Recent analyst actions on Air Products and Chemicals (APD), including a rating upgrade from Bank of America Securities and a reaffirmed outlook from Citi, have refocused attention on the company’s large hydrogen and ammonia project execution risks.

See our latest analysis for Air Products and Chemicals.

At a share price of US$261.35, Air Products and Chemicals has recently seen a 5.63% 1 month share price return. However, its 1 year total shareholder return of an 18.51% decline shows that longer term holders are still sitting on losses. This suggests sentiment is stabilising rather than strongly rebounding as investors weigh hydrogen project risks against the core industrial gases business.

If this kind of project risk and recovery story has your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With the stock at US$261.35, trading at only a small intrinsic discount and below the average analyst price target, are investors looking at an underappreciated industrial gases leader, or at a market that already prices in future growth?

Most Popular Narrative: 10.2% Undervalued

At a last close of $261.35 versus a narrative fair value of $291.00, the most followed model sees upside that hinges heavily on long term clean energy projects and margin expansion.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Curious what earnings path and margin profile justify that valuation gap? The narrative leans on a specific growth runway and a lower future earnings multiple. Want to see how those pieces fit together in the full story?

Result: Fair Value of $291 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on big energy transition projects staying on track, and any delays or cost overruns at NEOM or in Louisiana could quickly challenge that upside story.

Find out about the key risks to this Air Products and Chemicals narrative.

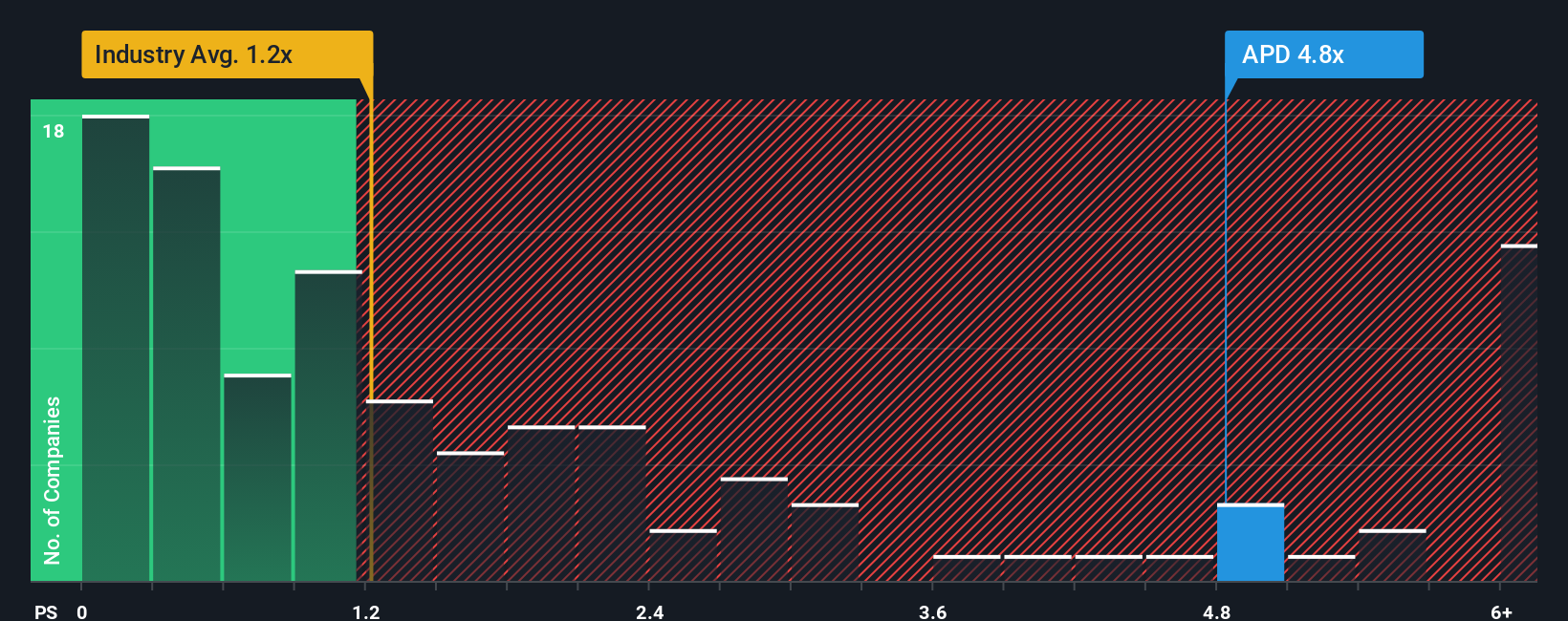

Another View: Multiples Flash A Caution Signal

That 10.2% undervalued fair value of $291 sits awkwardly beside the current P/S of 4.8x. The fair ratio suggests 2.6x, while the US Chemicals industry sits around 1.2x and peers at 4.4x. In plain terms, you are paying up, so is the margin of safety really there?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:APD P/S Ratio as at Jan 2026 Build Your Own Air Products and Chemicals Narrative

NYSE:APD P/S Ratio as at Jan 2026 Build Your Own Air Products and Chemicals Narrative

If the numbers here do not quite match your view, or you prefer to work through the data yourself, you can build a customised thesis in just a few minutes with Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If APD has sharpened your focus, do not stop here, use the Simply Wall St Screener to spot clear, data driven opportunities before everyone else notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com