary heating elements that ensure consistent indoor comfort throughout harsh winter months. According to the National Renewable Energy Laboratory, cold climate heat pumps can achieve coefficient of performance ratings above 2.0 even at temperatures of 5°F, making them viable alternatives to traditional fossil fuel heating systems. Modern cold climate heat pumps integrate smart controls, variable speed technology, and enhanced insulation materials that improve overall system efficiency. The Environmental Protection Agency recognizes these systems as eligible for energy efficiency incentives under various federal and state programs. As per the U.S. Department of Energy, residential buildings account for approximately 20% of total energy consumption in the United States, with heating representing the largest portion of this usage. The growing awareness of environmental sustainability and the need for reduced carbon emissions have positioned cold climate heat pumps as essential components of residential energy transition strategies.

MARKET DRIVERS Government Incentives and Rebate Programs

Government incentives and rebate programs is major factor propelling the growth of the North American residential cold climate heat pump market. Federal initiatives, such as the Inflation Reduction Act,t provide substantial financial support for homeowners seeking to upgrade to energy-efficient heating systems, with tax credits covering up to 30% of installation costs for qualifying heat pump systems. The U.S. Department of Energy has allocated over $8 billion for state energy programs that include specific provisions for cold climate heat pump installations, creating widespread accessibility for residential consumers. According to the Database of State Incentives for Renewables & Efficiency, over 35 states currently offer specific incentives for cold climate heat pump adoption, with combined annual funding exceeding $2.3 billion. Canadian provinces have implemented similar support mechanisms, with British Columbia’s CleanBC program providing point-of-sale rebates of up to $5,000 for qualified systems. Quebec’s Hydro-Québec offers interest-free financing options for residential heat pump installations, making these systems financially accessible to broader consumer segments. The cumulative effect of these government programs has reduced the effective cost of cold climate heat pump installations by 25-40% for average homeowners. Additionally, utility companies across North America have introduced time-of-use pricing structures that favor electric heating systems, further enhancing the economic viability of cold climate heat pump investments.

Advancing Technology and Improved Performance Metrics

The technological advancement and enhanced performance capabilities by making these systems viable alternatives to traditional heating methods, even in the harshest winter conditions, additionally leverage the growth of the North American residential cold climate heat pump market. Enhanced refrigerant formulations, particularly the adoption of R-32 and propane-based blends, have improved heat transfer efficiencywhile reducing environmental impact compared to traditional refrigerants. The coefficient of performance for contemporary cold climate heat pumps remains above 2.4 at temperatures of -5°F, representing a 60% improvement over first-generation systems, as documented by the Northeast Energy Efficiency Partnerships. Advanced defrost cycle technologies have reduced energy losses during winter operation by up to 15%, while improved insulation materials and compressor designs have extended operational ranges to -13°F without supplemental heating requirements. Smart control systems now integrate weather forecasting data and occupancy patterns to optimize energy consumption, reducing annual heating costs by 25-30% compared to conventional systems. Variable refrigerant flow technology has enabled precise temperature control within 1°F, improving occupant comfort while maintaining energy efficiency. The integration of internet-connected monitoring systems allows for predictive maintenance and performance optimization, extending equipment lifespan by 20-25% according to manufacturer field studies. These technological improvements have eliminated many previous limitations associated with heat pump performance in cold climates, establishing them as reliable primary heating sources for residential applications.

MARKET RESTRAINTS High Initial Installation Costs and Financial Barriers

High initial installation costs and associated financial barriers to widespread adoption, despite their long-term economic benefits is restraining the growth of North AmAmerica’sesidential cold climate heat pumps. The average installation cost for a cold-climate heat pump system ranges from $8,000 to $15,000, representing a 40-60% premium over conventional heating systems, according to the National Association of Home Builders. These elevated costs stem from specialized equipment requirements, including enhanced compressors, advanced refrigerant systems, and reinforced outdoor units designed to withstand extreme winter conditions. Professional installation requirements add substantial labor costs, with certified technicians commanding premium rates due to the complexity ofcold-weathere heat pump systems. The Consumer Energy Center reports that many homeowners lack access to financing options that make these investments economically viable, particularly in lower-income communities where heating represents a disproportionate share of household expenses. Upfront costs are further compounded by necessary electrical system upgrades, including panel modifications and dedicated circuit installations that can add $2,000-$5,000 to total project expenses. Existing home compatibility issues often require ductwork modifications, zoning system installations, or complete HVAC system replacements that increase overall investment requirements. The payback period for cold climate heat pump installations typically ranges from 8 to 12 years, which exceeds many homeowners’ investment horizons and reduces adoption incentives. Additionally, the fragmented nature of the installation market, with numerous small contractors lacking specialized expertise, creates pricing inconsistencies and quality concerns that further deter consumer adoption.

Limited Consumer Awareness and Technical Knowledge

Limited consumer awareness and insufficient technical knowledge regarding cold climate heat pump capabilities and benefits are limiting the growth ofthe North American residential cold climate heat pump market. Consumer surveys conducted by the Heating, Air-conditioning & Refrigeration Institute reveal that over 70% of homeowners remain unfamiliar with cold climate heat pump technology and its advantages over conventional heating systems. Misconceptions about heat pump performance in cold weather persist despite technological advances, with many consumers believing these systems cannot provide adequate heating below freezing temperatures. The complexity of system specifications, efficiency ratings, and performance characteristics creates confusion among potential buyers who lack the technical expertise to evaluate different product offerings. According to the Consumer Reports annual HVAC survey, 58% of respondents expressed uncertainty about heat pump suitability for their climate zones, particularly in northern regions where heating demands are most important. Information asymmetry between manufacturers, contractors, and consumers results in suboptimal purchasing decisions and installation quality issues that undermine system performance and consumer satisfaction. Educational outreach efforts by industry associations and government agencies remain insufficient to address widespread knowledge gaps, with limited funding allocated for consumer awareness campaigns. The absence of standardized performance rating systems for cold climate applications creates additional confusion, as consumers struggle to compare different manufacturers’ claims and specifications. Contractor training and certification programs have not kept pace with technological advancement, resulting in installation quality variations that affect system performance and consumer confidence. Geographic disparities in awareness levels further complicate market development, with rural and remote communities experiencing greater knowledge deficits compared to urban areas where contractor density and consumer education initiatives are more prevalent.

MARKET OPPORTUNITIES Expanding Market Penetration in Northern Climate Regions

Expanding penetration in northern climates, particularly in areas previously considered unsuitable for heat pump technology, is creating new opportunities for the growth of the North American residential cold climate heat pump market. States such as Maine, Vermont, New Hampshire, and Minnesota have demonstrated remarkable adoption rates, with cold climate heat pump installations increasing by over 300% between 2020 and 2023, according to the Northeast Energy Efficiency Partnerships regional tracking data. Canadian provinces,s including Quebec, Ontario, and the Maritime provinces, es have experienced similar growth patterns, driven by government incentives and improved system performance capabilities. The Northern Powerhouse initiative in the United Kingdom has documented successful cold climate heat pump deployments in regions with average winter temperatures below 14°F, providing valuable market development insights for North American expansion. Rural electrification programs across northern states have created new market segments where cold-weather heat pumps can replace expensive propane and heating oil systems, with the Rural Utilities Service reporting over 50,000 new rural electric service connections annually. Climate zone mapping studies conducted by the Pacific Northwest National Laboratory identify over 2.3 million residential units in North America located in climate zones suitable for cold climate heat pump deployment that currently utilize fossil fuel heating systems. The Alaska Housing Finance Corporation has initiated pilot programs demonstrating cold climate heat pump viability in extreme arctic conditions, opening new market opportunities in previously untapped regions. Utility-scale demonstration projects in northern communities have proven system reliability and performance, building consumer confidence and contractor expertise.

Integration with Renewable Energy Systems and Smart Home Technologies

Integration with renewable energy systems and smart home technologies by enabling comprehensive energy management solutions that maximize efficiency and reduce environmental impact, which additionally leverages the growth of the North America residential cold climate heat pump market. The emergence of solar photovoltaic systems with cold climate heat pumps has created hybrid energy solutions that can achieve net-zero or positive energy performance in residential applications. According to the National Renewable Energy Laboratory, homes equipped with solar panels and cold climate heat pumps demonstrate 65% lower annual energy costs compared to conventional heating and cooling systems. Battery storage system integration allows for optimal energy utilization during peak heating periods while reducing grid dependence and utility costs. Smart home platform compatibility enables seamless integration with voice assistants, mobile applications, and automated control systems that optimize performance based on occupancy patterns and weather forecasts. The Internet of Things ecosystem provides opportunities for predictive maintenance, performance monitoring, and remote diagnostics that enhance system reliability and reduce service costs. Energy management systems can coordinate cold climate heat pump operation with other residential loads to maximize renewable energy utilization and minimize peak demand charges. Grid-tied systems with vehicle-to-home capabilities allow electric vehicle batteries to provide backup power during heating system operation, creating resilient energy solutions for residential consumers. The emergence of microgrid technologies enables community-scale energy sharing and optimization, with cold climate heat pumps serving as flexible loads that support grid stability. Manufacturer partnerships with smart home technology companies have accelerated product development and created seamless user experiences that drive consumer adoption.

MARKET CHALLENGES: Supply Chain Constraints and Component Availability

Supply chain constraints and component availability issues pose significant challenges to the residential cold climate heat pump market, affecting production schedules and installation timelines, which is one of the major challenges for the growth of the North American residential cold climate heat pump market. The global semiconductor shortage that began in 2020 has severely impacted the availability of critical electronic components used in variable-speed compressors and smart control systems, with lead times extending from weeks to months,s according to the Semiconductor Industry Association supply chain monitoring reports. Rare earth magnet shortages, essential for high-efficiency permanent magnet motors used in advanced compressors, have created bottlenecks in manufacturing processes and increased component costs by over 4,0% as documented by the U.S. Geological Survey critical materials assessments. Refrigerant supply chain disruptions related to environmental regulations and production facility limitations have constrained the availability of specialized refrigerant blends required for cold climate heat pump operation. The concentration of manufacturing capacity in Asia-Pacific regions has created logistical vulnerabilities, with shipping delays and port congestion affecting component delivery schedules and increasing transportation costs. Labor shortages in the manufacturing and logistics sectors have compounded supply chain challenges, reducing overall production capacity and affecting quality control processes. Component standardization issues across different manufacturers have limited substitution options during supply disruptions, forcing extended project delays and cost escalations. The complexity of cold climate heat pump systems requires specialized components that cannot be easily sourced from alternative suppliers, creating single-source dependencies that amplify supply chain risks. International trade tensions and tariff implementations have further complicated procurement strategies and increased component costs for North American manufacturers.

Skilled Workforce Shortage and Installation Quality Variability

The skilled workforce shortages and installation quality variability that directly impact system performance, consumer satisfaction, and long-term market sustainability will additionally hamper the growth of the North America residential cold climate heat pump market. The North American Technician Excellence organization reports a 35% shortage of certified HVAC technicians capable of properly installing and servicing cold climate heat pump systems, with rural and northern regions experiencing even greater workforce deficits. The specialized knowledge required for cold climate heat pump installation, including refrigerant handling, electrical system integration, and performance optimization, exceeds the capabilities of many traditional HVAC contractors, according to industry training organization assessments. Installation quality variability has become a significant concern, with field studies indicating that 45% of cold climate heat pump installations fail to achieve manufacturer-specified performance levels due to improper sizing, ductwork issues, or control system misconfigurations. The complexity of system commissioning and performance verification requires advanced diagnostic equipment and technical expertise that many contractors lack, resulting in suboptimal system performance and premature equipment failures. Training program capacity has not kept pace with technological advancement and market demand, with waiting lists for advanced heat pump certification courses extending six months or longer. Geographic disparities in workforce availability create market access challenges, particularly in remote northern communities where qualified technicians must travel significant distances to complete installations. The aging HVAC workforce, with average technician ages exceeding 50 years in many regions, creates succession planning concerns and knowledge transfer challenges that threaten long-term market development. Quality assurance and certification programs have struggled to establish consistent standards for cold climate heat pump installation, resulting in consumer confusion and contractor performance variations. The premium pricing associated with cold climate heat pump systems amplifies the consequences of poor installation quality, as performance shortfalls directly impact return on investment and consumer confidence in the technology.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2025 to 2034

Base Year

2025

Forecast Period

2026 to 2034

CAGR

9.85%

Segments Covered

By Product, Application, By Country

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Regions Covered

United States, Canada, Mexico, etc.

Market Leaders Profiled

Bard, Blue Star, Bosch, Carrier, Daikin, Fujitsu, Gree, Klimaire, LG, MrCool, Nordic Heat Pumps, Panasonic, Rheem, Samsung, Trane

SEGMENTAL ANALYSIS By Product Insights

The ducted cold climate heat pump segment accounted for a dominant share of the North America residential cold climate heat pump market in 2024, with its compatibility with existing forced-air heating systems and the extensive infrastructure already in place across millions of North American homes. The vast majority of residential buildings in the United States and Canada were constructed with forced-air distribution systems, which creates an enormous addressable market for ducted heat pump installations. According to the U.S. Census Bureau, over 115 million housing units in the United States utilize forced-air heating systems, with approximately 75% of these located in climate zones suitable for cold-weather heat pump technology. The American Society of Heating, Refrigerating, and Air-Conditioning Engineers reports that ducted systems can achieve 15-20% higher installation efficiency in existing homes compared to ductless alternatives due to reduced air distribution modifications. Retrofit applications represent the largest portion of ducted system installations, with homeowners seeking to replace aging furnace and air conditioning systems with more energy-efficient alternatives. The National Association of Home Builders indicates that over 60% of home renovation projects involving HVAC system replacement now specify ducted cold climate heat pumps as the preferred solution. Existing ductwork infrastructure eliminates the need for extensive interior modifications, reducing installation costs by 25-30% compared to ductless system installations in homes without pre-existing distribution systems. The familiarity of homeowners and contractors with ducted system operation and maintenance further supports market adoption. Building codes and energy efficiency standards in many jurisdictions favor ducted systems for new construction applications, particularly in multi-family developments where centralized distribution systems are preferred. Superior comfort distribution and advanced zoning capabilities have significantly contributed to the dominance of ducted cold climate heat pumps. Ducted systems provide uniform temperature distribution throughout residential buildings, eliminating cold spots and ensuring consistent comfort levels in all occupied spaces. The Air Conditioning Contractors of America reports that properly designed ducted systems can maintain temperature variations within 2°F throughout multi-story residential buildings, compared to 5-8°F variations typical of ductless system installations. Advanced zoning capabilities enable homeowners to independently control temperatures in different areas of their homes, optimizing energy consumption based on occupancy patterns and room usage. Modern ducted cold climate heat pumps integrate with smart zoning systems that can accommodate up to eight separate zones within a single residential building, according to manufacturer performance specifications. The ability to integrate with existing programmable thermostats and smart home automation systems has made ducted systems particularly attractive to tech-savvy homeowners. Humidity control capabilities in ducted systems provide additional comfort benefits, particularly during summer months when dehumidification is essential for indoor air quality. Energy recovery ventilators and fresh air integration capabilities further enhance the appeal of ducted systems for health-conscious consumers seeking improved indoor air quality.

The ductless cold climate heat pump segment is projected to witness a prominent CAGR of 8.4% throughout the forecast period, od owing to the increasing emphasis on energy efficiency, flexible installation options, and growing awareness of advanced heating technologies among residential consumers. Minimal installation disruption and flexible application capabilities have emerged as primary drivers for the rapid adoption of ductless cold climate heat pumps across North America. These systems require only a small three-inch diameter hole through exterior walls for refrigerant line connections, eliminating the need for extensive interior modifications that characterize traditional HVAC system installations. The Home Innovation Research Labs reports that ductless system installations typically require 1-2 days to complete, compared to 3-5 days for ducted system installations in existing homes. Historical building preservation requirements have made ductless systems particularly attractive for older residential properties where interior modifications would compromise architectural integrity. Multi-generational housing developments and accessory dwelling units have created new market opportunities for ductless systems, as these applications often lack existing ductwork infrastructure. The flexibility to install individual indoor units in specific rooms or zones allows homeowners to address heating needs incrementally, spreading investment costs over time. Retrofit applications in basements, attics, and converted spaces have particularly driven demand, as these areas often present challenges for traditional ducted system integration. The ability to provide supplemental heating in specific areas without affecting entire building HVAC systems has made ductless systems attractive for home addition projects and room conversions. Enhanced energy efficiency and individual room control capabilities have become increasingly influential in driving the rapid adoption of ductless cold climate heat pumps across North American residential markets. Variable refrigerant flow technology enables ductless systems to modulate output based on individual zone requirements, achieving efficiency improvements of 25-40% compared to conventional heating systems, ms according to the Pacific Northwest National Laboratory. Individual room control capabilities allow homeowners to optimize energy consumption by heating only occupied spaces, with smart controls enabling automatic temperature adjustments based on occupancy sensors and scheduling preferences.s.. Advanced inverter technology in modern ductless systems maintains consistent temperatures while minimizing energy consumption, with coefficient of performance ratings exceeding 3.0 even at outdoor temperatures below 0°F. Integration with smart home platforms enables remote monitoring and control through mobile applications, allowing homeowners to optimize system operation based on real-time weather conditions and occupancy patterns. The ability to provide precise temperature control within 1°F has made ductless systems particularly attractive for health-conscious consumers seeking optimal indoor comfort conditions. Energy monitoring capabilities provide detailed consumption data that helps homeowners identify optimization opportunities and track return on investment for system installations.

By Application Insights

The single-family residential application segment held a prominent share of the North American residential cold climate heat pump market in 2024. The fundamental role single-family homes play in North American residential construct, ion and the inherent suitability of cold climate heat pump technology for standalone residential buildings. New residential construction and homeowner upgrade treares is prompting the growth of the segment. Energy efficiency requirements in building codes have increasingly favored cold climate heat pump installations in new construction projects, with the International Energy Conservation Code mandating minimum efficiency standards that align with cold climate heat pump capabilities. Replacement of aging furnace and air conditioning systems has created substantial market opportunities, particularly in northern climate regions where heating costs represent significant household expenses. The trend toward larger single-family homes with open floor plans has favored ducted cold climate heat pump installations that provide uniform temperature distribution throughout expansive living spaces. Custom home construction projects have particularly driven demand for advanced cold climate heat pump systems that can accommodate unique architectural features and specialized comfort requirements. Rural residential development and suburban expansion have created new market segments where cold-weather heat pumps provide cost-effective alternatives to propane and heating oil systems. The integration of cold climate heat pumps with renewable energy systems in new construction projects has further supported market growth, as homeowners seek comprehensive sustainable energy solutions for their residential properties. Ownership patterns and investment decision-making authority have significantly contributed to the dominance of single-family applications in the North American residential cold climate heat pump market. Homeowners possess complete control over HVAC investment decisions in single-family properties, which eliminates the complexities associated with multi-family property management and tenant preferences. Long-term ownership horizons in single-family properties justify premium investments in energy-efficient heating systems, with homeowners typically remaining in their residences for 8-10 years according to U.S. Census Bureau mobility data. The ability to customize system specifications and installation approaches appeals to homeowners who prioritize comfort and efficiency over standardized multi-family property solutions. Tax incentives and rebate programs are more accessible to individual homeowners compared to multi-family property owners, making cold climate heat pump investments more financially attractive. The emotional connection homeowners have with their living environments drives demand for premium comfort solutions that provide consistent heating performance throughout harsh winter months.

The multi-family residential application segment is anticipated to witness the fastest CAGR of 7.6% throughout the forecast period, with the increasing emphasis on energy efficiency in rental property management, regulatory compliance requirements, and evolving tenant expectations for modern heating solutions across North American urban markets. Energy cost management and property operating efficiency represent the primary factors driving rapid growth in multi-family residential cold climate heat pump applications across North America. Property management companies and real estate investment trusts are increasingly recognizing the substantial energy cost savings achievable through cold climate heat pump installations in multi-family developments. The Urban Land Institute reports that heating and cooling costs represent 25-30% of total operating expenses in multi-family properties, making energy efficiency improvements a critical focus for property managers seeking to optimize operational performance. Cold climate heat pumps can reduce annual heating costs by 40-50% compared to traditional electric resistance heating systems, according to utility-sponsored pilot program data from major metropolitan areas. The ability to provide individual unit control and sub-metering capabilities enables property managers to implement tenant-paid utility programs that reduce overall property operating costs. Portfolio-wide energy efficiency initiatives have driven adoption among large property management companies, with Equity Residential and AvalonBay Communities reporting 200% increases in cold climate heat pump installations over the past three years. Regulatory compliance requirements in major metropolitan areas have mandated energy efficiency improvements in rental properties, with New York City’s Local Law 97 requiring 40% carbon emission reductions by 2030. The integration of smart building technologies with cold climate heat pump systems enables centralized monitoring and optimization that reduces maintenance costs and improves tenant satisfaction. Benchmarking requirements in many jurisdictions have made energy performance transparency essential for property marketing and tenant attraction, supporting continued growth in this application segment. Tenant demand and rental market competitiveness have emerged as significant drivers of multi-family residential cold climate heat pump growth in North America’s urban housing markets. Modern renters increasingly prioritize energy-efficient and comfortable living environments when selecting rental properties, with cold climate heat pump installations serving as key differentiators in competitive rental markets. The National Multifamily Housing Council reports that 70% of prospective tenants consider heating system quality and energy efficiency when evaluating rental properties, with a willingness to pay premium rents for properties featuring modern HVAC systems. Green building certifications such as LEED and ENERGY STAR have become marketing advantages in multi-family rental markets, with cold climate heat pump installations contributing to certification achievements that attract environmentally conscious tenants. Rental property marketing studies indicate that cold climate heat pump installations can command rent premiums of 5-8% compared to properties with conventional heating systems. The quiet operation and precise temperature control capabilities of cold climate heat pumps address common tenant complaints about noisy heating systems and inconsistent temperatures.

COUNTRY ANALYSIS United States Residential Cold Climate Heat Pump Market Analysis

The United States residential cold climate heat pump market was the outperformer by capturing 88.3% of the share in 2024, attributed to the country’s extensive residential building stock, robust HVAC industry infrastructure, and continuous investment in energy efficiency initiatives. The U.S. market represents the largest single national market for residential cold climate heat pumps in North America, driven by diverse climate zones and substantial residential construction activities. The United States residential cold climate heat pump market demonstrates robust growth characteristics, supported by comprehensive federal and state-level incentive programs and evolving energy sector requirements. The Inflation Reduction Act has allocated $27 billion for residential energy efficiency improvements, directly supporting cold climate heat pump demand, according to the U.S. Department of Energy. This legislation includes specific provisions for heat pump rebate programs, tax credits, and utility modernization initiatives that require advanced heating technologies. The American Rescue Plan Act has also provided funding for weatherization assistance programs thatutilize cold-climatee heat pump installations in low-income housing developments. Rural electrification initiatives have contributed to market expansion, as utilities extend electric service to remote areas where cold-weather heat pumps provide cost-effective alternatives to propane heating. Climate resilience programs and disaster preparedness initiatives have also driven heat pump replacement and upgrade activities in regions prone to heating fuel supply disruptions. The emergence of smart home technologies and grid-tied energy management systems has created new market opportunities for integrated cold climate heat pump solutions.

Canada Residential Cold Climate Heat Pump Market Analysis

Canada was positioned second by holding 12.3% of the North American residential cold climate heat pump market share in 2024, owing to the federal and provincial climate action plans, energy efficiency programs, and northern region heating requirements. Canada’s cold climate heat pump market is characterized by stringent environmental standards and a strong focus on sustainable heating solutions. The Canadian residential cold climate heat pump market exhibits stable growth patterns, supported by government initiatives focused on clean energy transition and residential building modernization. Provincial utilities and municipal authorities drive demand through comprehensive energy efficiency programs and climate action initiatives. Canada’s commitment to achieving net-zero emissions by 2050 has created substantial opportunities for residential cold climate heat pump manufacturers and suppliers,s according to Natural Resources Canada. The Pan-Canadian Framework on Clean Growth and Climate Change includes specific provisions for residential heating system modernization that support cold climate heat pump demand. Provincial initiatives such as Ontario’s Home Energy Savings Program and British Columbia’s CleanBC Better Homes program have allocated significant funding for heat pump installations and energy efficiency upgrades. The Canadian Energy Efficiency Alliance reports that over $2 billion has been invested in residential energy efficiency programs across Canadian provinces since 2020. Northern electrification programs, particularly in remote indigenous communities, have created unique requirements for cold climate heat pumps that can operate in extreme climate conditions. Hydroelectric development projects in provinces like Quebec and British Columbia have provided low-cost electricity that makes electric heating systems economically attractive. The integration of cold climate heat pumps with renewable energy systems has also contributed to market growth, as homeowners seek comprehensive sustainable energy solutions. Smart grid pilot programs in major metropolitan areas have further supported demand for advanced cold climate heat pump technologies that can participate in demand response programs.

COMPETITIVE LANDSCAPE

The North American residential cold climate heat pump market exhibits dynamic competitive dynamics characterized by the presence of established global manufacturers, regional specialists, and emerging technology innovators. Market competition is driven by technological differentiation, energy efficiency performance, and customer service excellence rather than purely price-based competition. Leading manufacturers compete through innovation in cold weather performance, environmental sustainability, and smart home integration capabilities that align with evolving consumer requirements. The competitive landscape is influenced by regulatory compliance requirements that mandate specific performance standards and safety certifications for residential heating systems. Brand reputation and long-term reliability track records play crucial roles in market positioning, with homeowners prioritizing proven performance and support over initial cost considerations. Regional market dynamics create opportunities for specialized manufacturers to compete effectively against larger global players through localized expertise and responsive service capabilities. Supply chain management and component sourcing strategies have become critical competitive factors, particularly given the volatility of raw material prices that significantly impact manufacturing costs. Technology integration capabilities, including digital monitoring systems and predictive maintenance features, have emerged as key differentiators among market participants. The market also experiences competition from alternative heating technologies and emerging solutions that challenge traditional heat pump applications and specifications.

KEY MARKET PLAYERS

A few of the dominating market players in the North American residential cold climate heat pump market are

Bard Blue Star Mitsubishi Electric Corporation Bosch Carrier Global Corporation Daikin Industries Ltd. Carrier Daikin Fujitsu Gree Klimaire LG MrCool Nordic Heat Pumps Panasonic Rheem Samsung Trane Top Players in the Market Mitsubishi Electric Corporation stands as a pioneering leader in the North American residential cold climate heat pump market through its innovative inverter technology and comprehensive product portfolio. The company’s extensive research and development capabilities have established industry benchmarks for cold climate performance and energy efficiency. Mitsubishi Electric’s commitment to technological advancement has resulted in the creation of advanced variable refrigerant flow systems that maintain optimal performance in extreme winter conditions. The company’s strong distribution network and certified installer program enable widespread market penetration and consistent service quality. Their integration of smart home technologies with traditional heat pump solutions has positioned them at the forefront of residential heating innovation. Mitsubishi Electric’s focus on environmental sustainability aligns with North American regulatory requirements and consumer preferences for eco-friendly heating solutions. The company’s ability to provide customized solutions for diverse residential applications demonstratesitsr market versatility and customer-centric approach. Daikin Industries Ltd. maintains a significant presence in the North American residential cold climate heat pump market through its comprehensive heating and cooling solutions portfolio. The company’s extensive manufacturing capabilities and technological expertise have enabled the development of robust heat pump systems that meet demanding North American climate requirements. Daikin’s focus on innovation has resulted in the creation of environmentally responsible heat pump solutions that utilize advanced refrigerant technologies and sustainable manufacturing processes. The company’s comprehensive service network provides installation, maintenance, and technical support capabilities that ensure long-term customer satisfaction. Their commitment to grid modernization aligns with North American utilities’ objectives for improved energy efficiency and demand response capabilities. Daikin’s integration of digital technologies withitsr heat pump products has enhanced operational performance and reduced maintenance requirements. The company’s strategic partnerships with regional distributors and contractors have strengthened their market position and delivery capabilities across diverse geographical markets. Carrier Global Corporation has established itself as a major player in the North American residential cold climate heat pump market through its comprehensive HVAC solutions portfolio and strong brand recognition. The company’s acquisition strategy and organic growth initiatives have expanded its heat pump manufacturing capabilities and market reach across the region. Carrier’s focus on sustainability and energy efficiency has resulted in the development of high-performance cold climate heat pumps that meet evolving environmental regulations and consumer expectations. Their modular design approach enables flexible solutions that can be adapted to specific residential requirements and installation constraints. The company’s digital transformation initiatives have integrated advanced monitoring and control capabilities with their heat pump products, supporting smart home deployment objectives. Carrier’s strong presence in both new construction and retrofit markets demonstratesitsr ability to serve diverse customer segments effectively. Their commitment to safety standards and quality assurance has built trust with homeowners and contractors throughout North America. Top Strategies Used By Key Market Participants Strategic Technology Innovation and R&D Investment

Leading players in the North America residential cold climate heat pump marketplace place substantial emphasis on strategic technology innovation, research, and development investments to maintain technological leadership and competitive advantage. These companies allocate significant resources to develop next-generation heat pump technologies that address evolving consumer requirements and regulatory standards. Innovation efforts focus on improving energy efficiency, reducing environmental impact, and enhancing operational reliability in extreme cold weather conditions. Companies invest in advanced materials research to develop heat pumps with superior performance characteristics and extended service life. Digital transformation initiatives within R&D programs enable the integration of smart technologies and predictive analytics with traditional heat pump designs. Collaboration with academic institutions and research organizations provides access to emerging scientific discoveries and engineering innovations. The development of modular and scalable heat pump solutions allows companies to address diverse market segments with standardized yet customizable products. These R&D investments also focus on sustainability initiatives, including the development of eco-friendly refrigerants and recycling technologies that support circular economy principles.

Strategic Partnerships and Channel Development

Key market participants actively pursue strategic partnerships and channel development initiatives to expand their market reach and enhance customer service capabilities. These companies identify specialized distributors, installation contractors, and technology partners to strengthen their product distribution networks and service offerings. Through strategic partnerships with utility companies and government agencies, market leaders gain access to rebate programs and promotional opportunities that accelerate market adoption. Joint ventures with regional manufacturers enable global players to establish local production capabilities and reduce supply chain dependencies. These collaborative approaches allow companies to leverage complementary strengths and accelerate time-to-market for new products. Strategic partnerships also include supply chain relationships that ensure critical component availability and maintain quality standards. The focus on channel development extends to training and certification programs that build installer expertise and improve service quality. Technology partnerships with smart home platform providers enable seamless integration with emerging residential automation systems and enhance user experience.

Market Expansion and Geographic Diversification

Market leaders implement comprehensive market expansion and geographic diversification strategies to strengthen their presence in the North American residential cold climate heat pump market. These companies establish regional manufacturing facilities and service centers to reduce delivery times and improve customer support capabilities. Geographic diversification strategies include adapting product designs to meet specific regional climate conditions and building codes while maintaining global quality standards. Companies develop regional supply chains that reduce costs and improve responsiveness to local market demands. Strategic placement of warehouses and distribution centers enables rapid product delivery and emergency response capabilities. Market expansion efforts extend to workforce development, with companies investing in regional talent acquisition and training programs to build local expertise. Cultural adaptation and customer relationship management approaches are tailored to specific regional markets to enhance customer satisfaction and loyalty. Geographic expansion also includes establishing regional headquarters and technical centers that provide localized engineering support and product development capabilities.

MARKET SEGMENTATION

This research report on the North America Residential Cold Climate Heat Pump Market is segmented and sub-segmented into the following categories.

By Product

By Application

Single family Multi family

By Country