Danaos (DAC) is in focus after agreeing to invest US$50 million in Glenfarne Alaska Partners and to become the preferred tonnage provider for at least six LNG carriers tied to the Alaska LNG export project.

See our latest analysis for Danaos.

The Glenfarne partnership comes as Danaos shares trade at US$101.35, with a 30-day share price return of 7.01% and a 90-day share price return of 13.74%, alongside a 1-year total shareholder return of 35.35% and a 5-year total shareholder return that is more than 4x. This points to firm long term momentum even as investors weigh upcoming earnings and the new LNG exposure.

If this LNG move has you thinking more broadly about transport and infrastructure themes, it could be a good moment to look at aerospace and defense stocks as another source of potential ideas.

With revenue and net income growth both currently in decline and the share price now slightly above the average analyst target, the key question is whether Danaos is still underpriced or if the LNG story is already fully reflected in the valuation.

Most Popular Narrative: 2.5% Undervalued

At $101.35 versus a most-followed fair value of $104, Danaos is framed as slightly undervalued, with that view leaning heavily on contract coverage and margins.

The company’s strong backlog of $3.6 billion, supported by an average charter duration of 3.8 years and high contract coverage (99% for 2025 and 88% for 2026), provides revenue stability and visibility, reducing the risk of sharp declines in earnings even if spot charter markets become weaker. Disciplined capital allocation and a strategic focus on securing long term charters for modern, larger vessels position Danaos to benefit from global trends favoring fuel efficient and larger container ships, supporting sustained fleet utilization and robust net margins.

Want to see how shrinking top line expectations still line up with healthy profitability and a higher future earnings multiple than today? The full narrative connects those moving parts to that $104 fair value estimate.

Result: Fair Value of $104 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, risks around shipping cyclicality and future charter repricing, as well as potential cost pressure from decarbonization efforts, could challenge the idea that earnings remain this resilient.

Find out about the key risks to this Danaos narrative.

Another View: DCF Flags a Very Different Story

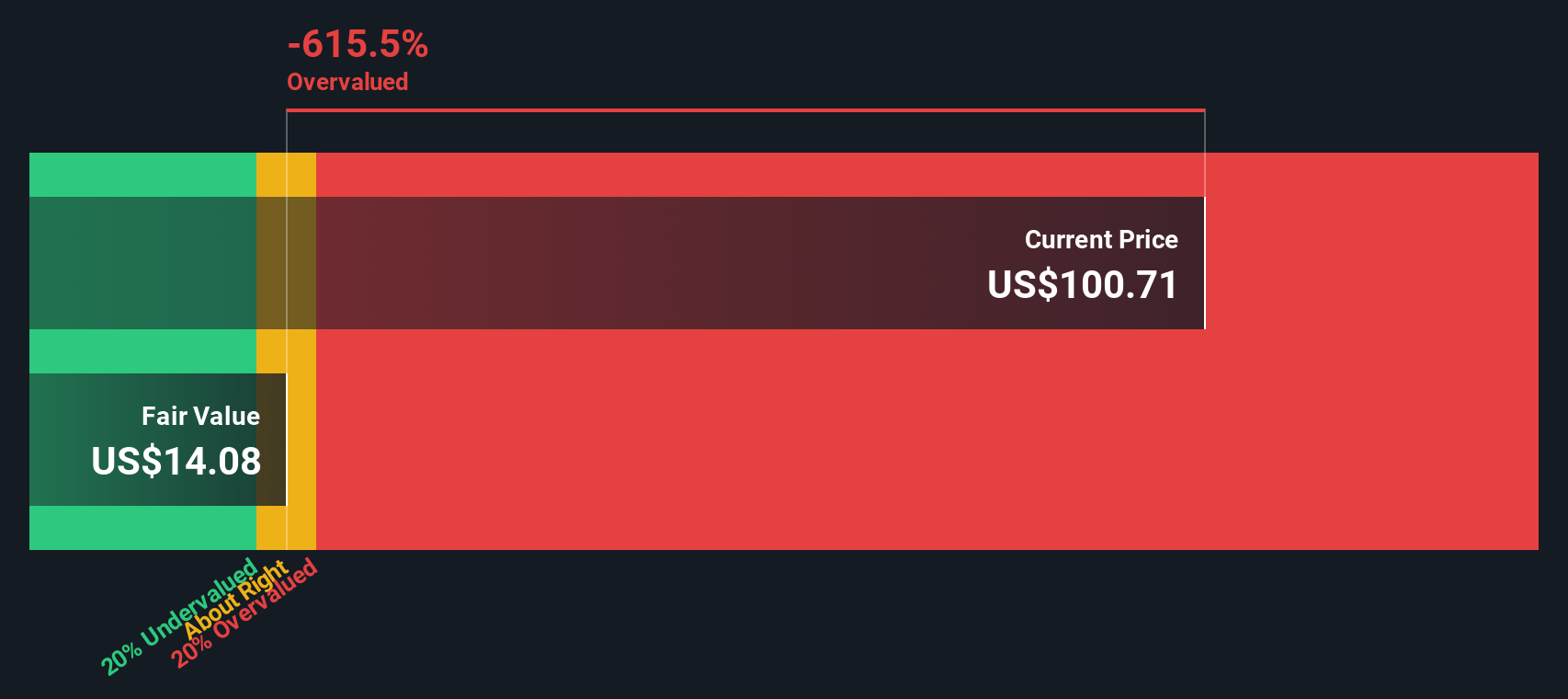

While the $104 fair value narrative leans on contracts and margins, our DCF model points a very different way, with a future cash flow value of just $14.08 per share versus today’s $101.35. That gap suggests investors may be paying up for earnings that cash flows do not fully support. Where do you fall on that spectrum?

Look into how the SWS DCF model arrives at its fair value.

DAC Discounted Cash Flow as at Jan 2026

DAC Discounted Cash Flow as at Jan 2026

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Danaos for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Danaos Narrative

If you see the numbers differently, or simply prefer to weigh the data on your own terms, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your Danaos research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing ideas?

If Danaos has you thinking harder about where to put your next dollar, do not stop here. These filters can surface opportunities you might otherwise miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com