BitMine Immersion Technologies, listed on the NYSE American as BMNR, is known for its focus on crypto infrastructure, Ethereum holdings, and staking services. By tying up with Beast Industries, it is moving closer to the creator economy, where large online audiences and direct-to-consumer products have become an important focus for brands and platforms.

For you as an investor, a key question is how this link between a crypto centric business and a mainstream creator brand might affect BitMine’s revenue mix, risk profile, and capital allocation. The company is positioning this deal as a way to connect blockchain based services with consumer products, licensing, and potential decentralized finance offerings tied to a widely recognized online personality.

Stay updated on the most important news stories for Bitmine Immersion Technologies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Bitmine Immersion Technologies.

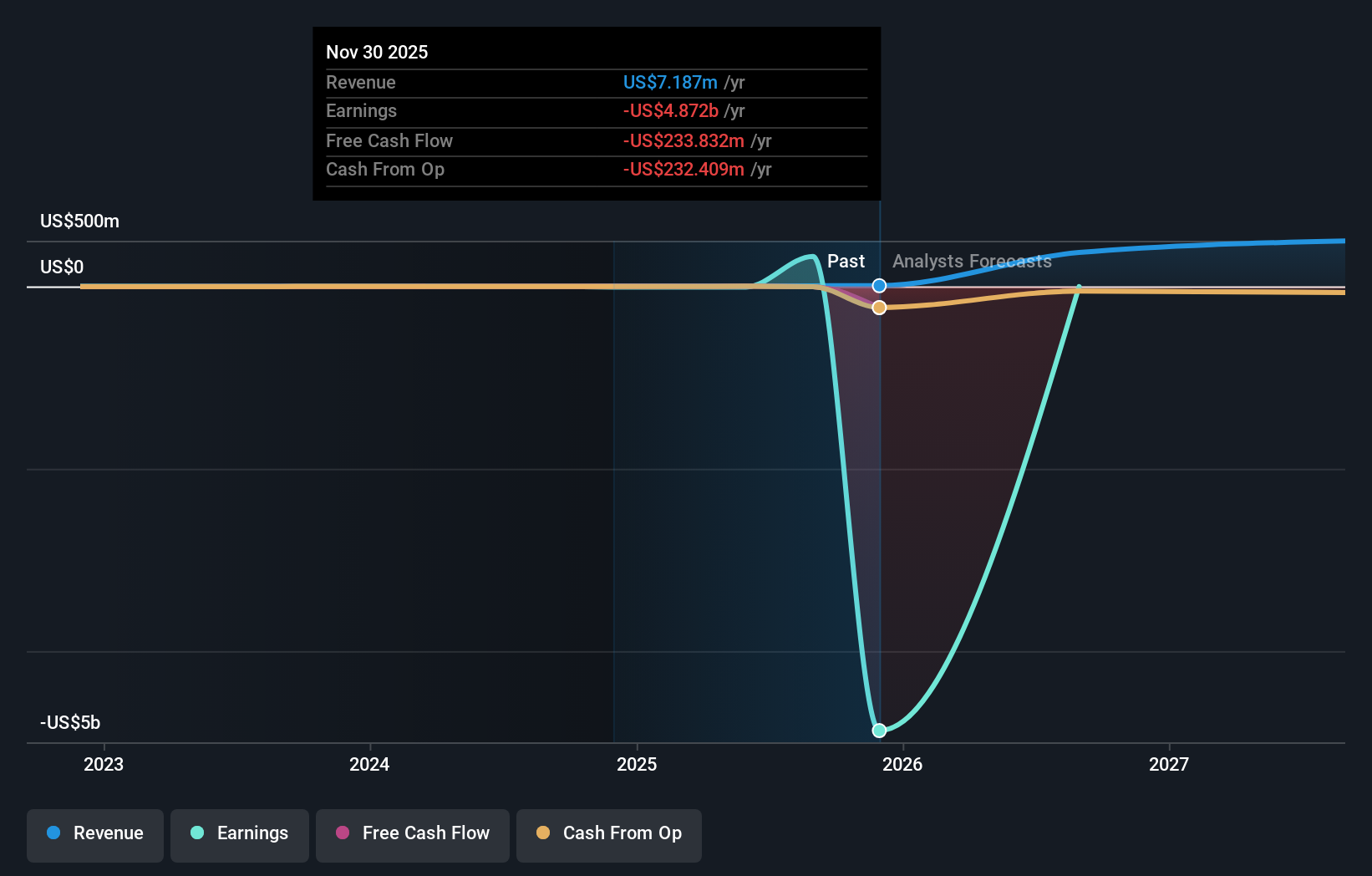

NYSEAM:BMNR Earnings & Revenue Growth as at Jan 2026

NYSEAM:BMNR Earnings & Revenue Growth as at Jan 2026

How Bitmine Immersion Technologies stacks up against its biggest competitors

Quick Assessment ✅ Price vs Analyst Target: At US$28.90, the share price sits about 41% below the US$48.67 analyst target range midpoint. ❌ Simply Wall St Valuation: The stock is flagged as very expensive, trading at roughly 163x above the platform’s estimated fair value. ❌ Recent Momentum: The 30 day return is about 3% lower, which signals recent weakness despite the MrBeast deal headline.

Check out Simply Wall St’s

in depth valuation analysis for Bitmine Immersion Technologies.

Key Considerations 📊 The US$200m commitment ties BMNR to MrBeast’s brand, so you may want to judge whether this aligns with a blockchain focused business you are comfortable owning. 📊 Keep an eye on how this deal flows through to revenue, cash usage, and any updates to analyst targets or estimated fair value. ⚠️ Major risks already flagged include heavy past dilution and weak earnings history, which could matter if more funding is needed to support this partnership. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Bitmine Immersion Technologies analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com