With West Texas Intermediate (WTI) oil prices currently trading below $60 per barrel, according to data from Oilprice.com, which is significantly lower than a year ago, the overall energy industry is now highly uncertain. However, unlike many other energy players, Valero Energy Corporation (VLO Quick QuoteVLO – Free Report) is likely to gain from the ongoing crude pricing environment.

This is because Valero Energy is a leading refining company with the capacity to process 3.2 million barrels of oil daily. VLO is now able to purchase oil at a lower cost, enabling the production of end products, such as gasoline and distillates. Additionally, crude prices are likely to remain soft in the coming days, as the U.S. Energy Information Administration (“EIA”) expects global oil inventories to continue increasing.

EIA projects the spot average West Texas Intermediate price for 2026 at $52.21 per barrel, lower than $65.40 per barrel for 2025. Thus, Valero Energy, which generates significant margin from its refining activities, is likely to benefit from soft oil prices.

PSX & PARR Also Poised to Gain

Phillips 66 (PSX Quick QuotePSX – Free Report) and Par Pacific Holdings Inc. (PARR Quick QuotePARR – Free Report) , two other well-known refiners, are also likely to benefit from the ongoing relatively low oil prices.

Refining operations continue to contribute to PSX’s earnings. Moreover, Phillips 66 expects refining to continue to back its bottom line considerably after its midstream activities.

Par Pacific is mainly a refining company with the capacity to process 219,000 barrels of oil daily. Notably, given its exposure to Canadian heavy oil, which is cheaper than lighter crude, Par Pacific is likely enjoying a cost advantage.

VLO’s Price Performance, Valuation & Estimates

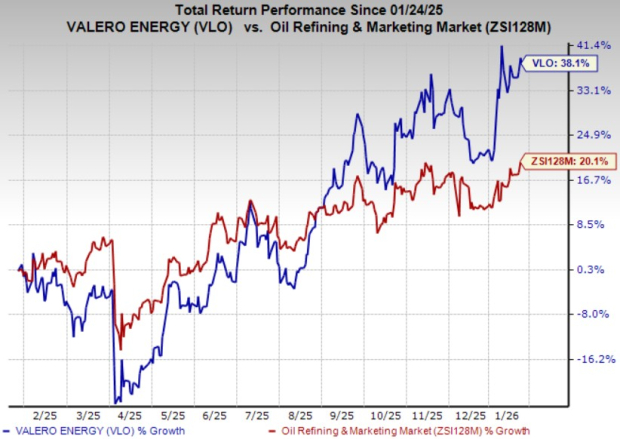

Shares of VLO have gained 38.1% over the past year compared with the 20.1% rise of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

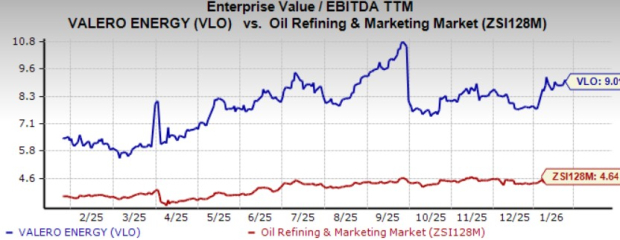

From a valuation standpoint, VLO trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 9.01X. This is above the broader industry average of 4.64X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

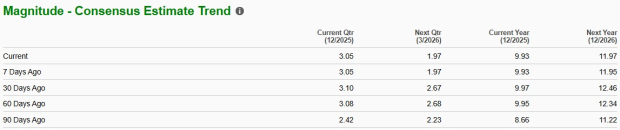

The Zacks Consensus Estimate for VLO’s 2026 earnings has seen upward revisions over the past seven days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

VLO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.