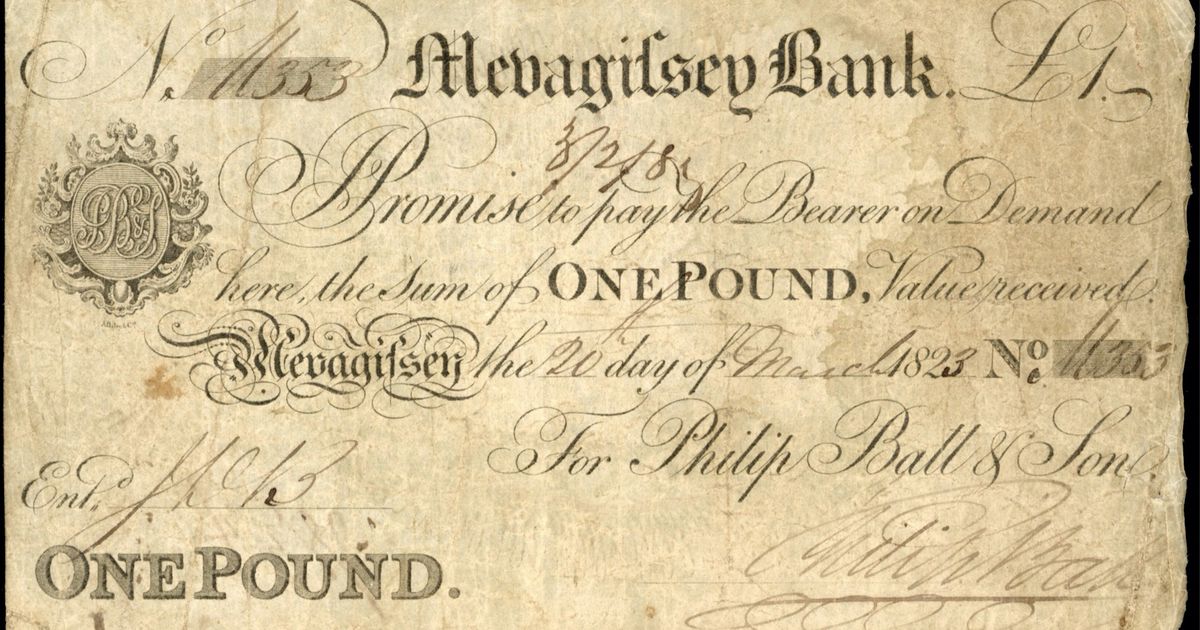

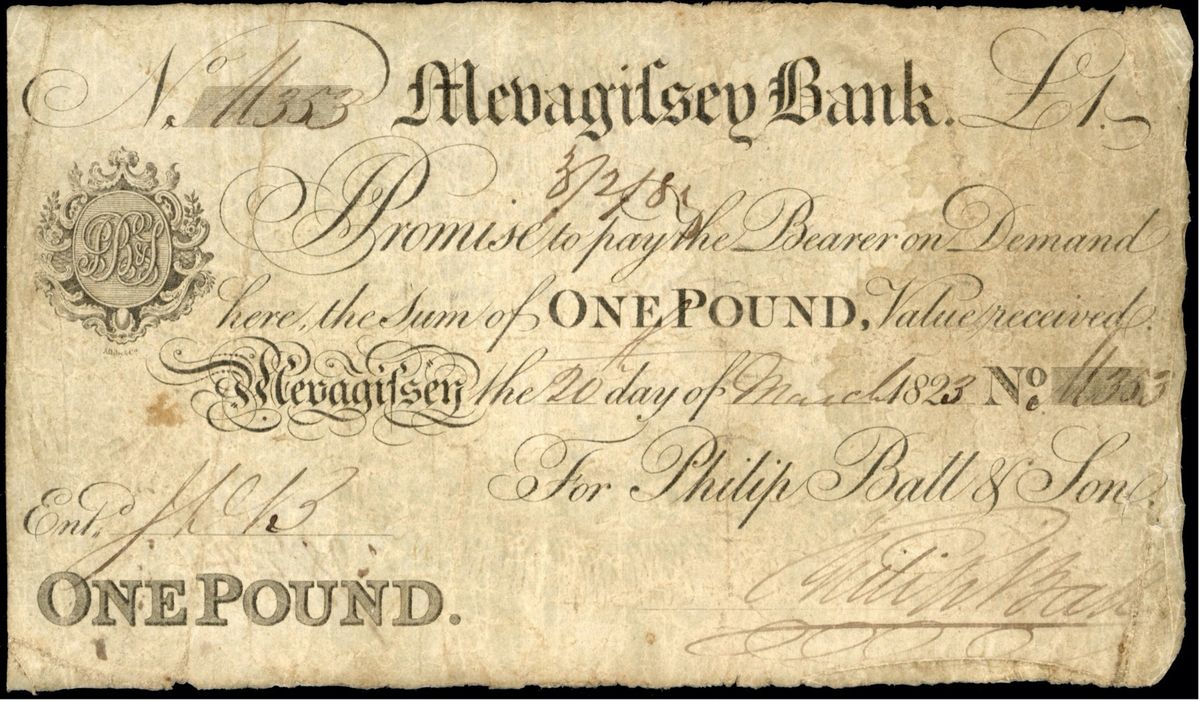

A rare bank note issued by a Cornish bank more than 200 years ago is to go under the hammer this month.

The £1 note from the Mevagissey Bank will be auctioned off by auction house Stanley Gibbons Baldwin’s in its British & World Banknotes sale in London next week.

It was was issued in 1823, a year before the bank went bust in an era when the prosperous fishing trade was declining – and smuggling was on the rise.

Mevagissey Bank was originally set up by Philip Ball in 1807, but it collapsed in November 1824, shortly after this note was issued. The Balls were very much a local family.

The fishing town, now so popular with visitors, relied on the pilchard trade which was declining by the 1820s and when the bank failed there was much hardship on a town already on its knees and many fishing boats had to be sold along the south coast.

Smuggling probably became more important to the town at this point as the lawful activity of fishing became more difficult to earn a living from.

A spokesperson for the auction house said: “Provincial banknotes are a real and tangible link with the past.

“Virtually every English city and town had a local bank that issued its own series of promissory notes and through them one is in contact with the origins and growth of the industrial revolution, the subsequent development of our major cities, and also with the establishment of a banking system that enabled London to eventually become so important in today’s world of finance.”

In 1844 there were 442 different banks operating in England and Wales and at that point it was legislated then that no more private banks could be set up.

Eventually at the end of the 19th century the major banking firms, through amalgamation and consolidation, came to dominate, ultimately leaving the banking names of Barclays, Midland, Lloyds and Nat West that we all know and use today.

Provincial private banks of England like the Mevagissey Bank provided the invaluable function of supporting and promoting the Industrial Revolution.

The Bank of England confined itself to the City of London and with very little exception, never established any branches outside of the capital.

In order to protect the Bank of England from competition a provincial bank’s size was limited to six partners and provided the emerging business and industrial enterprises with what we would call today ‘financial services’.

However, these were banking services under artificial constraints and consequently there were many failures – as can be seen in the many banknotes here with bankruptcy dividend stamps and inked dividend notices.

Many provincial banks prospered for long periods and household banking names such as Lloyds partially evolved from Gloucester and Stafford banks in its past, as did Nat West from Derby, Dover and Nottingham banks.

In the latter half of the 19th century these private banks which remained became part of the joint stock movement and established themselves within the modern banking institutions in which we are familiar today.

Each provincial bank could issue its own banknotes, although legislation in 1777 prohibited banknotes under £5 – but in 1797 this was reduced to £1 or one guinea due to the financial strains of the war with France.

After the French were defeated, this was raised to £5 in 1825 and no lower denominations were issued until the next century.

The auction house spokesperson added: “These often reflect the distinctive designs and features of the area, as well as offering a unique and fascinating insight into the historical development of the English banking system.”

The £1 bank note from Mevagissey Bank is estimated to sell for £80 to £120 at the British & World Banknotes Auction organised by Stanley Gibbons Baldwin’s, 399 Strand, London, on January 29 at 10.30am.

For more information on the auction visit https://sgbaldwins.com/auctions/british-and-world-banknotes-c26001

Want the latest Cornwall breaking news and top stories first? Click here to join CornwallLive on WhatsApp and we’ll send breaking news and top stories directly to your phone. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like. If you’re curious, you can read our Privacy Notice