We’ve found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Agnico Eagle Mines’ Investment Narrative?

For Agnico Eagle, the core investment case still rests on believing it can convert its large, merger-boosted asset base into durable cash flows while keeping costs in check and returning a meaningful slice of that cash via dividends and buybacks. The latest run-up in the share price, analyst target upgrades, a strong Zacks rating and high-profile endorsements deepen confidence in its execution and project pipeline, but they also tighten the margin for error around upcoming earnings and project milestones. Near term, the Q4 2025 and 2026 results remain the key catalysts, along with any updates on major growth projects and capital allocation. The main risks now feel more skewed toward rich valuation, execution slippage on large projects and any reversal in supportive gold prices, rather than balance sheet stress.

However, investors should be aware of how today’s richer valuation magnifies execution risk.

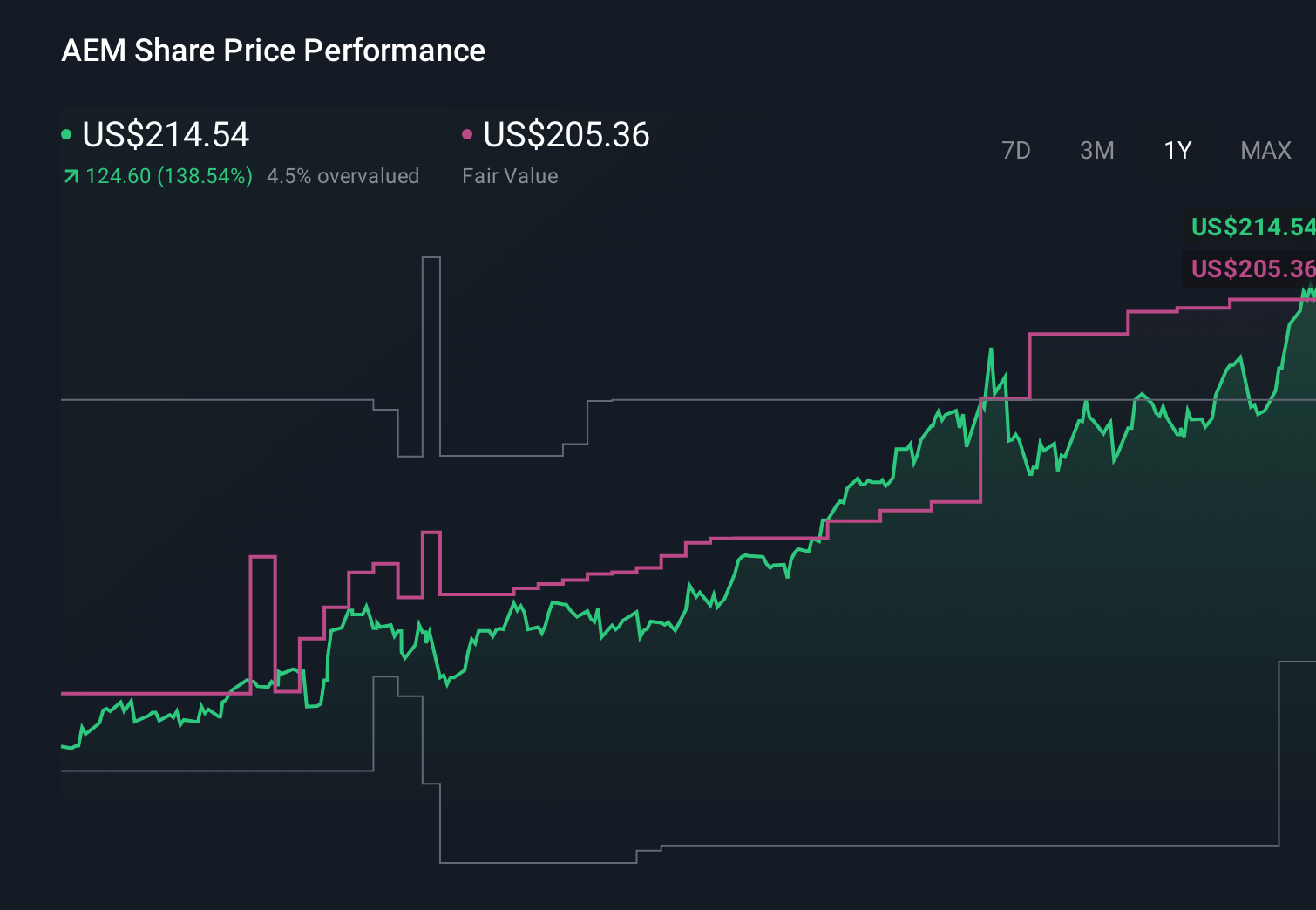

Agnico Eagle Mines’ shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives AEM 1-Year Stock Price Chart

AEM 1-Year Stock Price Chart

Eight fair value estimates from the Simply Wall St Community range from about US$110 to just over US$209 per share, showing how differently people are sizing up Agnico Eagle’s potential. When you set that spread against the recent surge in the share price and premium earnings multiple, it raises bigger questions about how much future project execution and gold price strength the stock already assumes and what happens if those expectations cool.

Explore 8 other fair value estimates on Agnico Eagle Mines – why the stock might be worth 49% less than the current price!

Build Your Own Agnico Eagle Mines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com