Fox Business

Moneywise and Yahoo Finance LLC may earn commission or revenue through links in the content below.

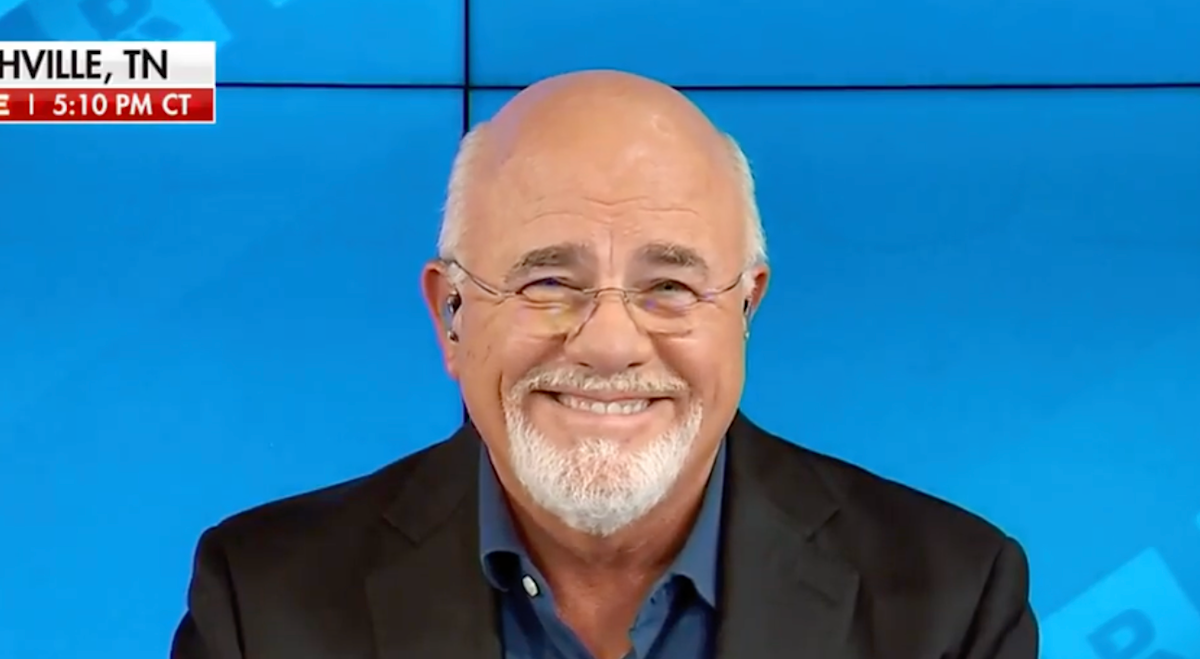

Dave Ramsey has never been shy about what really grinds his gears when it comes to the financial habits of young Americans.

In a 2024 interview with Fox News, Ramsey — a boomer — shared his true feelings about millennials and Gen-Z’s financial habits: ”They are awful. They live in their mother’s basement. They can’t figure out why they can’t buy a house because they don’t work. (1)”

While this sentiment may ring true for people of any generation, younger Americans certainly have some odds stacked against them amidst high home prices and interest rates.

A Consumer Affairs report found that Gen Z’s money had 86% less purchasing power than baby boomers did when they were in their twenties (2).

Ramsey isn’t frustrated with all Millennials and Gen Z in this age. But he says today’s tough economy — and young Americans’ spending habits — are what’s really holding them back.

“We have record credit card debt,” Ramsey said on his show last month (3).

The numbers add up. Total household debt hit $18.59 trillion in the third quarter of 2025, according to data from the Federal Reserve Bank of New York. Credit card balances, on the other hand, rose by $24 billion from the previous quarter to $1.23 trillion (4).

“They’ve been brainwashed to believe by the big banks that if I use a credit card, I can prosper with the points and the airline miles, which is mathematically ludicrous,” Ramsey added further.

Creating a budget and overall financial plan can be the exact spark you need to ignite to improve your financial situation. In a video with his daughter, Rachel Cruze, on her YouTube channel, Ramsey shared that getting on a budget is one of the best things you can do with your money in 2024.

A quick daily check-in of your accounts can show you exactly where your money is going.

An app like Rocket Money can easily flag recurring subscriptions, upcoming bills and unusual charges by pulling in transactions from all your linked accounts.

This can help you cut unnecessary costs, and then you can manually redirect savings straight into your retirement fund. No spreadsheets, no guesswork, no stress. Small habits like this can make a big difference over time.