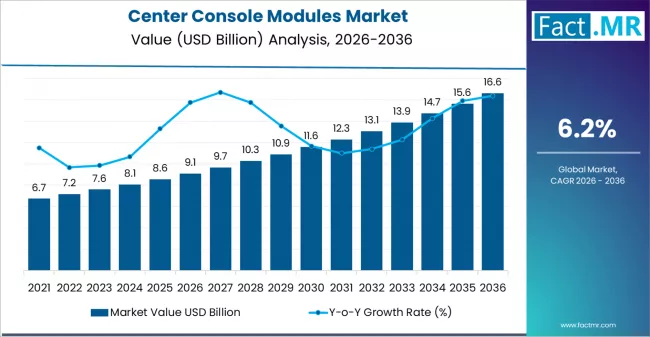

The global center console modules market is projected to grow from USD 9.1 billion in 2026 to USD 16.6 billion by 2036, depicting a compound annual growth rate (CAGR) of 6.2% between 2026 and 2036.

Major advancements in center console modules focus on enhancing functionality and integration capabilities to improve user experience in modern vehicle interiors. Improved connectivity systems now support wireless charging, smartphone integration, and advanced human-machine interface controls with faster response times.

Key Takeaways from Center Console Modules Market

Center Console Modules Market Value (2026): USD 9.1 billion

Center Console Modules Market Forecast Value (2036): USD 16.6 billion

Center Console Modules Market Forecast CAGR: 6.2%

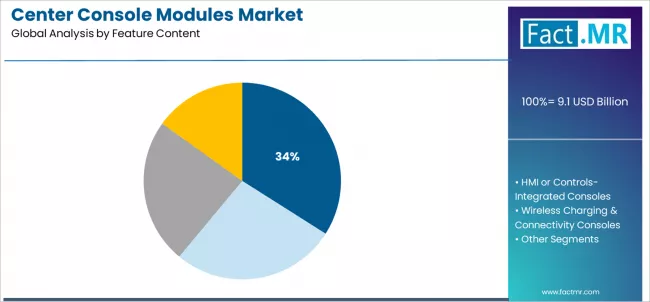

Leading Feature Content in Center Console Modules Market: Storage and Cupholder Modules (34.0%)

Key Growth Regions in Center Console Modules Market: North America, Europe, Asia Pacific

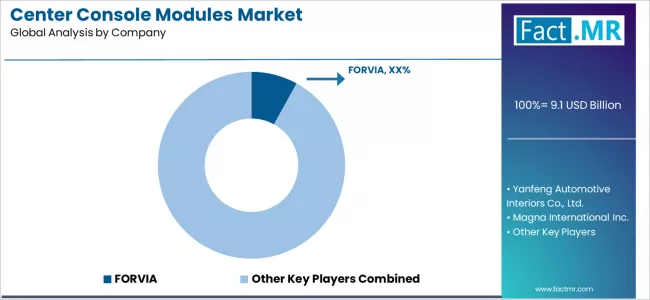

Key Players in Center Console Modules Market: FORVIA, Yanfeng Automotive Interiors Co., Ltd., Magna International Inc., Lear Corporation, Hyundai Mobis Co., Ltd.

Storage and cupholder modules have evolved to accommodate larger devices and multiple storage configurations, offering enhanced organization for both driver and passenger convenience. Material innovations contribute to more durable, lighter console components that resist wear and deliver consistent performance across various climate conditions. Adaptive design technologies adjust console layouts based on vehicle class and consumer preferences, reducing manufacturing complexity while improving user accessibility.

Integration with vehicle electrical systems allows better coordination with climate controls, infotainment systems, and charging capabilities, ensuring modules operate efficiently when needed. Newer designs also include modular components that maintain structural integrity and functionality longer during extended use cycles.

Center Console Modules Market

Metric

Value

Estimated Value in (2026E)

USD 9.1 billion

Forecast Value in (2036F)

USD 16.6 billion

Forecast CAGR 2026 to 2036

6.2%

Category

Category

Segments

Feature Content

Storage and Cupholder Modules; HMI or Controls-Integrated Consoles; Wireless Charging & Connectivity Consoles; Other

Material

Soft-Touch Plastics; Hard Plastics; Aluminum or Decor Trims; Other

Vehicle

Passenger Cars; SUVs or Crossovers; Light Commercial Vehicles; Other

Sales Channel

OEM or Tier 1 Supply; Aftermarket Accessories; Service Replacement; Other

Region

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Segmental Analysis

By Feature Content, Which Segment Holds the Dominant Share in the Center Console Modules Market?

In terms of feature content, the storage and cupholder modules segment leads the market with 34.0% share. Automotive manufacturers and interior designers increasingly utilize storage and cupholder systems for their practical functionality and proven user satisfaction characteristics.

Manufacturing investments in advanced molding technology and ergonomic design infrastructure continue to strengthen adoption among automotive interior facilities.

With vehicle manufacturers prioritizing user convenience and interior functionality, storage and cupholder modules align with both consumer expectations and design requirements, making them the central component of comprehensive vehicle interior strategies.

By Material, Which Segment Registers the Highest Share in the Center Console Modules Market?

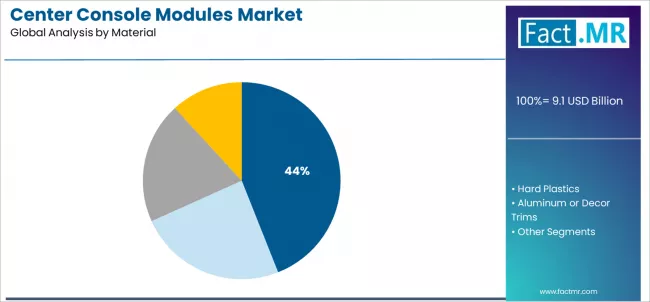

By material, soft-touch plastics dominates with 44.0% share, underscoring its critical role as the primary material choice for automotive engineers seeking superior tactile properties and enhanced user experience credentials. Automotive specialists and design teams prefer soft-touch plastic solutions for console applications due to their established performance validation requirements.

Automotive facilities are optimizing material selections to support comfort-specific requirements and comprehensive interior design strategies.

As material technology continues to advance and manufacturers seek efficient production methods, soft-touch plastic applications will continue to drive market growth while supporting comfort optimization and performance enhancement strategies.

What are the Government Regulations in the Center Console Modules Market?

Center console modules must meet several certifications to ensure their safety and compliance with regulatory standards. In the U.S., the National Highway Traffic Safety Administration (NHTSA) requires products to obtain Federal Motor Vehicle Safety Standard (FMVSS) certifications for interior component safety. These products may also need to adhere to ISO 26262 automotive safety integrity standards, ensuring they are produced under controlled automotive manufacturing conditions.

In the European Union, products must meet the European New Car Assessment Programme (Euro NCAP) standards, including compliance with UN Regulation ECE R21 on interior fitting requirements. Additionally, automotive interior formulations might require certifications such as the Global Technical Regulation (GTR) for enhanced vehicle interior systems.

For products claiming to meet specific quality and durability standards, certifications like ISO/TS 16949 (automotive quality management) or ISO 14001 (environmental management) may also apply. These certifications are critical for demonstrating the product’s reliability and ensuring its safe integration in automotive interior systems.

Analysis of the Center Console Modules Market by Key Country

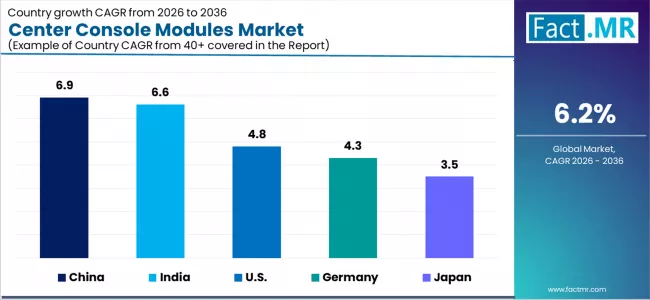

Country

CAGR 2026 to 2036

India

6.6%

China

6.9%

U.S.

4.8%

Germany

4.3%

Japan

3.5%

The report covers an in-depth analysis of 30+ countries; top-performing countries are highlighted below.

What Opportunities Can Center Console Modules Producers Expect in India?

Revenue from center console modules sales in India is projected to exhibit strong growth with a CAGR of 6.6% through 2036, driven by the country’s rapidly expanding automotive interior sector, growing awareness of vehicle comfort standards, and increasing automotive manufacturing accessibility across major industrial and urban regions.

Established automotive infrastructure and expanding interior technology capabilities are driving demand for console solutions across manufacturing plants, assembly facilities, and comprehensive vehicle interior systems throughout Indian automotive markets.

Strong regulatory trends and consumer comfort initiatives are supporting the rapid adoption of automotive interior services among quality-focused manufacturers seeking to meet evolving comfort standards and consumer requirements.

What is the Chinese Center Console Modules Market Size?

Revenue from center console modules products in China is projected to expand at a CAGR of 6.9%, supported by rising vehicle interior investment, growing automotive comfort consciousness, and expanding manufacturing accessibility capabilities. The country’s advanced automotive infrastructure and increasing investment in interior technologies are driving demand for console solutions across both traditional and modern automotive applications.

Advanced automotive development and expanding comfort capabilities are creating opportunities for console adoption across vehicle manufacturing projects.

Growing comfort consciousness initiatives and automotive technology advancement are driving the adoption of specialized interior systems among Chinese automotive manufacturers.

What Opportunities Can Center Console Modules Producers Expect in U.S.?

Revenue from center console modules sales in U.S. is projected to exhibit growth with a CAGR of 4.8% through 2036, driven by the country’s established automotive interior infrastructure, regulatory frameworks promoting vehicle comfort initiatives, and manufacturing awareness supporting specialized interior solutions across major automotive regions.

Established automotive infrastructure and expanding interior technology capabilities are driving demand for console solutions across manufacturing facilities, automotive plants, and comprehensive vehicle interior systems throughout American automotive markets.

Strong regulatory development and comfort initiatives are supporting the adoption of premium automotive interior services among quality-focused manufacturers seeking to meet comfort standards and consumer requirements.

What is the German Center Console Modules Market Size?

Revenue from center console modules products in Germany is projected to grow at a CAGR of 4.3% through 2036, supported by the country’s emphasis on automotive quality precision, interior technology excellence, and advanced manufacturing system integration requiring efficient comfort solutions. German automotive manufacturers and quality-focused establishments prioritize interior precision and performance control, making specialized console services essential components for both traditional and modern automotive applications.

Advanced precision automotive capabilities and growing interior applications are driving demand for console services across specialty manufacturing applications.

Strong focus on automotive quality precision and interior excellence is encouraging manufacturers and consumers to adopt console solutions that support comfort objectives.

What Challenges Do Japanese Center Console Modules Manufacturers Face?

Revenue from center console modules products in Japan is projected to expand at a CAGR of 3.5%, supported by rising automotive interior investment, growing vehicle comfort consciousness, and expanding manufacturing technology capabilities. The country’s advanced automotive infrastructure and increasing investment in interior technologies are driving demand for console solutions across both traditional and modern vehicle interior applications.

Advanced automotive technology development and expanding interior capabilities are creating opportunities for console adoption across manufacturing projects.

Growing vehicle comfort consciousness initiatives and automotive technology advancement are driving the adoption of specialized interior products among Japanese automotive manufacturers.

Competitive Landscape of the Center Console Modules Market

The center console modules market is characterized by competition among established automotive interior manufacturers, specialized component system providers, and integrated automotive companies. Companies are investing in advanced design technology, specialized material platforms, innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable console services.

Market players include FORVIA, Yanfeng Automotive Interiors Co., Ltd., Magna International Inc., Lear Corporation, Hyundai Mobis Co., Ltd., and others, offering commercial and specialty services with emphasis on automotive interior and comfort enhancement heritage. FORVIA provides integrated automotive interior solutions with a focus on comfort applications and premium quality networks.

Key Players in the Center Console Modules Market

FORVIA

Yanfeng Automotive Interiors Co., Ltd.

Magna International Inc.

Lear Corporation

Hyundai Mobis Co., Ltd.

Grupo Antolin, S.A.

Toyota Boshoku Corporation

IAC Group

Adient plc

Aptiv PLC

Scope of the Report

Items

Values

Quantitative Units (2026)

USD 9.1 Billion

Feature Content

Storage and Cupholder Modules, HMI or Controls-Integrated Consoles, Wireless Charging & Connectivity Consoles, Other

Material

Soft-Touch Plastics, Hard Plastics, Aluminum or Decor Trims, Other

Vehicle

Passenger Cars, SUVs or Crossovers, Light Commercial Vehicles, Other

Sales Channel

OEM or Tier 1 Supply, Aftermarket Accessories, Service Replacement, Other

Regions Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Countries Covered

U.S., Canada, Germany, Italy, UK, France, Japan, Australia, India, Brazil, China, South Korea, Mexico, and other countries

Key Companies Profiled

FORVIA, Yanfeng Automotive Interiors Co., Ltd., Magna International Inc., Lear Corporation, Hyundai Mobis Co., Ltd., and other leading automotive interior companies

Additional Attributes

Dollar revenue by feature content, material, vehicle, sales channel, and region; regional demand trends, competitive landscape, technological advancements in design technology, automotive interior optimization initiatives, comfort enhancement development programs, and premium automotive interior development strategies

Center Console Modules Market by Segments

Feature Content :

Storage and Cupholder Modules

HMI or Controls-Integrated Consoles

Wireless Charging & Connectivity Consoles

Other

Material :

Soft-Touch Plastics

Hard Plastics

Aluminum or Decor Trims

Other

Vehicle :

Passenger Cars

SUVs or Crossovers

Light Commercial Vehicles

Other

Sales Channel :

OEM or Tier 1 Supply

Aftermarket Accessories

Service Replacement

Other

Region :

North America

Europe

Germany

Italy

UK

France

Spain

Netherlands

Switzerland

Rest of Europe

Asia Pacific

Japan

Australia

South Korea

China

India

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East and Africa

United Arab Emirates

South Africa

Rest of Middle East and Africa

Bibliography

International Automotive Interior Association Research Committee. (2023). Console module technologies and comfort optimization in automotive interior systems. International Automotive Interior Association.

International Organization for Standardization. (2023). Automotive interior management: Assessment of console technology, design efficiency, and performance control of interior systems (ISO Technical Report). ISO.

European Committee for Standardization. (2022). Automotive interior management: Evaluation of console processing, performance control, and design compliance in automotive facilities (EN Technical Report). CEN.

Journal of Automotive Interior Editorial Board. (2024). Console module processing, performance control, and comfort optimization in modern automotive interior. Journal of Automotive Interior, 149(3), 287-304.

Automotive Interior Technology Agency, Technical Committee. (2023). Advances in console module processing and performance control technologies for automotive and interior applications. Automotive Interior Technology Agency.