Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is LTC Properties’ Investment Narrative?

For someone considering LTC Properties, the big picture is believing in a health care REIT that prioritizes steady income and disciplined capital management, even as its valuation sits at the higher end of sector multiples. The recent third quarter 2025 results, with revenue ahead of expectations but earnings per share lagging, highlight that growth is coming through the top line while profitability and margins remain a key short term swing factor. The amended credit agreement, adding US$200 million of capacity and pushing total commitments to US$800 million, meaningfully improves financial flexibility and could support future investments or refinancing, but it also sharpens the focus on how well cash flows cover debt and the dividend. The stock’s move to a 52 week high suggests this new liquidity is being viewed positively, yet it may also amplify concerns around valuation, payout coverage and the impact of large one off items on reported results.

However, one key risk around debt coverage and dividend sustainability still deserves closer attention.

LTC Properties’ shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.

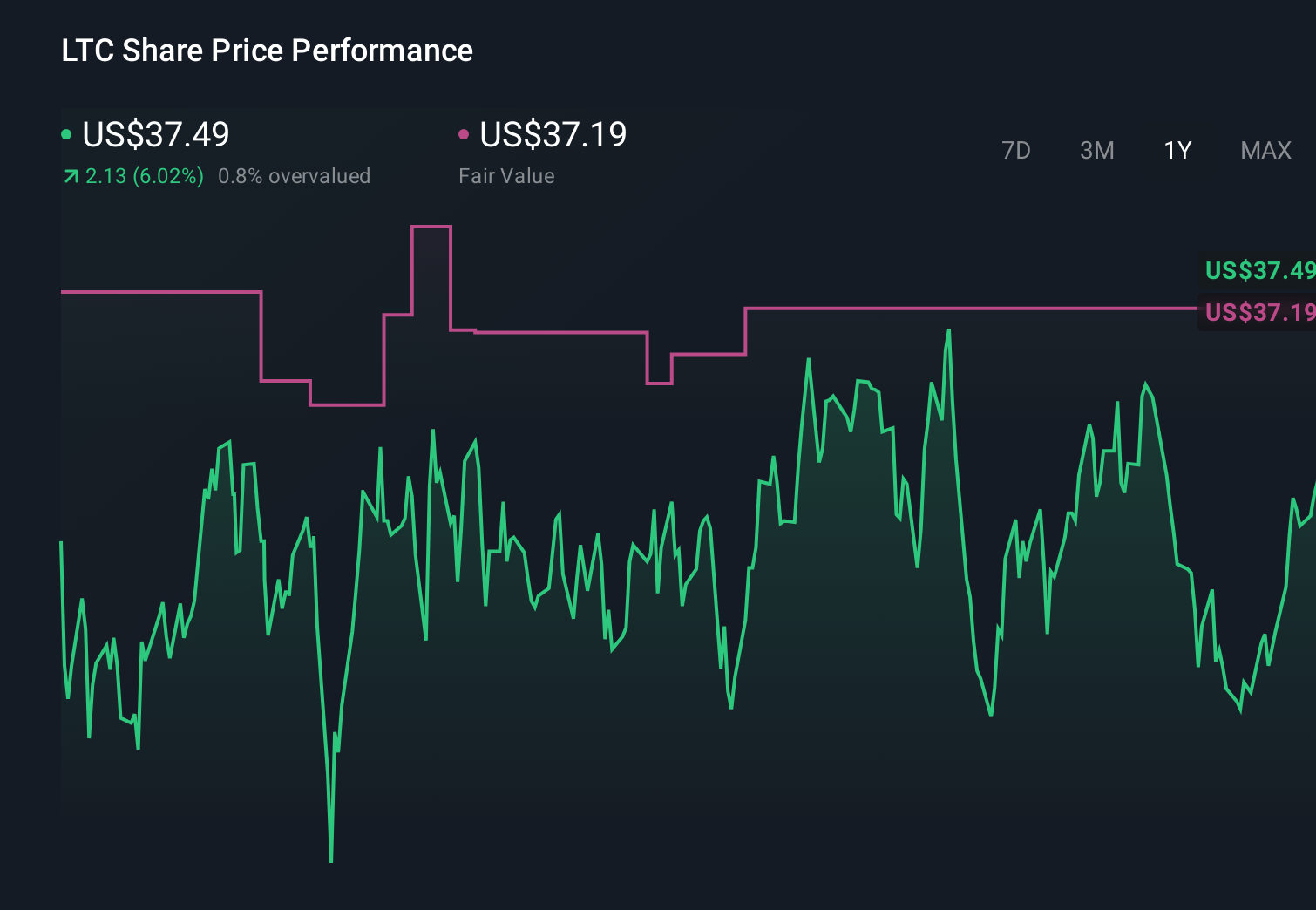

Exploring Other Perspectives LTC 1-Year Stock Price Chart

LTC 1-Year Stock Price Chart

Simply Wall St Community members offer three fair value views for LTC, from about US$37.83 to just over US$77.40, underlining how far opinions can stretch. Set against this wide dispersion, the recent revenue beat and expanded US$800 million credit facility give you a real time reminder that balance sheet strength and earnings quality can pull expectations in very different directions. You are seeing how varied assumptions on growth, risk and payout resilience can shape very different conclusions, so it is worth weighing several of these perspectives side by side.

Explore 3 other fair value estimates on LTC Properties – why the stock might be worth over 2x more than the current price!

Build Your Own LTC Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com