For you as an investor, this sits at the intersection of cybersecurity demand and government IT spending. SentinelOne focuses on AI powered endpoint and cloud security, an area that many public institutions are upgrading as they respond to more frequent and complex cyber threats. GovRAMP High status is a key credential for vendors that want to compete for larger and more sensitive US government contracts.

The tax settlement with the Israeli Tax Authority reduces an element of regulatory and accounting uncertainty around SentinelOne’s global structure. Taken together, the compliance milestone and the tax resolution provide more clarity on how the company is positioned for potential public sector work and how it is managing cross border operational risk.

Stay updated on the most important news stories for SentinelOne by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SentinelOne.

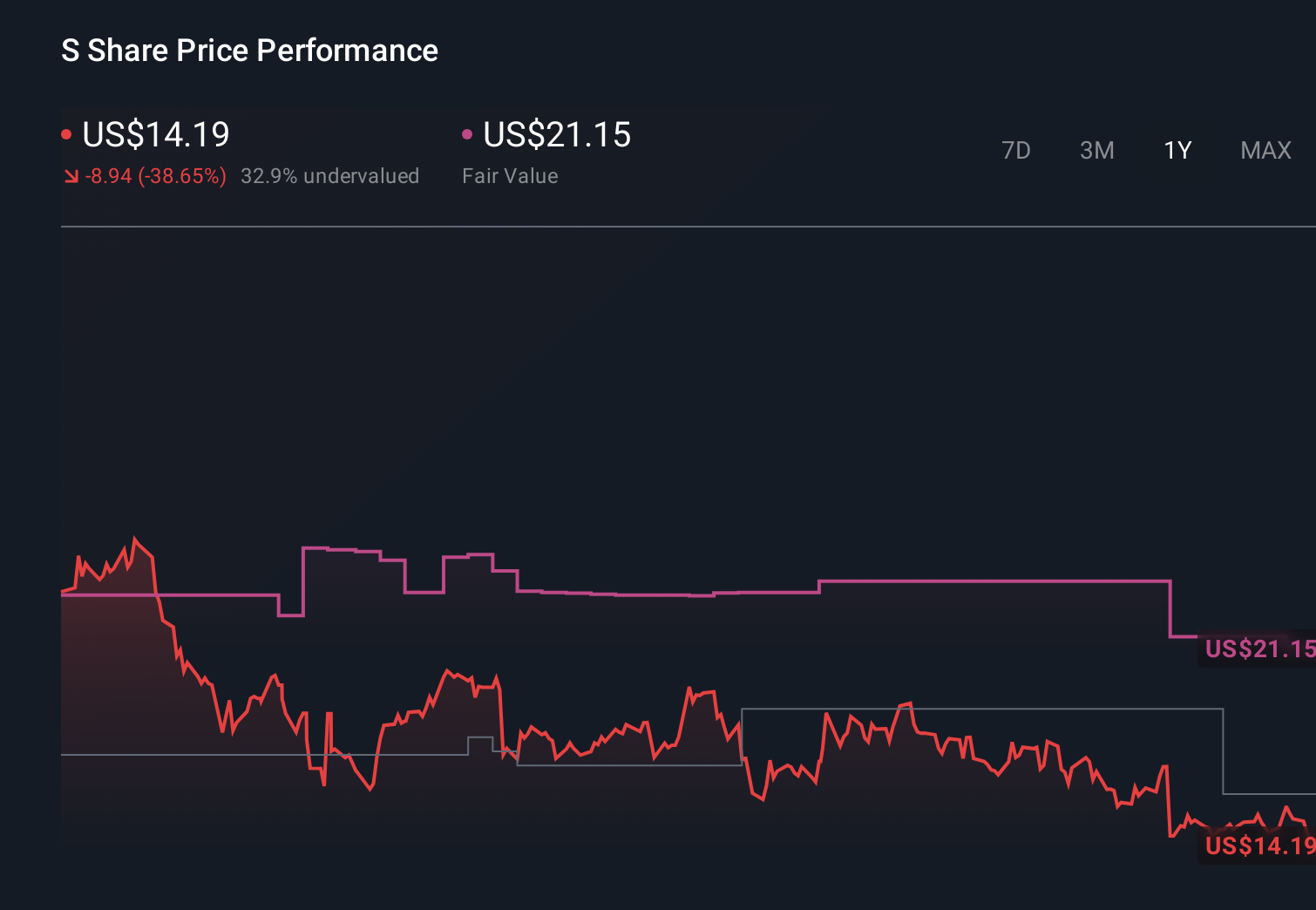

NYSE:S 1-Year Stock Price Chart

NYSE:S 1-Year Stock Price Chart

Why SentinelOne could be great value

For investors, GovRAMP High status and the Israeli tax settlement arrive after a tough stretch for the stock, including a 52 week low at US$13.55 and repeated sell offs around earnings on concerns about decelerating sales growth and margins. This news speaks directly to two areas investors have been watching closely: access to large, resilient government budgets and reduction of legal and regulatory overhangs.

SentinelOne narrative, is sentiment starting to shift?

Recent quarters have shaped a narrative of a high growth security vendor that is still working to convince the market on the durability and profitability of its model, as shown by sell offs after three of four quarterly reports and ongoing skepticism about the growth outlook. GovRAMP High and the tax agreement may challenge the most cautious versions of that story by adding clearer access to a defined customer pool and removing an accounting question, but the interim CFO appointment and prior concerns over guidance keep the debate open.

Risks and rewards investors are weighing ⚠️ Interim CFO and a recent CFO resignation can raise questions for some investors about continuity in financial leadership. ⚠️ Analysts have flagged 2 key risks, including that the company is currently unprofitable and not forecast to become profitable over the next 3 years. 🎁 GovRAMP High Authorization opens the door to higher sensitivity government workloads across federal, state, and local agencies, which some investors may view as a deeper opportunity set. 🎁 The Israeli tax settlement removes a source of regulatory uncertainty around transfer pricing for its subsidiary, giving investors more clarity on cross border operations. What to watch from here

From here, you might want to watch how quickly government related wins show up in reported bookings, how guidance evolves, and whether the interim CFO role is made permanent or replaced, because those signals can influence whether recent skepticism softens or persists. For a broader sense of how other investors are interpreting these moves, you can check out what the community is saying in this narrative hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com