Sandisk, now trading independently under NasdaqGS:SNDK after its spin off from Western Digital, is positioned in the middle of AI infrastructure spending and supplies NAND memory for large scale data centers and storage. Persistent supply tightness in NAND, combined with AI related demand, has made the stock a focal point for investors looking at the memory segment of the semiconductor industry.

The arrival of a dedicated 2X daily exposure ETF adds a new, higher risk tool for short term traders who want amplified moves in NasdaqGS:SNDK without using margin directly. For longer term investors, the launch can be interpreted as another indication of how closely the market is watching Sandisk as AI workloads, storage needs, and supply constraints continue to influence the memory market.

Stay updated on the most important news stories for Sandisk by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sandisk.

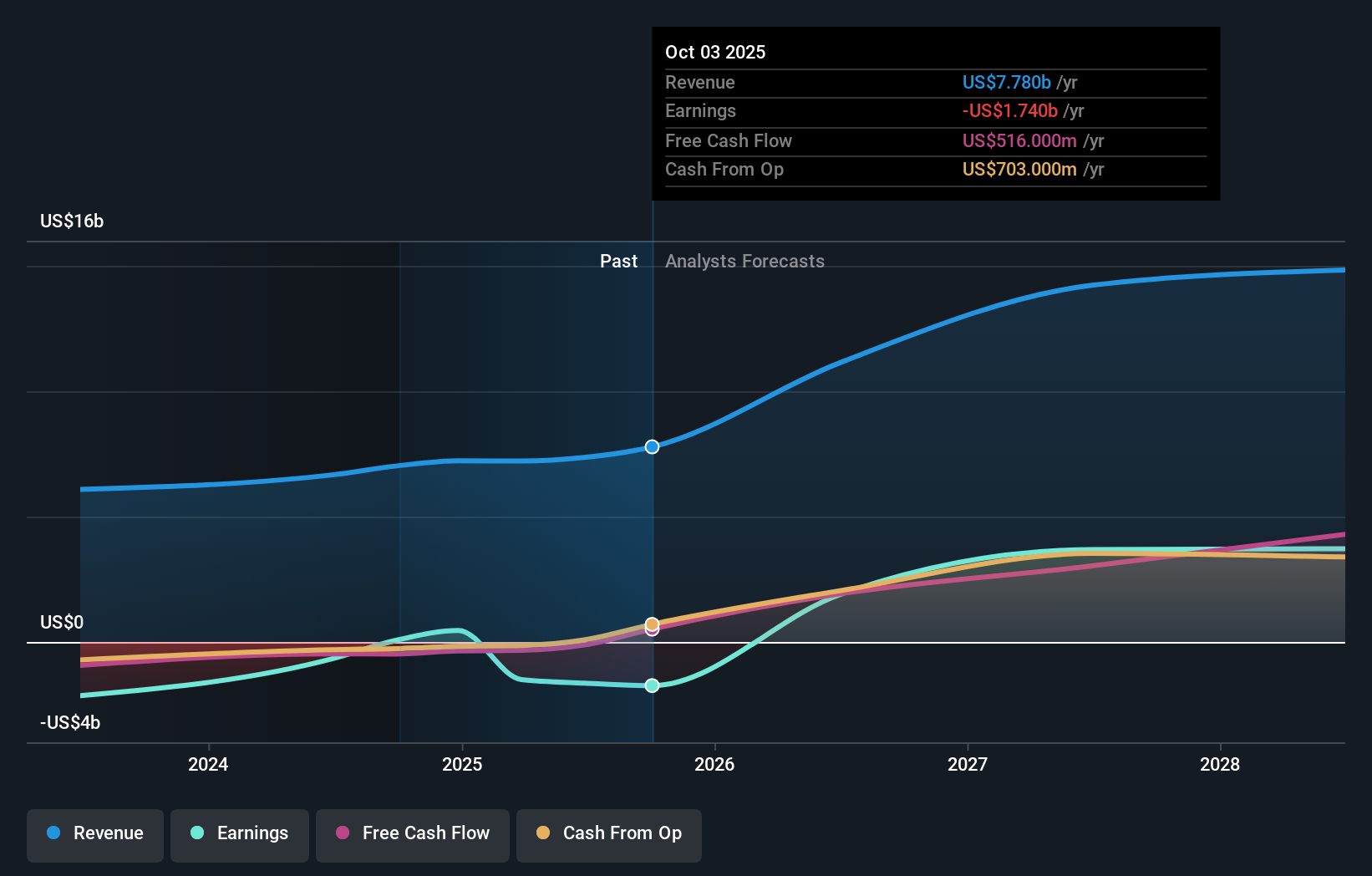

NasdaqGS:SNDK Earnings & Revenue Growth as at Jan 2026

NasdaqGS:SNDK Earnings & Revenue Growth as at Jan 2026

How Sandisk stacks up against its biggest competitors

The new 2X single stock ETF tied to Sandisk effectively formalises how closely traders are watching the name, after a run that has seen the shares gain more than 100% in 2026 and very large gains since the spin off. By giving short term participants a leveraged vehicle that reacts directly to AI driven data center demand and persistent NAND shortages, it may add extra liquidity and potentially sharper day to day swings in SNDK without changing the company’s underlying cash flows or competitive position.

How This Plays Into The Sandisk Narrative

Sandisk has gone from a once forgotten memory player to the S&P 500’s top performer in 2025, with stock returns of roughly 1,000% over six months and around 1,100% since the spin off, helped by AI capex and tight NAND supply. The ETF launch sits alongside this story of strong earnings beats, raised price targets and expectations for substantially higher fiscal 2026 earnings, while also echoing the more cautious narrative from some analysts who see stretched valuations and even flag the possibility of a 50% price decline from current levels.

Risks and Rewards In Focus Direct play on AI infrastructure spending and NAND shortages, with Sandisk largely sold out for the year and reporting strong data center and SSD demand. Recent history of earnings beats and positive estimate revisions, plus analyst references to higher fiscal 2026 earnings, support the view that fundamentals remain tied to strong end markets. Highly volatile share price over the past 3 months and very large gains since 2025 increase the risk that a leveraged ETF magnifies any pullbacks. Memory remains cyclical, and several Wall Street firms have warned that high valuation, potential future supply gluts and any disappointment versus January 29 earnings expectations could drive a sharp correction. What To Watch Next

Looking ahead, the key issues are how Sandisk’s January 29 earnings, AI driven NAND pricing, and any guidance on supply tightness line up with the high expectations already baked into the share price and now into the leveraged ETF. Check out how other investors are framing the Sandisk story before you decide how this new ETF fits your own approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com