At a share price of $50.3, Omnicell is coming off a mixed return profile, with the stock up 8.4% over the past 30 days and 11.4% year to date, while the 3 year and 5 year returns show declines of 12.6% and 57.3%. For investors tracking digital health exposure, NasdaqGS:OMCL sits in a part of the market that connects software, data and pharmacy operations. This can make company specific developments particularly important.

The XT Amplify program and broader digital medication management push may influence how investors think about Omnicell’s role in hospital workflows and pharmacy automation over time. For now, the key question is how effectively these offerings gain traction with health systems that are under pressure to improve safety, reduce waste and manage staffing constraints.

Stay updated on the most important news stories for Omnicell by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Omnicell.

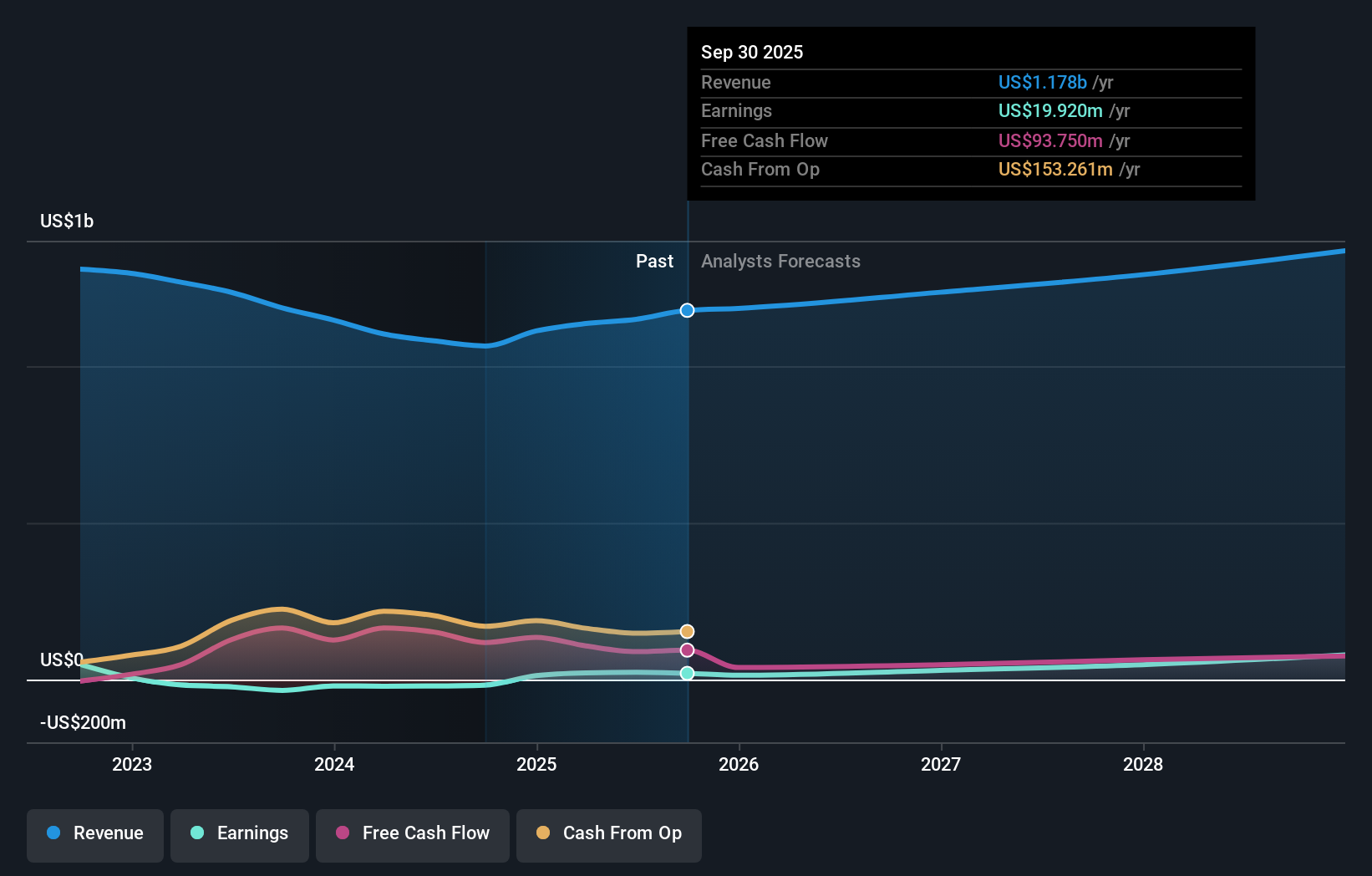

NasdaqGS:OMCL Earnings & Revenue Growth as at Jan 2026

NasdaqGS:OMCL Earnings & Revenue Growth as at Jan 2026

How Omnicell stacks up against its biggest competitors

Quick Assessment ✅ Price vs Analyst Target: At US$50.30, the price sits below the US$55.00 analyst target, with the low and high estimates at US$50.00 and US$63.00. ✅ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, with a current P/E of 113.3 versus an industry average of 32.0. ✅ Recent Momentum: The stock has returned about 8.4% over the last 30 days.

Check out Simply Wall St’s

in-depth valuation analysis for Omnicell.

Key Considerations 📊 XT Amplify and the wider digital medication management focus anchor Omnicell more firmly in software-enabled hospital workflows. 📊 Watch how recurring software revenue, hospital adoption metrics and any commentary on staffing or safety benefits track against this rollout. ⚠️ Execution on new offerings is important because the current P/E multiple of 113.3 already sits well above the Medical Equipment industry average of 32.0. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Omnicell analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com